Did New Chicago Mayor Brandon Johnson Inherit The Worst City Pensions in the Country?

by meep

UPDATE AND SPOILER: THE ANSWER IS YES. YES, HE DID.

Brandon Johnson was sworn in as Chicago mayor on May 15, and I already sent my condolences when he “won” the election.

It’s not much in the way of winning when you have to deal with the disaster that are Chicago pensions.

A variety of people are claiming that Chicago pensions are the worst in the country (for the appropriate peer groups).

The claims of Chicago being among the worst on pensions

8 May 2023, WBBM: Brandon Johnson inheriting some of the nation’s worst-funded pensions, finance expert says

Chicago owes billions of dollars to its public pension funds for its teachers, fire, transit and other city workers. Mary Williams Walsh, the managing editor for the online newsletter News Items, said she considers it the worst for a major city in the U.S.

“There’s different ways of measuring things, so you can never be very precise, but I would say it’s one of the worst — if not, the worst,” she said.

Williams Walsh, a finance expert and a former New York Times reporter, said those for fire and police have the lowest funding. For each dollar they have to pay, she said they get about 23 cents.

She blamed so-called “ramps” — plans under prior administrations to postpone pension payments and then increase them in later years — for Chicago’s current situation.

“What somebody should say is, ‘If you can’t afford your contributions now, [then] you can’t afford your plan, and you should do it over,’” Williams Walsh said. “I mean, you should find some way of making it affordable.”

So that’s one take.

Here’s another.

1 May 2023, The 74: New Chicago Mayor Brandon Johnson Inherits America’s Worst Teacher Pension Mess

As the newly elected mayor of Chicago, Brandon Johnson just inherited what is arguably the worst teacher retirement plan in the country.

That’s a big claim, so let’s walk through some numbers.

First up is the cost side. Next year, Chicago will contribute more than $1 billion toward the city’s teacher pension plan. A large portion of that money will come from the state, and another $550 million will come from a dedicated property tax levy the state authorized in 2018.

