Puerto Rico update: Temporary Respite, Again

by meep

Since I started my Puerto Rico Watch thread at the Actuarial Outpost, it looks like I hadn’t done an update.

Time to fix that!

NYTIMES COVERS FINANCIAL DISASTERS WELL

They can really surround a story of disaster:

Inside the Billion-Dollar

Battle for Puerto Rico’s FutureThe money poured in by the millions, then by the hundreds of millions, and finally by the billions. Over weak coffee in a conference room in Midtown Manhattan last year, a half-dozen Puerto Rican officials exhaled: Their cash-starved island had persuaded some of the country’s biggest hedge funds to lend them more than $3 billion to keep the government afloat.

There were plenty of reasons for the hedge funds to like the deal: They would be earning, in effect, a 20 percent return. And under the island’s Constitution, Puerto Rico was required to pay back its debt before almost any other bills, whether for retirees’ health care or teachers’ salaries.

But within months, Puerto Rico was saying it had run out of money, and the relationship between the impoverished United States territory and its unlikely saviors fell apart, setting up an extraordinary political and financial fight over Puerto Rico’s future.

On the surface, it is a battle over whether Puerto Rico should be granted bankruptcy protections, putting at risk tens of billions of dollars from investors around the country. But it is also testing the power of an ascendant class of ultrarich Americans to steer the fate of a territory that is home to more than three million fellow citizens.

The investors with a stake in the outcome are some of the wealthiest people in America. Many of them have also taken on an outsize role in financing political campaigns in the aftermath of the Supreme Court’s 2010 Citizens United decision. They have put millions of dollars behind candidates of both parties, including Hillary Clinton and Jeb Bush. Some belong to a small circle of 158 families that provided half of the early money for the 2016 presidential race.

To block proposals that would put their investments at risk, a coalition of hedge funds and financial firms has hired dozens of lobbyists, forged alliances with Tea Party activists and recruited so-called AstroTurf groups on the island to make their case. This approach — aggressive legal maneuvering, lobbying and the deployment of prodigious wealth — has proved successful overseas, in countries like Argentina and Greece, yielding billions in profit amid economic collapse.

……

Others fear a different precedent: A handful of wealthy investors, they argue, are trying to rewrite the social contract of an entire United States territory. Puerto Rican officials say they have already cut public services and slashed central government spending by a fifth to keep ahead of payments to the hedge funds and financiers.“What they are doing, by getting all the resources for themselves, is undermining the viability of Puerto Rico as a commonwealth,” said Joseph E. Stiglitz, the Nobel Prize-winning economist. “They want their money now, and they want to get the rules set so that they can make money for the next 20 years.”

……

Early this year, with Puerto Rico’s economic outlook darkening, the island’s nonvoting member of the House of Representatives, Pedro R. Pierluisi, made what he thought was a modest proposal.He introduced a bill that would change federal law to allow Puerto Rico’s struggling municipalities and public corporations, such as the island’s power authority, to declare bankruptcy. It would affect only about a third of the island’s debt, Mr. Pierluisi told Republican colleagues in Congress. It would also give Puerto Rico the same right as most states and leverage against creditors — so-called Chapter 9 bankruptcy protection. And it would cost taxpayers nothing.

……

But opponents were organizing against the measure, led by firms that owned debt from Puerto Rico’s power authority, according to federal lobbying records and other documents. Among them were two mutual funds — Oppenheimer Funds and Franklin Templeton — and hedge funds, some specializing in distressed debt: the D.E. Shaw Group and Angelo Gordon, along with Marathon and BlueMountain.……

Puerto Rico could not now gain access to bankruptcy protections that it had not been entitled to when it borrowed the money, the funds argued. And, they suspected, there was still revenue hiding within the island’s opaque books, as well as cuts to be made to its oversize bureaucracy.In a letter circulated to Republican staff members in February and obtained by The New York Times, representatives for BlueMountain, a $22 billion firm headquartered on New York’s Park Avenue, warned that the bill would put the bondholders at a disadvantage in any fight over Puerto Rico’s debt. Bankruptcy, they said, would inevitably prioritize those with pension claims over the island’s creditors, as had been the case when Detroit declared bankruptcy in 2013.

