Divestment and ESG Follies: A Lack of Humility - Tobacco, Climate Risk, and More

by meep

I have a bunch of “ESG” (aka environmental, social, and governance focus on investments) stories. I will be addressing some of these this week, but I’m going to start with the oldest stuff first. I will have my usual Taxing Tuesday tomorrow (special election edition!) and then I’ll have a couple more ESG-related posts.

Let’s get started with the first few.

UN FINALLY NOTICES THAT TOBACCO KILLS

This … is not exactly timely.

UN Launches Tobacco-Free Finance Pledge

The United Nations has launched the Tobacco-Free Finance Pledge, which encourages lending, insurance, and investment companies to adopt tobacco-free finance policies that are in line with the UN and the World Health Organization.

“Addressing the financing of tobacco companies—across lending, insurance and investment—is essential to comprehensive global tobacco control efforts,” says the pledge. “The finance sector can play a positive role in addressing global health priorities, such as the tobacco epidemic.”

What will y’all also target? Booze? Fast food? Marijuana?

The peak of tobacco use, even worldwide, was decades ago. Yeah, I see the various graphs re: increasing cigarettes sold…. but in absolute numbers, and for some mysterious reason the graphs all start in 1990 or so. I think the per capita use of cigarettes is a bit more interesting… or percentage of population who are smokers (no matter how heavy they smoke).

But back to the pledge:

The pledge, which was created by Bronwyn King, an oncologist and CEO of Tobacco Free Portfolios, has 93 founding signatories and 36 supporters representing more than $5 trillion in assets under management. Founding signatories include ABN-Amro, Ontario Teachers’ Pension Plan, Aegon, Swedish pension fund AP4, AustralianSuper, BNP Paribas, and ING.

The pledge aims to highlight financial institutions that have implemented tobacco-free finance policies, and encourage others to do the same; persuade the finance sector to play an active role in addressing global priorities; and de-normalize financial and corporate associations with tobacco companies, among other objectives.

To be morbid, you’d think pension funds might not want to invest in tobacco if it’s a shrinking market (and it is— the % smoking has dropped faster than population growth), but they might be interested in handing out cigarettes to their participants.

This has a lot of good stats on the rise and precipitous fall of smoking.

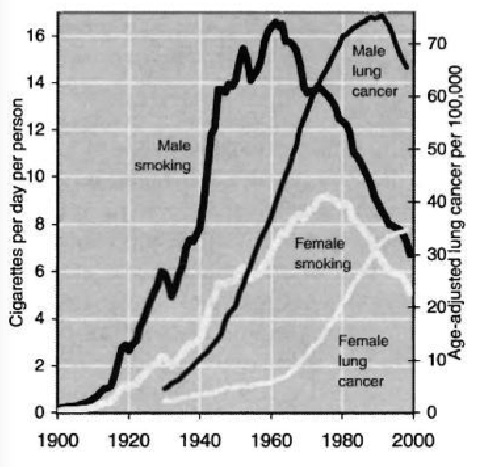

This is an old graph on smoking trends in the U.S.:

This is something I noticed in mortality trends — because the peak for female smoking came a few decades after the male peak, male mortality improvement has been much more rapid now, compared to women, especially with respect to cancer. Of course, women have had better mortality experience than men for over a century.

There are plenty of good reasons to not invest in tobacco companies, such as a shrinking market. But if tobacco is soooo evil, then the countries should outright ban it. How well do you think that will work out?

NY COMPTROLLER HAS AN ANNOUNCEMENT

From NY Comptroller DiNapoli, a press release from September in its entirety:

New York State Comptroller Thomas P. DiNapoli, trustee of the New York State Common Retirement Fund, released the following statement today in support of U.S. Senator Elizabeth Warren’s Climate Risk Disclosure Act. Under the act, the Securities and Exchange Commission (SEC) would require public companies to report their greenhouse gas emissions; how their businesses are impacted by climate change and the global effort to mitigate it; and what steps they are taking to minimize climate risk in their operations.