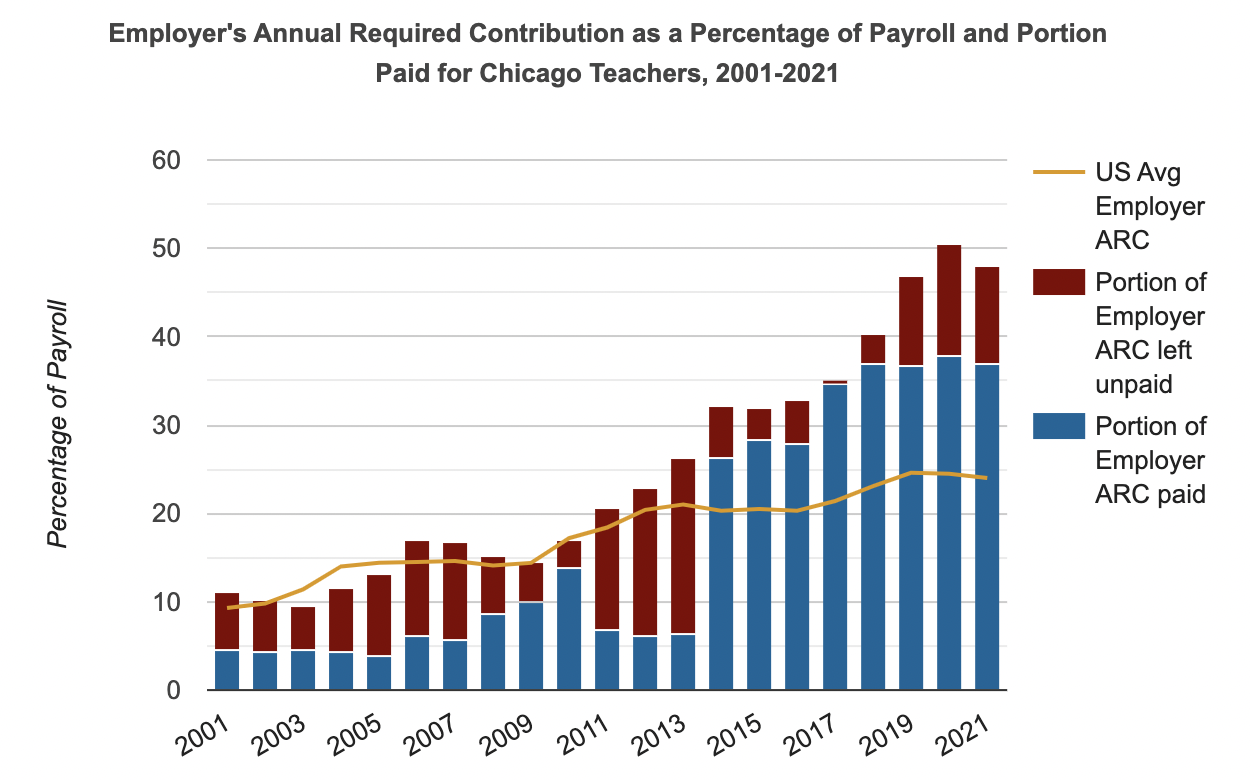

And yet, all this money is not enough. The chart below comes from the Public Plans Database from the Boston College Center for Retirement Research. As the chart shows, Chicago’s pension contributions have risen substantially over time (the blue bars), but not once in the last 20 years has it contributed as much as what its actuaries recommended (the red bars). In 2021 alone, that gap amounted to about $350 million.

Okay Chad Aldeman, the author of this piece, uses the same graph I have:

So this gives me an idea for a comparison of city pension funds (and let’s carve out a variety of types, because teacher funds differ from safety officers and from generic office workers).

Let’s compare based on:

- Funded ratio (most recent measurement — this may differ in fiscal year)

- Percent of payroll for “required” payment

- and maybe I’ll look at average percentage of “required” payment that was actually made (mmhmm)… but that’s a policy choice.

The first two are also related to policy choices, as I mentioned in my “Choices have consequences” series in terms of benefit design and retirement ages, in that it leads to how expensive the pensions are, but how much you actually fund the pensions has consequences, too.

But let us do the first two.

