Public Pensions Primer: Places to Start -- the Public Plans Database

by meep

While I’ve been thinking of writing my own public pensions primer (or doing something like that in bite-sized videos), there have been a couple of updated resources that I think are great places to go to. This week I will highlight good resources for those who want a broad view of the issues.

Let’s start out with the enhanced Public Plans Database.

I attended a webcast on its features last week, and while I wasn’t happy with the amount of data in most of the plans I checked out, and while it doesn’t have the built-in graphs I would like, I think this is a great resource for those who want to get a feel for numbers.

For newbies, start out at the Quick Facts page, and drill down to what you are specifically interested in.

An example, the funded ratio for the nation as a whole:

Or maybe you want to see how well governments throughout the U.S. have funded their pensions, by comparing what they actually paid versus the ARC (actuarially required contribution):

That’s against payroll, and there are two disturbing trends there:

- the ARC is increasing as percentage of payroll

- the gap between ARC and the actual contributions has been widening

So that’s from the national info. Let’s pick a state… how about…. Illinois?

That graph is especially disturbing. You’ll notice this does’t match the one above – because this is ARC compared to government revenue. Notice that for the country as a whole, the ARC seems to be growing fairly slowly compared to revenue, so that’s not too concerning… but Illinois? Holy crap.

And keep in mind, Illinois isn’t actually contributing the full ARC.

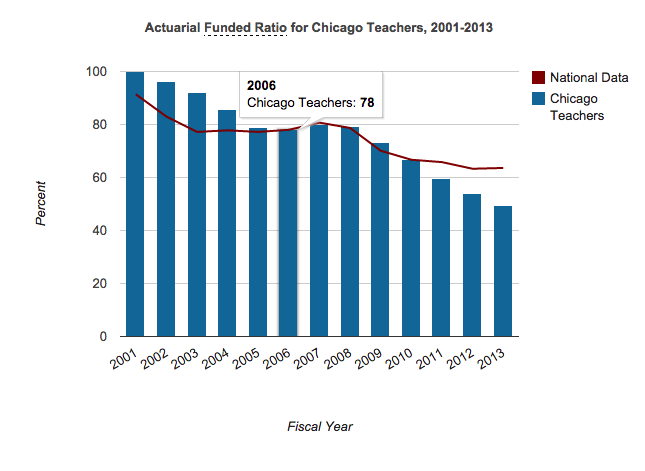

I’m going to pick my favorite doomed pension plan: Chicago Teachers

Ugh.

That’s awful.

Want to see what happens when you undercontribute to a pension?

Yeah. That.

Anyway, explore in Quick Facts to begin with, and then if you want to get really adventurous, you can download the entire database.

Yes, I’m going to do that, but it still does not have the info I want to make the kind of visualizations I want. I still may be able to make my own investigations, though.

Related Posts

Wisconsin Wednesday: Is Contribution Growth Moderate?

Testing to Death: Which Public Pensions are Cash Flow Vulnerable?

Connecticut Pensions: Pushing Off Payments Til Later Ain't Reform