Divestment and ESG Follies: Mandating Women on Corporate Boards

by meep

Get it?! MAN-dating?!

Yeah, that’s weak. Whatever. This whole subject annoys me.

[I started this article a couple months ago… a post from Powerline has spurred me to actually finish and post.]

OH CANADA: REQUIRING FEMALE BOARD MEMBERS

Canada Pension Plan Focuses on Board Gender Composition

The Canada Pension Plan Investment Board (CPPIB) said it is increasing its focus on strengthening corporate governance, with an emphasis on improving the gender composition of the board of directors of companies it invests in.

“It’s crucial for companies in which we invest capital to assemble boards that reflect the full range of talent available,” Mark Machin, CEO of CPPIB, said in a release. “If companies don’t take the required action to achieve the board effectiveness that today’s business environment requires, it falls to investors to provide a nudge, and when necessary, a push.”

In its most recent report on sustainable investing, CPPIB added board effectiveness as a fifth focus area, along with climate change, water, human rights, and executive compensation. The change is intended to help CPPIB better identify and address issues such as gender diversity. The report also said that during 2017, CPPIB voted on measures at shareholder meetings for 45 Canadian companies with no female directors to demonstrate the organization’s desire for improved diversity. It said that one year later, nearly half of the businesses had appointed at least one woman to their boards.

I think once you have FIVE “focus areas” you have absolutely no focus whatsoever.

According to 2020 Women on Boards, a non-profit organization created to increase the inclusion of women on company boards, women now hold 20.8% of the board seats among the 801 Fortune 1000 companies tracked by its Gender Diversity Index. This is up from 19.7% in 2016, and 14.6% in 2011, when it first started tracking the data.

20.8% is barely higher than 19.7%. I do recognize it’s a lot larger than, essentially, 15% in 2011.

But here’s the bit: who cares.

The problem isn’t women not being on boards, but how board members get there. Are “independent” board members really independent, if they were selected by the board members who are also management?

And if women are selected who are junior compared to most board members… do you really think they’re going to speak up?

And if women are selected who have no expertise in that particular industry… I mean, COME ON.

CALIFORNIA ALSO WANTS IN ON THE ACTION

Mises Institute: California’s Feminist Corporate Coup

The crown jewel of California’s Progressive-feminist policy this year was Senate Bill 826 which mandates publicly-held corporations to put women on their boards. It was passed and signed by Governor Jerry Brown. California now proudly leads the nation in identity politics. The law requires a minimum of one woman board member by 2019, and by 2020, two for boards with five members and three with boards of six or more.

…..

Klein says, based on rigorous research, that, contrary to feminists’ assertions, “… women named to corporate boards may not in fact differ very much in their values, experiences, and knowledge from the men who already serve on these boards.”…..

None of these studies suggest that women should be excluded from corporate boards because they are women. Rather, they say that women should not be appointed to boards just because they are women. One can understand women’s goal of achieving corporate recognition and support of equally competent women. The problem with these mandatory identity-politics issues is that they are divisive, they value identity over competency, and they are heavy-handed attempts to legislate Progressive agendas.With this bill, one based on false assumptions, we can expect other “underrepresented” groups demand laws mandating the appointment of, say, African-Americans, Latinos, and those identifying as LGBTQ on corporate boards because of their group identity.

Contrary to what “underrepresented” groups say, there is a constant scramble for talent in the business world, and most publicly-held corporations are eager to appoint any competent, qualified person to their board. In our healthy, highly competitive business environment, competent people can only add to a company’s success.

Okay, I’m going to step back from that for a moment. As much as I would love to believe that, some board members are obviously appointed because of their connections. Was Chelsea Clinton appointed to the board of Expedia because of her deep business knowledge?

Some people on boards are under the thumbs of the CEO/Chair of the Board, and the CEO who selected them likes it that way.

Some people put their golfing buddies on the board.

