Chicago Watch: Money Money Money...also, there went their plans

by meep

I saw something passing by about the Zika virus possibly becoming a major campaign issue this year.

Intriguing idea, but it seems to me as time goes on, Chicago’s money woes just may be bigger as a general election theme. And Puerto Rico. For starters.

I will develop that thought more later, but let’s do a round-up to see what’s happening.

BORROWING FOR PENSIONS: ALWAYS AN AWFUL IDEA

Credit Draw Highlights Chicago Pension Problems:

CHICAGO – The risky underpinnings of Chicago’s efforts to solve its $20 billion pension mess take center stage this week.

The Illinois Supreme Court on Thursday will release its opinion deciding the fate of the city’s overhaul of its laborers’ and municipal employees’ pension funds.

Word came of the impending ruling Monday, shortly after the city said it had made a $220 million draw from its $900 million short-term borrowing program to meet an obligation to its police and firefighter funds.

The council adopted Mayor Rahm Emanuel’s plan to phase in a record $543 annual million property tax hike last fall to cover rising police and firefighter contributions, but the plan to phase in the tax increase assumed the state government would approve a revised amortization payment schedule to slow the shift to an actuarially required contribution level mandated by a 2010 law, which would trim the $550 million payment spike in 2016 by $220 million.

The General Assembly approved the city’s plan to soften the blow for taxpayers, but hasn’t sent it to Gov. Bruce Rauner’s desk. The Republican governor has threatened a veto absent an agreement with Democrats on a fiscal 2016 budget and structural pension reforms.

….

With $20 billion of unfunded obligations, Chicago’s pension systems are just 34% funded.Investors and analysts are watching closely because any pension setback could further dent the city’s tarnished credit and impact the trading value of its debt. The city also stands to lose ground it gained in trimming yield penalties. The city’s 10-year maturity in a deal priced earlier this year landed at about a 250 basis point spread to the top-rated Municipal Market Data benchmark compared to spreads that neared 300 last year.

…..

Credit LinesFinance officials said the short term credit line was used to meet a March 1 deadline on a deposit with the city treasurer to cover the police and firefighter contribution this year should the re-amortization fall through. Chicago’s chief financial officer, Carole Brown, disclosed the plan in a letter to council members.

Finance officials portrayed the move as short-term cash flow management issue. “We will not be issuing long-term debt to make this pension contribution. The city continues to believe the governor will support Senate Bill 777 as it protects taxpayers and provides a responsible funding plan to secure police and fire pensions,” said finance department spokeswoman Molly Poppe.

The city pays an interest rate of 3% on the line. The credit line would be paid off if the amortization bill is signed, formally reducing the city’s required payment.

There is more at the link.

INTERLUDE: SHORT-TERM BORROWING FOR PENSION CONTRIBUTIONS IS INSANE

I don’t care what others say, but pension obligation bonds are of the devil. I am not exaggerating in my statement.

The short reason why:

- It doesn’t help. (Generally it is a very temporary fix for one year, and the unfunded liability continues to grow into an unwieldy problems.)

- It makes things worse. (Congrats, you’ve got a debt-strapped govt entity and you just added on more sure debt so you can stick money is risky assets.)

That said, at least when POBs are issued, those buying the bonds know the proceeds are being used to fund pensions, a long-term liability. Long-term funding; long-term liability. No, it’s not a capital program, but at least there’s something of a match in the intentions.

But short-term borrowing to make a pension contribution?

Are you kidding me?

The assumption is that state money will come through, or some money will come through, somehow, to fulfill the short-term borrowing.

When that’s not actually the case, some really serious problems occur.

Earlier this month, Chief Financial Officer Carole Brown sent a letter to aldermen informing them that Emanuel had used a $220 million “short-term funding bridge” to make the higher police and fire pension payment due on that day.

That’s because the police and fire pension bill is caught up in the marathon state budget stalemate, and state law required the city to deposit the difference between current law and Emanuel’s risky assumption by March 1.

“This short-term funding bridge will be terminated by the city when Gov. Rauner signs” the bill, Brown wrote.

….

“It would have been less expensive to raise property taxes by the amount necessary to fund this than it will be to use short-term debt or commercial paper that has to be repaid in one or two years. . . . They’re going to pay a larger interest payment for that borrowing — maybe as high as 8 or 9 percent. And they still have to come up with the $220 million principle they don’t have,” [Civic Federation President Laurence] Msall said.“In the past, the city has used long-term borrowing to roll short-term debt into a more manageable annual payment,” he said. “However, that would violate Mayor Emanuel’s pledge to eliminate scoop-and-toss. So, it’s likely to have to pay for this borrowing through existing budget cuts or other tax increases. There are no easy or inexpensive options. This is yet another bad sign of the financial distress the city is in [and] a very likely sign that next year’s budget will be even more difficult. The need for help from Springfield has never been more apparent.”

And never less likely to come. Oh well.

THAT PENSION REDUCTION GAMBLE

By the way…

Ill. Supreme Court strikes down Chicago pension rescue plan.

Hey Rahm: YOU LOSE.

I will make another post on that on another day.

I am not surprised by this outcome. In 2014, I said Chicago pension reform was a no-go.

So what of that short-term borrowing, eh?

Yeah, Illinois is going to be ugly, as is Chicago.

AUTOMATIC TAXES! WHEE!

