Labor Day Fun: Chicago Tax Wrangling -- Throwing Money into the Pension Money Pit

by meep

Kick it off, Rahm!

From Eric Allie at the Illinois Policy Institute.

(And for those who don’t understand Rahm’s get up, he evidently was a pretty good danseur in his youth.)

Nice hairdo. He should consider growing his hair out again.

MO MONEY! MO MONEY!

Oh look, here’s Rahm asking for more revenue. Never would have seen that coming.

Mayor Rahm Emanuel confirms he will propose the largest property tax increase in recent Chicago history.

The city needs the new revenue to pay its $30 billion unfunded police and fire pension debt. Rahm Emanuel all but confirmed Thursday the massive property tax increase is part of his soon-to-be released budget plan.

In an event not originally on his public schedule, the mayor read to children at a West Side day care center on Thursday. Afterwards, he used the opportunity to assess the chances that alderman will approve his leaked, $500 million city property tax increase.

….

Ald. Ramirez-Rosa said a 60 percent raise in the city-wide levy is too much. He wants downtown skyscrapers taxed a higher rate than private homes and exceptions for elderly and low income homeowners.

….

It’s also reported the Emanuel administration wants to charge for garbage pick-up and implement per-use fees on ride-sharing services like Uber and Lyft.

Good luck with that.

RAHM AND CHICAGO FISCAL HISTORY

Let me give a little perspective: Rahm Emanuel was elected mayor of Chicago in February 2011, and assumed office in May 2011.

As this was the info I could find, and as many Chicago entities have similar credit ratings, let’s take a look at the credit rating for Chicago Public Schools back in 2011: A+/AA-/Aa3 — solidly in investment-grade territory for the three major rating agencies.

Current rating: BB+/BB/Ba3 — in junk territory. (oh, pardon me, “high yield”)

Since May 2011, Rahm has had 4 budgeting cycles to get started on the problems. But nothing substantive has been done. He kept the short-term financing in place.

He touted a pension reform he had to have known the Illinois courts would strike down. Every politician should have taken heed that given the state wouldn’t be allowed to adjust health coverage for any retirees, they wouldn’t be able to adjust pensions with $$ amounts attached.

There was a big ramp up in contributions that had been baked into the law for years, but until now, when they’re forced to try to pay down their pension debt, Chicago did nothing to chip away at the problem.

So:

1. Rahm asking for more money via taxes was always to be expected.

2. Rahm will be asking the state for more…but the state is squeezed as well.

3. Rahm had to know this disaster was coming 5 years ago when he ran for mayor. He definitely knew it this year, when he ran for re-election.

Daley got out. Were you so stupid to think it was for “family reasons”, Rahm?

REACTION: PAYING FOR THE PAST

Plenty of people have had things to say regarding this half-leaked proposal.

From the Illinois Policy Institute:

Chicago Mayor Rahm Emanuel is reportedly set to call for the largest-ever collection of fees and taxes to plug the city’s $750 million budget hole.

Official city sources have told the Chicago Sun-Times and the Chicago Tribune that the fiscal year 2016 budget will include the following major tax hikes and fee increases:

-$450 million in property-tax increases for the city’s bankrupt police and fire pension systems

-$50 million in property-tax increases for school construction

-$100 million garbage-collection feeThe property taxes will amount to an additional $500 in taxes each year on a home worth $250,000. The garbage fees will cost every city household an additional $11 to 12 a month..

Additional fees will provide another $150 million for the budget:

-A tax on e-cigarettes and other smokeless tobacco products – equivalent to the approximately $7 tax now levied on a pack of cigarettes

-$1 per ride surcharge on Uber and other ride-hailing services

-A penny-an-ounce “fat tax” on sugary soft drinksUnfortunately for Chicago taxpayers, these increases in taxes and fees don’t even include what’s needed to fix the enormous budget deficit facing Chicago Public Schools, or CPS, and its nearly $10 billion pension shortfall.

…..

Chicagoans will continue to leave because they know these tax hikes and fees won’t be used to pay for improved services such as better roads, classroom needs or increased public safety. Instead, these fees and taxes will only go to pay for old debts and services already rendered, particularly pensions.

That last sentence I quoted points up the real reason to fully-fund pensions — people aren’t going to be too interested in paying money for a service rendered 20 years ago.

