Pensions Weekend Wrap-Up: Chicago, the Actuaries, and New Jersey

by meep

First off, thanks to my linkers!

Please keep linking to me! I love it!

CHICAGO: TAX ALL THE THINGS

Sometimes you want to kick that can, and the issue is that, at this point, the can has gotten so big and heavy, it doesn’t budge when you kick. [okay, I’ve tortured that metaphor enough]

In short, the bills are coming due for the Chicago pensions.

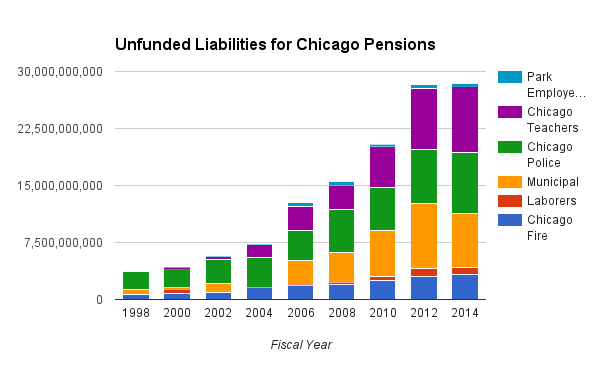

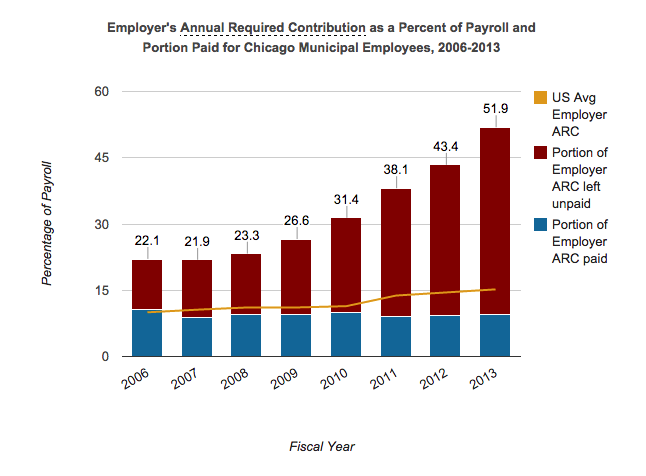

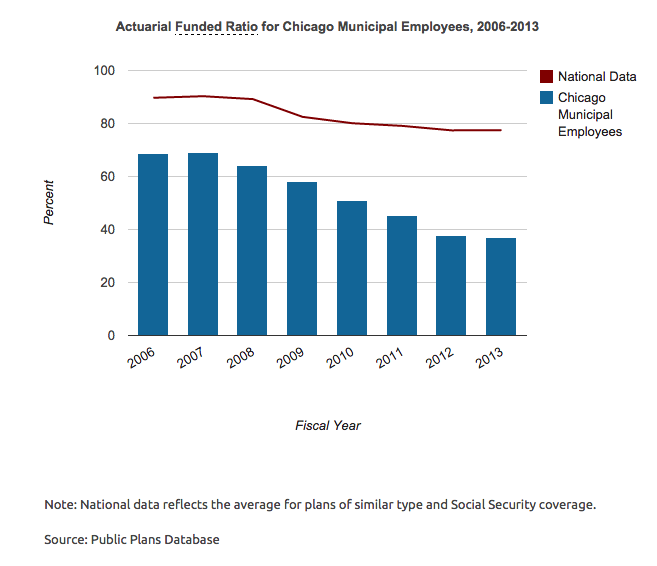

A reminder of how bad things are:

The total unfunded liability of all the Chicago-related pensions is near $30 billion (yes, with a b).

Chicago hasn’t made full contributions to pensions in many years, so the “required” contributions keep rising [due to undercontributions and other underperformance]

And most of the Chicago pensions are at abysmal funding ratios.

Those graphs are about a year old — there’s newer numbers, but it’s not like the pensions magically improved in one year. Especially given recent stock market performance.

So what’s Rahm to do?

Raise taxes.

