The Seven Deadly Sins of NJ Pensions is Really Only One Sin

by meep

New Jersey Watchdog has compiled what he considers the Seven Deadly Sins of NJ Pensions:

[for simplicity, I’m just listing the seven, plus my interpretation]

‘Seven deadly sins’ of NJ pensions add up to $104 billion debt

- – Retirement shams [retiring to get pension, but “rehired” immediately… a special form of double-dipping]

- – Full pensions for part timers [actually, a special form of spiking – working a part-time job at end to boost final salary]

- – Double-dippers and triple-dippers [just taking $$ from multiple sources – working govt jobs + collecting pension]

- – Disability pension abuses [fake disabilities]

- – Ill-advised health benefit costs [retiree health benefits]

- – The deadbeat state [undercontributions]

- – The $100,000 Club [high $$ pensions]

Now, some of these items (the fake disabilities) are out-and-out fraud, getting something they were never promised. Fraud can be prosecuted criminally, and money can be clawed back in that case. But many of the others are not specifically pension problems.

Let me do the last one — the $100K club.

Simply having a high-dollar amount pension wouldn’t bankrupt pensions necessarily. TIAA-CREF has a bunch of people taking annuity income of >$100K per individual. They’re not going bankrupt.

Hold onto the thought of why that may be.

Let me address the whole double-dipping issue. The standard use of the term “double-dipping” is that one is taking pension income while also getting regular income.

FIRST VERSION: The example in #1 is where one “retires” from a job and starts taking retirement income associated with that job… but then gets “rehired” for the same job the next day, collecting both regular income and pension for the same thing.

Let’s think about what would happen if it were a “real” retirement.

SECOND VERSION: Person A working the job retires, starts taking pension, and then Person B starts the job…and accrues their own pension while working that job.

Person B may or may not get the same salary as Person A working that job — if it were a private company, I would definitely not assume the two people were paid the same. But a government job? I’d assume Person B is being paid as much as Person A had been.

So in the double-dipping case, the state pays a pension to A, and income to A.

In the non-double-dipping case, the state pays a pension to A, income to B, AND B also accrues a pension.

Seems to me that “double-dipping” may save the state money, depending on the characteristics of A and B.

THIRD VERSION: There was a third situation, given that A is still doing the job: A doesn’t “retire”, but continues to accrue pension and works the job. While accruing additional pension for when they really retire may increase costs to the state, if they’ve legitimately reached a retirement age, chances are additional pension accrual is less than the income.

So when people are talking about double-dipping, they are usually comparing the FIRST and THIRD versions. From that point-of-view, double-dipping definitely looks fishy.

I can do similar analyses of the other “sins”.

Faking a disability, of course, is just outright fraud. I will not defend that.

But my point is there is really one sin of public pensions: not paying for the promises made.

That is, underfunding. (#6)

All the other items (except outright disability pension fraud) are not troublesome if the pension plans paid their full funding when due, and if realistic assumption sets were used (this includes retirement ages, mortality, discount rates, etc.)

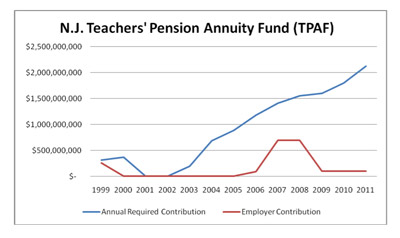

But even with favorable assumption sets, New Jersey has way underpaid its pensions.This is not unique to NJ, but NJ is particularly bad about this, yes, even under Chris Christie.

Here is a piece from 2010 with a relevant graph:

Oh, and that pension? That’s the one I referred to in the prior post that doesn’t even have the assets to cover their current retirees. Do you see why that may be now?

If the politicians think it’s okay to shortchange pensions because OMG! WE WANT TO BUY STUFF NOW!!! then the fact that people may do some spiking, or have health care obligations paid for, or all sorts of other promises aren’t what are breaking the bank.

It’s that the politicians feel free to make promises that they’re not actually planning to keep.

That’s not how they would term it, because they would claim the numbers nerds bamboozled them (yes, actuaries are used to being the scapegoats for bad news), but if you don’t put the money by, that means you’re not actually intending to pay.

The money ran out? Aw, just bad luck I suppose.

Whaddyamean, decades of underpayment to the pensions?

No, no, must be the bad luck thing.