Public Pensions Watch: California Keeps In All the Goodies

by meep

Or the latest hit from Calpers: 98 pensionable income enhancements, but a temporary spike ain’t one

More than a year after Gov. Jerry Brown signed a law he said would tamp down pension spiking, the state’s biggest public pension fund is on the verge of adopting rules critics say would undermine its intent.

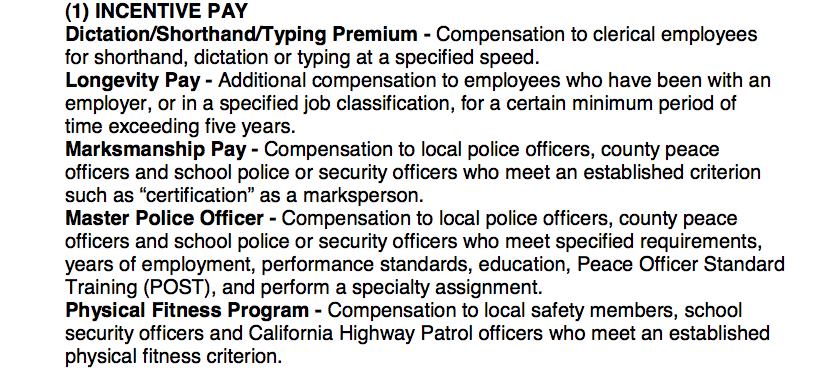

Staff at the California Public Employees’ Retirement System has suggested that the fund’s board authorize 99 types of special payments as counting toward pension calculations for employees hired since Brown’s pension law took effect on Jan. 1, 2013. Among them: longevity pay, police marksmanship certification pay, physical fitness pay, smog inspector license pay, notary pay, cement finisher pay and holiday pay.

Public pension-change advocates, including Democratic San Jose Mayor Chuck Reed, say the proposal is another sign that the union-dominated CalPERS board “is doing what they can to resist reforms. … They’re in favor of anything that expands benefits.”

But CalPERS says the proposal is consistent with the law and gives much-needed clarity to the 3,100 school districts and state and local governments in the retirement system who need to know what to report to the fund.

Look. Base pay is base pay. It’s easy enough to restrict pensionable income reporting to that. I assume they have some payroll system that separates out the base pay from all the goodies.

What I want to know is that if Calpers goes ahead with this recommendation, whether any of the supposed anti-spiking bits in the bill are in effect at all. Is there some kind of supplemental pay boost that would not be included in this recommendation?

Despite those concerns, Brown’s letter to CalPERS did not mention the other 98 items on the pensionable compensation list.

When asked whether the governor supported everything except the proposal to recognize temporary upgrade pay, Brown spokesman Jim Evans said, “I think the letter is pretty clear on what the governor opposes.”

CalPERS has taken the letter as a clear signal that temporary pay is Brown’s only objection to the proposal.

“We appreciate that Governor Brown recognized that CalPERS proposed regulations are essentially consistent with the purposes of the Pension Reform Act,” fund spokesman Pacheco said.

Okay, now I want to know the quantitative impact of letting all these “little” goodies through.

I’m not seeing that analysis. In the meantime, let’s check out some of these pay enhancements

Evidently there will be a hearing on this in a few hours. This should be fun.

Some of this is really the nature of a unionized workforce. You’re not allowed to make many distinctions on pay for the employees, so they put in all these little enhancements to make up for differences in skill levels and unpleasant assignments though one may have the same title/seniority.

Ok, fine, I guess I can see why some of this would be considered part of the base pay rate, especially if these are something you always get once you are awarded them.

But the point is that California municipalities really need to cut down on the richness of the total compensation package for their employees. If some of these goodies were classified as non-pensionable, and some do seem more temporary than others, then that would automatically cut the total comp.

I can understand why the union leader would say the municipalities should individually negotiate these packages, because that’s easier said than done. Much easier is to cut a whole bunch of little add-ons in one fell swoop.

Looking at the actual document, this is what is excluded

c) “Pensionable compensation” for all “new members” does not include; (1) Payments determined to have been paid to increase retirement.

(2) Compensation that had previously been provided in kind to the member by the employer or paid directly by the employer to a third party other than the retirement system for the benefit of the member and which was converted to and received by the member in the form of a cash payment.

(3) Any one-time or ad hoc payments.

(4) Severance or any other payment that is granted or awarded to a member in connection with or in anticipation of a separation from employment.

(5) Payments for unused vacation, annual leave, personal leave, sick leave, or compensatory time off, however denominated, whether paid in a lump sum or otherwise, regardless of when reported or paid.

(6) Payments for additional services rendered outside of normal working hours, whether paid in a lump sum or otherwise.

(7) Any employer-provided allowance, reimbursement, or payment, including, but not limited to, one made for housing, vehicle, or uniforms.

(8) Payment for overtime work, other than as defined in Section 207(k) of Title 29 of the United States Code.

(9) Employer contributions to deferred compensation or defined contribution plans. (10) Any bonus.

(11) Any other form of compensation inconsistent with the requirements of subsection (a).

(12) Any other form of compensation not listed and described in subsections (b).

So this is focusing on one-time, obviously temporary payments. It does seem that they’re claiming all those wage enhancements they are including aren’t temporary, and thus part of base pay. I suppose.

I would assume most of the spiking comes from including overtime and untaken holidays — the other items, I presume, would be items of long standing in the employee’s pay.

Still, it doesn’t look good, especially as California towns go bankrupt.

Editorial reactions — Los Angeles Daily News

At issue is what counts as income on which pensions are calculated. The 2012 law was clear: Pensions for new employees should be based on their “normal monthly rate of pay or base pay.” Whereas current employees can boost their pension calculations by also including “special compensation” for “special skills, knowledge, abilities, work assignment, workdays or hours, or other work conditions,” the Legislature didn’t include those sorts of extra pay items for new employees.

But CalPERS staff members have determined they know better what lawmakers intended. So they’re recommending the board issue regulations that allow new employees to count those items anyhow.

Some that jump out include compensation for staying physically fit; pay premiums for confidential work or 0n “audio visual” assignments; and extra police pay to be DUI traffic officers, or completing Peace Officer Standard Training courses.

It’s amazing the state and local governments pay extra for many of these items, which should in most cases be conditions of employment. It’s appalling that it counts as income for pension calculations for current workers. It’s outrageous that CalPERS might perpetuate these excesses for new employees.

So much for reform.

The California Public Employees’ Retirement System board needs to stop.

The board is preparing to approve rules today affecting employees who have been hired by local governments since 2013, after Gov. Jerry Brown pushed what he said was a pension reform intended to rein in the cost of pensions and end spiking for new employees.

The CalPERS staff cannot say whether the new regulations will increase costs or lower them. A staff report issued in April offered a vague analysis that there could be savings. We heard such comments in 1999 when the CalPERS staff declared the state could increase pensions at no cost to taxpayers. That didn’t work out well.

Our guess is that costs won’t be dropping. Most public employee unions are urging support or asking the board to go further. That’s their job. They’re supposed to work hard to get the most for their members. Elk Grove, Beverly Hills and many other cities are asking the board to reject the regulations.

Yeah, I don’t think this will play well.

Related Posts

Priorities for Pension Funds: Climate Change or Solvency?

Public Pensions Watch: Choices Have Consequences

Stupid Public Pension Trends: Divestment Expands