PSERS Update: What if it's just sloppy processes?

by meep

Quick capsule: PSERS (Pennsylvania School Employees Retirement System) is in a pickle because someone mis-calculated their 9-year average return.

They originally said it was 6.38%, but now it’s been found to be 6.34%.

The issue is that there’s a target of 6.36%, and if the fund makes more than the target, employees do not need to increase contributions. If it’s less than 6.36%, they do… and it tripled!!!!! [don’t hyperventilate, it’s actually a small amount]

For those who prefer your stories in video form, here you go:

For the readers, here are some links and text.

PSERS coverage at Actuarial News

Fat finger syndrome?

The key story I came across is this:

Internal PSERS documents show how Pa’s biggest pension fund got key financial calculation wrong

Now The Inquirer and Spotlight PA have obtained new internal fund documents that shed light on that consequential mistake. The material traces the error to “data corruption” in just one month — April 2015 — over the near-decade-long period reviewed for the calculation.

The error was small. It falsely boosted the $64 billion PSERS fund’s performance by only about a third of a percentage point over a financial quarter. Even so, it was just enough to wrongly lift the fund’s financial returns over a key state-mandated hurdle used to gauge performance.

The documents reveal that a fund consultant, Aon, blamed the mistake on its clerical staff for inputting bad data. The material also shows that even though the fund hired a consultant, the ACA Compliance Group, to check the calculations, the consultant made only limited checks, and skipped over the month with the critical errors.

Now, we only have partial information at this point.

Here’s the key table:

Yes, I know, you can’t clearly see the headers. Sorry, I don’t have the original documents, just what was shared in the news story.

Here’s how I’m interpreting this table: first column is the fiscal year, second column are the unaudited returns that was used to calculate the 9-year average return, the third column are the audited financial reporting numbers, and the fourth column is the difference between the two returns.

Now, there is a possibility of nefarious doings, as I originally thought, but looking at these specific numbers and what happened…. it could be that numbers were entered… manually.

And that’s a source of error. As I say in the video, it’s pretty easy to enter 3.41% instead of 3.04% (or vice-versa)…. or it could be that they pulled the wrong data field, or all sorts of things. There are ways to reduce error from manual processes, such as having a separate person check that everything has been entered correctly.

In any case, when I saw the magnitude of the result – that there was a 4 basis point difference in the average returns (and that the employee contribution effect was a lot smaller than I thought it would be) – my base assumption is that sloppy financial reporting processes were involved.

Especially since I’ve seen some sloppy practices before.

The result: tripling the employee contribution!!

Yes, this section header is true, but misleading.

With the correct 6.34% return, instead of the grossly erroneous 6.38% return, evidently PSERS active employees have to increase their contributions to the fund from 0.25% of their gross pay to 0.75% of their gross pay.

Yes, that would be a tripling of their contributions.

But it wouldn’t be a large amount of money.

WSJ: Pennsylvania’s Biggest Pension Racks Up Costs After Misreporting Returns

However, in March the pension system said that the actual nine-year return came to 6.34%, triggering an increase in employee pension contributions reportedly affecting some 100,000 workers whose contributions will increase by 0.50% to 0.75% starting July 1. For instance, a school worker who earns about $45,000 annually would have roughly $8.65 withheld from each biweekly paycheck, the system’s website explains.

To do the math for you.

$45,000 * 0.75% = $337.50. Per year. That’s the new total contribution.

The old contribution:

$45,000 * 0.25% = $112.50 per year

The difference? $225. Per year.

Now, yes, it sucks that you’d be taking home $225 less in pay on a $45K gross salary.

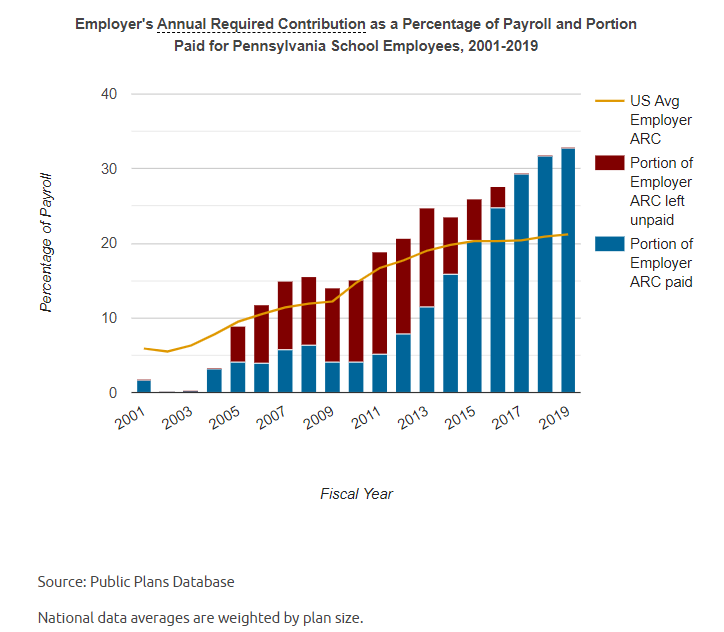

But compared to what the state of Pennsylvania is chucking in, it’s nothing:

The state is putting in 32.8% of payroll. For our $45K worker, that’s $14,760.

That is a lot bigger than a $337.50 annual contribution.

About those alternative assets

In my post from May 11: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition, at over 50% in their assets in alternatives, PSERS is in the top 10 for public pension funds having alternative assets.

It is way out of whack in comparison to its peers:

And it falls short in returns:

As per that earlier post, I thought that I would see that the plans with the lower returns would be chasing yield via increasing their allocation to alternative asset classes, but it seems I was wrong.

There doesn’t seem to be any relationship whatsoever.

Still, if you have a fund involved in more complicated and more opaque asset classes than the run-of-the-mill public equities and bonds, you really should be making sure your reporting on performance is rock solid in process.

Not whatever happened here.

In any case, the lawsuits have yet to begin to have been filed, the teachers union is asking for changes in the pension governance, and this story is far from its end.

Related Posts

Show Me (the Money) State: Missouri Tries a Pension Buyout

New York State Climate Investing Goals: Who's On the Hook?

Requesting a Public Hearing on Public Pension Actuarial Practice