Taxing Tuesday: Tax ALLLL the Internet! and New Jersey Puts Out Dumbass Idea

by meep

Let’s do the serious item first — the SCOTUS ruling last week on South Dakota v. Wayfair, about imposing sales taxes on internet retail.

Now, I’ve been paying taxes on my Amazon purchases (my main online purchases) since .. just wait. Nope, didn’t pay in 1998 (that’s the earliest order they have on record for me); 1999, nope.

Okay let me do a binary search.

Fine, 2011 is when I started paying NY sales taxes for my Amazon purchases. I’ve been paying tax on a lot of internet orders for years, but Amazon is the one where I have an easily accessible record going back to 1998.

It hasn’t killed off my Amazon usage. That’s for sure.

Anyway, let me pull in a little commentary, and then do a link dump.

Megan McArdle at WaPo: Goodbye, tax-free Internet sales. We sure will miss you.

As [Chief Justice] Roberts’s observation suggests, Amazon isn’t the only major online retailer collecting sales taxes. Best Buy and Walmart rack up far more in online sales than many “big” Internet retailers such as Wayfair, and they already have physical presences almost everywhere. The court’s ruling won’t affect players like these.

It will, however, affect companies like Wayfair, making it harder for them to compete against bigger retailers. Ultimately, the effect of this ruling will be not to keep tech giants like Amazon from stealing business from mom-and-pop shops, as critics of those firms might hope. Rather, the ruling will make it harder for upstarts to unseat massive incumbent Internet sellers that can afford to have a physical presence in every state, or to collect sales taxes even where they don’t.

Despite the ruling’s negative impact on small businesses, states will likely move quickly to avail themselves of this newly legal source of tax revenue. So bid a fond farewell to those great deals from Internet upstarts. We sure did enjoy them while they lasted.

There are two parts of this, of course — some of what made these smaller players appealling, supposedly, was the lack of sales tax collected.

But you also have to consider the compliance costs. It’s not just the effect on the item price, but also that you have to send the collected taxes to each state (I don’t know how often), and provide various reporting, etc. It’s one thing if you’re a behemoth making loads of sales so that the compliance burden isn’t much, but if you’re a smaller operation, it’s going to suck up time and money just dealing with it, even if there are some software solutions.

But I can imagine sites like Etsy are thinking through how they’re going to help sellers on this matter. I have idea re: eBay. I haven’t bought things there in a while.

The thing is, I believe states are getting the bulk of the sales taxes already anyway – at least, the big states are. I can see that South Dakota, and other states which may not have such a large tax base may need to scrape up every sales tax source they can.

- Ars Technica: Get ready for more sales taxes on online purchases

- Tax Foundation: Supreme Court Decides Wayfair Online Sales Tax Case – proud that their amicus brief was quoted in the majority opinion

- Governing: The Week In Public Finance: Supreme Court Clears Way for States to Tax Online Sales

- Supreme Court ruling on online sales tax could mean windfall for New Jersey

- SCOTUSblog: Opinion analysis: Court expands states’ ability to require internet retailers to collect sales tax

- Chicago Tonight: Sorry, Online Shoppers: No More Evading the Sales Tax

- INN: U.S. Supreme Court ruling on internet sales tax will likely mean consumers pay more

- Supreme Court sales tax ruling won’t be a quick fix for slumping government revenues

- Overstock to expand into new states after Supreme Court sales tax ruling

- Kentucky lawmaker: Supreme Court internet sales tax ruling has bipartisan support

- SCOTUS decision on internet taxes could bankrupt thousands of small online businesses

Let’s check effects. From the Governing magazine link above, here is an estimate:

Sales taxes account for more than half of all revenues in six states, according to Fitch Ratings. Among those six states, featured in the table below, they could see anywhere from a 1.1 to 1.7 percent revenue boost:

STATE POTENTIAL REVENUE GAIN

Florida $758 million

Nevada $134 million

South Dakota $47 million

Tennessee $363 million

Texas $1.2 billion

Washington $453 million

Note, those amounts are between 1% and 2% of current state revenues. Looking for these minor boosts is important to governments — should give you an idea of how desperate some of these places are.

The Tax Foundation delineates the current state of internet sales taxes, and you can see that New York has its own particular model that 21 other states have used.

NEW JERSEY DUMBASSERY

Never go full dumbass.