……

A little more than a week later, Mr. Hatch blocked an effort to bring Mr. Pierluisi’s bankruptcy legislation to a vote. He soon offered his own proposal: To respond to the island’s humanitarian needs, Congress would provide $3 billion to Puerto Rico if it submitted to federal financial oversight. It was the approach favored by bondholders. It was also, in effect, a bailout.Supporters of the bankruptcy bill clung to the hope that congressional leaders would insert a provision in its end-of-year spending bill allowing Puerto Rico to restructure at least some of its debt. But when the bill was unveiled on Tuesday, it contained no such language.

The island remains in negotiations with the financial firms that own its debt. Without the possibility of bankruptcy, its only leverage is the threat of default.

The House speaker, Paul D. Ryan, Republican of Wisconsin, said on Wednesday that lawmakers would try to come up with a solution by the end of March.

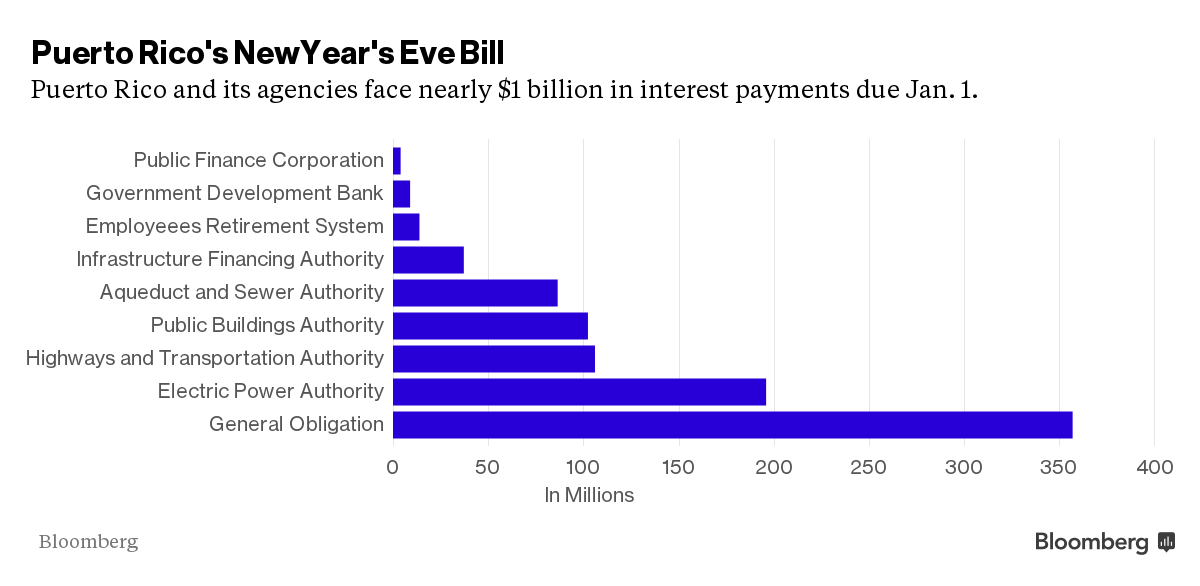

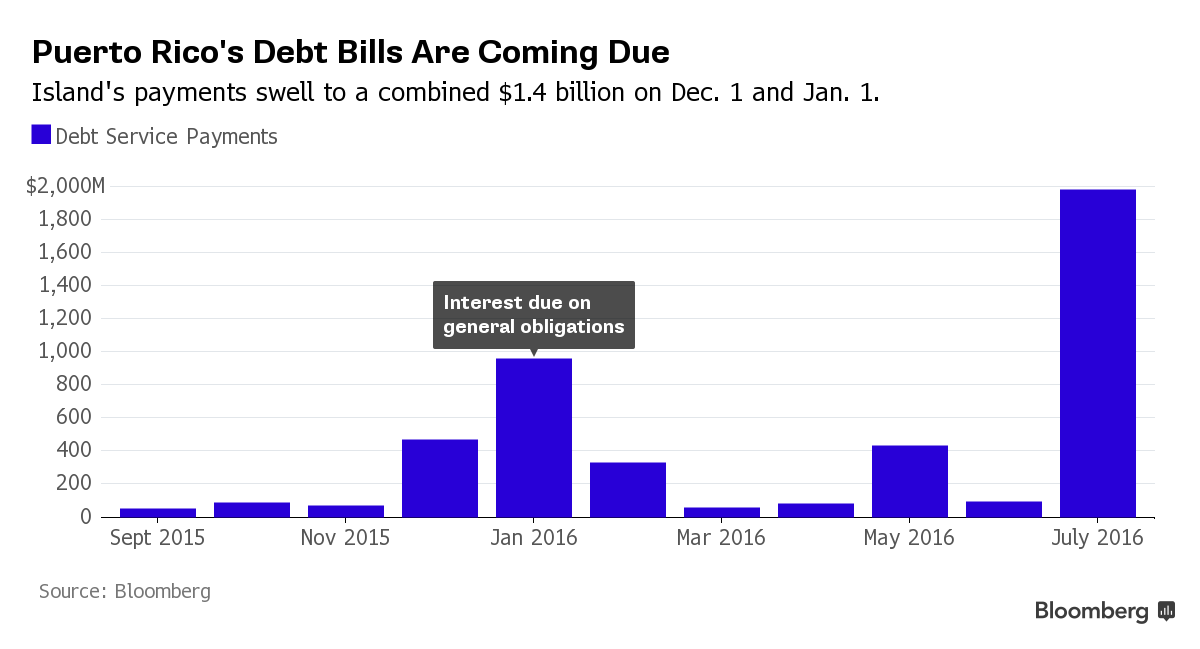

A reckoning could come sooner: On Jan. 1, bond payments of $1.4 billion will be due. No one is quite sure if the island can pay.

Well, they can’t pay. Not unless someone gives them a bunch of money.

And given Congress’s latest shenanigans, who knows?

GIVE EM MONEY THOUGH WE DON’T HAVE ANY!

Sure, give away other people’s money:

Puerto Rico Governor Avoids Scrooge Epithet by Paying Bonuses

Public employees owed $120 million in payments as of Dec. 20

Commonwealth owes $957 million in debt payments on New Year’sPuerto Rico Governor Alejandro Garcia Padilla will likely avoid comparisons to Ebenezer Scrooge by paying Christmas bonuses due to public employees as the commonwealth contemplates defaulting on bond payments at the start of the year.

The 44-year-old governor, who won’t seek re-election when his term expires in January 2017, will begin paying Monday about $120 million that workers were owed as of Dec. 20, according to an announcement posted Sunday on the administration’s website. Jesus Manuel Ortiz, a spokesman for the governor in San Juan, didn’t immediately respond to an e-mail and phone message.

Let’s go to the tape:

A 1969 commonwealth law requires the government to pay its workers a Christmas bonus if they work at least 700 hours that year, according to Jose Alameda, an economist and professor at the University of Puerto Rico at Mayaguez. Instead of implementing a raise at that time, lawmakers established the bonus to increase public-employees’ salaries, according to Sergio Marxuach, public-policy director at the Center for a New Economy, a research group in San Juan.

“I have to do everything in my powers to pay that money,” Garcia Padilla said during a Dec. 9 press conference in Washington . “If I have the funds, I have no option but to pay that money.”

The average salary of a central-government employee is $28,000, with most workers receiving a holiday bonus of about $600, according to Barbara Morgan, a spokeswoman who represents the Government Development Bank at SKDKnickerbocker in New York. The bank oversees the island’s finances and is in talks with bondholders to cut its debt load.

Fair enough, I suppose. If they had an actual bankruptcy process they could go through, then that law would be irrelevant.

FWIW, I will do the math for you: assuming government workers work 35-hour weeks, 700 hours is equivalent to 20 work weeks.

Officials project an economic impact of $150 million if the government pays its employees $120 million in bonus cash, according to Morgan. Alameda, the UPR professor, estimates a combined economic benefit of about $140 million from central-government, municipal and private-company bonuses.

Oh dear lord, not this shit again.

Why not figure out the economic impact of not paying your debt?

BANKRUPTCY: PRO AND CON

There are two parts to this. I am not writing much new content, so I will leave it at this:

1. Puerto Rico should/should not be allowed to have access to federal bankruptcy processes

2. Once allowed, PR should/should not avail itself of this process

I am taking no stance on the legal processes.

PR simply does not have the money to cover all its promises. It’s de facto bankrupt. The way it will get worked out will partly be political, no matter the choices on 1 & 2, but it would be nice to have a structured legal process to help protect interests.

But to the writers.

First, pro-bankruptcy: Tim Worstall

Puerto Rico’s Bankruptcy Case: If Something Can’t Go On Forever Then It Won’t

…..

