Multiemployer Pensions: Will the Recent Bailout Destroy Pensions (in the Long Run)?

by meep

Obviously, bailouts are going to help at least a few multiemployer pensions in the short run, but as I showed earlier, the amount being shoveled at MEPs is only a small percentage of the amount needed to make plans whole.

The amount in the bill (note: below it is claimed there is no cap) is only 13% of the last-measured unfunded liability for all MEPs. Now, sure, given the profligacy of the current Congress & White House admin, that can be inflated to 100%. No problem.

That was the amount measured at a particular moment in time, with specific valuation assumptions. I wouldn’t be the least surprised if the unfunded liability grows enormously after this bailout bill.

But I get ahead of myself. Let us look at the argument that the bailout bill will not lead to MEPs imploding.

Pro-bailout take (and my remarks)

From Joshua Gotbaum via Brookings: No, rescuing pensions won’t destroy them

Will the rescue lead to mass withdrawals? No.

In an article published by the Pension Research Council at the University of Pennsylvania’s Wharton School, Aharon Friedman, a former Republican Treasury official and House staff member, argued that the rescue bill won’t actually result in a rescue; instead, employers will withdraw from these plans, causing them to fail anyway.

This bit I agree with — as Gotbaum writes, the main barrier to withdrawal from plans was that the union members would have to agree to that withdrawal, and the Butch Lewis bailout makes it more attractive for union members to remain in an MEP versus a single-employer plan.

As long as nobody is making any employers to actually contribute enough to put the plans on the path to full-fundedness, why should they care?

Is this a “prelude” to a federal bailout of underfunded state & local plans? No.

