Puerto Rico Round-Up: Waiting for Decisions

by meep

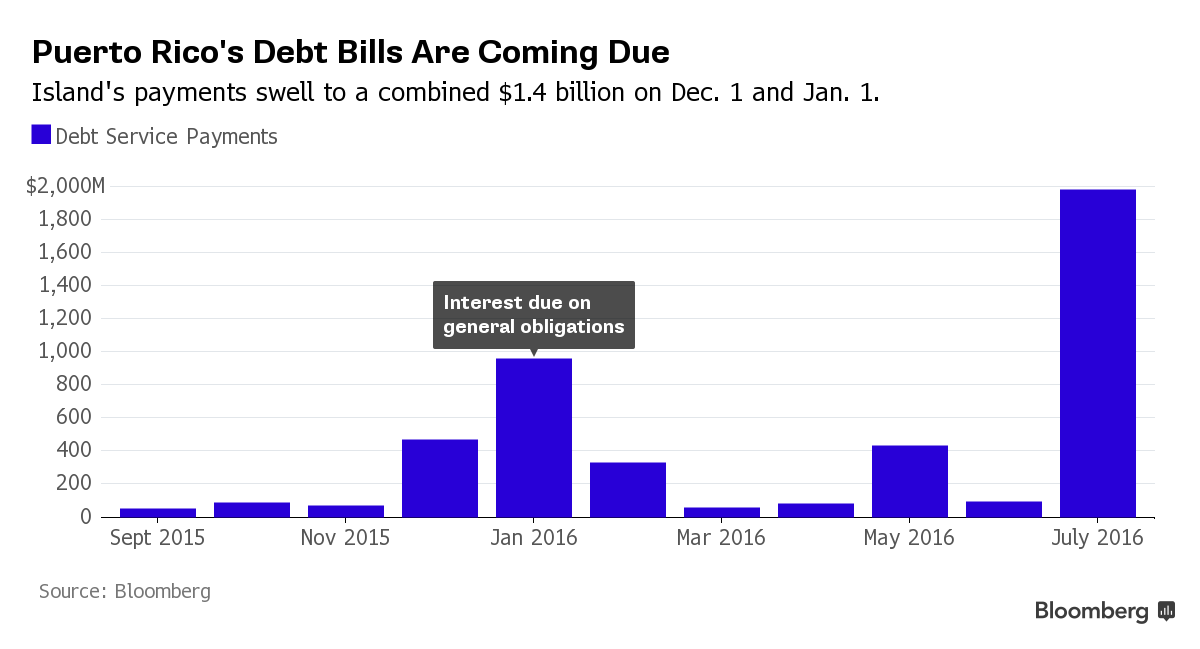

It’s been about a month since my last major Puerto Rico update. PR defaulted on some more debt, and they’ve got this large payment due in July:

What’s happening now?

SUPREME COURT CASE TO BE DECIDED

Justice Clarence Thomas may be writing an upcoming decision on Puerto Rico’s:

The March 22 Puerto Rico argument suggested the possibility of an ideological divide, with the liberal justices offering the strongest support for the law and Chief Justice John Roberts signaling skepticism. Thomas, as is his usual practice, asked no questions.

At issue in the case is whether federal bankruptcy law precludes Puerto Rico from creating its own debt-restructuring system. A federal appeals court struck down the island’s Recovery Act.

The court is weighing the case while Congress considers legislation to provide a more comprehensive answer to Puerto Rico’s fiscal crisis.

The case is Puerto Rico v. Franklin, 15-233.

The decision may come today. I wrote about the case a little in a prior blog post, but it’s better to go to my original sources:

Bloomberg: Sotomayor Helps Puerto Rico Argue Its Bankruptcy Case

An excerpt from the second:

Justice Sotomayor, who is herself of Puerto Rican descent, spoke by my count an astonishing 45 times. Sotomayor left no doubt that she was speaking as an advocate.

The interpretation of the law she favored would make the system fairer to Puerto Rico, allowing the commonwealth to create its own emergency bankruptcy measures outside federal law. But it depends on a highly doubtful reading of the statute, one that stretches credulity when read into the text. Ideally, Congress will hear what happened at the oral argument and pass one of the reform proposals it’s currently considering that would spare the court from having to decide the case.

…..

Sotomayor’s position, borrowed from Landau’s creative brief, was that the federal bankruptcy law doesn’t mean what the appeals court considered obvious. The law says that Puerto Rico is to be considered a state for purposes of the bankruptcy code, except that, unlike a state, it may not authorize its municipalities (and by extension, its utilities) to resolve debts under Chapter 9 of the code.

Hmmm.

Let’s take a look at what SCOTUSblog has on this case. Lyle Denniston made this analysis after oral arguments:

Argument analysis: If only Congress had taken the time to explain . . .

With only three members of the Supreme Court taking a genuinely active part in a hearing Tuesday on Puerto Rico’s debt crisis, and with those three ultimately reinforcing each other’s arguments, it might have been thought it would be fairly easy for them to control the outcome of the case just among themselves. And if, as seemed quite likely, they could pick up a fourth vote, they could surely prevail, since only seven Justices were on the bench.

But the argument in Puerto Rico v. Franklin California Tax Free Trust and a companion case was a truly labored exercise, made considerably harder because Congress had not explained itself at all (let alone clearly) in 1984 when it decided to treat Puerto Rico differently in bankruptcy law. It seems that, as part of an overhaul of the federal bankruptcy code, Congress simultaneously shut Puerto Rico’s public utilities out of a right to sue for bankruptcy under federal law but forbade the Puerto Rico legislature to come up with its own debt-restructuring plan.

