California Consequences: Turns Out, Pension Benefits Can Be Cut

by meep

Back in October, the New York Times profiled a small town in California that no longer was paying Calpers, and couldn’t afford the exit fees. What I wrote at the time:

WHEN THE BACKSTOP FAILS

So here’s a thing. That previous NYT piece on the closed pension that wanted to exit Calpers (and then did) talked about needing more money than what they were charged on a going-concern basis.

That plan sponsor did ultimately pay the money to Calpers and exit, so the handful of retirees from that plan should be getting 100% of their promised payments via Calpers.

That was the orderly exit, and yes, it was expensive.

But here’s another way it can go: reduced benefits when you can’t pay the exit fees.

….

So yes, it is an option to stop paying Calpers. And Calpers will reduce retiree benefits in line with that.Again, Calpers shows what it thinks the pension promises are really worth when somebody exits. I don’t necessarily have an issue with that valuation.

I have an issue that they didn’t recognize that value all along.

At the time of that piece, nothing official had been decided yet.

It’s been decided now.

CALPERS LOWERS THE BOOM

Here’s the official press release from Calpers:

CalPERS Finds the City of Loyalton in Default for Non-Payment of Pension Obligation

November 16, 2016…..

SACRAMENTO, CA – The Board of Administration for the California Public Employees’ Retirement System (CalPERS) today declared the city of Loyalton in default of its obligations to CalPERS after failing to pay what it owes to fund its pension plan. The decision means that Loyalton’s retirees will see their benefits reduced in accordance with California Public Employees’ Retirement Law.

“This is a decision we take very seriously and one we very much regret had to be made,” said Rob Feckner, president of the CalPERS Board. “As a Board, we have a fiduciary responsibility to keep the CalPERS Fund on secure footing, and as part of this duty we must ensure that employers adhere to the contracts they agreed to. When they don’t, the law requires us to act. The people who suffer for this are Loyalton’s public servants who had every right to expect that the city would pay its bill and fulfill the benefit promises it made to them.”

The city of Loyalton voluntarily terminated its contract effective March 2013. In June 2014, CalPERS provided city officials with an invoice for the termination liability in the amount of $1,661,897. CalPERS has had multiple discussions with the city on several important topics, including:

- How the termination process works

- Loyalton’s final valuation and the cost to terminate its contract with CalPERS

- Loyalton’s subsequent request to rescind termination and its desire to establish a new contract with CalPERS to administer its pension plan

- Once it was determined that Loyalton could not legally rescind its voluntary termination, a final collections letter was sent on December 15, 2015. After receiving no payment, a final demand letter was sent in August 2016 requiring Loyalton to bring its account current within 30 days or be declared in default.Subsequent meetings with Loyalton officials failed to lead to a resolution. To date, Loyalton has not made any payments toward its voluntary termination costs. In total, CalPERS has had over 50 telephone calls with Loyalton officials and sent 10 collection notices.

In addition, a certified letter explaining CalPERS’ proposed action to reduce benefits was sent to the four affected retirees and one individual who no longer works for the city but does not yet collect retirement benefits. Under Government Code 20577, the Board can reduce member retirement benefits from the date of contract termination in proportion to the amount of the employer’s deficiency in paying its required contributions. In Loyalton’s case, the reduction could amount to a 60 percent reduction in benefit payments.

Loyalton originally contracted with CalPERS for pension benefits in January 1986. In September 2004, the city amended its contract to provide its employees a retirement benefit formula of 2.7 percent at age 55.

I highlighted the bit that does indeed show that Calpers is allowed to cut benefits.

We see that there are five people specifically affected by this change, so it’s obviously a fairly small locality.

WHAT’S NEXT?

The questions I see:

- What’s next for Loyalton and those five people?

- Which towns will follow Loyalton into just stopping being in Calpers and having the retirees/vested employees take the blow?

Calpers probably knows that second item far better than I do (and if they don’t, they should probably hop to it.) I wouldn’t be surprised if there are local governments in California whose only debt is to Calpers.

It’s already been shown that it’s tough (if not impossible) to declare bankruptcy only due to pension debt (Prichard, Albama’s bankruptcy failed, btw, as its only debt was to the pension.)

But bankruptcy is a specific legal process. Just defaulting on payment is not.

Looks like Calpers wasn’t going to litigate over Loyalton, and the five affected people don’t have enough money to take on Calpers (and it seems to me, non-lawyer, that Calpers is correct in this matter, at least as currently consituted.)

But, according to this reporting by Ed Mendel of Calpensions, the five people may be taken care of::

The division continued yesterday after the CalPERS board was told the Loyalton city council voted the previous day to make payments from the city budget to replace the roughly 60 percent cut in the pensions, ensuring that retirees receive 100 percent of the promised amount.

