Public Finance Disaster Watch: Chicago Public Schools

by meep

So after doing a couple graph-heavy posts because I was fried on writing, today I had to do a bunch of graph-heavy slide decks and I am not wanting to play with graphs.

So, what to do?

Use other people’s graphs!

CHICAGO PUBLIC SCHOOLS

Things keep moving as people try to navigate precarious finances for the Chicago Public Schools. Let’s see what’s in the news:

Chicago Schools Seek Short-Term Relief from Bond Buyer

CHICAGO — Chicago’s school system is trying to avert a liquidity crisis through two short-term fixes to provide breathing room as it pursues long-term solutions to its pension and budget ills.

One was put on life support Tuesday not long after it was introduced. Chicago Public Schools had reached agreement with city and state leaders and Gov. Bruce Rauner to allow the district to push off to Aug. 10 from June 30 the deadline to make a $634 million teachers’ pension contribution. The district expects to be in a better cash position in August due to tax and state aid payments.

On Tuesday, State Rep. Barbara Flynn Currie, D-Chicago, filed the legislation as an amendment to Senate Bill 437, which quickly moved through committee only to fail in a House floor vote. It received 53 votes, short of the 71 needed. “It’s not dead. There is a procedural step that could allow for another vote, but there is a big hill to climb,” said Steve Brown, spokesman for House Speaker Michael Madigan, D-Chicago.

Madigan said later in the day at a news conference the measure would be called again for a vote next Tuesday when the House reconvenes.

In the meantime, Chicago Mayor Rahm Emanuel’s hand-picked school board is expected late Wednesday to approve $1.135 billion of short-term tax anticipation note and warrant borrowing.

I thought you said you would quit doing that, Rahm. My brain is too fried to check, but you’d think someone might look into it. A reporter, maybe.

The Chicago Board of Education has a report from consultant EY with regards to the state of finances of CPS.

I’m going to pick out my favorite points, some of which are on different slides:

4. Absent new revenue, a greater proportion of the budget is expected to be diverted from operational costs to the funding of debt service and pension costs through FY 20.

….

5. Although the magnitude of annual projected deficits through FY 20 is concerning, the anticipated immediate and medium term liquidity shortfalls are even more critical. CPS is projecting a cash shortfall of ~$1.9 billion at the end of FY 16 and absent material cost deferral or third party intervention CPS is projected to run out of cash as early as this summer.

…..

Over the past four years, CPS has benefitted from a number of one-time revenue/expenditure items, which have understated the full extent of its underlying operating deficit (refer to page 18 for detail), including the following:

UAAL pension payment holiday;

……

Even if CPS were to receive a UAAL pension holiday for the next five years, CPS could still have a

~$2.4 billion accumulated deficit by FY 20

…..

At the current pace, CPS may have to dedicate ~28% of unrestricted revenues to pension UAAL and

debt service thereby reducing funds available for educating students

It keeps going on like that.

PENSIONS ARE A BIG DRIVER

I want to pull out one particular detail:

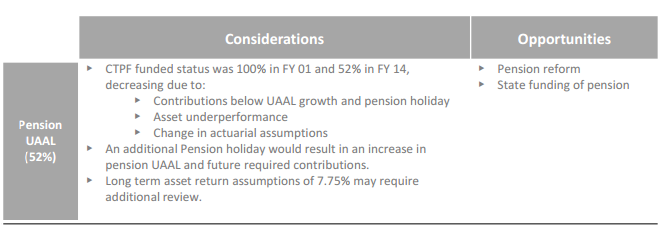

Over half of their 2014 debt is to the pensions. I want to note that a change in actuarial assumptions does not actually make the pension more or less expensive. It is what it is — assumptions are generally changed to be more in line with expected experience.

What were those changes, by the way?

Checking the Public Plans Database, I see three changes:

- The amortization period changed from 40 years to 30 years in 2006

- Assumed inflation changed from 3% to 2.75% in 2013

- Assumed future rate of return on assets changed from 8% to 7.75% in 2013

All of these should be minor changes.