There are plenty of iffy board members out there, but CEO/Chairs try to be careful in not being too blatant about picking someone grossly unsuitable. (For one, they could worry about their D&O rates if they had an incompetent board)

Okay, given that cronies of all sorts are put on boards, or politically connected folks, why not mandate women being on boards? Or other favored groups?

I can get into lots of reasons why, but the main reason is: that’s not your company, government. You do not own it. You force companies to make bad decisions, those companies (and really, their shareholders) are going to absorb the cost.

I decided to look up the average market capitalization of public companies — this isn’t all companies, but the median in the S&P 500 is $21 billion… but the S&P midcap 400 median is $4 billion, and the S&P smallcap 600 median is $1 billion.

That smallcap group ranges from $80 million to $13 billion in market capitalization… that’s really not a hell of a lot of money for corporations to play with. They’re not going to be able to pay $$ to scarce talent in the specified groups. Companies like Google will have no problem getting the requisite number of female board members (tsk tsk, only 2 out of 11?), but some small construction company is not going to have that luck.

I am looking at this bill, and this is for all publicly held corporations in California – no matter how small. Small companies in California: get the hell out.

AGAINST MY SELF INTEREST: ABOUT MANDATING WOMEN ON BOARDS

Look, I could make out like a bandit in certain respects because various industries are desperate to have women on their companies’ boards of directors [heck, I may very well make out later – but it will be in industries for which I am qualified]. But this mandating of women on boards is stupid.

None of the studies re: companies with more females on the board performing better are actually scientific in terms of cause-effect testing. All they can show is correlation… and some studies question if the correlation actually exists. The Mises piece I linked to above points out the problems with many of these studies.

Here is a piece from Wharton professor Katherine Klein:

Does Gender Diversity on Boards Really Boost Company Performance?

….

Spoiler alert: Rigorous, peer-reviewed studies suggest that companies do not perform better when they have women on the board. Nor do they perform worse. Depending on which meta-analysis you read, board gender diversity either has a very weak relationship with board performance or no relationship at all.

So what’s the harm in requiring it?

Well, there’s a weak relationship when it’s not mandated. That means, you have some scatterplot where some of the points have 0 women on the board… and you get some kind of correlation coefficient.

Now remove all those 0 points (just completely remove them) What do you think will happen to the correlation now?

But those companies will not necessarily go away, but now they have a different count for women on the board… and there was a reason they didn’t have women on the board before. We will consider some of those reasons below.

Do you think these companies now forced to select women will be able to find these magical return-inducing women?

I assume the results will be worse — if nothing else, either they’re going to have to bid up the price to get competent women (not all will be able to afford this) or get somebody much less senior than the men on the board, which puts the lie to the whole exercise.

WHAT ARE THE CURRENT GENDER RATIOS ON BOARDS?

Let’s check the stats: How Many Board of Directors Seats Are Held By Women?

So… a lot of companies currently devoid of female board members are going to have to scrounge for some.

If we go by percentage:

Take a look at which companies have all-male boards:

Ultimately:

While there are 282 companies (36%) that have no women on their Board, if we consider the requirements (at least 1 woman on all Boards, at least 2 women on Boards with 5 Directors, and at least 3 women on boards with 6+ Directors) by the end of 2021, there are 686 companies (87%) that are not compliant. If you are a woman looking for a position as a Board Member, let us know (hello@craft.co) – we can send you the list of companies that may be looking to fill some spots in the next few years.

So, let’s think about this.

Look at the specific sectors where they have all-male boards. I see construction, tech, manufacturing/industrial. These are sectors that have very few women at any level, much less executive level experience. And for some – like tech – you’ll find the executive women tend to be in marketing or HR.