The most important, and yet still underappreciated, point about this capitalism and free market system is the way that it deals with failure. For there always will be failures in an economy. And the most important question is what happens when there is one. The correct answer being to draw a line under it, allocate the losses and then get on with the job of trying not to fail again. This applies to companies and also to governmental organization. But, sadly, US law does not currently allow Puerto Rico to declare bankruptcy.“The justices said Friday they will review a lower court ruling that said Puerto Rico could not pass a law giving local municipalities the power to declare bankruptcy.

“Puerto Rico lawmakers passed the law last year to help the cash-strapped utilities meet their obligations to bondholders and creditors. Puerto Rico is in a nine-year economic slump and struggling with $72 billion in public debt.

“But a federal district court ruled that the measure is not permitted by federal bankruptcy law. The 1st U.S. Circuit Court of Appeals agreed.”

Someone needs to cut this Gordian Knot and it’s really only the Supreme Court who can do so. In the absence, that is, of the currently dysfunctional Congress being able to do anything.

…..

With Puerto Rico the choice is bankruptcy or bankruptcy. The only question is which way is it done? Do some of the creditors get stung in a debt write down, or is the entire economy plunged into Depression as has happened with Greece (it’s not far off that already). Sure, I know, we all like to point out that Walmart has masses of money, but taxing people at 91.5% on their profits does mean that people aren’t going to stick around to be taxed. Bye bye economy then.Better that Puerto Rico be allowed bankruptcy protection than that.

It also sets up possibilities for various states, though there is a sovereignty issue there.

But I bet Illinois and California are watching the PR mess carefully.

Here is an opposing view: Steven M. Fetter

Filing For Bankruptcy Isn’t The Right Solution For Puerto Rico

When I testified before the Senate Energy and Natural Resources Committee last month, I was the only voice among a panel of esteemed colleagues to oppose allowing Puerto Rico’s electric utility, known as PREPA, to file for Chapter 9 bankruptcy.

I stand by that testimony, not because I have a lack of empathy for the residents of Puerto Rico, but rather, just the opposite. I believe that changing the current law to allow PREPA to file for Chapter 9 restructuring would be a further setback for the island’s economy.

A declaration of bankruptcy would effectively dry up PREPA’s access to the capital markets for the foreseeable future, making borrowing new money extremely costly, if available at all, erecting yet another obstacle to the recovery of the already stagnant economy.

…..

During the hearing, Senator Bernie Sanders of Vermont and Senator Elizabeth Warren of Massachusetts raised the specter of so-called “vulture” investors profiting from Puerto Rico’s economic demise. While I share their distaste for these opportunistic investors, who represent a minority of Puerto Rico debtholders, the sad fact remains that following a Chapter 9 restructuring, “vultures” might be the only ones willing to provide PREPA with needed capital, of course at rates far above market levels.Certainly, funds will no longer come from small investors, like the young mother from Virginia who emailed me after the hearing to see if I might be able to help. You see, her former investment advisor had encouraged her family to load up on Puerto Rican bonds, safe from both taxation and bankruptcy. I could almost feel her tears through the email as she wondered whether she would ever get anything back if Puerto Rico and its agencies were allowed to file for Chapter 9. I didn’t have an answer for her, nor did I have the heart to tell her that there was still a type of investor that would be willing to help her, but only to the tune of pennies on her dollars.

Hmmm, here’s a thought:

MAYBE SMALL INVESTORS SHOULDN’T BE INVESTED IN PUERTO RICO

I am looking at something for my day job, which involves institutional investors possibly getting burned by certain investments.

While insurers do invest in things available to “retail” investors (i.e. the little guys), they also have assets not available to the general public. All sorts of risky and complicated assets have qualification requirements to be allowed to buy them.

While I understand why governmental entities love having their debt held by the general public, and most municipal bonds out there are just fine, some of these bonds are indeed risky. There’s a reason you got extra yield for these bonds!

People recognize that investments in stocks can be wiped out — and that is true of bonds as well. They just happen to fail in a different way.

Not allowing for a bankruptcy process is not going to protect investors at all.

WORKING OUT DEALS

In any case, some sort of deal is being worked out:

Puerto Rico Electric Reaches Tentative Pact With Creditors

Accord is the final piece in a $8.2 billion debt restructuring

Any possible debt restructuring requires legislative approvalPuerto Rico’s electric utility reached a tentative agreement with insurance companies MBIA Inc. and Assured Guaranty Ltd., along with some bondholders, to restructure the utility’s $8.2 billion of debt, according to two people with knowledge of the discussions.

