Obamacare Tax Watch: H&R Block Survey Bolsters My Prediction

by meep

When I made my prediction of angry stories about the individual mandate tax/penalty/“shared responsibility payments, I was going by how I knew regular people (and irregular people) would read the various news stories about the penalty.

People would hang onto the $95 minimum penalty, and not really think through what 1% means.

I forget which blog I was reading, but one commenter had thought that if you made less than $95K, then the most you would pay would be $95 if you didn’t get Obamacare-compliant coverage in 2014. That’s if the penalty were 0.1%, not 1%. If I recall correctly, this statement was made by a commenter who normally didn’t say stupid things.

Just most people, even educated ones, don’t think about numbers too often and don’t have good gut feel for numbers.

(Btw, here is quick & easy percentages: 100% is the whole thing. 50% is half.

10% – move the decimal place one place to the left. 1% — move the decimal place two spaces to the left.

Example: 10% of 95,000 is 9,500. 1% of 95,000 is 950)

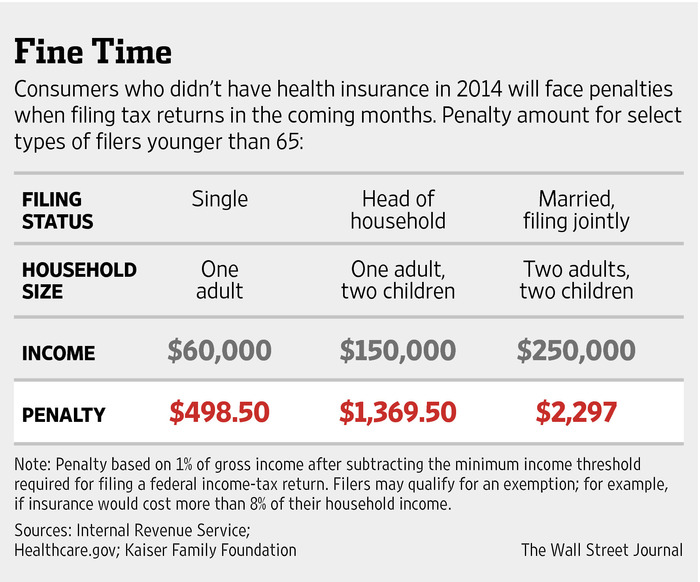

Again, as a reminder, here are some possible penalty amounts:

Not $95, but thousands of dollars, potentially. (Note that it’s not a simple 1% of income, but let’s not worry about that right now)

Anyway, H&R Block did a survey, and it bolsters my intuition:

2. Consumers still think the penalty for being uninsured, or underinsured, is just $95

Originally, many of the policy specialists struggling to explain PPACA said taxpayers with income over a certain level who failed to qualify for an exemption and failed to have “minimum essential coverage” in 2014 would pay a penalty of $95.The actual penalty for an individual will be the greater of $95 per person or 1 percent of income over a $10,000 threshold, up to a limit equal to the cost of exchange plan coverage. For a single taxpayer who earns $40,000, for example, the penalty would be about $300. The maximum monthly penalty, for a “shared responsibility family” with five or more members, is $1,020.

The author here is also being a little tricky — how many people will notice the “monthly” bit? Of course, you would have to have a really high income to hit the $12K/year max.

The angry coverage is not going to come from really high income people bitching they were surprised by the tax penalty. (Or will it? — maybe that’s for a later blog post)

It will be from regular schmoes who thought that, what with the Obamacare exchange hassle, and that the penalty would “only” be $95, they could suck that up for one year.

Wait for the surprise when they find out they’re taking a hit of hundreds to thousands of dollars… and it will be taken out of the tax refund they thought they’d get.

btw, LifeHealthPro, it wasn’t very nice to use a doofus photo for that particular survey item — it was one of the things deliberately not made clear in Obamacare explanations.

Then there’s this bit:

3. Some survey participants had not heard of the PPACA penalty at all

About 79 percent of the consumers surveyed at least pretended that they knew the PPACA mandate penalty existed — but 19 percent did not even pretend that they had heard of it.

Twelve percent of the survey participants who claimed their households had household income over $100,000 per year said they had not heard of the mandate penalty.

“Pretended”? Well, I guess so. They didn’t know how much the penalty was, after all.

They also link to an old Gallup poll result showing that the majority of uninsured U.S. adults were unaware of the individual mandate. That was in 2013.

I bet a whole bunch of them will find out very rapidly once they start doing their taxes.

Related Posts

Trying to Deflect the Blame: Calpers and the Catholic Church (and Trump!)

SCOTUS Doings: Public Employee Union Dues and Justice Kennedy Retiring

Obamacare Watch: 30 March 2014 -- Voter Registration, Incompetency, and Not Thinking Things Through