Anyway, wanna bet on which companies will move out of California to avoid this hassle, and which ones will have to just get a woman… any woman… on the board? (Hey, let’s put the CEO’s sister or mom on the board…)

TANGENTIAL DIVERSITY THOUGHT

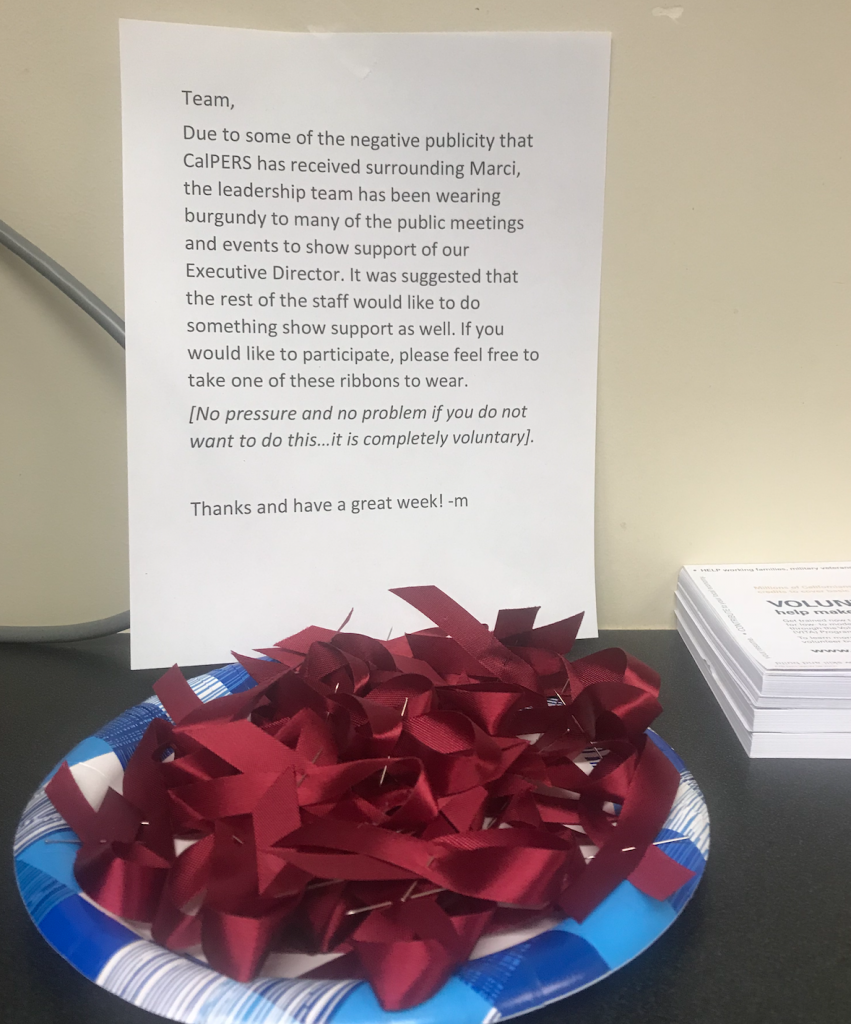

So, my original thought on the whole Marcie Frost brou-ha-ha, which I last wrote about in September, was that the Calpers board was desperate to have “diversity” at the executive level. So they hired a woman who had an iffy resume, and they hired a black man as CFO who also had an iffy resume.

That CFO is out, but Marcie Frost is still hanging on. I do wonder how long she can hang on, because stunts like this do not surround her with any aura of competence, much less suitability for her position.

CalPERS CEO Marcie Frost Pressed Senior Staff to Wear Burgundy to Show Loyalty

Posted on December 19, 2018 by Yves Smith

CalPERS as an institution is either unable to curb its poor impulses or so lacking in self-awareness as to not even recognize them. And more than ever, these pathologies start at the top of the organization.One case study is l’affaire burgundy, in which CEO Marcie Frost asked the CalPERS senior leadership team to wear burgundy to show their support for her. This is obviously inappropriate since a request made by a CEO is effectively an order. CalPERS executives and employees are civil servants, not Frost’s personal retainers. As an expert on managerial and political conduct reacted:

“I don’t even know what category to put this in. A scandal-plagued boss orchestrating support by inventing gang colors and pressuring employees to wear them? What happens to the employees who don’t perform this ritual of fealty? Should they be polishing their resumés and practicing their swimming skills?”

