Chicago Teachers Pensions: Questioning Assumptions

by meep

I’ve done some number-crunching on this particular pension plan before, but I needed to update the graphs, so here we go. Some of these graphs come directly from the Public Pensions Database page on the pension fund, some I have created using their data, and some I have built up from external data sources. If you want to look at what the individual benefits look like, you can check out this older post detailing benefits from 2014.

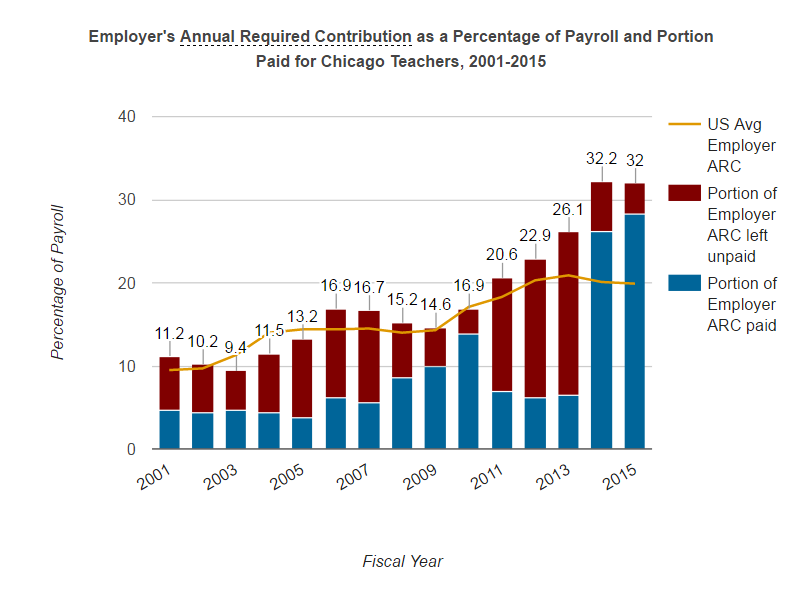

First, the updated contribution history, as percent of payroll, up through fiscal year 2015:

You can see the ramp up… and they can’t meet that. It’s still assuming future ramps up, but more on that later.

Funded ratio:

Just a skosh over 50%. Yeah, I can see why some people would rather target 90%, 80% or 70%.

Net Cash flow as % of assets:

YEESH! 2013 was a horrid year. Not that more recent years are that great. This is showing quite a high net outflow, relative to the assets.

Development of the unfunded liability:

I am sorry the “other” is so big, but there’s some odd things going on in there. The big jump for other in 2013 was due to the decrease in discount rate, mostly.

But check those undercontributions just mounting up.

RATE OF RETURN FOR THE CHICAGO TEACHERS PENSION FUND

Here’s the Public Plans Data info:

So the fund is very like other plans, right?

Ah, but this is the time-weighted, not dollar-weighted return.

So first, the time-weighted average return since 2001 (which is where the database begins) was 6.16%.

I did a calculation of the dollar-weighted net return. Spreadsheet of the calculation is here.

I made the following simplifications:

- I started/ended the fund on 6/30 of the fiscal year, using market value of assets

- To calculate the dollar-weighted return, I did not count expense cash flows — the concept is that you put in contributions and you get out benefits.

- I had the cash flows occur on January 1 (mid-fiscal year)

Here’s the result:

5.19% dollar-weighted net average return since June 30, 2001.

Either way, the discount rate of 7.75% currently being used (after so much bellyaching when they dropped it from 8%) is quite a bit higher than the 6.16% time-weighted gross return and 5.19% dollar-weighted net return.

David Crane talked about Calpers considering dropping their discount rate to 6.1%.

The CalPERS board is considering a recommendation to lower its investment return assumption to 6.1%. That would mean higher pension costs now but much lower pension costs in the future. Therein lies the inter-generational battle represented by the issue of public pension fund investment return assumptions.

What’s hideous is that the Chicago Public Teachers Pension fund can’t even keep up with contributions needed at 7.75%.

Can you imagine how much worse the fund would look at 6.1%? Or 5.2%?

ON THE PAYROLL GROWTH ASSUMPTION

The following links are to documents written by Theodore Konshak, whose scribd pages can be seen here.

Konshak does his own investigation into a variety of public pension actuarial issues, with a special look at Chicago pensions. Here’s his description of himself, from the top of his scribd documents:

Theodore Konshak is a former Enrolled Actuary. From 1981 to 1994, Mr. Konshak was employed as a pension actuary in the Chicago offices of William M. Mercer and the Aon Corporation. He would later teach mathematics at Menominee Indian High School located on the Menominee Tribal Reservation in Keshena, Wisconsin. Mr. Konshak received his B.A. in mathematics and sociology from Northwestern University.