Here’s a round-up of news items on the proposed taxes (in no particular order, but all from the past week)

- Chicago property tax bill double whammy: Increases plus an assessment hike

- What Chicago Will Tell Bond Investors This Week

- Chicago bonds gain as city plans tax hike to fix biggest pension

- Emanuel rules out compromise on water and sewer tax

- Chicago’s Bills Will Increase in 2017 as Pension Costs Escalate

- Chicago’s Public Safety Pension Liabilities Rise Slowly

- More Cities Will Look Like Detroit If Property Taxes Are Used To Pay For Pension Promises

- Emanuel eyes utility tax increase to save largest pension fund

- Some aldermen give cold shoulder to utility tax hike for pensions

- Pension fix: 28 percent water/sewer tax, phased in over 4 years

- Analysis: If only Daley hadn’t punted pension crisis to Emanuel

That last one is a gas.

If it’s not clear: Daley left because he knew the games would be over, and whoever came after him would have to raise taxes, and not for fun stuff.

These are not fun taxes (i.e., punishing the groups you want to punish) and these are not fun expenditure (i.e., getting to funnel money to specific individuals who can pay you back.)

This is raising taxes on everybody, from the poorest to the richest, so you can pay for service rendered decades ago.

No new parties. No nice new buildings to dedicate.

Just paying for stuff now that should have been paid for when it was promised. But it wasn’t.

And some comments from Leo Kolivakis:

I have not changed my mind on Chicago’s pension patch job. It’s going from bad to worse and just like Greece, they’re implementing dumb taxes to try to shore up insolvent public pensions instead of addressing serious governance and structural flaws of these pensions.

But unlike Greece, Chicago and Illinois are part of the United States of America, the richest, most powerful country in the world, so they can continue kicking the can down the road, for now. Still, what message is Chicago sending to its own residents and to potential workers looking to move there?

I’ll tell you the message: apart from one of the worst crime rates in the nation, get ready for more property taxes and hikes in utility rates to conquer a public pension beast which has spiraled out of control.

And the sad reality is while these taxes might help at the margin, they’re not going to make a big difference unless they are accompanied by a change in governance, higher contributions and a cut in benefits (get rid of inflation protection for a decade!).

…..

The other problem with raising taxes and utility bills is they are regressive, hurting the poor and working poor a lot more than Chicago’s ultra rich.

Here is my rebuttal to Leo:

Yes, the taxes are going to hit people of more modest means harder than the super-rich… because when the taxes really bite the super-rich, they have the means to leave.

And unlike, say, New York City or even San Francisco, there is nothing so awesome about Chicago that a super-rich person has to be there.

While so many politicians play dumb, most aren’t that dumb. Even in New York City and State, they nixed the idea of a millionaire’s tax…. even though New York City is the best city in the world.

I am not going to address his comments on DC v. DB, but only to say that if I were required to contribute 30% of someone’s salary to a DC plan, I bet they would do just fine.

Lastly, I don’t think Chicago has to go the way of Detroit, necessarily. If they’re allowed to declare bankruptcy before it gets as dire as Detroit’s situation was, they may just be able to claw their way back. I obviously don’t like Chicago, but I don’t think they’re quite as beat up as Detroit was.

Leo is correct in that Chicago could go the way of Detroit. Any city can. I think Rahm is taking it seriously, so I will give him credit for that.

ACTUARIES: WHAT ARE WE HIDING?

Others have noticed the internecine actuarial battles.

Comments from Walter Russell Mead:

BLUE MODEL BLUES

Actuarial Establishment Tries to Suppress Explosive Paper on Public Pensions

…..

There are powerful interests that don’t want public pensions to be governed by the same kinds of accounting principles used in the private sector because… well, because if they were, public pensions would go from seriously underfunded to catastrophically underfunded.Union officials and state legislators (in both parties) seem to believe that it makes more sense to allow public pension funds to play “let’s pretend” with public money. To be sure, the sudden imposition of a tougher standards would cripple business as usual in many state and local governments, so there can and should be some reasonable accommodations made to allow the adjustment to take place in a less disruptive fashion. Governing by catastrophe is almost never a good idea, and a series of small and incremental changes is usually (though not always) a better way to manage public affairs.