“Intergenerational equity” is the fancy-pants term used in the public policy sphere to say that each generation of taxpayers should be paying for the public goods and services they consume.

Under such a concept, it’s okay to issue a 30-year-bond, say, for the construction of a bridge that will be used over a 30-year period.

Financing capital assets over their useful lifetime: good. Everybody pays something for their use.

Financing operational expenses (THIS YEAR’S EXPENSE) with long-term borrowing: very bad, especially when it’s borrowing not from the bond market, but from the pension fund itself.

BUT…PENSIONS PUT MONEY INTO THE ECONOMY!

A little tangent for a moment. Public employee unions and public pension funds realize that they are going to have a difficult time making it politically palatable to make current taxpayers fill billion-dollar holes for services provided years ago.

So, SQUIRREL!

What does TRS think, or at least tell us, about the contribution of Illinois teacher pensions to the overall economy?

The May 2015 TRS study of the issue is currently featured on the front page of the TRS website. The first sentence reads “The Teachers’ Retirement System of the State of Illinois annually distributes approximately $3.8 billion in pensions and benefits to men, women, and children in every corner of the state, creating a sustained economic stimulus that helps drive the economy in all 102 counties.”

In turn, the study calculated a total value of economic activity of $5.6 billion from those $3.8 billion in benefits, using “multipliers” derived from an assumption that the payments are spent and become income for others in the state besides the benefit recipients alone. The study found that these payments support over 40,000 jobs in Illinois.

Notice something missing from this study?

Bill Bergman of Reboot Illinois did:

Where did this money come from? What effect does taking that money away from people have on the Illinois economy?

It’s not like the magic money fairy made cash-in-hand for teacher retirees worth more than cash-in-hand for taxpayers.

Especially given 20% of Illinois retirees don’t live in Illinois anymore.

According to that last link, $875 million of the TRS benefits went to people living outside of Illinois. I hope they remembered to exclude that from their “multipliers”.

BACK TO THE TAX: DOES THE HOLE GET FILLED?

Mark Glennon of Wirepoints says no — using Chicago’s own numbers:

Chicago’s 2014 Comprehensive Annual Financial Report was released in July (after the June 30 deadline required by law). Page 83 shows that, for the year ended this past December, Annual Pension Cost for the city’s four pensions was $1.788 billion. Total contributions made to those pensions were $447 million. The difference of $1.34 billion is how much the city underfunded the pensions.

In other words, it would take a $1.34 billion tax increase, not $500 million, just to start funding Chicago’s pensions adequately. Throw in another $150 million or so for the garbage collection fee, sugary drink tax, Uber tax and e-cigarette tax the city is also considering and you still don’t get nearly enough to fund pension promises made.

If you underpay what you’re supposed to be paying that year, then the unfunded liability grows.

I’ve also noticed that the unfunded liability grows even when plans supposedly pay their full annual costs, but that’s for another time.

The point is: the proposed taxes would cover only 56% of the prior year’s pension funding shortfall (for that year).

Rahm still assumes that the state is going to fill the hole.

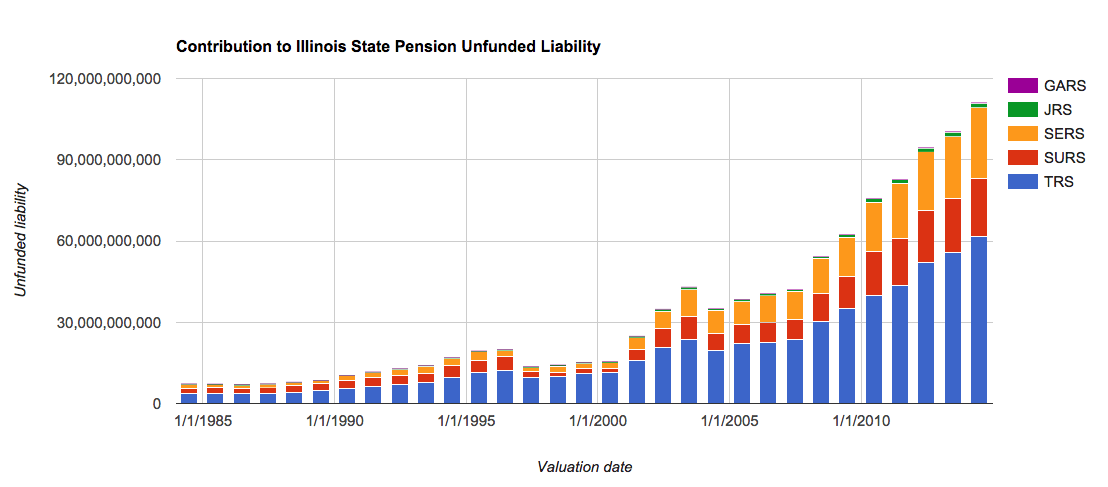

But the state itself has a huge hole to fill.