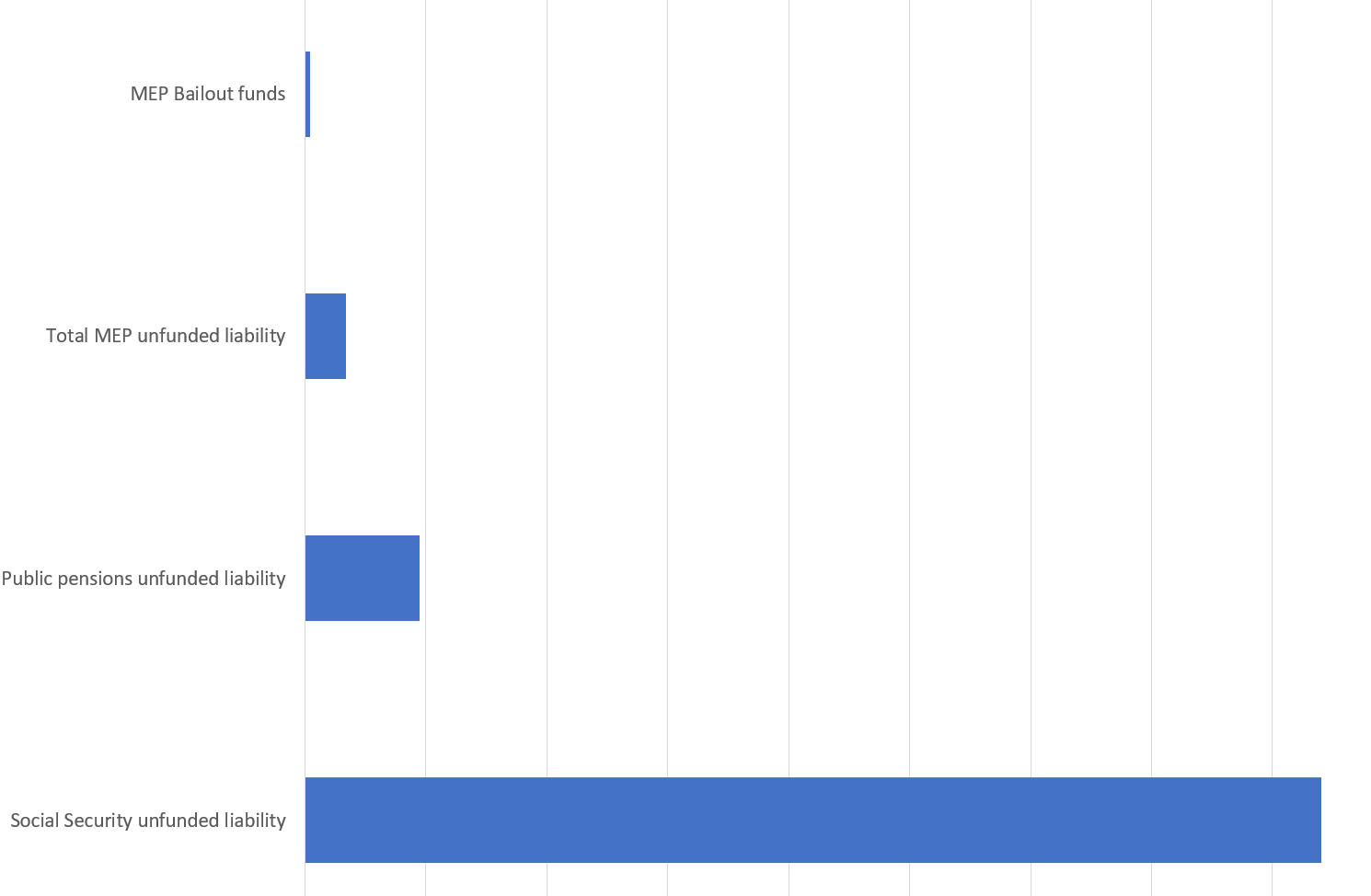

Andrew Biggs, an economist who has both written about pensions and is dealing with them as a member of the board appointed to oversee Puerto Rico’s financial crisis, raised a different objection: He claims in a Wall Street Journal piece that Congress’s decision to spend $86 billion to rescue private multiemployer plans is a “prelude” to a federal bailout of underfunded state and local pension plans. This, too, is exceedingly unlikely, for several reasons. First, private multiemployer pensions are regulated by the U.S. Department of Labor and have been federally guaranteed for 40+ years by the Pension Benefit Guaranty Corporation. Congress is unlikely to walk away from pensions it has guaranteed for decades. Public pensions, by comparison, have been neither regulated nor guaranteed by the federal government. Even if the legal objections to federal intervention were overcome, it’s hard to see how Congress, which took over a decade of negotiation to come up with $86 billion, could ever come up with the $1 to $4 trillion that is the public plan shortfall.

I also agree with this, to a certain extent.

Before I go further, Joshua Gotbaum was the director of the PBGC from 2010 to 2014. At the time, MEPs were in an awful state… and they didn’t get much better over this decade. So what I’m about to link to has to be known by Gotbaum: MEPs are horribly underfunded: via the Heritage Foundation:

Gotbaum is not mentioning how bad the problem was (and is) for MEPs.

The main reason the bailout had to happen, if not now before 2024, was that the Central States Teamsters fund in particular was going to wipe out the PBGC. If they hadn’t bailed out the plans now, they’d have bailed out the PBGC in a few years.

But passing by arguments of constitutionality (when has that ever stopped Congress from spending money?), no, they will not be able to bail out just the state pension plans, forget about all the local pension plans also grossly underfunded. I do not dispute that.

Let’s go back to Gotbaum’s argument:

Will Congress let plans get into trouble again? Probably not.

In his post, Mr. Friedman describes another possible disaster scenario under which, decades from now, plans that continue to use optimistic funding assumptions again face insolvency. The current law prohibits any assistance beyond 10 years, so such a scenario would require both (a) that pliant future congresses make no reforms in the decades ahead and (b) instead pass a new law that ignores history, rewards questionable behavior, and reopens the federal checkbook. History suggests the opposite result: Congress legislated multiemployer reforms in 2006, years before even attempting a bailout.

It’s easy to understand why Republicans who dislike unions, pensions, union pensions, or unilateral action dislike the Butch Lewis Act. It’s also easy to understand why pension reformers who want to stop the use of the optimistic investment return assumptions that promote underfunding are unhappy, too.