Here’s a bill:

ASSEMBLY, No. 4202; STATE OF NEW JERSEY 218th LEGISLATURE; INTRODUCED JUNE 18, 2018:

SYNOPSIS

Imposes surtax on corporation business tax liability; decouples certain

provisions from Internal Revenue Code; imposes tax on certain dividends.….

7 1. (New section). a. In addition to the tax paid by each

8 taxpayer determined pursuant to section 5 of P.L.1945, c.162

9 (C.54:10A-5), each taxpayer, except for a public utility, shall be

10 assessed and shall pay a surtax as follows:

11 (1) For a taxpayer, except a public utility, that has entire net

12 income in excess of $1 million, but less than $25 million for the

13 privilege period, the surtax imposed shall be 2.5%;

14 (2) For a taxpayer, except a public utility, that has entire net

15 income in excess of $25 million for the privilege period, the surtax

16 imposed shall be 4%.

Let me interpret this for y’all:

They want to do a “millionaire’s tax” on local taxpaying corporations.

Already, companies that left New York for New Jersey (because of high costs) will be looking for an exit. If they didn’t want to stick to New York, they sure as hell won’t want to stay in NJ when they have NY-level costs.

I checked out the record on this bill: Go here to search for bills – It’s A4202/S2746.

A4202 Imposes surtax on corporation business tax liability; decouples certain provisions from Internal Revenue Code; imposes tax on certain dividends.

Passed both HousesIdentical Bill Number: S2746

Pintor Marin, Eliana as Primary Sponsor

Sweeney, Stephen M. as Primary Sponsor6/18/2018 Introduced, Referred to Assembly Budget Committee

6/18/2018 Reported out of Assembly Committee, 2nd Reading

6/21/2018 Motion To Table (Bucco) (30-43-0) (Lost)

6/21/2018 Passed by the Assembly (41-34-0)

6/21/2018 Received in the Senate without Reference, 2nd Reading

6/21/2018 Substituted for S2746

6/21/2018 Passed Senate (Passed Both Houses) (21-17)Statement – ABU 6/18/18 – 2 pages PDF Format HTML Format

Introduced – - 24 pages PDF Format HTML Format

Committee Voting:

ABU 6/18/2018 – r/favorably – Yes {9} No {4} Not Voting {0} Abstains {0} – Roll CallSession Voting:

Asm. 6/21/2018 – TABLE – Yes {30} No {43} Not Voting {6} Abstains {0} – Roll Call

Asm. 6/21/2018 – 3RDG FINAL PASSAGE – Yes {41} No {34} Not Voting {4} Abstains {0} – Roll Call

Sen. 6/21/2018 – SUB FOR S2746 – Yes {0} No {0} Not Voting {40} – Voice Vote Passed

Sen. 6/21/2018 – 3RDG FINAL PASSAGE – Yes {21} No {17} Not Voting {2} – Roll Call

So, it’s passed the New Jersey legislature… but now it waits for the governor. I’m curious as to what he’ll do.

HEARTWARMING TALE: POL KICKED TO CURB OVER TAX

You know, I don’t often get to blog about happy stuff.

Via Amy Alkon aka Advice Goddess I see this lovely story: With Bitter Parting Shot, CA State Senator Confirms Voters’ Wisdom

State Sen. Josh Newman cast a deciding vote in favor of a much-maligned and dramatic increase in gasoline taxes. He was promptly shown the door.

If voters had second thoughts about bouncing California state Sen. Josh Newman (D-Fullerton) from office in a high-profile recall election held during the June 5 primary, his self-centered stem winder on the Senate floor should disabuse them of any such regrets. I was left humming the chorus from a 1980s rock song: “Don’t go away mad, but just go away.” It wasn’t the classiest way to end a short and undistinguished legislative career, but at least it’s over.

…..

The state Constitution’s recall provision places procedural limits on how to recall elected officials, but it places no limits on the rationale for doing so. As the California Secretary of State’s Office explains in its guide to recalling sitting politicians, “Recall is the power of the voters to remove elected officials before their terms expire. It has been a fundamental part of our governmental system since 1911 and has been used by voters to express their dissatisfaction with their elected representatives.”Voters clearly were dissatisfied with Newman, judging by the margin that removed him from office. Activists on both sides of the fracas figured it would be close. But the final tally had voters from Senate District 29, encompassing parts of Orange, Los Angeles and San Bernardino counties, rebuking Newman by a nearly 59 percent to 41 percent. They also overwhelmingly chose Republican Ling Ling Chang of Diamond Bar to replace him.

