Public Pensions Primer: Choice of Discount Rate Influences Results

by meep

I’m going to be taking it easy for a little while. Most recent explanation here, a more comprehensive explanation here, and so what I’m going to do is what’s easiest for me: playing with numbers.

I just did a big ole data dump from the Public Plans Database, and I’m going to be doing a variety of graphs from the data therein.

ON DISCOUNT RATES

Prior posts on the choice of a discount rate:

- Public Pensions Primer: How Discount Rates Work

- Public Pensions Primer: The Choice of Discount Rate and Return Volatility

- Public Pensions Earnings Season: How are the Assets Doing?

I did some graphs in the second post, but I’m going to redo them, and do a few new ones, because I’ve found some really interesting trends.

ORIGINAL GRAPHS

In my original two graphs one sees the same trend: decreasing discount rate used.

The first is weighting the discount rate used by count:

The second is weighting it by liability:

There are problems with both these graphs, but I will get to that later.

TRENDS IN THE NEWS

In the past month, I’ve seen several announcements of reductions of discount rates for public pensions.

Being a New Yorker, I noticed this announcement from the NY Comptroller:

DiNapoli Announces Decrease in Pension Contribution Rates for FY 2016-17; Lowers Assumed Rate of Return

New York State Comptroller Thomas P. DiNapoli announced the New York State and Local Retirement System (NYSLRS) employer contribution rates will decrease for fiscal year 2016-17 and the assumed rate of return for NYSLRS will be lowered from 7.5 percent to 7 percent.

The average contribution rate for the Employees’ Retirement System (ERS) will decrease from 18.2 percent of payroll to 15.5 percent, or about 15 percent. While the average contribution rate for the Police and Fire Retirement System (PFRS) will decrease from 24.7 percent of payroll to 24.3 percent, or about 2 percent.

“For the third year in a row, there will be a decline in pension contribution rates as a result of solid investment returns,” DiNapoli said. “Lowering the assumed rate of return is fiscally prudent and will better position the state pension fund for the future. This strategic decision is consistent with the tougher investment climate ahead.”

Now here’s something interesting: a lowered discount rate, all else staying the same, makes the liability measurement larger.

And here is the Comptroller moving the discount rate down 50 bps…. at the same time saying the required contribution is decreasing.

Hmmmm.

San Diego County is also reducing its discount rate:

David Wescoe, the executive who rehabilitated San Diego’s scandal-plagued pension system in the late 2000s, will run the county’s system as chief executive.

“After a thorough and comprehensive national search process, the Board of Retirement is very pleased to have found the best individual to assume leadership of this organization,” said Skip Murphy, chairman of the board of the San Diego County Employees Retirement Association. The board voted unanimously Thursday to hire Wescoe, who has been interim chief executive since March, as full-time CEO on Sept. 18.

…..More recently, the county’s pension system has been criticized for use of leveraged derivatives and excessive investment costs. Since last year, the system has lost its CEO, general counsel, investment strategist and other executives.

…..

Also on Thursday, the county pension board approved technical changes to how officials estimate the fund’s capability to pay retirees well into the future.

On the advice of its actuary, the system will reduce its assumed rate of investment return from 7.75 percent a year to 7.5 percent; inflation from 3.25 percent to 3 percent; and salary increases from 4 percent to 3.75 percent a year.

In general, cutting the investment assumption effectively boosts the unfunded liabilities — a form of debt — to current and retired county government workers. That’s because the less the fund earns in markets, the more it needs to put in reserve to cover future retirement payments.

“All else being equal, this will push the accrued liabilities up,” said Tom Aaron, assistant vice president of Moody’s, a credit-rating agency.

….

Cutting the assumed salary inflation rate can also boost the liability by increasing the early payments a fund must make to amortize its unfunded balance, Aaron said.

Again, hmmm.

Finally, the overall trend:

Public Pension Funds Roll Back Return Targets

Few managers count on returns of 8%-plus a year anymore; governments scramble to make up fundingPublic pension funds from California to New York are cutting investment-return predictions to their lowest levels since the 1980s, a shift that portends greater hardships for employees and cash-strapped governments as Americans age.

New upheavals in global markets and a sustained period of low interest rates are forcing officials who manage retirements for nearly 20 million U.S. beneficiaries to abandon a long-held belief that stocks, bonds and other holdings would earn 8% each year, as well as expectations that those gains would fund hundreds of billions of dollars in liabilities.

