Central States Teamsters Pension Fund finally gets its bailout money, as planned -- now what?

by meep

Back in March 2021, the Moneypalooza Monstrosity, as I call it, or the American Rescue Plan of 2021 as others call it, passed.

One of the bailout provisions of the ARP was a multiemployer pension bailout, with a total price tag of $86 billion quoted at the time. (I will return to this in a moment.) Money from this bailout was going to be doled out in stages. That’s the context for what I’m about to link.

Here is the latest news on that particular bailout:

Pensions & Investments: Biden announces $36 billion in federal aid for struggling Central States Teamsters plan:

President Joe Biden on Thursday announced that the Pension Benefit Guaranty Corp. has approved $36 billion in federal assistance to shore up a massive union multiemployer pension plan facing steep cuts.

Teamsters Central States, Southeast & Southwest Areas Pension Fund, Chicago, will receive the funds under the Special Financial Assistance Program. The program, created by the American Rescue Plan Act that Democrats passed in March 2021, was designed to shore up struggling multiemployer pension plans through 2051. The PBGC estimates the total cost of the program will range from $74 billion to $91 billion.

The Central States Pension Fund covers more than 350,000 union workers and retirees who were facing estimated benefit reductions of roughly 60% in the next few years, according to a White House news release.

The pension plan had a funding ratio of 18% with $57.2 billion in projected benefit obligations as of Jan. 1, 2021, according to the plan’s most recent Form 5500 filing. As of Dec. 31, the plan had $10.1 billion in assets, the filing showed.

The PBGC approved the first SFA application in December 2021 and since then has awarded funds to 36 other struggling multiemployer plans. But Thursday’s announcement is by far the largest. As of Dec. 1, the PBGC had approved just over $8.9 billion in SFA funds to cover roughly 193,000 workers, retirees and beneficiaries.

If you want to look at current stats, and some of the historical stats, go to John Bury’s post here.

I will pull a few crucial numbers from the post/from the most recent valuation.

How much of a bailout is this for Central States?

Let’s look at Bury’s post — his numbers come from the most recent valuation filed with the government, and the key form is hosted by John Bury — it’s a Form 5500.

The last measurement of the MEP was as of January 1, 2021, which is almost two years ago. That’s the problem with these pension problems – but as it really is long-term, we won’t worry about two years. Until, later in this post, we’ll think about what has happened over these two years.

But here is the breakout:

Assets: $10.4 billion

Liabilities (valued at 2.43%): $58.6 billion

Expected payouts in 2021 (after the above): $2.9 billion

Expected contributions in 2021: $0.6 billion

Yes, the plan was in an asset death spiral, and it was projected to run out of assets by 2025, and was going to wipe out the PBGC multiemployer pension guaranty plan. I’ve written about this before, such as this 2016 post titled: Central States: I Guess the Plan is To Run Out of Money.

So, let’s just ignore 2 years’ worth of cash flows, though we could just subtract $4 billion from the assets without much harm, and just hold the liabilities relatively level.

But let’s just pretend we’re adding $36 billion to $10 billion and ta da, $46 billion in assets for $59 billion in liabilities, and it’s just gone from 18% funded to 78% funded, and I’m about ready to revive my 80% funded hall of shame!

The moral hazard of bailouts

Let me go back to my 2016 post, which was so quaint.

May 2016: Central States: I Guess the Plan is To Run Out of Money

THE PLAN: FAILURE

So, there’s no current cut to the plan, which means everybody keeps getting their full benefit til the money runs out. At which point the benefits get drastically reduced. Much worse than what was proposed by Nyhan.

….

I think if one did an investigation, one will find most of what causes pensions to fail is not enough money put in early enough. While sometimes there’s malfeasance in the asset management, in general one finds that plans had been shortchanged on contributions for decades by the time they fail….and that this shortchanging was completely legal.Imprudent, but legal.

….

THERE WILL BE NO BAILOUTSThis all goes to say: there will be no bailouts. Mish agrees.

Also, this should be a signal to public employees and retirees in some places (like Illinois and New Jersey), which Mish and Mark Glennon point out.

Yes, it’s sad that retirees will get heavily slashed in retirement when they have little flexibility to increase their income. But that being sad didn’t stop Detroit pensions from being cut. That should have been a signal as well.

Detroit got no bailout. Central States will get no bailout. Neither Illinois nor New Jersey (nor California nor Connecticut nor…) will get bailouts.

