Public Pensions and Finance Round-up: Sunday, April 10

by meep

No single theme here, but a bunch of stories I thought worthwhile looking at.

Also, I’m stuck in DC for a few more hours and I don’t feel like grading papers right now. Or playing more Candy Crush Saga.

NEW YORK: IT’S SO TOUGH TO YANK PENSIONS FROM CRIMINALS

I’ve written about this before. And before. And before. And before.

New York just can’t seem to get its act together on the matter.

Let’s go to the official news source:

Lawmakers clash over pension-forfeiture proposals

Just like Gov. Andrew Cuomo and 84 percent of New Yorkers who were polled in January, state lawmakers in both parties and both chambers seem to agree that politicians who are convicted of corruption should not be allowed to draw their taxpayer-funded pensions.

And yet, with two months left in this year’s session and former legislative leaders Dean Skelos and Sheldon Silver soon to be sentenced for federal crimes, the Democratic-controlled Assembly and Republican-controlled Senate still disagree on the exact language that should be added to the state constitution to deny ex-officials like Skelos and Silver their pensions.

The Senate proposal would apply to anyone in state and local government who is convicted of any work-related felonies. Assembly Democrats, under pressure from New York’s public employees’ unions, crafted their own version last year that would penalize elected officials and certain other employees – including judges, government administrators and governor’s appointees – but spare all other public workers that aren’t listed. So far, neither side is going with the other side’s version.

The Senate’s briefly worded amendment would deny a pension to any “public official” convicted of a felony “related to public office,” and would allow further details to be spelled out in a subsequent statute. Conor Gillis, a spokesman for state Sen. John Bonacic, R-Mount Hope, pointed out on Friday that legislative leaders and Cuomo had agreed on the language during budget negotiations a year ago, only for the Assembly to back out. “The Senate passed that amendment, and the Assembly did not,” Gillis said.

Michael Whyland, a spokesman for Assembly Democrats, contends the Senate proposal was “overly broad.”

Look, I understand from the “The Feds can get you on 3 felonies a day” point of view that they may see felony conviction as a low threshold for yanking a pension.

But as it is, some people who blatantly abused the power of their office do not get their pensions yanked.

I think there does need to be situations where a cop or a teacher could get their pension yanked.

In any case, it’s Democrats balking. Maybe they have more to worry about with regards to felony convictions, in New York, but primarily because there’s more of them.

CREDITORS KEEPING THE FAITH?

This just… doesn’t make me feel good.

Chicago bondholders keep the faith after pension fund setback

Chicago’s biggest bondholders aren’t losing faith.

Nuveen Asset Management, Wells Fargo Asset Management, Columbia Threadneedle Investment Advisers and BlackRock are showing optimism that the nation’s third-largest city will work its way out of a pension crisis, even after the Illinois Supreme Court rejected Mayor Rahm Emanuel’s plan to ease $20 billion of unfunded retirement obligations.

Despite a lack of help from the gridlocked state of Illinois and mounting liabilities that threaten the city’s solvency, holders of more than $1 billion of the city’s debt, point to Chicago’s growing economy and track record of a willingness to raise taxes.

Chicago actually benefits in the short-term from last month’s court ruling. Required pension payments drop by about $89 million this year, relieving some of the immediate pressure on the city budget. The two funds still are projected to run out of money in 10 to 13 years. While the decision was a disappointment, city officials now have a new set of facts to work with as they address the liabilities, said Lois Scott, Chicago’s former chief financial officer.

I understand it’s just an expression being used by the writer, and not by the bondholders themselves, but…. it’s not bondholders who have to keep the faith. It’s the ones who promised to pay back the bonds.

As for that willingness to raise taxes… sure, they can raise tax rates, but how much extra tax revenue is really available to them?

RUMORS OF FUNDS RUNNING OUT?

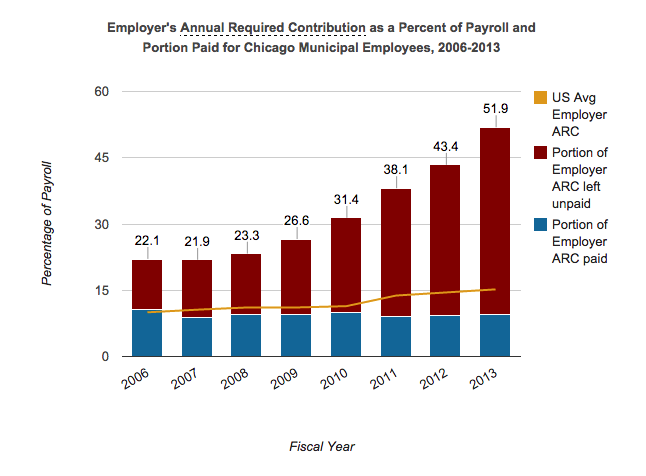

One of the Chicago pension funds has worried trustees, supposedly:

Sneed is told trustees of the city pension funds are getting increasingly nervous about the prospect of the Municipal Employees Annuity and Benefit Fund paying out $900 million a year in benefits — but taking in only $300 million a year in revenue, according to an informed city source.

“At the rate it is going, the fund — which has 79,000 city and board of education employees, which also includes widowers and children — could go broke in 2025,” the source added.

Okay, let’s go check the numbers.

I looked at MEABF’s numbers, briefly, a few years ago. It mentioned the asset death spiral then.

The Public Plans Database entry for MEABF doesn’t look all that good – you don’t see a big drop in asset value, except in 2008. But there is a small decrease in a year when the investment return was supposedly good.