More than two-thirds of state retirement systems have trimmed assumptions since 2008 as the financial crisis and an uneven U.S. recovery knocked many below their long-term goals, according to an analysis of 126 plans provided by the National Association of State Retirement Administrators. The average target of 7.68% is the lowest since at least 1989. The peak was 8.1% in 2001.

…..

U.S. pensions first started to reconsider their investment-return assumptions after being stung by deep losses during the 2008 financial crisis. The event helped drop 10- and 15-year annual returns at large public pensions to 6.9% and 5.8%, respectively, according to the Wilshire Trust Universe Comparison Service. The retirement systems’ median return was 3.4% for the 12 months ended June 30 amid downturns in foreign stocks and bonds, their worst annual performance since 2012.Retirement systems argue that lowering assumptions fortifies their fiscal health, because the influx of extra contributions means they become less reliant on generating big returns.

Hmmm.

Let’s look at a few graphs, shall we?

ALTERNATIVE DISCOUNT RATE GRAPHS

Most of the graphs and calculations made are on a count of plan level — a plan of only a million dollars is weighted the same as one worth billions.

I’ve decided to redo the graphs. The NASRA graphs are based on survey results. I’m using the Public Plans Database info, which is based on 150 plans. It’s the same 150 plans for 2001 – 2013 (I cut off the 2014 data, because only half of the plans are filled in for 2014).

First off, I plotted the unfunded liability (already accrued), with the different colors representing discount rate choice:

Now, I think there’s an order of magnitude problem here. I didn’t check the data dictionary for the Public Plans Database, but I’m pretty sure those numbers are in thousands (so it’s in trillions of unfunded liability, not just a few billions). I am too much in pain to dig into this — people can

Looking at the graph, I notice that relatively high discount rates disproportionately contribute to the unfunded liability.

So I decided to do a few more graphs.

How about the average contribution rate — contrasted against the “required” contribution:

That’s a bit messy, but just eyeballing it, it looks like those with the lowest discount rates are more likely to “over“contribute, and the ones with the higher discount rates are likely to undercontribute.

Again, a lower discount rate means the liability measure is higher, which should mean the contribution rate required is higher.

So let’s look at funded ratio trends.

Hmmm. So those with the lowest discount rates seem to have the highest funded ratios…of course, the trend has been negative overall, no matter the choice.

WHAT SHOULD THE DISCOUNT RATE BE?

I am not going to say myself, but here’s something at Forbes:

Pew collects its information from state government disclosures. Its 2013 data suggest that, across 237 state-level pension systems, there were $3.43 trillion of liabilities backed by $2.47 trillion of assets. In other words, this implies a net gap GPS -3.23% of around $1 trillion.

These liability measures are far too low. They are based on state assumptions of high assumed returns on risky asset portfolios: the median assumed return was 7.75% (and the liability-weighted average 7.66%). The funding gap amounts to a mere $1 trillion only if the public plans can achieve these high compound annualized returns over the horizon during which these benefits must be paid. Yet governments have promised to pay the pensions regardless of what happens to the pension investments. As such, pension promises should be treated like the senior government debt they are, akin to default-free government bonds.

….

Using the Treasury yield curve and assuming the pension payouts have an average maturity of 14 years, the correct 14-year discount rate is 2.8% — implying a whopping $5.77 trillion in total state pension liabilities for these accrued benefits only.

Just going by what I see, lower discount rates is correlated with “good behavior” — making the “required” contributions, and seeing higher funded ratios. Even though the lower discount rates make for much higher liability measurements.

No, I haven’t done a thorough statistical study yet, but I find these rough graphs very suggestive.

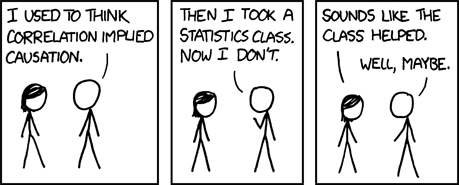

As the alt text for this cartoon says: “Correlation doesn’t imply causation, but it does waggle its eyebrows suggestively and gesture furtively while mouthing ‘look over there’.”

I think that lower discount rates tend to be associated with better behavior on the part of public plan funders.

Related Posts

Checking the Numbers: How Much are Social Security Benefits?

Geeking Out: House of Representatives Apportionment Visualization 1910-2010

Kentucky Update: Republicans Take Legislature, Pensions Still Suck, Hedge Funds to Exit