Chicago Mayoral Race: What Do The Candidates Say About Pensions?

by meep

Don’t worry, I’ll be getting back to the corruption inherent in the system soon enough (I have at least one more topic — the unpaid vendors of Illinois — to cover there).

But there’s a Chicago mayoral race on… Crain’s Chicago Business asked all the candidates the same set of questions. I don’t live there, and my only main interest is in finance… and especially pensions.

These are the pension-related questions that were asked:

“Should city employees and annuitants be required to contribute more toward and/or accept lesser benefits as part of stabilizing pension finances?”

“Should the city issue bonds to pay pension costs?”

So — the first is on making employees/retirees feel the pain, and the second is kicking the can. Let’s address the second first.

PENSION OBLIGATION BONDS: SHOULD CHICAGO DO IT?

I will list the candidates in the order they appear on Ballotpedia: (alphabetical order by last name), and link the Q&A for each

I listened to Mayor Emanuel’s speech about this idea, and while I am not sold on the idea by any means, I am interested in learning more. I have asked numerous banking and pension experts to explore the idea, and I will look into any idea that will help us solve our unfunded liability problems.

We can’t fix our pension problems without tackling the state constitution, identifying new sources of revenue, and pursuing necessary government reform. Short-term measures like additional borrowing, and securitizing revenue streams can make sense to manage our immediate situation, but they are not a lasting fix.

The city’s issuing of bonds at unsustainable rates is what got us into this mess and we do not believe it is what will get us out of it. Our budget allocation is increasingly hurt by our interest payments, and more debt is not the answer to an issue caused by too much debt.

No. No more kicking the can down the road on pensions

No. We need to tighten our belts, support projects such as Lincoln Yards if they are privately funded, and gradually enhance strategic pockets throughout the city. Let’s turn the TIF funds to paying our past debts and work creatively to enhance the creativity of our city to bring about the renaissance that is our full potential. A soccer stadium is within our potential, and that is ideal for private funding.

I am not in favor of issuing pension bonds because with the near term market volatility, I would not be willing to gamble taxpayer money. I would only consider a pension bond if the federal government would avail Chicago its full faith and credit — even if only for pension obligations for first responders.

Mayor Emanuel has proposed a $10 billion pension obligation bond to solve the pension crisis. I do not support this plan for several reasons. First, the proposed plan will increase the city’s outstanding debt by approximately 50% and will constrain the city’s ability to borrow in the future. Second, despite Mayor Emanuel’s assertions, there is no guarantee the pension funds’ actual rates of return will exceed the city’s borrowing costs. In an effort to sell this plan, Mayor Emanuel and his staff have focused on the spread between the bond’s anticipated interest rate, which they claim would be roughly 6%, and the four funds’ actuarial rates of return, which average 7.25%. An actuarial rate of return is not the same thing as an actual rate of return. Between 2008 and 2017, the city’s four pension funds had an average annual rate of return of 6.4%, or 85 basis points below their average actuarial rate of return. While the 6.4% return exceeds the city’s claimed interest rate for the bond, the Civic Federation notes that the last taxable general obligation bond the city issued in 2017 had an interest rate of 7.045%. Third, Mayor Emanuel and his administration have not been transparent about the proposal’s details, and they have not shown a willingness to hold public hearings about the proposed plan. No one should support this plan until it has been fully and honestly been presented to the public.

No. Our first solution is to get the city budget in the black. From there, we will allocate surplus revenues toward alleviating our pension costs. We will not bond to pay for our pension liabilities.

As Illinois state comptroller, I was proud to lead our state through the worst budget crisis in its history, calm markets, and save taxpayers billions. I will build on that experience moving forward when considering potential bond deals for Chicago pensions to ensure any financing deal is both smart for the city’s long term fiscal health and transparent to taxpayers.

At this time, I am not in favor of issuing bonds to pay pension costs. We need to first pursue more sustainable and less risky revenue sources that do not mortgage the city’s future earnings against a volatile equity market. In the event of an economic downturn, a pension obligation bond could put the city’s fiscal position in severe jeopardy. Therefore other options should be pursued prior to the POB.

I oppose Mayor Emanuel’s pension obligation bond proposal. The pension obligation bonds are highly risky ventures and the mayor’s plan will securitize much of the remaining flexible revenue that exists in the City’s budget. I have said that I will consider a pension obligation bond proposal that would be funded with a portion of expiring Tax Increment Financing revenues. But I would use such borrowing as a contingency in the event that my state legislative agenda was delayed.

No. I do not believe we should issue bonds and borrow money to pay our current debts. That’s like putting your groceries on your charge card without knowing where the money will come from to pay the charge card bill.

