Taxing Tuesday: Poor Little Rich People and the SALT Cap

by meep

This is rich (to me).

A leftie source complains that highly-taxed folks see their property values drop due to increased taxes.

Boo hoo.

Trump’s trillion-dollar hit to homeowners

In recent weeks, President Donald Trump has been talking about plans for, as he put it, a “very substantial tax cut for middle income folks who work so hard.” But before Congress embarks on a new tax measure, people should consider one of the largely unexamined effects of the last tax bill, which Trump promised would help the middle class: Would you believe it has inflicted a trillion dollars of damage on homeowners — many of them middle class — throughout the country?

That massive number is the reduction in home values caused by the 2017 tax law that capped federal deductions for state and local real estate and income taxes at $10,000 a year and also eliminated some mortgage interest deductions. The impact varies widely across different areas. Counties with high home prices and high real estate taxes and where homeowners have big mortgages are suffering the biggest hit, as you’d expect, given the larger value of the lost tax deductions. But as we’ll see, homeowners all over the country are feeling the effects.

….

Zandi says that because of the 2017 tax law, U.S. house prices overall are about 4% lower than they’d otherwise be. The next question is how many dollars of lost home value that 4% translates into. That isn’t so hard to figure out if you get your hands on the right numbers.

It’s not Trump’s fault that you live in Connecticut.

It’s not Trump’s fault that Connecticut (and New York) have super-high property taxes.

My property taxes alone push me over the SALT cap, so I know the problem here.

The Federal Reserve Board says that as of March 31, U.S. home values totaled about $26.1 trillion. Apply Zandi’s 4% number to that, and you end up with a $1.04 trillion setback for the nation’s home owners. That’s right — a trillion, with a T.

Thing is, it definitely doesn’t hit all homeowners equally.

Please note that Zandi isn’t saying that house prices have fallen by an average of 4%. That hasn’t happened. What he’s saying is that on average, house prices are about 4% lower than they’d otherwise be.

Hmmm. Where was this sort of analysis during Obama’s years? Not that the unemployment rates weren’t improving (for example), but that they’d be improving so much faster if the ACA hadn’t been passed (that’s Obamacare in its original form, though it has been whacked at for years now.)

Here’s the estimated impact on some of the highest-taxed counties:

Oh cool, they provide their estimates. I’ve grabbed the data set.

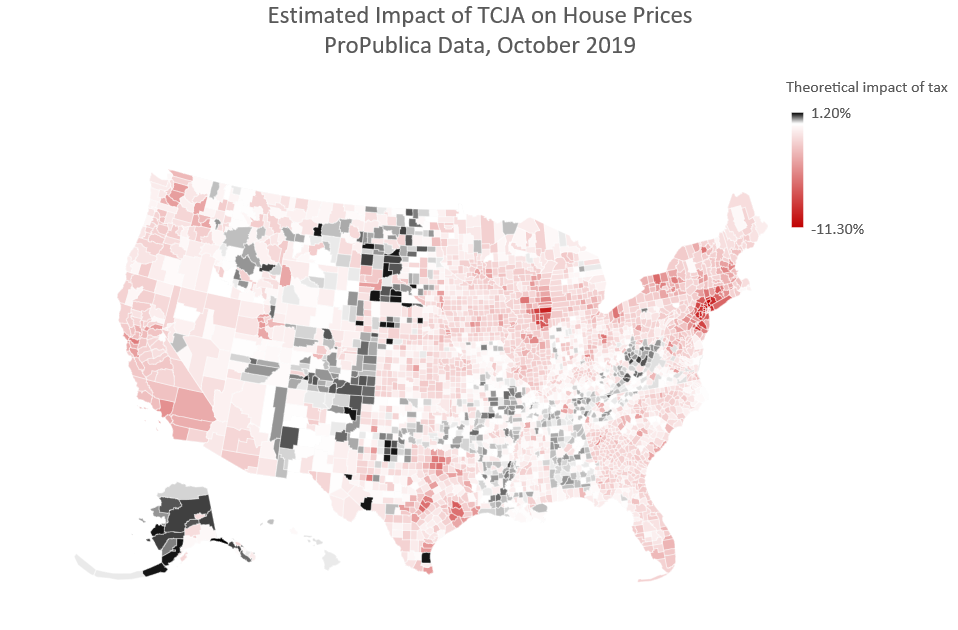

Here’s a map: those with positive estimated impact (that is, house prices benefited from TCJA) are in black, and those with negative impact are in red.

You can find Zandi’s county-by-county list in our Data Store. Eyeball the list, and you’ll see that counties throughout the country have home values lower than they would otherwise be.

Here’s how it works. Zandi took what financial techies call the “present value” of the property tax and mortgage interest deductions that homeowners will lose over seven years (the average duration of a mortgage) because of changes in the tax law and subtracted it from the value of the typical house. That results in a 3% decline in national home values below what they would otherwise be.