“Global investors are aggressively addressing climate risk, but we face a severe lack of information from our portfolio companies on how they expect to perform in the changing world,” DiNapoli said. “I applaud Senator Warren for drafting this vital legislation. If the SEC required the climate disclosure required by this bill, it would help investors determine which companies are preparing to succeed in a low carbon economy. It would also help spur innovation and encourage more companies to engage in building the growing low carbon economy. Current reporting is uneven and inconsistent, with limited evidence that companies are preparing for climate change’s impact. Time is short. No matter what the current President says or does regarding climate risk, local, state and city governments and nations around the around the world are moving to make the Paris Agreement’s goals a reality. Investors need the information required by Senator Warren’s bill to succeed.”

About the New York State Common Retirement Fund

The New York State Common Retirement Fund is the third largest public pension fund in the United States, with an estimated $209.2 billion in assets under management as of June 30, 2018. The Fund holds and invests the assets of the New York State and Local Retirement System on behalf of more than one million state and local government employees and retirees and their beneficiaries. The Fund has a diversified portfolio of public and private equities, fixed income, real estate and alternative instruments.

Find out how your government money is spent at Open Book New York. Track municipal spending, the state’s 150,000 contracts, billions in state payments and public authority data. Visit the Reading Room for contract FOIL requests, bid protest decisions and commonly requested data.

In this case, I included the info the comptroller usually adds at the end of these press releases.

I have an issue with all of this: thinking they can actually quantify any climate risk.

WHAT EXACTLY IS THE RISK?

Just from a historical point of view: the danger to humanity is not with the earth being too warm, but the earth being too cold.

That came from this post.

Here’s another one:

From this site.

It seems to me the real danger of too-cold temps, not a bit-too-warm temps. Unless the vegans are willing to admit that yes, humans are really dependent on meat to survive, which can do pretty well in an ice age.

But there’s something beyond that.

LACK OF HUMILITY IN THESE DIVESTMENT DRIVES

There are multiple levels to the humility problem. One problem is the humility with respect to current human knowledge. I’m more climate model agnostic than anything else – but given my experience with complicated models, with little validation, I’m very skeptical about the ability of climate models to extend decades, forget about centuries.

But forget about the climate science aspects – let’s rope in the tobacco, too.

The biggest problem is the lack of humility of public pension (or other public fund) fiduciaries in keeping to their scope. Their positions aren’t there to try to save the world. Their positions are to safeguard the pension funds.

They are exceeding their duties, and not in a good way.

Now, some make the arguments that they are being fiduciaries, in that the specific sector is likely to financially underperform because of regulatory changes, yadda yadda. That may very well be true.

However, when you talk on that score, especially with respect to climate change regulations, you need to think about time horizon over which these actions will be taken.

Some of the time horizons over which the specific impact is posited is beyond even the reasonable time horizon of holding the investment in the first place. And with respect to some of the squawkiest public pensions, the time horizon of financial impact is beyond the horizon of solvency for these particular pension funds.

So.

Stick to your knitting, fiduciaries.

THE CALPERS REMINDER

A couple weeks back I noted that an outsider pushed off the Calpers president, mainly by arguing that the ESG policy without reference to returns was killing the fund.

Barron’s now reports on the upset: ESG Investing Suffers a Setback in California

A funny thing happened recently in the left-leaning Golden State. In a board election last month, members of the California Public Employees’ Retirement System, or Calpers, the biggest pension fund in the nation, threw out their president and gave ESG investing a bloody nose.

ESG is the increasingly popular asset-management style that applies environmental, social, and governance standards to screen potential investments. Following this approach, an investor might avoid certain stocks or push shareholder proposals to modify corporate behavior. Unfortunately, they often favor hard-to-define social objectives rather than the narrower goal of maximizing shareholder returns.

In the vote, Jason Perez, a sergeant in the Corona, Calif., police department, upset board member Priya Mathur, a 15-year Calpers veteran, who was also board president and a champion of Calpers’ focus on ESG investing. The pension fund runs $351 billion for its 1.9 million members. Because of its size and stature, Calpers is among the most influential institutional investors in the U.S., and its policies are often adopted by other state pension funds.