These incidents smack of underlying panic. Frost is working overtime to shore up her position as CEO in the face of fully deserved questions regarding her long history of misrepresentations about her background, which include committing perjury in Washington on a gubernatorial questionnaire. Not only is Frost pushing her subordinates far too hard to back her up, since they can only do so much for her and coercing them will diminish their good will, she is also showing a lack of a sense of professional boundaries.

This is beyond inappropriate. And it smacks of someone who is incompetent at their job, so they have to come up with stunts to supposedly project “strength”.

Here is a picture:

And you really should go to Yves Smith’s piece to see emails, etc., on this.

It would be nice to blame only Marcie Frost here, but the “establishment” Calpers Board members are no different on this matter. At this point, if there’s a public meltdown (and I think that’s how it’s going to end), not only Marcie Frost will be brought down.

Calpers has some bad management history — the criminal pay-for-play scandal being the biggest, most recent bad history, and you would think somebody would have learned about getting better personnel.

But no, after the board president was booted by Calpers members who found Calpers policy/management iffy, they’re looking for an easy landing for her:

Even though the item up for approval by the CalPERS Board of Administration this Wednesday is far from the most important CalPERS abuse, it’s a case study in how CalPERS staff put their personal prerogatives over what is best for the fund.

We’ve embedded the agenda item in question at the end of this post. You will see that CalPERS staff, meaning Marcie Frost, is proposing to have soon-to-be-ex board member Priya Mathur continue on the board of the Principles for Responsible Investment Association (or “PRI”), an investor group that is “UN backed”. PRI is one of the highest-profile organizations promoting “ESG” or “environmental, social, and governance” oriented investing.

Mathur’s term was set to end in 2020. In the note to the board, General Counsel Matt Jacobs states that Mathur could remain on the PRI board if the CalPERS board were to make that request in writing.1 That means she will continue to get to swan about the world on someone else’s dime (CalPERS claims not theirs; we’ll discuss why that claim is questionable).

Again, go to naked capitalism for the whole thing.

The board could rein in Frost, even if they don’t want to fire her. But they’re not going to do that. This is a Democratic political problem, and they had better get an eye on this, as Calpers is the largest state pension fund out there. Having incompetent management is not a good look. You can throw out all the “green investment!” piffle out there, but the participants and retirees want to feel their benefits are safe.

And the next time you go looking for executives? Just forget about having a “diversity slot”. That desperation makes it easier for a con artist to get by filters. You need to be a lot more skeptical of what’s being presented.

A POSTMODERN FIX

Of course, given current popular hysterias, there is a really easy fix to this.

Paul Mirengoff at Powerline mentions the obvious:

What really caught my eye, though, was a new law not about sexual harassment, but about female representation on boards of directors. The bill is SB 826.

…

According to this report, the penalties would amount to at least $100,000 for a single violation and $300,000 for each subsequent violation. California is the first state to set such a quota.There may be a loophole, though. The new law defines female as “an individual who self-identifies her gender as a woman, without regard to the individual’s designated sex at birth.”

And given faddish theories that gender is fluid, and thus one can rapidly change gender with one’s feelings, I recommend all board members identify as gender-fluid and conveniently identify as female on board meeting days. If California says that’s not good enough, they should sue the state for having such an archaic concept of fixed gender.

The great thing about modern gender theory is one need not behave in any particular way, or look, dress, or anything in any particular way, but simply state how one is currently feeling. So just fire up the Shania Twain, and you’re good to go.

Related Posts

ESG and ERISA -- Pity the Poor Tort Lawyers Their Lost Business as Biden Gives a Safe Harbor For Now

SCOTUS Doings: Public Employee Union Dues and Justice Kennedy Retiring

Friday Trumpery: No Exemptions for State-Run "Private" Pensions [UPDATED]