Well, sure, there’s a light pink all over the place, but what I notice is that the deepest red is concentrated in very specific places. The map is screwed up around Illinois (I guess various Great Lakes are being assigned to specific counties), for some reason, but the darkest red is around Chicago and New York.

You can argue, as some people do, that real estate taxes should never have been deductible because allowing that deduction is bad economic policy that inflated home prices and favored higher-income people over lower-income people.

It sure does, doesn’t it?

But even if you believe that, there’s no question that eliminating the deduction for millions of homeowners inflicted serious financial damage on homeowners who had no warning that a major tax deduction that they were used to getting would be wiped out.

Oh, we got a warning. And people are still squawking over it. Oh, the poor little rich Democrats in their highly-taxed states. Why can’t they get a break?

Maybe we should be looking to our local governments, and quit looking to the feds.

(A brief aside: Among the modest winners here are first-time buyers who purchased their homes after the tax law took effect and benefited by paying less than they would have paid under the old tax rules.)

Ah, perhaps that explains the black regions.

Lamle’s model isn’t applicable to most people because it works only for taxpayers with a household income of at least $200,000 a year who paid at least $1 million for their homes. But the principle underlying Lamle’s model applies to everyone who owns a home or is interested in owning one. To wit: You calculate the tax-law-caused loss of value by figuring out how much a house’s price needs to fall for buyers’ or owners’ after-tax costs to be the same now as they were before the tax law changed.

WAIT A SECOND.

All this is for an extremely small percentage of the population. Plenty of people with incomes that high buy cheaper homes than $1 million.

At the suggestion of one of my editors, I asked Lamle to use a modified version of his economic model to estimate the tax law’s impact on the value of a theoretical house in the New York City suburb of West Orange, New Jersey, purchased for $800,000 in 2017 by a theoretical family with a $250,000 annual income. Those home value and income numbers are very high by national standards — but middle class by the standards of large parts of suburban Essex County.

