Taxing Tuesday: Don't Count Those Geese Before They've Laid Those Golden Eggs

by meep

From The Other McCain: Congratulations, Massachusetts Liberals: Your ‘Millionaire Tax’ Just Cost the Patriots an All-Pro Wide Receiver

Background on this piece: DeAndre Hopkins was released by the Arizona Cardinals in May, after they couldn’t find a team on the other side to trade him, so he had been a free agent. He had one of the richest contracts of a wide receiver in the NFL according to this article when released.

It had been rumored multiple teams had been bidding on him, but ultimately Hopkins went with the Tennessee Titans.

The #Titans are giving star WR DeAndre Hopkins a 2-year, $26M deal worth up to $32M with incentives, source said.

— Ian Rapoport (@RapSheet) July 16, 2023

He gets a base of $12M in Year 1 with a chance to get to $15M. https://t.co/4Vsy2sF1zG

What is the connection with taxes, you ask?

The Other McCain has the skinny:

Here’s a fact: Tennessee has zero state income tax.

Here’s another fact: Last year, Massachusetts voters passed a referendum approving a 4% “millionaire tax” in addition to the state’s existing 5% income tax, so that all income over $1 million a year earned by Massachusetts residents is now taxed at 9%. So in order for the New England Patriots to be competitive with the Tennessee Titans in bidding for the services of All-Pro free agent wide receiver Deandre Hopkins, they would have had to add about 10% to whatever the Titans offered.

And this competitive disadvantage, which the voters of Massachusetts have imposed on the Patriots, will also apply to athletes for the Celtics in the NBA, the Bruins in the NHL and the Red Sox in baseball.

For those of us who are just fine with Boston teams losing, we’re cool with this.

Exit question:

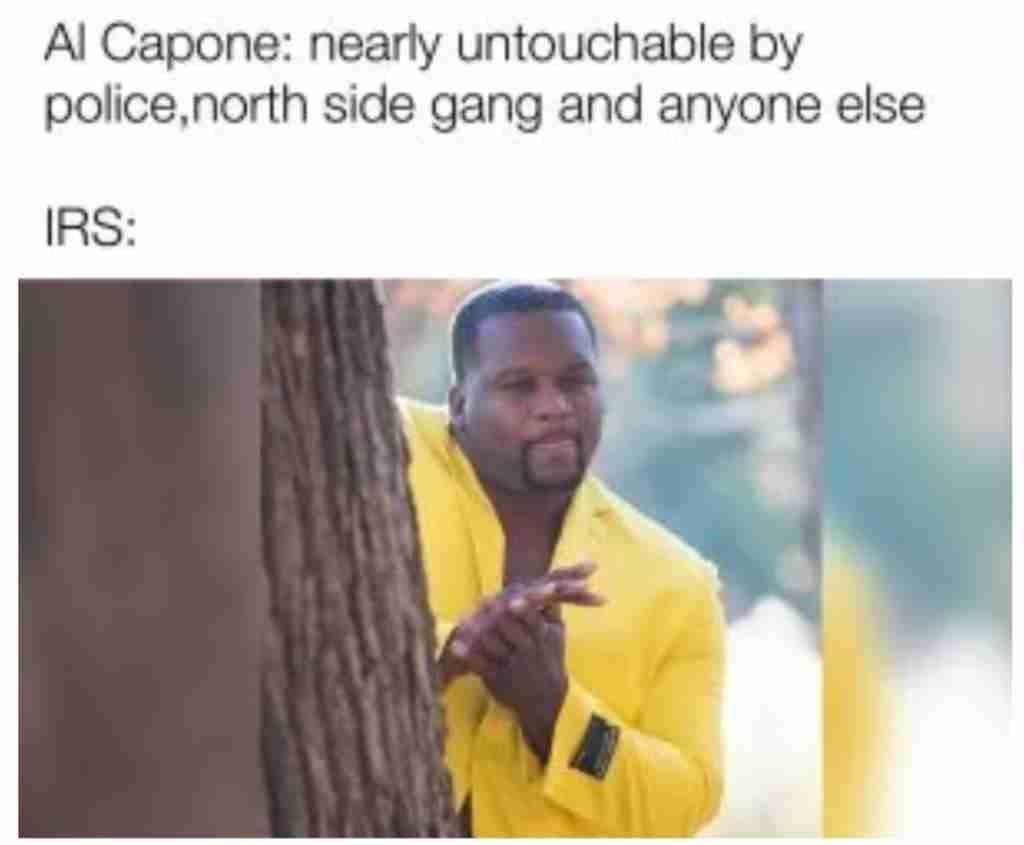

Hey, math quiz: What’s 9% of zero? Because you’re not going to get any tax revenue from millionaires, if millionaires leave your state.