So, in general, I’m liking what I hear from the candidates on POBs — they are a bad idea in general, and I think they’re a horrible idea for Chicago specifically (they really do not need additional leverage on their balance sheet at this time.)

The only answer I really didn’t like was Mendoza’s, which was essentially contentless re: the POB question…and she should know better.

I’m also a bit wary of Gery Chico’s “I want to know more” statement. I would hope you’d know enough to see that more debt is a bad idea.

The ones that got into details – like Lightfoot and Vallas – seem to understand how many problems there are with Rahm Emanuel’s proposal.

Oh, and LaShawn Ford — it is not clear to me that he understands the magnitude of the numbers involved, but he wasn’t the only one with TIF comments. I haven’t done a deep dive into all of Chicago’s finances (I just want to look at the pension piece).

And… okay, I don’t really know any of these politicians well enough to see if Jerry Joyce’s comment: “I would only consider a pension bond if the federal government would avail Chicago its full faith and credit”….whut? Is this some kind of joke?

The federal government did not bail out Detroit. You’re not going to get a federal bailout for a POB. JEEZ.

CITY PENSIONS: SHOULD WORKERS AND RETIREES SHARE IN THE PAIN?

The exact question from Crain’s:

Should city employees and annuitants be required to contribute more toward and/or accept lesser benefits as part of stabilizing pension finances?

Let’s check out all the answers again.

The state Supreme Court has spoken multiple times on this and it is settled. Pension benefits cannot and should not be reduced.

I have called for an amendment to the state constitution on pension benefits. Recent history has made clear that there can be no serious reform without changing the constitution, and the current state of our finances makes clear that we can’t balance our budget without reforming pensions.

Reforming pensions is only part of the solution. As described above, I am also committed to making necessary changes to city government and finding new sources of revenue.

No. Workers should not be held responsible for lowering the city’s pension obligations in the form of mitigating their future and retirement income. Part of the liability is for money meant for workers that was never set aside, as it should have been. Part of it is a result of unrestricted borrowing during the nineties and early aughts meant to keep city government afloat and maintain a veneer of progress. Current, retired and future workers were not responsible for creating or exacerbating the pension crisis.

Current city employees and annuitant pensions cannot be altered, as the Supreme Court has ruled many times. I agree with those rulings. New employees should have a different pension structure going forward including higher contributions to the pension fund. I think a defined contribution plan, such as a 401(k), for new hires should be on the table for consideration as I called for on the floor of the city council.

The existing contracts of both previous and current employees need to be fulfilled. We need to work collaboratively with new hires to ensure they have full future protections and strategic certainty.

Pensioners and city employees have done what has been asked of them, including contributing into their pension funds. It is city leaders who have broken their promises. I would work within the collective bargaining process to explore concessions for future employees but would oppose changing any existing benefits.

I know and believe that pensions are a promise, and I will make sure that current city employees and retirees receive the pensions they have been promised. I am opposed to amending the Illinois Constitution to reduce or diminish pension benefits for current city employees or retirees. Retired public service workers make up the backbone of the middle class in so many of our communities. To derail their retirement security would be devastating to local economies across our city. We have to resolve the pension problem for retirees and current employees.

We will have no choice, if we want to act in a fiscally responsible way, but to explore alternatives to a city-funded pension for people hired on or after January 1, 2020. Just as pensions are a promise, we cannot make promises that we have no ability to keep.

No. Our municipal workers were promised security in retirement and signed up to their pensions under strict definitions. Simply changing the Illinois Constitution or demanding more be paid of our middle class workers & retiree’s is not a solution of a compassionate government.

However, municipal pensions were never intended as a means to become independently wealthy. Therefore, all retirees who pull multiple pensions (state and municipal, both included) with a cumulative gross monthly benefit greater than 1.5x that current year’s U.S. median household income must be taxed. This is intended to go after pension abusers like our municipal & state bureaucrats and politicians.

I believe pensions are a promise and will not reduce promised pension benefits. For future employees, we should examine every option our city has to get through our difficult set of financial challenges, protect what’s already been promised, and make the critical investments necessary to ensure the stability of our pension funds and retirement security of our pensioners.

The Illinois Supreme Court has ruled that it is unconstitutional to retroactively require city employees and future retirees to contribute more or accept lesser benefits than were collective bargained. To solve our pension debt problem we must enact constitutionally permissible reforms that save money on the repayment of the debt and allow us to keep our promises to workers. To do that we must find revenue in order to front-load that repayment. I will seek legislation that will permit Chicago pension funds to offer discounted benefit buyouts to Tier 1 employees, as was enacted by the state last year. I would also seek to ensure that a portion of revenue raised by the adoption of progressive rates be diverted through the Local Government Distributive Fund, to all municipalities to be utilized for pension debt stabilization. Additionally, I will work with Springfield to pass legalization of recreational marijuana and gaming expansion to increase revenues available for pension debt stabilization.