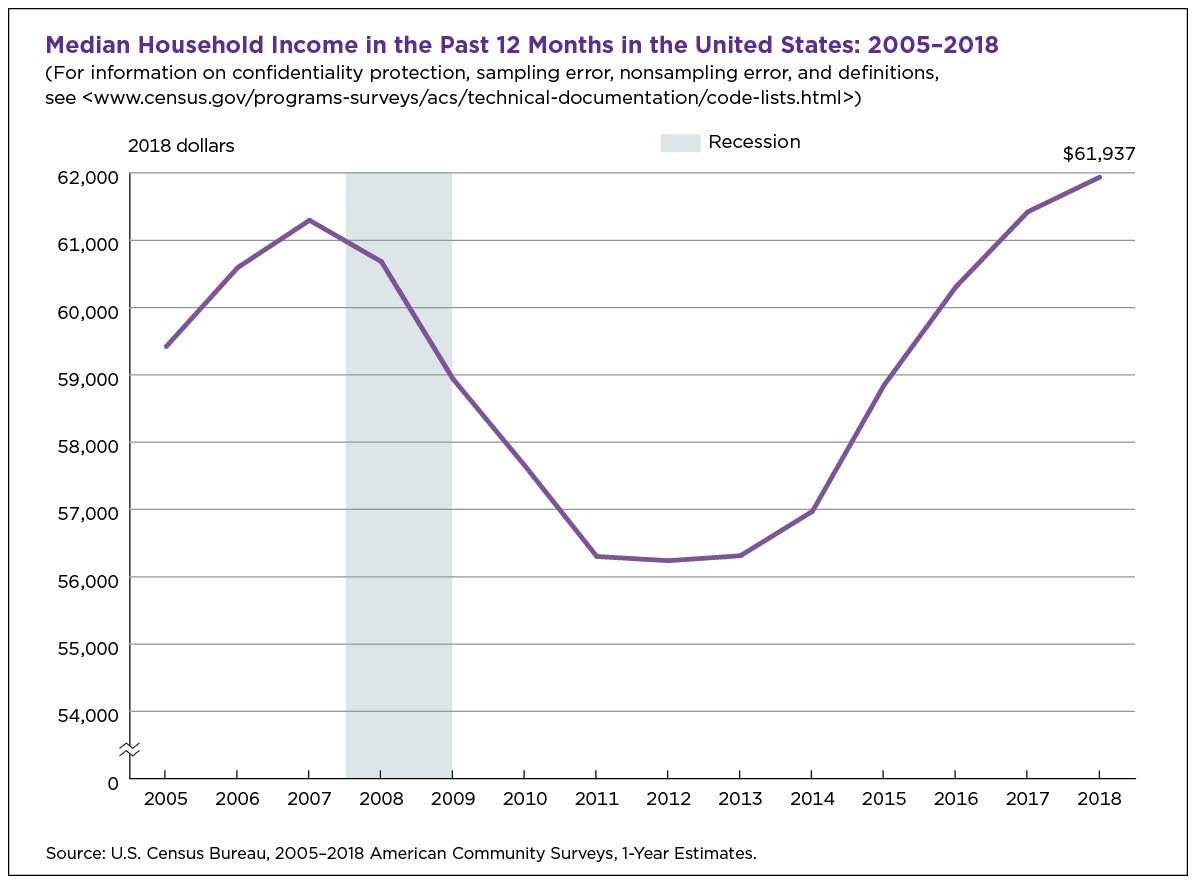

Guys, I have a high income. I’m below the median income for my particular town. But I’m not “middle class”. I’m just lower down than the much richer folks in the town — just because people like Michael Bloomberg and David Letterman own estates in my town doesn’t make me “middle class”. Just because one is less rich than super-rich folks doesn’t make one middle class or more sympathetic to the people near the median household income level of $62K/year.

If you’re a politician in New Jersey, New York, or Connecticut, you do have to consider the concerns of the $250K income taxpayer, because they are living an expensive lifestyle.

Oh, and speaking of things unmeasured/unsaid:

That’s inflation-adjusted income levels, by the way. I will note that the inflation-adjusted median did not exceed the 2009 level until 2015. The vertical scale does distort how much change was involved, but note that people did not see/feel a recovery til about 2016. Isn’t that interesting.

In any case, even though I’m in one of the hardest-hit counties re: the SALT cap, I’m just fine with it.

As I remark every time I write about the SALT cap, I think it should be set at zero.

Back to the piece [obviously, I’m just excerpting]:

According to the Tax Policy Center, the Treasury will get $620 billion of additional revenue over a 10-year period because people can’t deduct their full state and local taxes.

Well, $620 billion is a nice chunk of change, but given the annual revenue of the federal government is about $3.6 trillion, $620 billion over 10 years, or $62 billion for one year, is $0.062 trillion, which is 1.7%…. okay, that’s pretty decent as a boost.

This cap disproportionately hits people like me, and shouldn’t we be pulling our fair share of the federal taxes, right?

I get a bit tired of this bitching and moaning over the SALT cap, as these very same people turn around and cheer for wealth taxes.

TAX THOSE SLIGHTLY-RICHER FOLKS, NOT ME!

Why do liberals think rich people have money just lying around, like Scrooge McDuck swimming in a giant pool of gold coins? That’s the myth behind plans to tax Americans’ wealth, as Sens. Elizabeth Warren and Bernie Sanders both propose.

…..

The revenue side is even worse, as a wealth tax would suck money away from productive investments. Of course liberals in favor of taxation always trot out the tired trope that the poor drive growth by spending their money while the rich hoard it, tossing gold coins in the air in their basement vaults. As the Times put it, wealthy Americans supposedly have “more money than they know what to do with.” So just tax the rich and government spending will create great jobs for the poor and middle class.

I don’t see the credibility that the government knows how to effectively spend money.

Government bureaucrats know how to effectively keep money in their own pockets, no question.

So really, with no rational economic use, a wealth tax is big-government punitive class warfare. It’s obvious. Ms. Warren rails against Wall Street “looting” and considers private-equity firms “vampires.” Mr. Sanders’s website keeps a list of his “anti-endorsements,” from Jamie Dimon to Andy Puzder — a practical Who’s Who of successful job creators.

So what’s the right way to tax wealthy people? Robert Hall and Alvin Rabushka proposed a flat tax on income from employment, with no deductions save for a personal allowance. In fact they did it on these pages in 1981. The government would replace all taxes on corporate and personal income with a simple levy on total compensation. The op-ed even showed a postcard-size mock tax form.

The point is that existing taxes on interest, dividends and capital gains discourage the healthy savings that create jobs in the economy. These are effectively taxes on wealth — and we don’t need another one.

So what’s really stupid is that by any reasonable measure, Elizabeth Warren and Bernie Sanders are rich people themselves. They own more than one house, each. They’ve got highly-paid spouses (who we never see, but I’m fine with that.) They’ve been used to doing not much more work than most people for much bigger paychecks.

And neither has started a business.

Isn’t that interesting.

This “class warfare” is not between the rich and the poor, but between highly paid bureaucrats versus much richer entrepreneurs.

Some of those rich entrepreneurs are just as annoying as the bureaucrats in yammering at the rest of us proles as to how we should live our lives, but as long as said rich folks just waste their money on ads I don’t look at, I don’t mind them.

The bureaucrats are another thing entirely.

TAX STORIES

I looked around at the Japanese consumption tax stories, but I don’t have enough results yet to comment on it. So it will just be in stories & tweets.

