Illinois Lottery Update, the Pensions, and General Blogging Announcement

by meep

Remember how I mentioned the phony lottery “crisis” in Illinois, wherein winners of more than $25K would have to wait until the state budget passed?

Well, guess what:

Oct 14 The cash-starved Illinois lottery lowered the boom even harder on its players on Wednesday, saying anyone with a winning ticket worth $600 or more will face delays collecting prizes until the state’s long-running budget impasse ends.

Since July, the state has not been making timely payments to players who have won $25,000 or more, triggering a class-action lawsuit in federal court last month against Republican Governor Bruce Rauner’s administration.

The state lottery department indicated it had to lower the payout threshold even more because there has been no break in the budget fight between Rauner and Democrats controlling the state legislature.

“We don’t have the legislative authority to replenish our check-writing account,” lottery spokesman Steve Rossi told Reuters.

Rossi said players with winning tickets worth $600 and up eventually will be paid once the stalemate is over. The new payout policy takes effect Friday.

He said the agency has not contemplated suspending any of its betting games while the budget fight continues. The state is in its fourth month without a spending plan. (Editing by David Gregorio)

So they basically are running through what they had already transferred into the checking account….but the new ticket sales go directly into the fund they can’t transfer out of? Not the checking account?

I’m trying to understand this really dumbass way to run a lottery.

A few thoughts come to mind:

1. It’s political theater (obviously, the lottery employees are still getting paid)

2. I would love to see if the lottery sales have been affected … maybe not, and maybe could even increase so that they can be double-winners, by getting in on a sweet sweet federal class action suit (okay, maybe not)

3. This is Illinois. And yes, though the above is a federal lawsuit, federal judges in Illinois do reflect a lot of what’s going on around them by being in Illinois. Just as judges forced a whole bunch of stuff in Illinois to be paid even though a budget has yet to be passed, I imagine the lottery winners will get paid as soon as a judge can rule on this, no matter the political situation in Springfield.

I could be wrong about that, but hey — Illinois. According to this, about 80% of state revenue is still being spent. It’s like nobody knows how to shut down a government anymore.

WHAT IS ALSO NOT BEING PAID

Contributions to the state pension funds are also not being made:

By now, Illinois’ budget problems are no secret.

Back in May, after the State Supreme Court struck down a pension reform bid, Moody’s move to downgrade the city of Chicago thrust the state’s financial woes into the national spotlight.

Since then, the situation hasn’t gotten any better and despite hiring an “all star” budget guru (for $30,000 a month no less), Bruce Rauner was unable to pass a budget in a timely fashion leading directly to all types of absurdities including everything from the possibility of shortened school years to lottery winners being paid in IOUs.

Now, as Bloomberg reports, pension payments are set to be delayed. Bond payments, apparently, will still be made.

You see, the bonds are a real debt, and they’re treating the pension debt as not real.

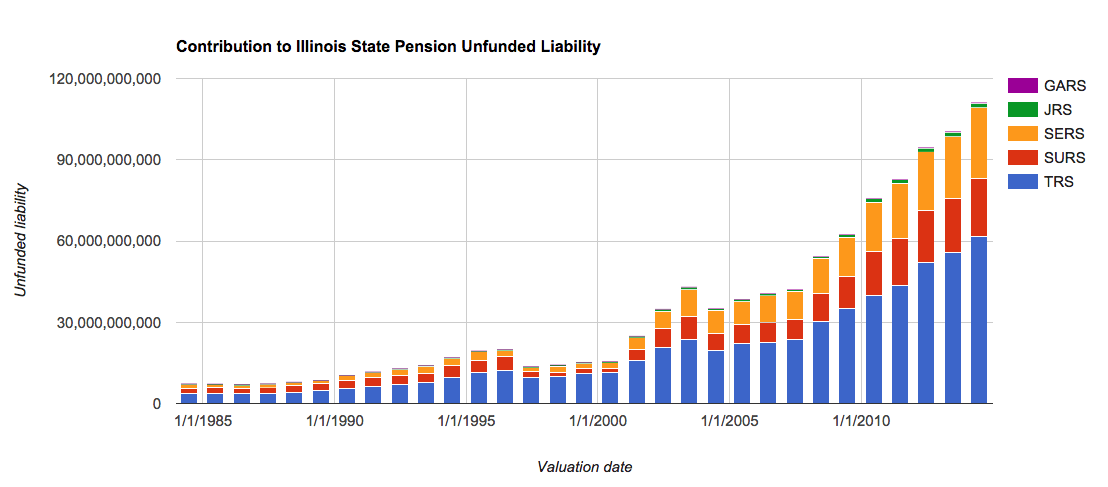

ZeroHedge has its own series of graphs, but I will just leave these here:

Remember, I’m using Illinois’s own numbers there, based on some semi-optimistic assumptions. Such as pension contributions being made.