Hmmm, let’s check in on what the Massachusetts polity thought they’d get with these taxes.

Massachusetts voters: Let’s tax those OTHER guys… hey, where is the money?

November 2022, CNBC: Massachusetts voters approve ‘millionaire tax.’ What it means for the wealthy

If you make more than $1 million a year in Massachusetts, you may soon be subject to a “millionaire tax” approved by voters this week through a ballot initiative.

The new law creates a 4% tax on annual income above $1 million, on top of the state’s current 5% flat income tax, aiming to fund public education, roads, bridges and public transportation.

It’s expected the levy will affect roughly 0.6% of Massachusetts households, according to an analysis from the Center for State Policy Analysis at Tufts University.

Well, if that 0.6% have loads of income… oh wait, that 0.6% probably have a lot of power in shaping how they take income, don’t they…..

The new tax is estimated to bring in roughly $1.3 billion in revenue during fiscal 2023, according to the Tufts analysis. But Guarino expects lower numbers due to tax planning, and in some cases, “leakage” from some higher earners moving out of state.

“The informed will now work more with their advisors and look for ways to minimize or avoid the surtax,” he said.

For example, someone may consider stretching income over a period of years, rather than “one big hit” that bumps them over the million-dollar threshold in 2023, Guarino said.

In other cases, they may try to receive some of next year’s earnings in 2022, before the law goes into effect, he said. “If you can defer taxable income, that’s usually a good thing,” Guarino noted. “But in this instance, accelerating income may give you an immediate 4% [tax savings] at the state level.

“I think we’re going to be busy over the next six or seven weeks with our Massachusetts clients,” he added.

I wonder how rich the tax planners got off this idiocy…

It is far more likely that the super-rich are wealthy… which means they don’t necessarily take in a lot of income.

They have a lot of assets. Assets which may have unrealized capital gains (or losses), to be sure. But they don’t necessarily have to realize that.

There is likely to be a renegotiation of various compensation packages so that there will be some tax-advantaged compensation (ah, the life insurance industry thanks you, Massachusetts.)

And, of course, business owners will be doing intense planning of how they may do deals like buying out partnerships, and similar transactions.

(Intelligent sports agents may re-look at the sort of creative deal-making that led to Bobby Bonilla Day, just saying.)

The Tufts analysis of the tax did include the following:

Though this tax would only apply to around 0.6 percent of Massachusetts households in any given year, it could raise a meaningful amount of money, as those few households account for more than one-fifth of all taxable income in the state

However, the millionaires tax also could have some serious side effects if top earners opt to leave the state or shield their income to avoid paying.

….

Together, cross-border moves and tax avoidance would reduce millionaires tax revenue by roughly 35 percent.

Here is another item: if you are too dependent on too few people for a revenue source, this can be a very frothy and unreliable source of revenue for state programs.

Ask Connecticut how well that works out.

Tax Tweets, Links, and Memes

Lawmakers should avoid using the tax code to deliver social or economic benefits.https://t.co/TQQZMt2jT8

scottahodge</a></p>— Tax Foundation (TaxFoundation) July 18, 2023

Will keep coming back to that Tory MP I spoke to who, when I pointed out my effective marginal tax rate is over 50%, told me to suck it up and stop being ungrateful.

— James (@TypeForVictory) July 18, 2023

You can't square that with their whinging about IHT and the 45% additional rate and not conclude they loathe us. https://t.co/1y7mYmkgMB

ProPublica: How Harlan Crow Slashed his Tax Bill by Taking Clarence Thomas on Superyacht Cruises

CNBC: Powerball jackpot hits $900 million. Here’s the tax bill if you win

WSJ: High-Earning Retirement Savers Are Losing Some of Their 401(k) Tax Break

CalMatters: Californians are smoking less: Why that’s a problem for these early childhood services

From that last one:

For 25 years, some of California’s best-known early childhood services have been funded by an almost ironic source: Taxes on cigarettes and other tobacco products.

That was the deal voters made when they passed Proposition 10 in 1998, levying a tobacco tax and dedicating the money for programs that would help families with young children.

The arrangement was never supposed to last forever. Advocates for youth services have known from the beginning that fewer people would smoke over time, and the funding would fall.

Now, the money for so-called First 5 California programs is starting to plummet and First 5 leaders around the state say they are beginning to trim their budgets and cut back on programs. The trend is accelerating following last year’s approval of Proposition 31 to uphold a state law banning the sale of flavored tobacco products, compelling youth programs to adjust their budget assumptions.

Related Posts

Taxing Tuesday: The Money Goes Away

Hey Amazon: Come to Hartford, CT!

Meep Quicktake: Congressional Bailout Bill Status and Positioning