Pension Quick-Takes: Chicago, Houston, Chile, and More

by meep

I’ve been having an action-packed week. (To give you an idea of how edge I am, check out my rant about the mention of a spoon in a novel.)

Okay, maybe not, but I’m tired.

So here’s some quick nuggets on pensions!

CHICAGO

You thought the tax stuff was over? Nope, time for more taxes!:

Chicago homeowners have already seen their water rates double and a $9.50-a-month garbage collection fee attached to that water bill in the five years since Mayor Rahm Emanuel took office.

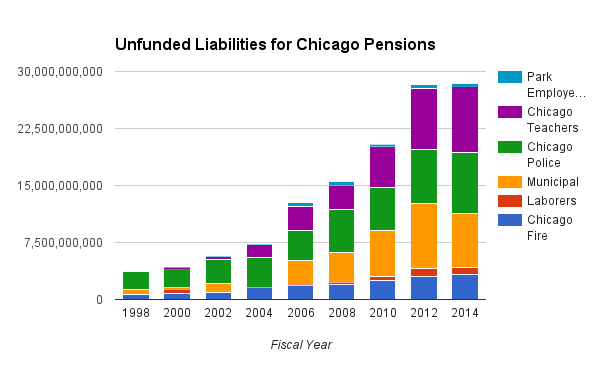

They got soaked again Wednesday, this time to help solve the $30 billion pension crisis that has sunk Chicago’s bond rating to a junk status shared only by Detroit among major cities.

By a lopsided vote of 40 to 10, the City Council approved the mayor’s plan to slap a 29.5 percent tax on water and sewer bills to save a Municipal Employees Pension Fund with $18.6 billion in unfunded liabilities that’s due to run out of money in 2025.

…..

Ald. George Cardenas (12th) walked off the Council floor prior to the vote to protest the mayor’s opposition to a TIF subsidy ordinance that would funnel up to $150 million to the cash-strapped Chicago Public Schools.

…..

Prior to the final vote, Finance Committee Chairman Edward Burke (14th) “reserved the right to close” the debate, only to learn that there would no debate.When Burke asked if any other alderman wished to talk about the tax, he got no takers — even though the City Council has spent hours debating far less weighty issues.

That left Burke to sell the mayor’s tax as the “alternative that makes the most sense” to save the largest of four city employee pension funds.

Thing is, seems like there’s a really good case to make that all these extra taxes will barely make a dent in the unfunded liability.

Mayor likely to get utility tax, but pension hole not filled yet

Mayor Rahm Emanuel likes to “put points on the board” and take a victory lap every time he does.

Expect more of the same on Wednesday, even though the “victory” means more pain for Chicago homeowners and businesses already reeling from $838 million in property tax increases for police, fire and teacher pensions and school construction, a new garbage collection fee, and a doubling of water rates in the mayor’s first term.

….

Emanuel’s victory would be sweeter if not for the fact that the parade of tax increases is not over.The Municipal Employees Pension Fund would still be left with a gaping hole in 2023 — even after the utility tax is fully phased in — that would almost certainly require a steady stream of additional tax increases to honor the city’s ironclad commitment to reach 90 percent funding over a 40-year period.

Good luck with that.

Reminder:

HOUSTON

A plan is out there… and the mayor seems to be playing hardball:

In the plan, which the mayor hopes to present to the Texas Legislature next year, operating costs would be required to remain within a specified range. If costs rise above that range, it would require operators to immediately determine how to reduce spending to fall back within the range.

The plan also calls for 30-year evaluations of the plan, instead of negotiations happening every year, Turner said. He also said changes can’t be accomplished without a change in benefits.

“No longer will we kick the can down the road in this city,” Turner said.

Turner said that while the governing bodies of both the police and municipal workers systems have consented to the plan, there are some sticking points with the firefighters’ governing body. However, he’s confident that they will become more comfortable with the plan as the final language is worked out.

Turner warned, however, that his plan is non-negotiable.

“The current system is not sustainable,” Turner said. “This is in the best interest of employees.”

….

One assumption is a 7 percent return on investments, annually, over the next 30 years.The other assumption proves to be a political hot potato in weeks to come: making sure all three pension boards: police, fire, municipal, agree with the proposal.

So far, Houston Professional Fire Fighters Association is not in agreement. The union takes issue with the $802 million in cuts, as well as a provision that would allow the city to renegotiate contributions and employee benefits, should costs increase in the future.