However, claims that the Act itself will cause disasters are far-fetched. What the Butch Lewis Act will do, however unartfully, is preserve more than a hundred distressed pension plans—some 1,500,000 current and future retirees and their families will sleep easier because of it.

I have a question for Gotbaum: what has been the result of said MEP reform legislation in 2006? Did it improve the situation for MEPs?

In fact, it was the 2006 reform that spurred UPS’s withdrawal from Central States Teamsters, which contributed to its almost going under as a plan:

The second big hit that Central States took was that UPS exited the plan in 2007. This means that they ceased making pension contributions for UPS employees who were Teamster members, and began providing for their pensions by themselves. Whenever a participating company leaves a multi-employer pension plan, it must pay into the fund what’s called “withdrawal liability” as a means of compensating for underfunding in the plan. However, UPS withdrew in 2007, with a hurried contract ratification with the Teamsters enabling them to avoid changes to multi-employer plans coming into effect in 2008. Because the withdrawal liability payment required under legislation at the time did not fully compensate the plan for the losses it would experience, this and other withdrawals brought about further decreases in pension funding.

When UPS withdrew, it underpaid for the liability it owed because withdrawal liabilities have been underestimated just like MEP regular liabilities have, and UPS wasn’t going to be making contributions for current employees in the future.

It would be useful to see if, outside the disastrous history of Central States Teamsters, if MEPs became better-funded as a result. Somehow, I think the answer is no, but I actually need to go look.

Anti-bailout takes

So here is John Bury’s take: Yes, Rescuing Pensions Will Destroy Them

A bailout mechanism is now in place and will be activated when enough politicians are bribed to act on behalf of:

Multiemployer plans who do not meet the first set of criteria,

Single Employer plans where participants have had their benefits cut in distress terminations,

Church plans, many of whom are already paygo,

Public Pension plans, and of course,

Social Security.

I do agree that MEPs will likely keep coming back to the bailout well, but there will be issues with the others.

The single-employer plans have fairly high pension guarantees backed by the PBGC, and people are not going to be all that well-disposed to bail out people getting DB benefits guaranteed up to amounts seen here, and are also covered by Social Security. If you’re 65 years old in 2021, and that’s when the PBGC took over your pension, as a single person you’d get up to $6,034.09 per month. The guarantees for the MEP program are much, much lower.

Church plans are problematic, I agree. There was a notable church plan failure here in New York state – St. Clare Hospital. While I do not see anybody looking to bail out, say, retired Episcopal priests, the lay workers of church-run businesses such as hospitals and schools might be able to catch a break. Maybe. But if they get bailed out, I would argue these plans have to get covered by the PBGC.

Public pension plans…. I guess they could spit in that bucket. It wouldn’t be a bailout, though.

Andrew Biggs thought the MEP bailout is a prelude to a public pension bailout:

The larger worry is that Congressional Democrats’ willingness to bail out private-sector multiemployer pensions signals they would do the same for state and local employee plans. Public-employee pensions operate under the same loose funding rules as multiemployer pensions, and public plans in Illinois, Kentucky, New Jersey, Texas and other states are no better funded than the worst multiemployer plans.

Many public pensions have a history of poor stewardship, increasing benefits in good times and failing to make their pension contributions when the economy turns downward. Will a Democratic Congress turn away unionized public employees when it already has bailed out union-run private sector pensions? At this point, the assumption has to be no.

I know the Democratic Congress would love to bail out the state/local pension plans. They did manage to shove a bunch of money at states, which I think should be used to contribute to pensions.

But as I remarked at the time: the magnitude of the problems differ:

That’s $1.9 trillion vs. $86 billion.

If you think the 13% bailout of MEPs was pathetic, what would you say to a less-than-5% bailout of public pensions?

Social Security will get handled, eventually (again). In my opinion, the benefits will get flattened and taxes will go up. But there won’t be a “bailout” in terms of everybody will get what they think they were promised.

