Taxing Tuesday: ALL YOUR ASSETS ARE BELONG TO US

by meep

I hope you had a peaceful tax day yesterday.

Happy Tax Freedom Day!

Tax Freedom Day is a significant date for taxpayers and lawmakers because it represents how long Americans as a whole have to work in order to pay the nation’s tax burden.

This year, Tax Freedom Day falls on April 16, or 105 days into the year.

In 2019, Americans will pay $3.4 trillion in federal taxes and $1.8 trillion in state and local taxes, for a total bill of over $5.2 trillion, or 29 percent of the nation’s income.

Americans will collectively spend more on taxes in 2019 than they will on food, clothing, and housing combined.

If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 22 days later, on May 8.

Of course, because I live and work in high-tax states, my levels are much higher.

NY is #50 (May 3) and CT is #46 (Apr 25). Ugh. I chose this.

REDUCING DEDUCTIONS

Chipping Away at the Mortgage Deduction

Less than half as many American taxpayers are claiming the mortgage-interest deduction for 2018 as did the year earlier. With any luck, the 2017 tax overhaul will prove to be only the first step toward eventually replacing the century-old housing subsidy with a more effective program.

Taxpayers claim the greater of the standard deduction or the sum of various itemized deductions, including mortgage interest. The Tax Cuts and Jobs Act of 2017 raised the standard deduction, capped deductible state and local taxes at $10,000, and reduced the maximum mortgage principal eligible for deductible interest to $750,000 (from $1 million) for new loans. As a result, according to Tax Policy Center estimates, the number of taxpayers who take the mortgage-interest deduction will fall from 34 million (20% of returns) in tax year 2017 to 14 million (8% of returns) in 2018.

This is a welcome change. The mortgage-interest deduction has existed since the income tax was created in 1913, but it has never been easy to justify. Under classical economic theory, interest payments on an investment should be deductible, so that only profits — the income left over after expenses have been paid — are taxed. But the economic “income” from occupying a house — imputed rent — isn’t taxed in the first place, so there’s no reason the cost of earning that income should be deductible.

….

The deduction has always been regressive, and the 2017 tax changes made it more so. In 2018 almost 17% of the benefits will go to the top 1% of households, and 80% of the benefits will go to households in the top 20% of the income distribution. Only 4% will accrue to households in the middle income quintile.While the economics of the deduction have always been suspect, the 2017 tax law changed the politics of the subsidy, too. By cutting the use of the deduction and further concentrating the benefits onto high-income households, the tax overhaul makes clear that current mortgage subsidies aren’t meant to help the middle-class or new homeowners.

The next step should be to eliminate the deduction altogether. The phaseout should be gradual but complete. One approach would be to reduce the maximum principal against which interest can be deducted by $75,000 a year — 10% of the current limit — for the next 10 years.

Sounds good to me.

SALT cap zero!

Mortgage interest deduction zero!

Note: BOTH of these are against my interests.

The mortgage-interest deduction has been expensive, reducing federal revenues by about $60 billion a year before the tax overhaul. That figure is now down to around $30 billion.

Axing the deduction would provide more than enough resources to give each first-time home buyer a one-time refundable tax credit of $10,000. That would be more progressive and less expensive than current policy and, most important, would actually help some middle-class families become homeowners.

Mmmm, I don’t know about that, but okay.

STUPID TAX IDEA: TAXING UNREALIZED GAINS

WILFORD: WYDEN’S BREATHTAKINGLY TERRIBLE IDEA TO TAX ‘UNREALIZED’ CAPITAL GAINS

Under current policy, capital gains, such as increases in value for held stocks, are only taxable when they are “realized.” In other words, if you own stock that increases in value from $1,000 to $1,500, you’re only liable to pay taxes on the $500 increase in value if you sell the stock at $1,500 and “realize” the $500 gain.

Wyden’s idea, on the other hand, would replace this simpler system with one in which capital gains would be taxed annually whether or not they were realized. In other words, if a stock you held increased in value from $1,000 to $1,500, you would still be liable for that $500 gain even if you didn’t sell and the value only changed on paper.

…..

When tax is assessed when gains are realized, compliance is simple — values are established when the asset is purchased (how much you spent) and when the asset is sold (how much you received). And that value isn’t subject to interpretation or manipulation; the gain is a simple matter of arithmetic.But a tax on unrealized capital gains would be an administrative nightmare prone to gaming. Similar to the problems with Warren’s wealth tax, some assets are difficult to value. Stock in publicly-traded companies is easy enough to assess, but the value of something like a rare art piece is near-impossible to establish since there are so few potential buyers and few comparable sales to use as guideposts. Thus the ultra-wealthy are likely to employ expensive accountants to go to great lengths to minimize the on-paper value of their assets. Needless to say, middle income Americans will have no such luxury.