Perez, who received 57% of the vote to Mathur’s 43%, ran a campaign that criticized her support for Calpers’ use of ESG, which goes back to at least 2012. Perez’s victory didn’t come as a surprise to those who bothered to look at Calpers’ mediocre recent returns. And that’s exactly what members seemed to have done.

Well, let’s see how mediocre Calpers’ returns actually are.

According to its Public Plans Database entry, it’s essentially at average. I guess that’s mediocre, by definition. But it doesn’t sound like the ESG policy has not yet hurt Calpers returns…

…except to the extent that all the large pension funds have that same problem.

But what really hurts, of course, is what the 5- and 10-year averages show, compared to the rate being used to project future returns.

Compare those averages against the assumed 7.5% per year return. That’s set to decrease, down to 7% by FY2020

Anyway, back to the Barron’s piece:

In an interview with Barron’s, Perez credits his win to a growing belief among members that ESG wasn’t doing them any favors. “Calpers’ social investment focus and lack of returns received a lot of attention of labor up and down the state….Everyone noticed the performance and [Calpers’] desire to concentrate on social issues.”

Perez is straightforward about his plans: The mission of the fund is primarily to provide benefits to members and reduce the burden on contracting agencies like the municipalities that hire state workers, he says. “We have a fiduciary duty, and I intend to hold them [Calpers] to that.”

Thank GOODNESS somebody mentions the fiduciary duty.

Of course, being a participant in the pension itself gives him a direct interest.

And then, there’s this bit:

There’s another basic problem with ESG: no standard legal definition. Each fund approaches it in its own way, which can mean varying degrees of emphasis on the environmental or social good or governance. In my experience, better governance and transparency are shareholder friendly and worthwhile. How hard is ESG to define? On Oct. 1, a group of securities lawyers and dozens of institutions, including Calpers, petitioned the Securities and Exchange Commission to standardize rules on ESG. I doubt the SEC knows any better.

I also doubt this.

I’m very pro G for pensions — governance is extremely important with respect to a fiduciary protecting their principals.

But… well, in a later post we’ll see how warped the idea of governance is with some of these pension funds. No, I don’t mean the governance of the funds themselves (though some could do with much better governance… says the person in a state where there is a sole fiduciary for the state pensions. UGH) I mean the governance of the companies being invested in. Or the sovereigns whose debt is being held (talk about a mess).

Here is Barron’s conclusion:

With ESG so popular, the election of Perez could be just a blip in its ascent. But if ESG investing doesn’t produce demonstrable proof of its efficacy on long-term shareholder returns, it could be the first tremor before an earthquake.

It could just be a fad. The Governance portion, as I said, has real value.. if it’s substantive, as opposed to demanding a certain percentage of board members check off boxes for gender identity, ethnic identity, sexuality identity or whatever.

Steven Hayward at Powerline posted A SIGN OF SENSE IN CALIFORNIA?

What’s this? An actual expression of common sense in California? Yes, it has actually happened.

CalPERS, the public employee retirement system in California, has one of the largest investment portfolios in the world (0ver $350 billion), though it is still not large enough to fulfill its pension obligations. Naturally being a political plaything, several years ago CalPERS board decided that it should use its investment clout on behalf of “social investing,” which of course means in plain speaking “lower return investing.” By its own estimate, CalPERS decision to exit tobacco stocks back in the late 1990s reduced portfolio returns by $3 billion from 2001 to 2014.

To be fair to Calpers, I believe it was forced to exit tobacco stocks by the California legislature… but I could be wrong. (Remember: the legislatures are NOT fiduciaries to the pension funds)

Hayward’s conclusion:

P.S. How long, however, will it be until California politicians demand that CalPERS divest from corporations that don’t meet California’s new legal mandate that half of their boards of directors must be women? I give it one year or less.

Yeah, I’ll get to that in its own post.

Related Posts

The Kentucky Pension Mess: Ain't Getting Cleaned Up Now

Wisconsin Wednesday: Is Benefit Growth Moderate?

New York State Climate Investing Goals: Who's On the Hook?