While I would be open to a grand compromise, I do not anticipate that there will be the support to change the Constitution to allow for a change in pension benefits. Even before Governor Pritzker announced his opposition to such a Constitutional amendment. That is why I have prepared a five-year plan that assumes that there will be no fundamental changes in pension benefits and that we will have to provide the funding that is statutorily mandated.

My answer is clear in the answer above. No new taxes. Only new revenue. No new taxes, large or small. I believe that is the resolution to the pension shortfall. I believe city workers who were promised a pension and gave 20 or more years of their life should receive the full pension they worked for and was promised.

So … basically they all understand that there’s no changing the benefits for current retirees and workers without a state constitutional amendment… and Daley is the only person pushing for such an amendment (this obviously would need support from the state legislature).

Now, some of them go with what should and what ought and talking about blame… but some of us who think that benefits will have to be reduced (or there will be definite municipal bankruptcy) don’t think that it’s the workers’ and retirees’ fault, any more than I think it was the workers’ or retirees’ fault when Detroit went bankrupt.

“Deserve” has nothing to do with it.

It’s has to do with what Chicago will be able to afford.

A few of them do understand that, as they talk about different benefits for new entrants.

But the city pensions aren’t pushing only 25% fundedness because of future workers.

The problem has already accrued over decades. Many of us are very skeptical that Chicago will be able to actually fulfill those old promises, no matter what’s deserved.

CHECKING CONSISTENCY: AMANDA KASS HAS HER OWN SURVEY

Before Crain’s put this up, here is what Amanda Kass found the candidates saying, as of February 1.

So What are the Mayoral Candidates Saying Now about Pensions?

Why care about pensions? The quick answer is because under current law the city’s annual pension contributions are going to increase from year-to-year, with the biggest jumps projected to occur in budget years 2020 and 2022 (which correspond to payment years 2021 and 2023). So it’ll be up to the newly elected mayor to identify a way to make those increased payments.

For the 2020 budget the next mayor will need to fill an estimated $270 million hole in order to make that year’s pension contributions. To put that figure in context, the city’s 2018 budget was $10 billion, so $270 million isn’t even 3% of that spending. Nevertheless, the new mayor will need to come up with the money either through raising taxes, cutting spending, or a combination of the two. Many of the revenue-generating proposals candidates favor (like a Chicago casino) simply won’t be available for the 2020 budget.

Kass came up with a handy table which can be found in her post, and I’m just comparing that against what I see above. Also Here’s an even easier checkerboard on pensions.

Tax hikes are often discussed as a solution to Chicago’s under-funded pension crisis. Will you explore cutting benefits for current and/or future workers and retirees in order to lower the city’s pension obligations?

My summary:

YES: Bill Daley, Bob Fioretti, John Kozlar

NO: Gery Chico, Amara Enyia, LaShawn Ford, Garry McCarthy, Susana Mendoza, Toni Preckwinkle, Paul Vallas, Willie Wilson

NEITHER: Jerry Joyce, Lori Lightfoot (actually, what they both say is we can’t cut for current employees and retirees, but that new entrants should have something different)

For the three YESes, I wanted to see that they knew a state constitutional amendment would be required. Daley – yes; Fioretti and Kozlar actually agree with Joyce and Lightfoot — can’t cut current, but let’s cut future workers’ benefits.

So basically, only Daley is calling for lowered pensions for current employees/retirees (and for all we know, he just wants to reduce COLAs, airtime, OPEBs, etc.)

Anyway, they are basically consistent between earlier statements and what they said to Crain’s. Good.

But back to Kass — all the “we won’t cut” people are going to have a problem:

The new funding laws have five-year ramp periods, and city officials identified revenue sources for the payments in those years: property tax increases for the police and fire pension contributions; increased 911 charges for the laborers’ pension fund; and a water-sewer usage tax for the municipal employees’ pension fund. Revenue for the increases in budget years 2020 and 2022 have not been identified, nor has one been identified for the city’s future payments. A long-term, recurring revenue source is needed because under the new laws, between budget years 2023 and 2054 the city’s pension contributions are projected to increase from year-to-year by an average of 2%. Actual year-to-year changes will fluctuate and will depend on the changes in the pension systems’ assets and liabilities.

Now, 2% increases don’t sound so bad, right?