I’m an outsider to the pension world, though I know a lot of people within it. It’s unsurprising that Konshak has more pointed words about actuarial public pension practice than I do… because I’m coming from a certain amount of ignorance. So I will pull back where I am unsure about what’s going on.

Konshak published some papers about the Chicago Teachers pension fund, and I want to highlight a few. I’m also trying out embedding scribd objects, so if this didn’t work for you (it’s worked for me in testing on Chrome on a Windows machine) please email me to let me know.

The most recent paper:

Chicago Teachers Cooking Their Pension Books? by Theodore Konshak on Scribd

This is building on an earlier paper, Be the Independent Actuarial Auditor of the Chicago Teachers’ Pension Fund.

This is digging into the numbers that I’m interested in: as I mentioned in Public Pension Primer: Payroll Growth Assumption:

But here is the point: there is a danger of negative amortization when one amortizes as a percentage of payroll, when you’re assuming that the payroll increases at a steady rate. And then it doesn’t.

Konshak digs into the numbers, and this is what he found (I haven’t checked these numbers yet, btw):

The underlying wages of that payroll reported above for the years 2002 through 2012 would have already increased due to inflation. The average payroll increase during that 10-year period, with

inflation already considered, was reported to 2.40% per year.Increases in the underlying wages of each individual employee in the Chicago Teachers’ Pension

Fund are assumed to vary by their attained ages. If there is a decrease in the assumed future

inflation rate, in determining a table of assumed future salary increases to use for individual

employees, to account for this decrease in the future inflation rate, a decrease both in the actual

data collected on the underlying wage increases and the actual 10year average increase in

payroll of 2.40% per year may be appropriate and necessary. The actual inflation rate contained

in the 2.40% per year could be higher than the assumed future inflation rate. So why are the

actuaries of the Chicago Teachers’ Pension Fund assuming a future payroll growth of *3.50% per

year* instead of something less than 2.40% per year?

In the prior post, I compared a 0% growth vs. a 3.25% growth. The difference between 2.40% and 3.50% is less stark, but let’s do some very quick comparisons by assuming we accumulate at these compounding rates over different periods of time:

10 years: 11% difference

20 years: 24% difference

30 years: 38% difference

This really begins to add up, and this isn’t even including a confounding factor of using a discount rate of 7.75% when the return on the fund since 2001 has been 6.16% from a time-weighted point of view and 5.72% from a dollar-weighted point of view.

But wait, it gets worse.

The arithmetic average growth of these pensionable payrolls is 1.4%. Adjusting for a 2.1% drop

due to population decline, as determined in the Actuarial Experience Review of July 1, 2007 to

June 30, 2012, one obtains a future payroll growth assumption of a negative 0.7%.The average future payroll growth assumption would seem to be closer to zero than to that 3.50%

per year rate assumed by the actuaries even if that 2.1% drop or anything else in this analysis was

challenged as being inaccurate. All that you need is their actuarial projections of the pensionable

payroll. Factoring into the equation the continuing decline in the employee population, that

average payroll growth of 1.4% in those five central years of this actuarial projection,

approximately 20 or more years hence, will decline significantly.The Suck Factor

For the sake of argument, *let’s say a teacher needs to work 5 years for the Chicago Public

Schools to earn a pension benefit*. Over 99% of future teachers will leave the workforce before

they work 5 years and will therefore not earn any pension benefit. Teaching in Chicago sucks.

Eventually the current cohort of older and highly paid teachers will be permanently replaced by a

revolving door of lowly paid younger teachers. In addition to factoring into the equation the

continuing decline in the number of teachers, the actuaries also need to consider the suck factor.

It was considered in the actuarial projections but not in the future payroll growth assumption.In actuarial parlance, the pensionable payroll figures in that actuarial projection above are affected

by the future rates of termination of employment utilized by the actuary but they were not

considered in the development of the future payroll growth assumption.

But wait — it’s worse!

ULTIMATE SURVIVOR: 10 YEARS TO VEST

It doesn’t take 5 years for a teacher to vest in the Chicago Teachers pension fund.

It takes 10 years for new entrants.

Is it any wonder that the projected pensionable payroll actually shrinks over time?

So.

Have a good weekend.

Related Posts

Meep's Data Visualization Evolution: Tile Grid Maps

Geeking Out: Census Numbers for Apportionment Released -- Let's Visualize!

Geeking Out: Florence Nightingale, Data Visualization Pioneer - and Redoing Her Famous Graph