Comparing city-only pension plans

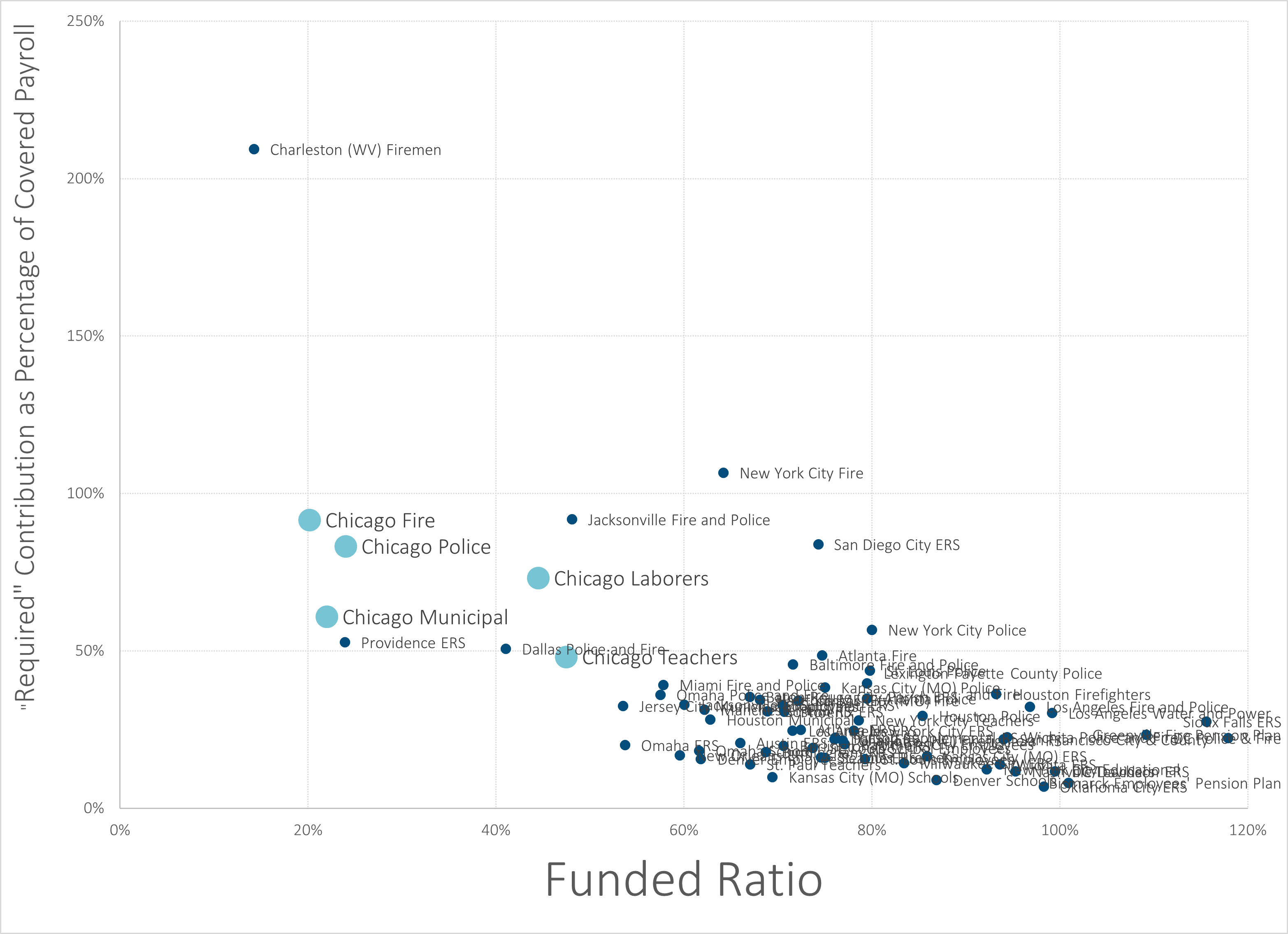

I grabbed data from the Public Plans database, and got the funded ratios and “required” payments as percentages of covered payroll. I filtered for city-level pensions (more on that in a moment), and here is the result:

So that’s the scatterplot highlighting the Chicago plans only … and yeah, they’re about the worst. You can see a few plans worse-funded, and requiring much higher contributions… but let’s see what plans those are now:

First, you probably don’t have to be told that the Charleston, WV Firemen’s fund is pretty small compared to any of Chicago’s funds.

Lessons from the other poorly-funded city pensions

A few of the other pension plans are notorious for being bad, and have appeared on STUMP before:

Providence ERS, of Rhode Island, has appeared in these posts (not exhaustive):

October 2019: When the Money Runs Out: Some Thoughts on Public Finance and Pensions

The city has suffered from deep-rooted mismanagement of its pension system. Rosy expectations about investment returns and decades of inadequate contributions to the fund — the city came up $16 million short in 1999 alone — have left it just a quarter of the way toward covering the $1.3 billion it owes to current and future retirees.

Such numbers are mind-boggling in and of themselves, but the budget pressure they create reveals an acute crisis with a concrete human impact. A 2010 refinancing scheme demands 3.5 percent yearly increases in Providence’s annual contributions to its pension system, outpacing the 2 percent rate at which the budget grows overall. This means that pension liabilities could edge out priorities like other social spending and infrastructure. This would be catastrophic for a public school system defined by chronically absent teachers, for the 70 percent of Rhode Island streets in poor condition and for a city with the highest poverty rate in the Northeast.

Providence has been in quite the squeeze.

June 2022: Fewer than 4000 people just approved boosting Providence Rhode Island liabilities by $515 million

There was a special election on Tuesday, June 7, in which less than 4% of Providence, Rhode Island voters showed up.

Of that 4%, 70% agreed to the issuance of $515 million in pension obligation bonds. This would be a new liability, on top of the liabilities they already have.

….

I am not surprised that this sort of thing is coming from Rhode Island, and specifically Providence. They had some of the worst finances coming out of the Great Recession, and it took a lot of wrangling to try to get it in line, and it’s still not there.

Dallas Police and Fire has appeared in these posts (also not exhaustive):

August 2014: Public Pensions Watch: Dallas Pension Learns About Concentration Risk

Nov 2016: Dallas Police and Fire: The Pension that Ate Dallas

Dec 2018: Hindsight is Hilarious: Pension DROP Program Presentation

Jacksonville Fire and Police:

Dec 2016: Pension Nastiness in Jacksonville: Huge Jump in Required Payment and Public Pension Primer: Payroll Growth Assumption .

From that last post:

People have been behaving like pension funds are special sorts of creditors, so of course they can handle ways of “paying off” the unfunded liability that actually was guaranteed to cause it to increase in the “short run”.

Until the “short run” became 10 years.

And one finds one’s self in a much bigger hole than when one began.

Ugh.

The party has been over for a long time, and the hangover will be a bear

Chicago finds itself in the same hole as Providence, Jacksonville, and Dallas has, for much the same reasons.

It made promises to its employees, and didn’t pay for the promises at the time the employees earned them. That is, when the employees were actively providing services.

After all, those promises were for retirement benefits, right? The cash flows didn’t have to come til later! And of course, the tax base would only be growing! We could make all those skipped pension payments in future years!

Forgetting that in those future years, those future taxpayers would want services for themselves.

And that retirees can’t really strike.

So Brandon Johnson is going to be finding himself in a very hard place, because the Chicago pensions have made some very large promises, which have accrued … and the underpayments to those funds have continued to snowball.

Johnson’s grand ideas of spending plans will get undermined by the need to pay for these pensions.

I have sympathy for him, because he’s actually going to have to deliver on operations, and he’s going to find the “rich” people he wanted to squeeze for revenue have become thinner on the ground. Maybe he can tax some of the highest-paid public employees. Let’s see how well that will go over.

Tell them it’s for their pensions.

Related Posts

Nevada Pensions: Asset Trends

The Moral Case for Pension Reform

Around the Pension-o-Sphere: Illinois, California, Shareholder Activism, and Puerto Rico