Additionally, how would Wyden handle asset value declines? Presumably Wyden is not proposing that taxpayers receive a tax credit when an asset declines in value, but assets such as stocks can be notoriously fickle. Imagine being stuck paying taxes on unrealized capital gains for years, when the company you invested in suddenly goes out of business and your asset becomes worthless. Essentially, you could be forced to pay tax on years of speculative on-paper “gains” for an asset that is now worthless.

Commentary from Legal Insurrection:

Yeah, the wealthy aren’t paying their fair share, according to Wyden and the Democrats — even though the top 1% are actually paying 37.3% of all income taxes in the US. And by the way, unrealized gains are not income.

This particular idea may not be quite as dreadful as the Green New Deal, but it’s way up there (or down there). It’s another attempt to spread the wealth around, but this one is especially stupid/pernicious.

….

But paper gains represent potential wealth, wealth that is only made actual if and when the asset is sold. The thing itself has no stable value—the wealth it generates depends on what it actually does generate for the seller at the exact time it is sold. What’s more, an unrealized capital gains tax goes against what I understand to be the basis of our income tax laws, which is that they are a tax on income both earned (wages, etc.) and unearned (interest, dividends, etc.).As far as I know, most taxes (both local and federal) except for property taxes (which are not federal) involve paying when there is some kind of actual transaction in the real world. That transaction can be a purchase or the profit from a sale, it can be a tariff on the import of goods, it can be the receipt of wages or interest or dividends, but the tax is paid either at the time of the transaction or at the end of the tax year in which the transaction occurred. To change that rule for income tax from realized gains to unrealized ones is a big big deal and an enormous and transformative change rather than a small one.

Oh, and about those millionaires and billionaires, the only ones it will supposedly affect? That’s the sort of thing that was said in order to get the 16th Amendment passed to have a federal income tax in the first place—that it would only apply to the very very rich. We all know how that turned out.

Yes, it would pretty much hit everybody. Because they want your money. There is nothing deeper than that.

Given this is Holy Week, I’d like to remind the legislators that both Envy and Greed are deadly sins. Examine your consciences.

TAX STORIES

- Dunleavy grab for local oil taxes meets immediate resistance – Alaskan governor tried to grab local property taxes from oil companies to shove into the state exchecquer. The legislature is not going along.

- As Alaska budget tightens, $1.2 billion oil tax deduction comes under scrutiny

- Jane the Actuary: What, actually, is a “fair tax”?

- Yahoo Finance: The best and worst U.S. states for taxpayers

- Governing: Federal Tax Reform May Be Saving Money for States, Even High-Tax Ones

- Tax Foundation: A Tradition Unlike Any Other: The Masters Tax Exemption

- Illinois Policy Institute: NEW YORK WILL MAKE 2% PROPERTY TAX CAP PERMANENT

- National Review: Why ‘Tax the Rich’ Demands Are So Unreasonable

- Reason: I Got Stoned and Did My Taxes

- Twitchy: ‘Who’s stopping them?’ Group of ‘Patriotic Millionaires’ wants to pay more in taxes, so what are they waiting for?