There was a court case around the smallest of the Houston pensions:

Houston Loses Appeal in Firefighter Pension Fight

By CAMERON LANGFORDHOUSTON (CN) — Houston can’t overhaul a state-governed firefighter pension system that the mayor claims is pushing the city towards insolvency, a Texas appeals court ruled.

Houston sued the Houston Firefighters’ Relief and Retirement Fund in January 2014, seeking a declaration that a state law setting how the fund is operated, and giving the city no control over the amount of its contributions, is unconstitutional.

The city paid $350 million in pensions to firefighters, police and city workers in 2015, but its unfunded pension debt is $6 billion and growing.

A state judge sided with the fund in May 2014 and granted it summary judgment.

The city appealed, pressing its argument that the subject state law, passed in 1997, gives too much power to the pension fund’s board that is comprised of a majority of firefighters who are beneficiaries of the fund, and thus are inherently self-interested in maximizing firefighter pension benefits to the detriment of the city’s financial health.

The 10-member board is made up of six active or retired firefighter fund members who are elected by other firefighters, the mayor or an appointed representative of the mayor, the city treasurer and two citizens who are elected by the other trustees.

Houston claimed on appeal the state law violates the separation-of-powers principle in the Texas Constitution by delegating authority to a nonlegislative entity, the fund board.

The city cited Texas Boll Weevil Eradication Fund v. Lewellen. In that case, the Texas Supreme Court ruled in 1997 that a foundation established by the Texas Legislature to exterminate boll weevils that were threatening to destroy the Texas cotton industry unconstitutionally gave too much authority to the foundation to tax private farmers to pay for weevil killing.

I already fell asleep. And I thought actuarying could bore outsiders. Lawyering can be even worse.

CHILE

There have been loads of protests of late over the Chilean version of Social Security. There’s a whole story there, and I may revisit it in depth another time. But for now, let’s look at a few stories on what’s going on.

Chile pension reform comes under world spotlight:

For many years, institutions like the World Bank held up Chile’s defined-contributions pension system as an example to follow, and it has been copied by more than 30 countries across Latin America, Southeast Asia and Eastern Europe, but its legitimacy is in question, and President Michelle Bachelet is promising reforms to try to shore up the system.

“The World Bank is terrified that the Chilean model will fail,” says David Blake, a pensions expert at the Cass Business School in London.

…..

Pensions saving was privatised in 1981, when Chile was one of Latin America’s poorest countries and shunned by foreign investors, and the new scheme replaced a failing state-funded pay-as-you-go system. By requiring employees to set aside 10 per cent of their income, it provided a huge boost for savings, investment, employment and growth.In particular, Chile’s nascent capital market roared to life, and pension funds now exceed $170bn, or around 70 per cent of GDP. This played a key role in turning Chile into the richest country in the region, lifting millions out of poverty.

The problem is that most are not saving enough. The 10 per cent of pay that is sent to individual savings accounts is about half the total put into pension schemes in developed countries, according to Mr Bravo. The average monthly benefit is about $300, less than earnings from a minimum wage job. The problem is made worse because many people have made only inconsistent payments and there is a large informal economy. Women are especially hard hit.

Many also complain that a lack of competition has allowed the private companies, known as AFPs, that manage the pension funds to earn disproportionately high fees. Investment returns have averaged more than 8 per cent since the system was founded but after commissions, net returns are closer to 3 per cent, according to Mr Bravo’s commission report.

…..The reforms under discussion now go further. They include requiring companies to contribute 5 per cent of workers’ pay to the solidarity fund, the introduction of a state-run AFP to increase competition, and measures to keep fund managers’ commissions under control.

If Chile’s reforms are successful, countries that face pensions shortfalls thanks to ageing populations and historically low bond yields will continue to look to the country as an example.

Unlike many other countries where governments have racked up enormous debts to pay promised pensions to public employees, that debt does not exist in Chile. The onus of saving has been transferred to individuals, says Jonathan Callund, a pensions policy consultant based in Santiago.

Yes, if you want to have money in retirement, you should save some up.

With Pensions Like This ($315 a Month), Chileans Wonder How They’ll Ever Retire:

SANTIAGO, Chile — Discontent has been brewing for years in Chile over pensions so low that most people must keep working past retirement age. All the while, privately run companies have reaped enormous profits by investing Chileans’ social security savings.