There’s simply not enough money to fulfill all these promises.

So they will be defaulted on.

So, that’s not what’s happening with Central States. They got bailed out.

I was wrong.

(as were many others, so I will take comfort in the crowd.)

(as were many others, so I will take comfort in the crowd.)

Note, their bailout is a very large percentage of the multiemployer bailout package of the American Rescue Plan of 2021.

Pretty much none of the MEP failures had anything to do with the pandemic. I wrote the above in 2016. We knew for years that Central States was going to fail without a bailout. The UPS withdrawing from the Central States plan is a big part for the failure, but part of the reason for their withdrawal was the failing nature of the plan. I don’t feel like recapitulating their problems right now, and no, it’s not all the Mafia’s fault — not now.

But the issue was that when the Moneypalooza Monstrosity was on, everybody came traipsing to DC with their demands, and this was as good a time as any to try, try again at the bailout. And with the Democrat sweep in the 2020 elections, time was on to turn that money printer on!

I know many people have forgotten about all the cash printed out (figuratively), but we’ve got the hangover now in the form of inflation.

So yay, the Central States Teamsters folks didn’t get their pensions cut… but those dollars aren’t worth as much anymore. But if they hadn’t gotten that bailout, they would have gotten some explicit cut and… still have weakened dollars because those “stimulus” bills went through anyway. I mean, what’s the difference of $86 billion in a $1.9 trillion bill?

(4.5%, that’s what)

But that’s the point — when the federal government was throwing around dollars at everybody, without regards to actual impact, why not go grab the dollars? Where’s mine?

And now… what about other grossly underfunded pensions — especially those that have no PBGC backstop?

Are public pensions next?

The WSJ editorial board makes that point: Biden Bails Out the Teamsters

Central States’ overseers proposed modest pension cuts that would have spared nearly half of participants. But progressives howled, and the Obama Administration rejected the reforms. At their first opportunity, Democrats rushed through a bailout. Last year’s union, er, Covid relief bill lets the PBGC make lump sum payments to keep some sick 200 multi-employer plans solvent through 2051 and fully restore benefits in the 18 plans that had cuts.

Notably, the law prohibits the PBGC from conditioning aid on governance reforms or funding rules. But it doesn’t forbid benefit increases. So the failings that got these plans in trouble will continue and may lead to future bailouts. Government unions with under-funded pensions in New Jersey and Illinois will surely demand one too.

So there are two parts to this.

One is the “getting into the weeds” aspect, which is to talk about the oversight of MEPs under ERISA, and no, I do not feel like doing that. Not today, at least.

But I do want to talk about the potential of bailing out New Jersey or Illinois pensions.

I’m not surprised that the WSJ and others are trying to make hay of Central States getting their money, which was a foregone conclusion when the bill was passed. It was just a matter of how much they would get. back when the Moneypalooza Monstrosity passed I wrote about the possibility of this crap being extended to bailing out public pensions:

We can’t bail ourselves out

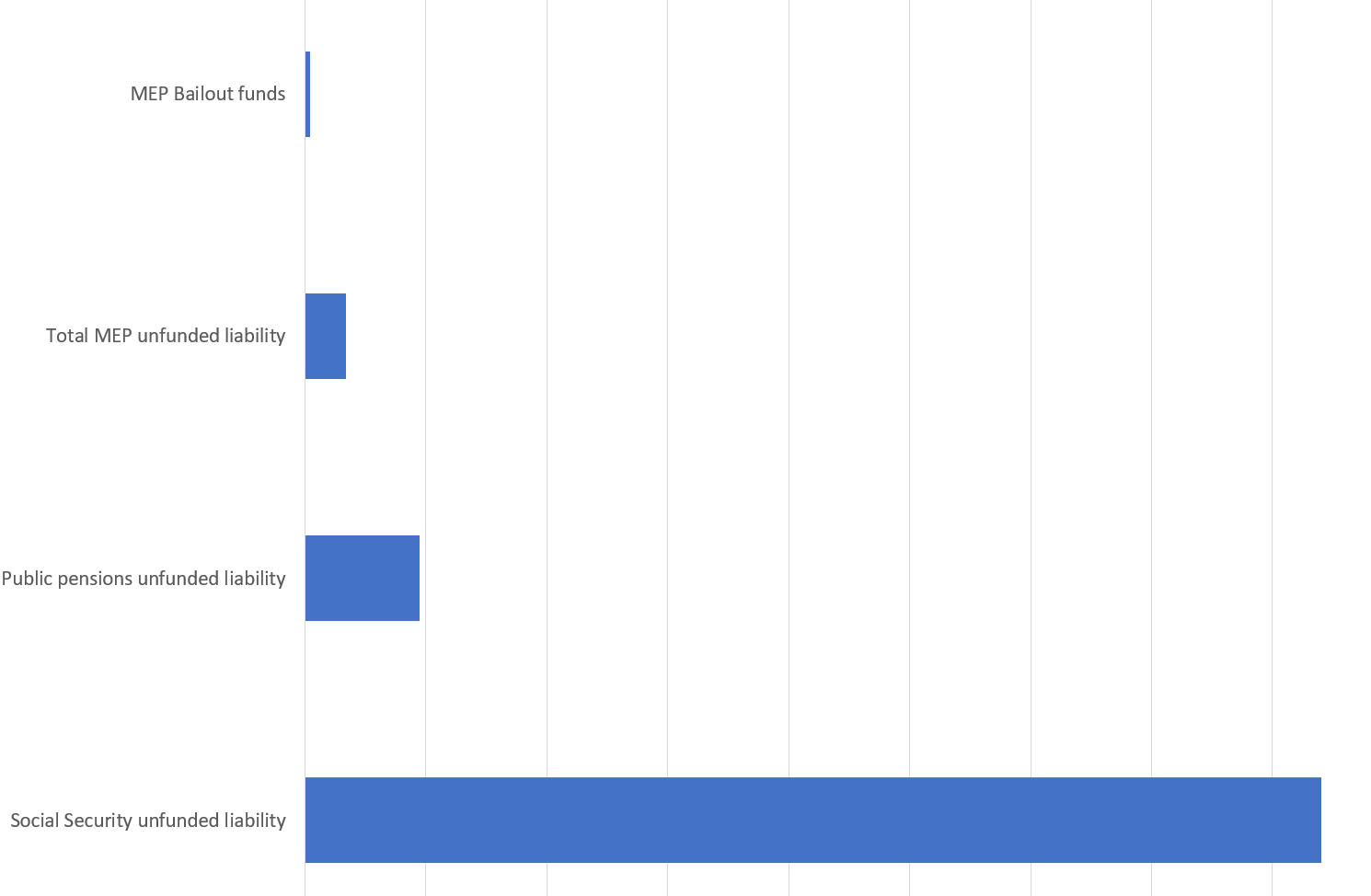

Let me make a comparison of four numbers:

- the MEP bailout size in the current bill ($86 billion)

- total MEP underfundedness ($673 billion)

- a theoretical public pension bailout ($1.9 trillion)

- a Social Security “bailout” amount ($16.8 trillion)

Here ya go:

Here are the whole-number ratios if you can’t eyeball the relationships above.

- The total MEP unfunded liability is 8 times that of the bailout bill amount

- The total public pension unfunded liability is 22 times that of the bailout bill amount (this happens to be the same as the total American Rescue Plan Act of 2021)

- The total Social Security shortfall is almost 200 times that of the MEP bailout bill

Now, there are loads of things that can be done with Social Security, and it wouldn’t even have to involve cutting benefits, but it definitely would involve taxing a bunch of people (and well beyond “the rich”) more. You can try out a bunch of different proposals yourself, many of which don’t involve benefit cuts at all.

We can’t bail out ourselves (look, don’t start with MMT on me or the magic money printer. I know about these. I’m talking reality.)

The future cannot bail us out. We tried that before, with the Boomers. The Boomers’ parents did fine – they produced enough people to make that sort of system work. But the Boomers produced far too little, in terms of the future.

We saw what the magic money printer has gotten us.

The future is here. And nobody is interested in bailing out Illinois.

and certainly not New Jersey.

To be sure, it could happen. Loads of things could happen.

Maybe they can manage to get rid of the SALT cap in the next Congress, and tell Illinois and NJ that’s their “bailout”. See if they go for it.

Related Posts

Taxing Tuesday: Let's Tax the Rich in NY! It Will Really Work This Time!

Taxing Tuesday: Back to Work!

Taxing Tuesday: How Can You Tax Your Pudding, if You Don't Tax Your Meat?