- Reason:Starve the Tax Man

- Vodkapundit: Abolish the Income Tax, Abolish the IRS

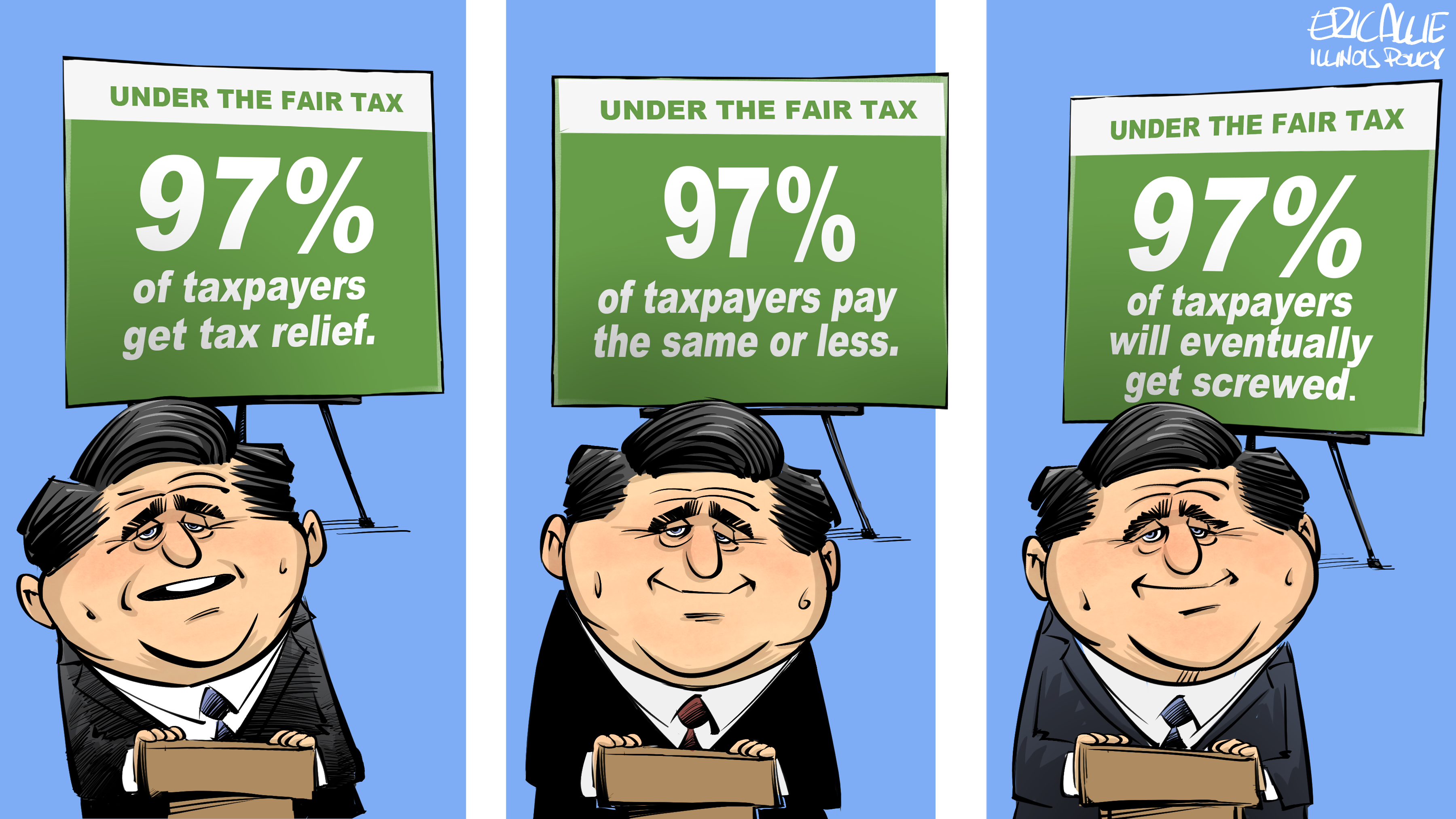

and here, have a cartoon about Illinois taxes

TAX TWEETS

Thread.

— (((AG))) (@AG_Conservative) April 15, 2019

Can’t imagine why people didn’t get an accurate perception of the consequences of the tax bill… https://t.co/xpZGVYPXYL

Pelosi: GOP tax proposal 'the worst bill in the history' of Congresshttps://t.co/INOTm0Hyn8

Because many media outlets and Dems said they weren’t really getting one. Only the greedy rich people and big bad corporations were.

— Debbie MacDonald (@DmactotheD) April 15, 2019

MacCallum: “So would you be willing to pay 52% on the money that you made? You can volunteer, you can send it back”

— Ryan Saavedra (@RealSaavedra) April 15, 2019

Bernie: “You can volunteer too…why don’t you give? You make more money than I do”

M: “I didn’t suggest a wealth tax”

Baier: “And she’s not running for POTUS” pic.twitter.com/zn4XrzJIXG

Final thought:

Just a last-minute reminder that tax rates are merely legal minimums. If you believe you should pay more, it’s perfectly acceptable to send more.

— Pat Sajak (@patsajak) April 15, 2019

I will add to that — if you want to give extra to the IRS, you can do it any time of the year! There’s no deadline for sending more money!

Related Posts

Centless in Seattle: The New Soda Tax Saga

Here Comes the Junk: Hartford Downgraded, State Says Get It Together

Taxing Tuesday: Taxes for Old, Taxes for New?