The bubbling anger boiled over in July when Chileans learned that the former wife of a Socialist Party leader was receiving a monthly pension of almost $7,800 after retiring from the prison police department. That figure dwarfs the average monthly pension of $315, which is even less than a monthly minimum-wage salary of $384.

In a country already battered by widespread political and corporate corruption, this was the last straw.

Hundreds of thousands of people marched through Santiago, the capital, and other cities to protest the privatized pension system. More than 1.3 million people, according to organizers, turned up in August, the largest demonstration since Chile’s return to civilian rule in 1990.

One protester was Luis Montero, 69, whose monthly pension is about $150. Like many Chileans, Mr. Montero has mainly worked informal jobs without a contract at wages too meager for him to save enough for retirement. He still does maintenance work at a school to make ends meet.

……

Under the privatized system, which President George W. Bush hailed as an example to follow, workers must pay 10 percent of their earnings into accounts operated by private companies known as pension fund administrators, or A.F.P.s, the initials of the term in Spanish. The administrators invest the money and charge workers a commission for transactions and other fees. Employers and the government do not make any contributions to the workers’ accounts.Chileans were given the option of keeping their old plan or switching to the new system. Most switched. But those entering the work force after 1981 had to invest in the privatized system. (The armed forces and the police were exempted from the change and today enjoy pensions several times higher than those available in the privatized system.)

The money invested by the administrators bolstered Chile’s capital markets, which stimulated economic growth and yielded reasonable returns. Today six A.F.P.s — half of them owned by foreign companies — manage $171 billion in pension funds, equivalent to about 71 percent of Chile’s gross domestic product, according to the office of the supervisor of the pension funds.

But the pioneering privatized system has failed to provide livable pensions for most retirees. If the stock market dips or investments go awry, workers’ savings and retirees’ pension checks decline.

……

“The median A.F.P. pension will be equivalent to 15 percent of the last wages,” he said. “When we have an entire generation retiring solely from the A.F.P. system, the picture gets even bleaker. We have to address this problem now.”…..

A study carried out by the association found that only a quarter of those who retired last year had paid into the pension system for more than 25 years, and that 62 percent of women had contributed to their accounts for less than 15 years.Roughly half of the more than 10 million participants in the private pension system had contributed on a regular basis, according to a state office overseeing the fund companies.

…..

But a return to the old system seems to be off the table. The options being considered include creating a state-run pension administrator, raising the retirement age, instituting a 5 percent contribution from employers and adopting stronger regulations for the pension fund administrators.“After going from a totally public system to the other extreme in 1981, now we are moving towards a middle ground that combines individual savings, state spending and contributions from employers,” said Mr. Bravo, of the Catholic University of Chile. “Another option is tearing down the A.F.P. system, but it’s too costly. We don’t have the privilege of starting from zero anymore.”

Comment: If you hadn’t been putting any money aside for decades… what exactly were you expecting?

You can have a nice income from less than 25 years’ worth of saving if you chuck a hell of a lot of money in there. I’m assuming they didn’t.

So, again, the $315/month result does not sound all that shocking to me. Here, learn about the ants and the grasshopper.

KENTUCKY

Lexington cop discovers city shorted pension fund by $500,000

The city of Lexington failed to deposit more than $400,000 it had agreed in 2013 to give to the police and fire pension fund, city officials confirmed Wednesday. The city made a payment of more than $500,000 to the fund late last week to cover earnings on the missed payment.

The mistake — discovered by a Lexington police officer on the pension board — has prompted some board members to question whether the pension fund should separate from the city, which pays the salary for the pension fund’s one employee and manages its finances.

Lexington Police Sgt. Larry Kinnard, a pension board member, asked city officials for a detailed breakdown of how much the city has contributed to the fund. The amount the city puts into the fund can fluctuate each year.

That request led city Finance Commissioner Bill O’Mara to discover that an additional payment the city had agreed to put into the fund during a November 2013 pension board meeting was never transferred to the pension.

After O’Mara discovered the mistake, the city transferred $515,571 into the pension’s account Sept. 8. That $515,571 included $418,517, the original amount the city had agreed to add to the fund in November 2013, plus $97,054, the amount the money would have made if it had been invested nearly three years ago.