THE NEXT MAYOR WILL HAVE EVEN LESS FUN THAN RAHM: CONTRIBUTION RAMP

But: the projected ramp is a much steeper slope than 2% per year:

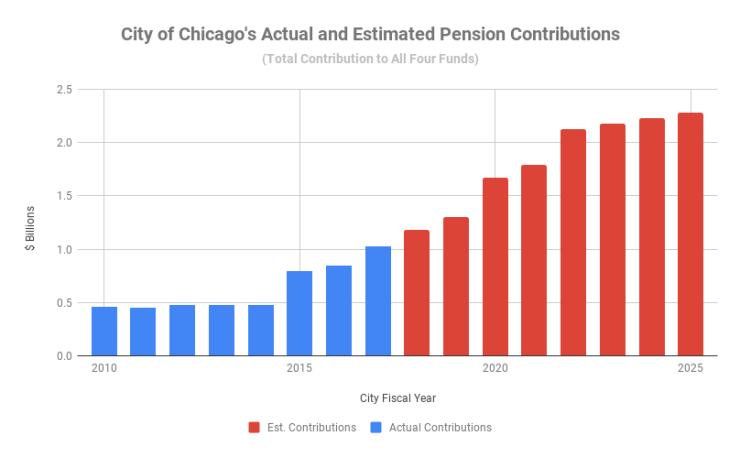

the City’s most recent estimates have the City’s required pension contributions increasing nearly 30% in 2020. The chart below shows the City’s actual and estimated pension payments for 2010-2025.

That’s just a single year projected increase. Yowza. Do they have funds for that?

I actually dug up the numbers from the CAFR. It’s worse than a 30% increase in one year. It’s a doubling of the contributions over five years.

[By the way, the combined funded ratio for FY2018 is estimated to be about 26%. Looks like they’re using a horizon of about FIFTY YEARS to try to get the pensions to 90% funded — not even fully-funded in a HALF CENTURY.]

But here’s the deal: they are at least trying to front-load the contribution increases (though they’re trying to get around that by doing fake contributions — aka pension obligation bonds).

FY2019 — 16% increase

FY2020 — 10% increase

FY2021 — 28% increase

FY2022 — 7% increase

FY2023 — 19% increase

after which the 2% increases into eternity

From FY2018 to FY2023, we see a cumulative 108% increase in pension contributions.

Do you think that’s going to happen?

I don’t.

By FY2024, they’re looking at an over-$2 billion contribution to the pensions — and that’s assuming everything behaves nicely (no stock market tumble, for example).

Did I mention that the “Corporate Fund” of Chicago had about $3.8 billion in revenue? There’s other stuff, but let’s just say, order of magnitude, a budget of about $10 billion.

You really think they’re going to allow for pension contributions to go from $1 billion to $2 billion in the space of 5 years? You think that’s politically doable?

I don’t.

CORRUPTION AND PUBLIC FINANCE

This is not exactly jumping back fully into my corruption series, but let me just re-link the three parts:

- The Undeniable Corruption of Chicago and Illinois: Effects on Public Finance

- Part 2: Workers Comp Fund

- The Undeniable Corruption of Chicago and Illinois: part 3 – Who Sent You?

If nothing else, Solis is wiped out — and Burke may or may not hang on. Who knows. But whether Burke stay or goes, imagine trying to deal with that doubling of pension contributions over the next mayoral term.

With all the stink emanating from Chicago politics.

The public will not look kindly on large hikes in personal taxes (income, property, sales, or anything). When the specific charges of corruption and self-dealing have to do with, oh, having the connected swing special property tax deals… well, the people of the city are not going to be happy paying higher property taxes themselves.

Businesses don’t necessarily want to be associated with politicians on the take, forget about being displeased with higher taxes.

You think the federal government will step in, considering? Ha, they definitely didn’t step in for 1970s New York City, forget about the more recent (and also very corrupt) Detroit 2013 bankruptcy.

How about the state? Well, Illinois has huge challenges itself with respect to funding pensions… and there is the matter of Mike Madigan. No, I don’t think Chicago will get much extra out of them.

Go to the bond market with a POB? Some now saying no may change their tune because it will be seen as the “easy” fix… but what if the bond market prices the yield so high, you can’t even pretend to a fake arbitrage?

The next mayor of Chicago has a huge challenge, and the corruption probes will not help.

Best wishes to the loser, I’m sorry I mean “winner”, of the mayoral election.

Related Posts

Around the Pension-o-Sphere: the "Strong Men" of Venezuela and Russia Can Do Only So Much

Arguing against the Public Pensions "Truths" and "Myths"

San Diego City ERS Has No Business Giving Out 13th Checks