So, again, good luck with that.

Mark’s conclusion:

Chicago’s tax increase will go down a nearly bottomless pit. Same for any other Illinois municipality with a pension crisis. You’ve seen the madness before. Ninety percent of revenue from the temporary state income tax increase went to pensions. 90% of the Cook County sales tax increase is expected to go to pensions.

Taxpayers should insist on this: Not one dime of new taxes absent radical reform to eliminate the causes of the crisis and an honest accounting of how large a problem we face.

Not for new or improved services. It’s for services often performed decades ago.

Even current public employees see this. These people would like to get paid equitably, and also think that their own pension contributions aren’t going into a black hole, with the money never to emerge from the fiscal event horizon.

BRIGHT SIDE: CHICAGO CITY WORKERS ARE STUCK

Here’s a feel-good story for Labor Day: an associate prof at Northwestern gloating that Chicago city workers can’t easily leave their jobs:

DON’T WORRY, WE’RE ALL STAYING

Doomsayers predict that this long-overdue tax hike will cause an urban exodus, as the fed-up lowly people flee Pharaoh Emanuel’s onerous impositions, and Chicago will become the next Detroit or Cleveland.

Utter nonsense.

Prophets of tax-hike doom forget that Chicago has a unique advantage over other Rust Belt burgs: our city worker residency rule.

Anyone who works for the city of Chicago has to live in the city of Chicago. The city, therefore, has a captive middle-class tax base of police officers, firefighters, garbage truck crews, teachers, executives (with a few exceptions, of course: Unusual “skill sets” can get a clouted Chicago Public Schools executive, or even a highly trained special-ed teacher, a free pass to live in the burbs). Unless I misread the city’s Data Portal, from Aaron to Zyskowski, more than 32,000 city employees are stuck.

Anyone who has spent any time in the great Northwest or Southwest sides can attest to the power of this phenomenon, as exhibited both in housing choices and in endless barstool griping. Decently paid city workers flock to the neighborhoods that most resemble suburbs but never can quite cross the line to bucolic Oak Lawn or scenic Schaumburg. These taxpayers are not going anywhere unless they want to quit their jobs as well. *The fact that some part of these additional taxes will go into their pension funds might ease the pain a bit.

Yes, I’m sure that they are very happy to see the current Chicago retirees, who are now free to escape the city, getting their pensions when they have the specter of falling funding ratios hanging over them.

Dude, you’re an instructor in English. Not a political PR expert. I think Rahm could do without your “help”.

Ugh, that was unseemly.

PREDICTING THE UNAVOIDABLE IS NOT THE SAME AS DESIRING IT

Look, I’m not gloating that many current public employees will not get their full pensions, as promised.

I find that sad. But it’s just reality that neither Chicago nor Illinois will be able to tax people enough to get the pensions fully paid, and they can forget about going cap-in-hand to the feds on the matter as well.

The city employees may find it really easy to leave Chicago if they don’t have a job any more, because the rest of the taxpaying population find that they, at least, aren’t stuck.

Yes, people may like living in cities, but you know Chicago isn’t even the Second City anymore. Detroit used to be ranked 4-5 among top U.S. cities, from 1920-1970.

In 2000, Detroit was in the number 10 spot.

In 2010, it dropped off the list.

I wouldn’t assume that people won’t leave.

I wouldn’t assume people will hold still so you can pay for somebody who retired 20 years ago and whose prime service to the city was 40 years ago.

If you had paid for the pensions when they were accrued, you’d not have to count on a growing tax base to prevent pension fund money from running out.

Good luck, Chicagoans.

Happy Labor Day.

Related Posts

Kentucky County Pensions: 60 Percent Fundedness and Decreasing is Awful

Kentucky Pension Blues: Let's Get This Fire Started

Kentucky Pension Update: GIVE US A BUNCH OF MONEY