…..

Moreover, Kinnard said he was concerned that the city had not caught the error — a $500,000 mistake —until he had asked repeatedly for a breakdown of the city’s contribution. Before becoming a police officer, Kinnard had worked in banking. He has also worked in the financial crimes unit.The board voted unanimously Wednesday to send the issue of improving the financial accounting to a board subcommittee. Kinnard said after Wednesday’s meeting that separating from the city is an option the subcommittee will likely explore.

Good work by Kinnard.

Somebody professional should have caught it (as in, pension fund management…“Hey, guys? When are we getting that extra contribution?”), but this is the kind of question board members should ask, and does show why it’s good to have someone with skin in the game on the board.

KANSAS

Kansas lawmakers fear further pension payment delays:

TOPEKA, Kan. (AP) — Lawmakers are expressing concerns that Kansas won’t be able to quickly catch up with $100 million in delayed contributions to public employee pensions.

The Topeka Capital-Journal (http://bit.ly/2cCVeIt ) reports that members of the Joint Committee on Pensions and Investments discussed their concerns Monday. The pension payments were delayed this spring to address budget shortfalls. Under the plan, the delayed payments were to be repaid with interest by 2018.

Republican Rep. Steven Johnson, of Assaria, says he’s “not optimistic” about the prospects of the money being paid back in time. Committee members note that the state faces budget difficulties that lawmakers must confront next year.

But Gov. Sam Brownback noted Tuesday that the pension system’s finances have improved significantly since he took office in 2011, partly because the state boosted its contributions.

Thing is, it’s very easy to say you’ll pay more. It’s a bit more difficult to actually come up with the money.

DO PUBLIC PENSIONS ADD TO THE ECONOMY?

1.2 Trillion Economic Impact, 7.1 Million Jobs from Pension Spending

A new report finds that economic gains attributable to defined benefit (DB) pensions in the U.S. are substantial.

PENSION SPENDING SUPPORTS 7.1 MILLION JOBS, $1.2 TRILLION IN ECONOMIC OUTPUT ACROSS THE U.S.

Food Services, Healthcare, Real Estate and Retail Industries See Biggest Employment Impacts

Webcast on September 14th at 11 AM ET to Review Findings

WASHINGTON, D.C., September 14, 2016 – A new report finds that economic gains attributable to defined benefit (DB) pensions in the U.S. are substantial. Retiree spending of pension benefits in 2014 generated $1.2 trillion in total economic output, supporting some 7.1 million jobs across the U.S. Pension spending also filled government coffers with retirees paying a total of $190 billion in federal, state and local taxes on their pension benefits and spending 2014.

But these claims, which NIRS back with impressive-seeming figures on where the economy grows and why types of jobs are created, are entirely fictitious. They depend upon counting only one side of the equation: that is, pension benefits boost the economy but the taxes necessary to fund those pensions – that is, billions of dollars that can’t be spent because they’re instead flowing into government pension plans – have no negative effect. If you count both sides of the equation, the rough effect of public sector pensions on the overall economy is zero. NIRS, and the various retirement plans, unions, investment managers and actuarial firms who support its work, should be embarrassed that this quality of work continues to be produced.

But NIRS should know this, because their own studies basically admit it. On the second-to-last page of the paper, NIRS finally acknowledges – however obliquely – that there’s another side to the story:

“This study measures the gross economic impacts of pension benefit expenditures only, rather than the net economic impacts. Pension payments are a form of deferred compensation, meaning that employees and employers contribute to the pension trust over the course of an employee’s career as a portion of the employee’s total compensation. Had that employee received that compensation in another form—for example, a slight increase in gross pay each month—s/he would have seen higher disposable income, and presumably would have spent a portion of that income in the local economy at that time.”

Let’s just say that Andrew Biggs (the guy with the counterpoint) has a stronger case.

“Look at all the stuff these pensioners spend their money on!”

“But that money was with other people… are you saying that they would shove that money into a hole in the ground if you didn’t make them give it to the state for pensions?”

“Uh… yeah! That’s what those taxpayers would do! Damn taxpayers!”

You go with that one.

Related Posts

Around the Pension Blogosphere

Show Me (the Money) State: Missouri Tries a Pension Buyout

Public Pension Roundup: Bailing out Pensions, The Return of Pension Envy, Kentucky Lawsuit, and more