This isn’t the most recent graph, but it’s only worse with 2014 in:

Unsurprisingly, this is what the funded ratio trend looks like:

Remember that the 2014 uptick was assuming that the Chicago reform, forcing higher employee contributions and whacking COLAs, was assumed to be in effect. It’s not in effect anymore.

In the most recent available CAFR, I see the following info:

297,850 annuity benefit payments to retirees and beneficiaries totaling $754.4 million. Of these,

91% were paid via electronic funds transfer with the remaining 9% by check. (pg 6)

….

The Plan continues to liquidate portfolio assets to supplement the disbursement of benefit payments.

During fiscal year 2014, approximately $525.5 million in portfolio assets were liquidated compared to

$496.3 million in fiscal year 2013 and $459.7 million in fiscal year 2012. (pg 13)

….

Total additions as reported in the Statements of Changes in Fiduciary Net Position decreased by $452.4

million or 44.2 percent in 2014 to $572.1 million from $1,024.5 million in 2013. (pg 16)

So yes, they’ve been having to sell off assets in order to cover benefits.

This isn’t good, especially since the benefits being paid has been increasing, which is unsurprising. This is not a closed pension. It’s not in run-off. Liquidation of assets to cover benefits in a run-off situation is to be expected.

Not when the benefits are only growing.

Yes, running out of funds within a decade is definitely believable.

KANSAS PLAYING TRICKS: NEVER A GOOD SIGN

This is how Chicago’s own fiscal shenanigans got started. Delaying payments to the next fiscal year to make things look balanced:

Kansas delays contribution to state employee pension system

About $93 million in contributions will be pushed back

Delay does not affect current retirees’ benefits

Kansas is delaying an April contribution of $92.6 million to its state pension system, a move that could be used to help balance the current budget.

The delay does not affect current retirees’ benefits in the program, the Kansas Public Employees Retirement System, said Shawn Sullivan, budget director for Gov. Sam Brownback.

“No decision has been made as to whether this will be used as a budget-balancing tool for this fiscal year,” Sullivan said, “but this action allows us to maintain the flexibility provided by the Legislature through the budget bill as we wait for the Consensus Revenue Estimating Group to provide new revenue numbers later this month.”

If the Brownback administration chooses not to make the retirement system contribution this fiscal year, the payment would have to be paid with 8 percent interest by Sept. 30. That provision was included in this year’s budget bill to try to avoid damage to the pension system.

Brownback spokeswoman Eileen Hawley said it’s not yet clear how long the contributions will be delayed. It’s possible, she said, that it might not be more than a few weeks.

This crap is silly. Cut it out.

And no, it doesn’t endanger benefits paid in the very short term…. but this is just the start of trying more and more tricks. Like pension obligation bonds.

Oh crap. I’m too late to warn them.

Anyway, stop it. Stop it now. You’re going in a bad direction.

PENNSYLVANIA PENSION DEBT: CONCERNING

Pennsylvania’s pension debt continues to mount; critics alarmed

HARRISBURG, Pa. (WHTM) – Time, as the saying goes, is money.

Nowhere is that truer than in Pennsylvania’s mounting pension debt.

“It’s growing, if you haven’t figured it out, at $143 a second,” Barry Shutt of Lower Paxton Township said.

Shutt, a pensioned retiree himself, commissioned a pension clock similar to the national debt clock in New York City. He paid for it and positioned it just outside the Capitol cafeteria. That’s a fitting spot because pension debt has an insatiable appetite for tax dollars.

“It’s at $4.5 billion a year and it’s jeopardizing the future economic growth of Pennsylvania,” Shutt said. He is a citizen activist who has hung around the Capitol for two years trying to cajole lawmakers into focusing on the state’s pension problem.

…..

The crisis dates to 2001 when benefits to retirees were enhanced without an additional revenue stream to support those increases. School districts and state government then for a decade made less than the minimum payment on their pension credit cards. Add in a recession that ravaged investments and ridiculously rosy projections on those investment returns, and you’ve got a sinking pension ship.Rick Dreyfuss is an actuarial consultant. Here’s how he describes the problem: “We are dealing with overstated assets and understated liabilities coupled with poor funding practices.”

Philadelphia is trying to escape this debt trap:

Council to consider pension buyouts

City Council will take a closer look at a proposal to save the city’s underfunded pension fund with buyouts, an idea recently raised by City Controller Alan Butkovitz.

“I think we need to be creative,” said Councilman Derek Green, who called for the hearing Thursday. “We have a very challenging pension situation right now. . . . We need to put everything on the table.”

The city’s pension fund is $5.7 billion short of its $11 billion obligation. Butkovitz has proposed that the city offer cash buyouts to retirees who would then surrender their lifelong pensions.

…..

Butkovitz has not proposed what the buyout rate should be, but he is suggesting that the city make the offer to 31,000 city retirees and 2,500 active employees who are covered by the city’s oldest and most costly pension plan, referred to as Plan 67. Plan 67 retirees account for $5 billion of the fund’s $5.7 billion shortfall.Butkovitz has suggested the city sell bonds to cover the cost of paying for the buyouts. The city’s actuary has said taking the cash from the city’s current pension assets would severely drain the fund.

Adding leverage to the situation doesn’t help matters, either (through a different kind of pension obligation bond)…. except removing the liability completely does reduce leverage.

So, eh. Might be a wash.

Getting rid of the liability entirely could be a winner… but you need enough people, and enough of the right people, to take the deal. If it’s just the people in poor health where they were expecting to die soon then… yeah, selection issues could be a problem.

Related Posts

Taxing Tuesday: Trying to Escape Property Taxes, Follow-the-Leader, More Married Couple TCJA Scenarios

Testing to Death: Which Public Pensions are Cash Flow Vulnerable?

Divestment and Activist Investing Follies: What's Next? My Lunch?