The accord sets into motion what would be the largest-ever restructuring in the $3.7 trillion municipal-bond market and potentially averts a default on $196 million of interest due Jan. 1. Under the pact with the Puerto Rico Electric Power Authority, the insurers will provide about $450 million in the event of a default through what’s known as a surety bond, according to the people, who asked for anonymity because the negotiations are private. Prepa may execute a debt-exchange in the second quarter, one person said.

It took more than a year of fitful negotiations for the agency known as Prepa to strike a deal with bondholders, who in November agreed to take losses of 15 percent. The protracted process for the utility shows the difficulty Puerto Rico faces in seeking to persuade investors to accept less than they’re owed on its bonds, which were sold by more than a dozen different agencies. Governor Alejandro Garcia Padilla said this week that the commonwealth will default as soon as January because it has run out of cash.

…..

Possible Framework

The restructuring would be the first step in Puerto Rico’s goal to reduce its $70 billion debt burden by asking bondholders to take a loss or agree to delay principal payments, and it may provide a framework for agreements with other creditors. It follows a stalled effort by the Obama administration to give the commonwealth broad bankruptcy powers to help the island improve its finances and revive an economy that’s failed to grow since 2006. Congressional leaders rejected access to bankruptcy as part of a budget bill crafted this week.

Wait, $8 billion out of $70 billion?

Yeah, it’s only a small part of the debt:

Puerto Rico Deal Is Only a Small Fix for $70 Billion Debt Crisis

Utility’s tentative accord would be the first restructuring

Governor says bankruptcy would avoid costly, `chaotic’ talksRepresentative Nancy Pelosi, the leader of the House Democrats, took to the chamber’s floor on Friday morning and scorned Congress for not giving Puerto Rico the tools to cut its crippling debt.

Twelve hours earlier in New York, island officials and creditors reached a tentative agreement to begin doing just that.

The accord, if completed by bondholders and insurers, would reduce the $8.2 billion owed by Puerto Rico’s electric utility. It’s just a first step in the island’s struggle to escape from under a $70 billion debt burden, held by more than a dozen agencies — a task so complex that Puerto Rican officials are lobbying Congress for the power to declare bankruptcy.

While the agreement reached late Thursday took more than a year to negotiate, the process was “relatively smooth because the interests were fairly aligned on both sides,” said Triet Nguyen, a managing director at NewOak Capital, a New York financial-advisory firm. “When you get to the rest of the debt complex it’s a much messier process.”

That’s why the deal by the Puerto Rico Electric Power Authority may mark only a brief respite in a crisis that’s been escalating for six months, as the island of 3.5 million rapidly runs out of cash and veers closer toward the first default on its guaranteed debt.

Let’s look at what’s on tap:

‘Costly and Chaotic’

Garcia Padilla said renegotiating the government’s entire debt load would be far more difficult.

“The vast number of creditors with differing interests across all issuing entities would result in negotiations that are lengthy, costly and chaotic,” he said. “Access to legal, broad restructuring authority would allow us to undertake these in an orderly manner.”

Prepa had been negotiating since August 2014 with hedge funds and mutual funds including OppenheimerFunds Inc., who in November agreed to take losses of 15 percent. On Thursday, Prepa reached a tentative deal that includes bondholders and insurers MBIA Inc. and Assured Guaranty Ltd., which had been holdouts, according to two people with knowledge of the discussions.

…..

Still Could UnravelLate Friday, the utility said it extended a standstill agreement with creditors until Dec. 22 to give it more time to negotiate. Puerto Rico’s legislature would also still need to approve the final deal, and it could face legal challenges from other bondholders who don’t agree with the terms, said Phil Fischer, Bank of America Merrill Lynch’s head of municipal research.

While investors and analysts said they were encouraged by the Prepa agreement, they cautioned that it won’t automatically lead to a broader restructuring.

“Coming to a consensual agreement on the governmental debt is going to be really, really difficult,” said Peter Hayes, head of munis at New York-based BlackRock Inc., the world’s largest money manager.

It’s good that they’ve come to a (temporary) agreement on some of the debt… but the problem isn’t really settled.

So the watch goes on.

Related Posts

Taxing Tuesday: Time to Make the Donuts

Trying to Deflect the Blame: Calpers and the Catholic Church (and Trump!)

Podcast: Financial Reporting v. Budgeting: SC Comptroller Resigns Over $3.5 Billion Error