At Wharton, guest writer Aharon Friedman posted: Senate Throws a Pension Curveball

Many multiemployer rules are based on projections by plans of future unknowable events, instead of current conditions. Similarly, the bill bases the amount of taxpayer assistance on a plan’s projections about unknowable future events such as future contributions and pension accruals, instead of just looking at existing underfunding. Like under current law, plans have every incentive to manipulate the projections.

The bill half-heartedly tries to prevent game-playing by requiring plans to use prior 2020 assumptions in making these projections unless “unreasonable.” But in evaluating applications for taxpayer assistance, the government must accept plan changes to these projections unless “unreasonable.” And the usefulness of past assumptions for future projections is questionable given the vastly changed circumstances created by the bailout, especially given the Senate change reducing or even eliminating the exit cost for employers.

Despite the bailout having an $86 billion CBO score, the amount of taxpayer assistance, which may run into the trillions if exploited by plans, is not actually capped. And the score is based on a stringent interpretation of ambiguous statutory text that plans and the Biden Administration may read as providing tens of billions more. It seems doubtful the Biden Administration would attempt to challenge questionable assumptions by plans seeking to increase their bailout. If employers terminate plans after the bailout, the assistance would be based on phantom accruals, possibly leaving plans with more taxpayer funds than liabilities. The complexity, uncertainty and immense amounts at stake will likely result in years of litigation.

Oh wait, it wasn’t actually capped at $86 billion? Hmmm, that’s the first I’m hearing that.

In any case, there definitely are incentives for underfunded MEPs (which is pretty much all of them even with optimistic assumptions) to play games to grab more taxpayer funds from this program.

Belly up to the bar while the getting’s good, I say — Congress could turn the spigot off at any time. Sure, it says ten years, but there is nothing stopping Congress from stopping the fund outflow at any time. So cash in now, MEPs!

Watch what happens to the drowning plans

The $86+ billion will start walking out the door soon enough, and more and more plans that had cut benefits or were applying to will walk that back in order to get that sweet sweet bailout cash. John Bury’s multiemployer pension category is a good place to watch for all these happenings.

Bury already caught one plan walking back its request to cut benefits, though this one just filed…….but maybe so it can be first in line for disbursements. Who knows?

I will note what jumped out at me between the two plans.

The one rescinding its request to cut benefits:

Retirees: 17,116

Separated but entitled to benefits: 13,777

Still working: 20,402

Ratio – Retired/Active: 84%

Ratio – (Retired + Vested not retired)/Active: 151%

The one newly requesting benefit cuts:

Retirees: 1,029

Separated but entitled to benefits: 672

Still working: 312

Ratio – Retired/Active: 330%

Ratio – (Retired + Vested not retired)/Active: 545%

The second one might not even be able to crawl out of its hole even with government funds… not that I think that’s one of the requirements for getting those funds.

So I make no predictions about the long run here… in the long run, we’re all dead.

I think it unlikely that Congress, at least this Congress, will pass any MEP reforms. The bill allowing for MEP benefit cuts passed under Obama, during his second term – with a Republican House and a Democratic Senate.

There may eventually be MEP reforms, but with a big cash injection into Central States Teamsters, the reckoning day has been pushed off.

The real crisis was Central States Teamsters going under. It would have taken down the PBGC. The puny plans like Warehouse Employees Union Local No. 730 Pension Trust (total liability amount: $474,757,777) are drops in the bucket compared with Central States (total liability amount: $56,790,308,499).

A parting thought, from that last link:

Unfunded liability of Central States Teamsters: $43,622,264,779

To simplify: $43.6 billion dollars

To simplify further: a little over 50% of the estimated $86 billion cost of the MEP bailout.

Isn’t that interesting.

Related Posts

Taxing Tuesday: Yadda yadda yadda

Taxing Tuesday: Let's Tax the Rich in NY! It Will Really Work This Time!

Other Pension News: Low Interest Rates, MEP Cuts, and More