- Tax breaks for seniors could widen gap between CT’s rich and poor

- Years ago, Trump wanted to release his tax returns to brag about how little he paid: report

- Most Japan households plan to cut spending after tax hike: BOJ survey

- Yahoo Japan rolls out ‘deep-fried tax’ for employees

- Illinois drivers are paying more in taxes at the pump but buying less gas — I wonder, sometimes, at the use of “but” in headlines, when the conjunction really should be “and”

- Urban Institute: Are States Betting on Sin? The Murky Future of State Taxation — of course, this includes soda taxes.

- The Political History of Japan’s Consumption Tax

- Japan Times: Consumers look for ways to blunt impact of consumption tax hike

- Japan’s government pledges to act swiftly if economy slows after tax hike

- The consumption tax hike delays painful spending reforms

- LA Times: Criticism hounds Gov. Gavin Newsom over his plans for California gas tax dollars

- WSJ: Who Pays What in Taxes? The Answer Isn’t So Simple.

- This major tax deadline is today. What you need to know – oh, you people filing for extensions and then waiting til this deadline (again). You should have wrapped this up during the summer.

- Bernie Sanders unveils plan to raise corporate tax rate to 35% and ban stock buybacks – no stock buybacks, huh? Oh, that would be hilarious.

- These Billionaires Want The Ultra-Wealthy To Pay More In Taxes – Indeed. And how much are they ponying up themselves? Seems to me these are the sorts who should voluntarily be sharing their tax returns. Let’s see how much you are so generously donating to the government!

- Billionaires could face up to 97.5 percent tax rates under Sanders’ plan: economists – what bullshit.

I wish we could ship all these class-warrior-billionaires and millionaires off to some island in the middle of the Pacific, wall them off for a time, and let them fight it out amongst themselves. I’m tired of hearing their yapping.

TAX TWEETS

We need to repeal the 2017 $2T tax cut (put back in the middle class one), stop corporate subsidies, negotiate lower drug prices w/ big pharma,stop military spending over what military says they need, tax 3% billionaire assets, 2% on over $500M. Then we have some cash on hand…

— Marianne Williamson (@marwilliamson) October 15, 2019

Abhijeet Banerjee supported huge freebies and high tax rates. He may have done great in his professional life but as an ordinary Indian, I know that he was suggesting to administer poison to Indian economy. Period.

— Divya Kumar Soti (@DivyaSoti) October 15, 2019

Key takeaways from Abhijit Banerjee’s economic philosophy:

— Sanjay Dixit (@Sanjay_Dixit) October 15, 2019

1. Nothing is viable without raising taxes.

2. We are not using ‘inflation tax’, we must have high inflation.

3. High interest rates are ok if inflation is high

Such ‘socialist scum’ win Nobels on removing poverty. pic.twitter.com/vrYJWciUr9

What does a Conservative majority mean for you?

— Stephanie Kusie (@StephanieKusie) October 15, 2019

✓ Universal tax cut

✓ Increases to healthcare and education spending

✓ Infrastructure spending

What does a Liberal-NDP coalition mean for you?

➢ Higher taxes

➢ Fewer jobs

➢ Bigger deficits pic.twitter.com/GxPQVOpcEI

#Japan's consumption #tax hike supports medium-term fiscal consolidation efforts, and the country's sovereign credit profile. It will lower Japan's debt ratio; however, very high public debt will remain a key credit weakness. https://t.co/T8n8gppuJ0 pic.twitter.com/QO6PF2TCot

— Fitch Ratings (@FitchRatings) October 15, 2019

Japan data point to bigger than expected hit from sales tax rise https://t.co/3UtsOIu7XI

— Financial Times (@FinancialTimes) October 8, 2019

Why do you think Trump so desperately doesn't want his tax returns revealed?

— Matt Haran (@mattharan) October 15, 2019

My theory: to waste the Dems’ time.

Tax vs. Fine pic.twitter.com/CH8h2fpU2w

— CAclubindia (@CAclubindia) October 15, 2019

How do you accomplish the perfect socialist state? Squeeze out the middle class while claiming to support them. Tax them out of existence. Like California.

— Chuck Woolery (@chuckwoolery) October 15, 2019

Tax the billionaires.

— Bernie Sanders (@BernieSanders) October 15, 2019

Pretty sure they’re already taxed.

Andrew Scheer wants to give a $50,000 tax cut to millionaires. I want to cut taxes for middle class Canadians. #ChooseForward

— Justin Trudeau (@JustinTrudeau) October 15, 2019

Best wishes, Canadians!

Their election day is next Monday, so next Taxing Tuesday, we should know where the Canadian Parliament stands.

Related Posts

Governing Magazine: In Memoriam

Taxing Tuesday: I'm Sure Suing the Feds will Really Work for New Jersey

Taxing Tuesday: Last One of the Year!