Loyalton Councilwoman Patricia Whitley, a former mayor who voted to leave CalPERS, said the council voted unanimously this week to offer the retirees a supplemental city payment to restore their full pensions.

“It’s really not a settled thing,” said Whitley. “The employees have to agree. We have to have some sort of agreement between us, because now it becomes a contract between us and the employees.”

Loyalton Mayor Mark Marin said there was no vote at the council meeting this week, only an understanding, and he was skeptical about the retirees accepting the proposal.

“The employees are not going to go for this,” Marin said. “The city is so broke. They will start paying the benefits. But what happens if the city goes bankrupt? Then people are screwed.”

Note: they are already screwed.

Back to the piece:

Marin said some of the retirees are talking to an attorney about possible legal action. A CalPERS staff report said there is a risk that a pension cut could trigger an employee lawsuit against the city requiring CalPERS involvement.

Whitley has said a 50 percent pay raise that may not have been legitimate increased the cost of unaffordable pensions. The CalPERS report said Loyalton generously increased its pension formula to “2.7 at 55” in 2004, more than the “2 at 55” for most state and school workers.

Marin said he has been told that the vote to leave CalPERS may have been illegal because it was done as an “emergency” action. He said city council members wanted to divert the pension contribution to a city museum and other uses.

“PERS has been really good to us,” said Whitley. “They have at least listened to us and taken it to heart. So we have gained some mutual respect, I think. This is really their first case, I guess.”

Okay, so perhaps other towns may not follow Loyalton over the cliff, if the legal issues do persist.

A DIGRESSION: WHY DOES LOYALTON HAVE A MUSEUM?

Also: city museum?! WTF?!

They’re not kidding – they’ve got a museum.

But this is what it says at the top of the page:

Closed Until Memorial Weedkend 2012. With budget restraints, the Sierra Valley Museum will be run by local volunteers, starting Memorial Day of 2012. If interested, call City Hall at 993-6750

Looks like the volunteers aren’t much into updating webpages.

[I notice the copyright notice at the bottom of the page is 2015]

I also notice that the files aren’t exactly… current. Or copious. The last notice was from February 2016.

Anyway, this town of 750 people is even smaller than my own town in New York (5,000 people-ish). We’ve got a historical that’s somewhat active, but I’m pretty sure we don’t have a museum. Our society mainly goes around to fairs and shows off documents and refurbish cemetaries, and that sort of thing.

So I don’t know how active this museum is, or what kind of funding they were going to try to feed it. Some nice artifacts, though.

Okay, let me not get too sidetracked by the museum (wtf) issue.

WILL OTHERS LEAVE?

So Loyalton is very small, may have questionably boosted pensions for its tiny staff, and if they couldn’t pay enough for future benefits, I’m wondering if they really can support pay-as-you-go.

That said: are other towns in a similar position? How many people would that be?

So I took a look at this set of data, and one category is towns below 1000 in population.

Number of results: 286

So if they each had 5 covered people, that’s still under 1500 affected people.

The number of covered lives in Calpers: 1,815,699

That’s not even 0.1% of Calpers. So the first-level estimate is that all of these small towns could default, and it’s equivalent to a rounding error.

To be sure, Calpers doesn’t really want to let towns think they can default with impunity, but with these smallest towns, there’s not much leverage to be had. They probably don’t have much in the way of bonds, and if they’re broke, they’re broke.

CalPERS, CalSTRS considering more rate increases

The state’s two largest public pension systems never recovered from huge investment losses during the deep recession and stock market crash in 2008. CalPERS lost about $100 billion and CalSTRS about $68 billion.Now after a lengthy bull market, most experts are predicting a decade of weak investment returns, well below the annual average earnings of 7.5 percent that CalPERS and CalSTRS expect to pay two-thirds of their future pension costs.

The two systems are still seriously underfunded, CalPERS at 68 percent and CalSTRS at 65 percent. This is not money in the bank. It’s an estimate of the future pension costs covered by expected employer-employee contributions and the investment earnings forecast.

Last week, the CalPERS and CalSTRS boards got separate staff briefings on how the “maturing” of the two big retirement systems creates new funding difficulties. Both are nearing a time when there will be more retirees in the system than active workers.

The California State Teachers Retirement System board, for example, was told that in 1971 there were were six active workers in the system for every retiree. Today CalSTRS only has 1.5 active workers for every retiree, similar to the CalPERS ratio.

A wave of baby boom retirees that began around 2011, and the continuing increase in the average life span of retirees, have added to the growing cost of paying pensions, giving both systems what actuaries call “negative cash flow.”