I have a feeling this following is a much bigger explanation:

While this doesn’t help:

Note that these averages are also below the new assumed rate of return. Imagine if they had to put their valuation rates down to what annuities or private pensions have to use for valuation.

EFFECT OF LOWER DISCOUNT RATE

Oh, wait — these guys imagined it: GAO Report in 2014

Let me take one slice:

So for one cashflow 15 years in the future, you have a result ranging from 32% to 56% of the target amount. So say you have to value at 4% discount rate (which is higher than US Treasuries for 10-20 years) instead of 8%. You have to put in about 75% more money now to get the same amount at 4% rather than 8%.

I don’t want to get into the philosophy of discount rates right now, but maybe this issue brief from the American Academy of Actuaries will tide you over.

As an aside, when they show you these average returns, it’s usually a straight arithmetic mean (just take a normal average) as opposed to geometric mean (more appropriate when something is growing).

Guess what? Arithmetic means are usually higher than geometric mean results, using real data:

Also, they’re both wrong, but that’s an argument for another time.

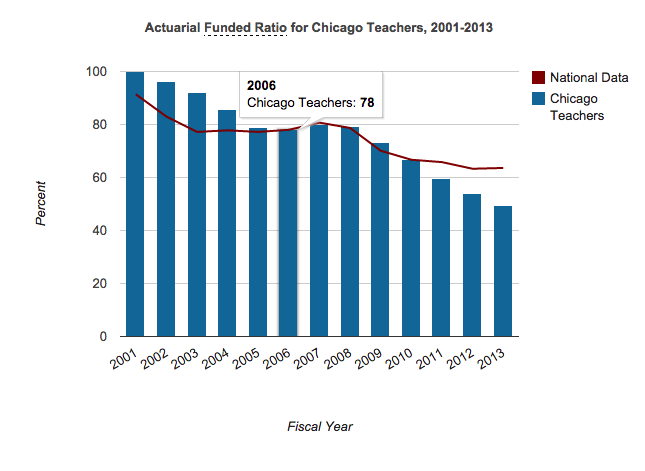

RESULTING FUNDING RATIO

And this is the result:

I’m going to say the deep underfunding is the main problem. It’s not changing the assumptions, and it’s not their investments — their investment performance is in line with the rest of the country.

But when the assets churning out those returns are small compared to the liabilities… yeah, it’s a problem.

RELATED

I am including posts from STUMP as well as other sources.

- Munilass with: Chicago Board of Education Bondholders Should be Very Scared Right Now

- Chicago Pension Watch: Teachers Pensions — What are the Benefits Like?

- Watch It Unwind: Chicago, Greece, and Asset-Grabbing

- Chicago Tribune editorial: Where do we line up to retire at age 52?

- Chicago Sun-Times: CPS to run out of cash this summer

- Chicago Sun-Times Editorial: A single, grim reality for the Chicago Public Schools

An excerpt from this last:

The clock is ticking: A $634 million pension payment is due June 30. CPS has only about 30 percent of that cash on hand. The teachers’ contract expires the very same day. The two sides are miles apart.

This page for years has watched CPS sputter along, passing bare-bones budgets that rely on sleight-of-hand, masking an underlying mismatch between spending and revenue that was destined to one day reach a breaking point.

That day has arrived. An analysis of CPS’ finances, obtained by the Sun-Times and outlined in a story on Sunday, makes that clear.

…..

The school system is in serious, deepening, trouble. CPS and the state have failed miserably in planning for this financial reckoning, but there is no wishing it away now. The EY analysts laid out a laundry list of solutions, including unions concessions on pensions, salaries and health care reductions, increased state aid for the classroom and for Chicago pensions, cutting expenses back to 2011 levels, state capital money and two property tax hikes.CPS cannot make these happen on its own. Most of these solutions require cooperation from legislators, the governor, taxpayers, teachers and their union.

It’s time to end the competing narratives. There is only one grim reality.

I don’t expect them to face that reality.

Related Posts

Wisconsin Wednesday: Pew Research on Its Ability to Weather Bad Experience

The Kentucky Pension Mess: Ain't Getting Cleaned Up Now

Some Public Pensions Take (Small) Losses from FTX Disaster... But What About Other Alt Messes to Come?