Despite claims by the Democratic majority, which went all in to save a seat that gave them a Senate supermajority, there was nothing deceptive or unclear about the purpose of the recall. Newman cast a deciding vote in favor of a much-maligned and dramatic increase in gasoline taxes and the vehicle-license fee. “Recall is the ultimate device of accountability between elections,” said Carl DeMaio, the former San Diego councilman and radio host who led the effort. It was the “perfect weapon” to use in this case, he added, because the tax increases went into effect in April and voters were able to quickly communicate dissatisfaction with his vote.

Here is my approval otter:

And the really happy thing? His sacrifice to the electoral gods may have been for naught. There is a repeal of the gas tax up for a vote via initiative on the November ballot.

Ooooh, I love the anticipation!

OTHER LINKS AND TWEETS

- In Stinging Rebuke, Massachusetts High Court Strikes ‘Millionaire’s Tax’ from Ballot

- Gov. Scott Walker: Wisconsin will collect online sales taxes and then cut other taxes by same amount

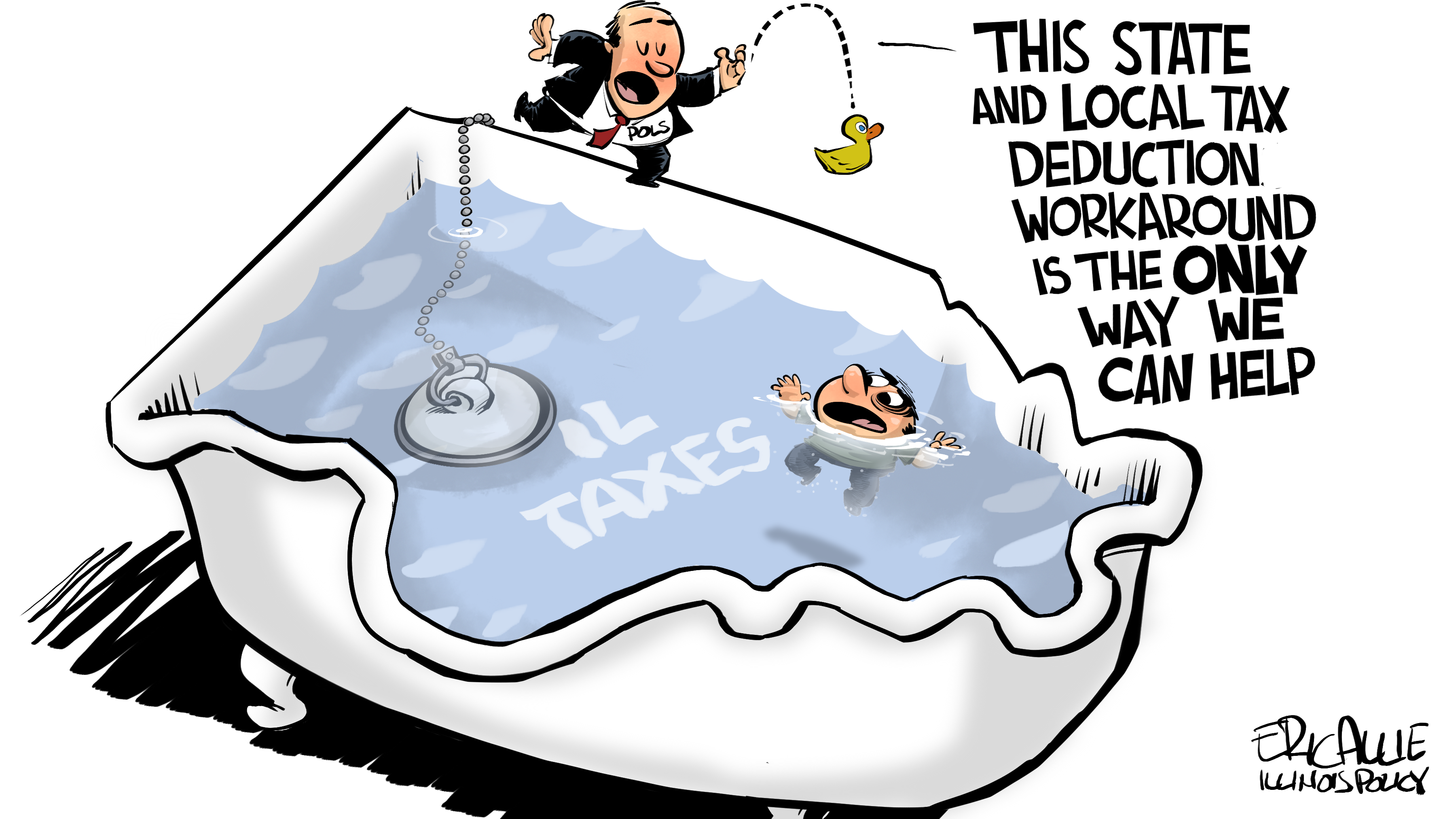

- Walters: IRS nixes California’s federal tax dodge scheme

- Doug Schoen: Democrats face trouble from population losses in high-tax blue states

- US expat business owners have a new tax to worry about

- Basic Services will wuffer without sales tax increase

- Proposed gas-tax hike to boost Utah school funding may be in trouble, new poll says

- Study: Soda Taxes Hit Poor the Most

- What you need to know about Sunday’s Louisiana sales tax change

- Tax refunds could be significantly higher next year — but is that a good thing?

They’re right.

People should have had that cash in hand earlier. That one is actually reasonable.

Surprised that Harley-Davidson, of all companies, would be the first to wave the White Flag. I fought hard for them and ultimately they will not pay tariffs selling into the E.U., which has hurt us badly on trade, down $151 Billion. Taxes just a Harley excuse – be patient! #MAGA

— Donald J. Trump (@realDonaldTrump) June 25, 2018

.

SenSasse</a>: “This will go over like a Vespa at Sturgis. The problem isn’t that Harley is unpatriotic - it’s that tariffs are stupid. They’re tax increases on Americans, they don’t work, and apparently we’re going to see more of this.” <a href="https://t.co/K0pd2lVYVM">https://t.co/K0pd2lVYVM</a></p>— Jake Tapper (jaketapper) June 25, 2018