Well, perhaps Congress will moot all this by passing some more legislation.

WHO’S AT FAULT?

The Nation asks who is responsible for Puerto Rico’s debt:

THE DEBT: ODIOUS… AND ILLEGAL?

One of the great ironies of the debt crisis is that following its victory over Spain in 1898, the United States successfully argued against responsibility for debts incurred by Spain when Washington was granted possession of Cuba, Puerto Rico, and the Philippines. This was so-called “odious debt,” because it had not been incurred in the interests of the people in those colonies. While in some senses one could argue that the debt taken on by the Puerto Rican government over the past few decades was in the interest of the people, since it kept government operating and provided services, some argue that aspects of it are illegal, and could thus be annulled in court.

At the Hunter College conference, journalist Juan González, taking advantage of an opportunity to question Weiss while on the same panel, asked the Treasury official about attempts to uncover illegality in the debt. “There are legal theories about the legality of the debt, and the legal theories can play out in a court of law, and it is possible that one could pursue legal cases that would not provide any protection for essential services,” said Weiss, who warned, “There is no time left. If Congress is prepared to enact legislation which allows the debt to be reduced to an amount that the economy can sustain, we need to pursue that, because anything that plays out in a court of law will take, in our judgment, a decade.”

The article itself is fairly long and I think it has a good overview of the various players. Yes, there’s particular bias playing out re: the hedge funds, but keeping that in mind, you can get a good feel for the issues.

Thing is, the illegal debt issue came up in the Detroit bankruptcy as well. I don’t know if there’s ongoing lawsuits surrounding the particular swaps in question for Detroit, but there had been dealmaking re: those swaps in the bankruptcy proceeding. The concept was to at least settle terms, along with all other obligations, in the bankruptcy. Even if there was continuing legal issues, there was no overhanging obligation on Detroit from them after Detroit exited its bankruptcy.

This is the benefit of having a formal bankruptcy proceeding. The entity under the obligation discharges it, without the pain of decades of litigation.

Because, let’s be clear here: Puerto Rico is de facto bankrupt, and has been for some time.

The issue is that they’re doing a bunch of ad hoc moves re: “restructuring” their debt. They are simply not making payments in some cases, and bondholders have recourse to piecemeal litigation.

CONGRESSIONAL UPDATE

Something was going on in Congress, wasn’t it?

What’s the status there?

Puerto Rico debt bill cleared for Thursday U.S. House vote

:

Legislation helping Puerto Rico dig out of its $70 billion debt crisis is set for a vote in the U.S. House of Representatives on Thursday after a House panel fended off attempts to open the bill to a series of controversial amendments.

By voice vote on Wednesday, the Rules Committee, the gatekeeper for bills moving through the House, sent the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) to the full House for debate and a likely vote on Thursday.

The legislation, the result of months of negotiations between Congress and the Obama administration, would create a federal oversight board to work with investors to determine how much they would recover of the island territory’s $70 billion in loans.

Republicans have stressed that no taxpayer money would be used to bail out Puerto Rico from a crisis that has left nearly half of the population in poverty amid closings of schools and hospitals and a contracting economy.

During a Rules panel debate that stretched into the night, the committee rejected pleas to allow amendments that would have changed the basic structure of the legislation and the operation of the oversight board.

Yes, there’s a lot of contention surrounding this bill.

Part of the issue is trying to get something into place before the big payment default on July 1.

Mind you, that payment isn’t going to be made, because Puerto Rico can’t make it.

The Senate looks like they’re going to be about as useful as always.

Piece supporting passage of the legislation:

Bipartisan legislation to help resolve the Puerto Rican debt crisis is actively being debated in Congress. The Obama Treasury Department worked with Speaker Paul D. Ryan (R-Wis.) and various House Democrats to hammer out a compromise that would allow the commonwealth to restructure its $70 billion in debt.

This is good news and while I have serious qualms, I believe the bill should quickly pass. Once it does so, a stay of litigation begins immediately, lasting either six months after enactment or until February of next year, whichever is later, providing vital relief from both creditor pressure and a series of large, forthcoming defaults, and giving the island a chance to start turning things around.

That’s from someone who worked for Joe Biden. Remember the House and Senate are putatively controlled by Republicans.

There’s been stuff going around about the oversight board being able to receive gifts. I agree, that looks bad, and I also agree, it’s a clause in many of these types of bills.

Doesn’t make it right.

Here is something about what Puerto Ricans think:

“The politicians, red and blue, have stolen this country; they have finished this country,” said Mr. Muñiz, 74, who grew up here and helped inaugurate this now half-closed pedestrian mall where he runs his business. “When a patient is sick, he needs medicine. When a patient is in critical condition, he needs intensive care. That’s what the junta is.”

The junta is the name here for the federal control board that could end up overseeing the reboot of Puerto Rico’s economy, chiefly by ensuring that the island repays its crippling $72 billion debt in an orderly way, funds its pensions and balances the budget — steps likely to require layoffs and cuts in services.

As I wrote earlier, there will be no bailouts. If Puerto Rico even wants a legal bankruptcy process, they’re going to be giving up some sovereignty.

States, keep an eye on that.

Cate Long’s twitter feed is a good one to watch for the Puerto Rico debt issues.

NOW WE WAIT

So I’m waiting for legislation to pass, the Supreme Court to make its ruling, and for Puerto Rico to start some kind of orderly legal process for recognizing its bankruptcy.

May be waiting a while on that last one.

Related Posts

On the Bailouts That Didn't Happen, Part 2: State and Local Governments

How About Turning Around Hartford?

Taxing Tuesday: Save Us Rich People From Senator Candidates