In the long run, shifting to a more portable system of public pensions—defined contribution, rather than defined-benefit—wouldn’t just help save states and municipalities from fiscal ruin. It would also do much to improve the performance of the civil service. The current system creates a jobs-for-life mentality in public employment because workers need to stay at their positions for decades to collect the full value of their pensions. Somebody who was a good teacher at 30 but wants to leave and should leave at 40 is currently trapped. Also, one of the reasons the unions fight quality evaluations so fiercely is that the loss of job and pension is so much more draconian than simply losing a job.

The report from dissident actuaries might have helped push state and local pension systems down a more sustainable path. And the conduct of American actuarial leaders—disbanding a reputable task force that had prepared a report that the bureaucracies didn’t like, and then hinting at legal action if the report is published—is irresponsible at best and corrupt at worst. Is it any wonder that Americans are fed up with experts and the institutions they manage?

You want to know what our actuarial orgs are doing right now? (other than fighting each other)

Signing petitions on NC’s HB2 bill. Go check out the discussion. [note: I’m campbell on the Actuarial Outpost]

Anyway. This is unlikely to be over. Some of these disputes can carry on for decades.

I know about that only too well… and I’ve been in the profession only since 2003.

NEW JERSEY: PITY IF ANYTHING WOULD HAPPEN TO YOUR ELECTIONS, EH?

Speaking of disputes, something more serious is going on in New Jersey.

Public sector unions are threatening to pull their political donations.

Public employee unions not giving money to incumbent Democrats in Jersey?! That’s extortion!

SWEENEY ACCUSES UNIONS OF THREATS AND BRIBERY OVER PENSION FUNDING

State’s top Democrat –- and probable gubernatorial candidate — accuses NJEA and others of intimidation tactics

In a highly unusual move, the state Legislature’s top Democratic official, Senate President Stephen Sweeney, took a big swing yesterday at New Jersey’s most powerful public employee union, the New Jersey Education Association.

It left many questioning Sweeney’s political strategy, as it is an open secret that he plans to run for governor next year in what is expected to be a very tough primary fight.

Sweeney (D-Gloucester) accused officials at the NJEA and a top police-union representative of bribery, saying they’ve threatened to hold back campaign contributions unless the Senate moves within the next few days to ensure a proposed constitutional amendment seeking voter approval of beefed-up state pension contributions makes it onto the ballot this fall.

The longtime Senate leader also sent letters to both the U.S. Attorney’s Office and the state Attorney General’s Office to report alleged intimidation tactics by the teachers’ union that he said “cross the line from lobbying to attempted bribery and conspiracy.” In addition to lobbing accusations at NJEA officials, Sweeney said the president of the state Fraternal Order of Police left him a voicemail in recent days making clear that future campaign contributions are at stake.

“I think laws have been violated,” Sweeney said during a news conference at the State House yesterday.

As John Bury comments, what exactly did the politicians think the unions were giving them money for?

More stories on the matter:

- N.J. Pension Fight Pits Democrats Against Unions

- Sweeney: N.J. public worker pension amendment may be doomed for this year

- With pension amendment nearly dead, Sweeney says he’s ‘not going to back down’

A quick comment on the heart of this dispute.

The NJ unions think they’ll fix their pension underfunding by getting a state constitutional amendment requiring full funding.

Thing is, it’s pretty damn hard to enforce such “positive” rights – i.e., that the government must do something – even if they’re in constitutions. Because constitutions don’t make money appear from nowhere.

There’s a positive right to representation when you’re a criminal defendant…. and… well, check out this story from Missouri. And how much cheaper is paying for public defenders than public pensions.

The NJ state legislature has been controlled by Democrats since 2004. If the legislature wanted to make full contributions before now, they could have.

They didn’t.

A constitutional amendment won’t change a damn thing.

Happy weekend!

Related Posts

Mornings with Meep: Two Pension Stories and Skin in the Game

Asset Grab Bag: Whistleblower Award for Blogger, Private Equity Fees and Returns, and more

Public Pension Watch: California and Illinois Executive Resignations, Spiking v. California Rule, and more!