Here’s the next stupid thing: the concept that Chicago taxes will automatically increase to fill a shortfall in paying bonds.

HAHAHAHHA

Okay, here is the article: If CPS ever misses a debt payment, property owners would see taxes jump

If CPS ever misses a debt payment, property owners would see taxes jump

As Chicago Public Schools’ money troubles worsen, students and their families face increasing uncertainty. Dozens of classroom staff were laid off last month after the school district cut principals’ second-semester budgets. A strike is looming as CPS prepares to slash teacher benefits.

But if the school district ever comes up short on its debt payments, the investors who bought CPS’ bonds can rest assured they will get what they are owed — straight from Chicago taxpayers.

The school district’s bond contracts include a little-known provision that would trigger a property tax increase if CPS fails to pay. The county clerk would deliver that additional revenue directly to a bank — much the way a creditor might garnish an individual’s wages.

….

Had CPS secured voters’ approval before issuing its bonds, the district would have a dedicated stream of property tax revenues available to pay off the debt. But for 20 years Chicago school officials have avoided holding referendums by promising to use an existing revenue source to make debt payments: mainly the per-pupil education funding the district gets from the state. Property taxes serve as a backup.With this type of borrowing, called an alternate revenue bond, the pledged revenue stream usually covers the debt payments and the backup option isn’t called upon.

…..

Indeed, in a statement responding to Tribune questions, the district noted that “CPS has used alternate bonds since at least 1997 and has never failed to make a debt service payment.”

But some analysts believe the district’s ongoing cash crisis makes that scenario more likely.

Last month CPS struggled to scrape together enough money for a $474 million payment on its $6 billion debt load. To come up with the money, the district had to borrow about $200 million — a deal that initially stalled for lack of investors and finally got done less than two weeks before the Feb. 15 due date.

To reassure prospective investors, CPS Treasurer Jennie Huang Bennett explained in a January online presentation that if the school district were unable to make a debt payment, “the taxes are then extended and collected for the benefit of bondholders.”

Good luck with that.

COUNTERPOINT:MISH. ALSO: REALITY

This is what Mish had to say about that counterfactual:

Bond Market Does Not Believe CPS Treasurer Bennett

Note that the district had to pay 8.5% in its last bond offering.

Hmmm. It seems bondholders don’t believe Bennett’s preposterous claim, and neither do I.

The fact is, bondholders can’t “force a tax increase.” The county clerk can assess the tax, but that tax can be challenged.

Since Chicago is a city of landlords, I would expect all kinds of enforceability challenges. Those challenges could drag on for months or even years.

Meanwhile the district would be in default. Yields would soar, and so would penalties and taxes to make up for it.

There is nothing automatic about payment. Bennett’s claim may very well trigger a lawsuit. It’s certainly a lie.

CPS Bankruptcy Coming Up

The one-sided Tribune article smacks of something written by the CPS and panicked boldholders, for the sole benefit of the CPS and panicked bondholders.

Would mayor Rahm Emanuel really take this all the way through the courts, knowing “victory” would mean massive tax hikes on top of the biggest tax hike in history he passed last October?

His comment at the time was “It’s Not a Piece of Art“. Indeed!

Would he really pass another hike just to pay off bondholders, with the city getting nothing out of it but more misery?

My prediction: lawsuits. Lots and lots of lawsuits.

But party time for lawyers, because they make sure they get paid. No matter what.

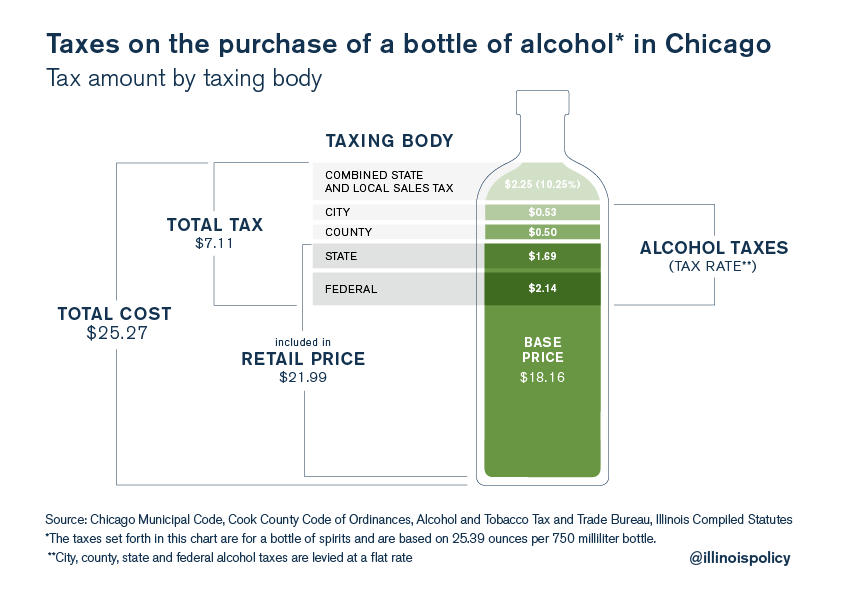

BONUS: Chicago has a fairly high tax on alcohol

Related Posts

Public Pension Returns Start to Roll In for FY 2022

The Moral Case for Pension Reform

PSERS Update: What if it's just sloppy processes?