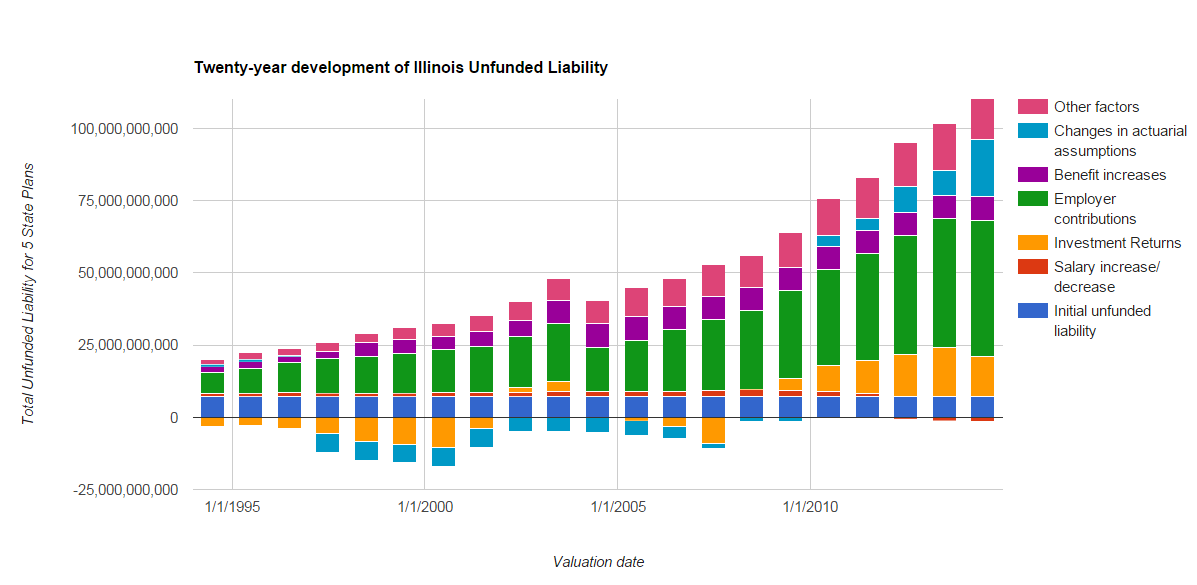

Let’s look at the causes of that over $100 billion hole:

See that huge green portion of the bar? That’s about $47 billion. Almost half of the problem.

That’s from employer undercontributions… and that’s including the pension obligation bonds (ptui!) as contributions.

So way to go on making those green bars larger. I’m sure that everyone will feel good that it doesn’t need to be all paid out at once… but neither did the lottery funds.

I have a feeling the lottery winners won’t get as much of a cut as the Illinois pensioners, though the pensioners won’t know it for many years.

BRIEF NOTE

I wrote some stuff about pain on my livejournal last month, and yesterday it got worse in that the pain has now spread from my right side (where it’s been for 5 years) to my left side. I got me a whole new set of MRIs for medical contemplation in the upcoming weeks.

I’m not necessarily going to stop blogging, but it’s going to be far from steady. I write when I can, and I’m resting when I can’t.

For today, I’m just trying to get back from Austin (where I had an awesome time at an actuarial conference…we may have kept Austin weird, but we definitely did damage to its hipster density) to New York.

Thoughts and prayers are appreciated.

Related Posts

Kentucky Asset Manager Warning: the ESG Brou-Ha-Ha Continues

Catch-Up Week: Dallas and Houston Pensions - Still A-Roar

Connecticut Pensions: Pushing Off Payments Til Later Ain't Reform