It’s not only actuaries who call it that.

FWIW, the oldest boomers turned 65 in 2011, but then public employees could retire younger than 65. That wasn’t really much of a wave. It’s the peak births in 1957 that will drive, and they’re turning 60 next year.

I went looking to see if I could find some census of Calpers members, but that does not seem to be publicly available.

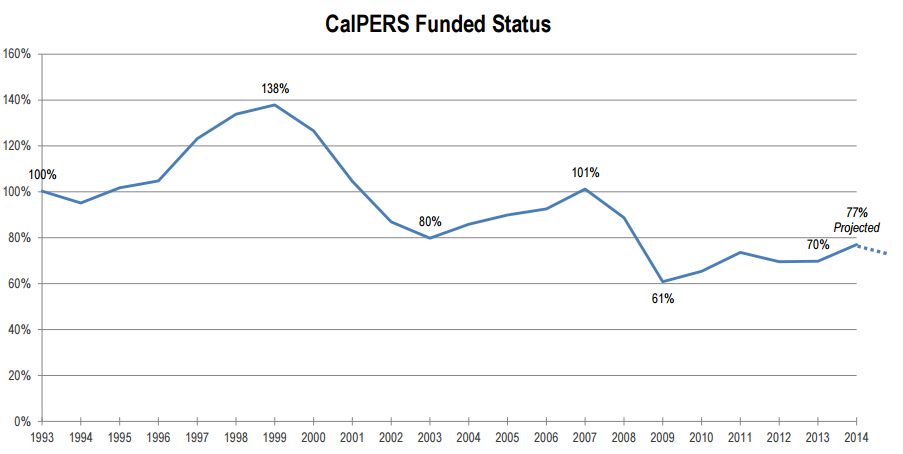

Here is a 20+ year history of Calpers’ funding status from Calpensions:

Seems to me there’s a secular pattern here, and it doesn’t seem to me that it corrected itself. We had multiple years of a bull market in recent years, and the funded ratio has barely recovered.

Back to Ed Mendel:\

CalPERS was 100 percent funded in 2007 before the stock market crash dropped funding to 61 percent. Experts have told CalPERS, now only 68 percent funded, that if funding drops below 50 percent getting back to full funding could require impractical rate increases and earnings forecasts.

The board was told that a rate increase must be approved by April to take effect for the state and schools in the new fiscal year beginning next July and for local governments in July 2018.

Supporters suggested a rate increase by April would allow a phase in before a recession, if one is on the way, while being fiduciarily responsible. “Pay now or pay more later,” said board member Richard Gillihan, a Brown administration official.

Alarmed union representatives, backed by some board members, urged the board to go slow and follow the regular two-year process leading to a full “asset liability management” review scheduled in 2018.

……

The legislation gave the CalSTRS board another new power to annually adjust school district rates beginning July 1, 2021. But the employer rate is capped at 20.5 percent of pay, allowing only small changes in the phased-in rate reaching 19.1 percent by 2020.“There is no need to increase state contributions further, based on what we have seen to date, even with the 1 percent return last year,” David Lamoureux, a CalSTRS actuary, told the board last week.

The CalSTRS board is scheduled to review “actuarial assumptions” in February, including estimates of the average retiree life span and probably a discussion of the earnings forecast.

“There is a possibility, depending on where we end up with the assumptions, that it could trigger an increase in the normal cost of more than 1 percent (of pay), and it could increase the member contribution rate,” Lamoureux said.

So, both Calpers and Calstrs are looking at possibly increasing contribution rates, partly by updating their valuation assumptions.

Because supposedly 100% contributions have been made to Calpers, and in the case of Calstrs, the contributions have been inadequate for years and have only been getting worse.

Something seems to be up with the Calpers data (so I will have to write the PPD people), but the Calstrs graph comports with what I know:

Anyway, I can imagine some smaller towns just assuming they’re screwed no matter what, and quit throwing money into Calpers. If they can’t make the increased contribution rate, they will definitely not be able to afford the termination. As noted above, the impact from the smallest towns will likely do little to Calpers as a whole.

The trouble comes when larger employers and more people are affected. Think of Detroit, but scaled up to California.

So Calpers would like this not to spread, I’m sure.

Making a public example of Loyalton at least points out what the stark choices are.

But then, if the towns can’t meet either increased contribution rates nor the termination fees…. there may not be much of a choice.

Related Posts

Taxing Tuesday: Taxing Anything That Moves

Taxing Tuesday: Phoning It In

Taxing Tuesday: Tax ALLLL the Internet! and New Jersey Puts Out Dumbass Idea