IT'S OFFICIAL – Gas Tax Repeal Initiative Qualifies for the November Ballot – My full statement: https://t.co/cMIVTtih0y pic.twitter.com/GR7bTDqGM6

— Carl DeMaio (@carldemaio) June 25, 2018

The sugar tax is having an impact on our freedom to choose.

— Against Sugar Tax (@AgainstSugarTax) June 25, 2018

Scrap that sugar tax! pic.twitter.com/Vf2LwhEqgS

As a tax practitioner and an Enrolled Agent, I'm not a fan of the new "postcard plus six extra forms" tax return. It actually makes things a lot more complex, in my opinion. It's like they started with a postcard and worked backwards from there. Better to just clean up the 1040EZ https://t.co/Ai09T0kJMg

— Ryan Ellis (@RyanLEllis) June 25, 2018

LOL. This is the Trump Admin's new tax filing "postcard." It's a two-sided form that refers to six other forms you might have to fill out.

— Seth Hanlon (@SethHanlon) June 26, 2018

As we knew, the tax scam was never about simplification. It was always about tax cuts for the rich.https://t.co/QDDIu8ODIH pic.twitter.com/7tSwhgw5dp

Who the hell wants to mail in a postcard?

Let us file via email!

When it was revealed Iceland's PM had investments in the Caymans he resigned in shame, and he only had about $4m there.

TurnbullMalcolm</a> has $200m there and he openly defends his tax avoidance. <a href="https://twitter.com/hashtag/auspol?src=hash&ref_src=twsrc%5Etfw">#auspol</a> <a href="https://t.co/jnlJY0VQuI">https://t.co/jnlJY0VQuI</a></p>— John Wren (JohnWren1950) June 25, 2018

Oh, and something seems to be going on in Australia re: tax.

.

— Sky News Australia (@SkyNewsAust) June 25, 2018billshortenmp</a>: Labor will support any Australian business with under $2 million turnovers to get a tax reduction...I just don't agree with <a href="https://twitter.com/TurnbullMalcolm?ref_src=twsrc%5Etfw">TurnbullMalcolm that that Big Four banks should get $17 billion in tax cuts.

MORE: https://t.co/5WizPEfB6e #amagenda pic.twitter.com/glf3CXyhwH

Related Posts

Public Finance: Full Accrual Accounting and Governmental Accounting Standards Board Testimony

Taxing Tuesday: IRS Sends a Shot Across the Bow

Taxing Tuesday: Time to Make the Donuts