Illinois Steps to the Edge: No Budget, Credit Downgrade, Stupid Tax Idea

by meep

As I said yesterday, it’s a time of deadlines.

The Illinois legislature had a deadline of May 31 for a variety of things.

But first, the punchline.

ILLINOIS DOWNGRADED. AGAIN.

S&P Downgrade Brings Illinois Debt One Step Closer to Junk

Illinois may become the first U.S. state to be given a junk rating

The S&P downgrade on Thursday applied to $26.3 billion in general obligation bonds. An earlier version of this article incorrectly stated the amount of the bonds. (June 1)

Illinois is on the verge of becoming the first state with a junk-bond rating following downgrades from two of the world’s largest credit-ratings firms.

S&P Global Inc. warned that Illinois could be downgraded to junk status next month if it doesn’t solve its partisan gridlock. The state hasn’t had a budget for two years because of a standoff between the Republican governor and Democratic legislature.

Illinois is one of many states that, despite a generally strong U.S. economy, are struggling to close budget gaps because of pensions and other entitlements. State and local retirement liabilities have ballooned since the financial crisis, and some governments don’t have enough assets to cover all future obligations.

S&P on Thursday dropped its grade on the state’s general-obligation bonds one level to BBB-minus, the lowest possible investment-grade rating, citing Illinois’s inability to pass a budget. Moody’s Corp. also dropped its Illinois rating one notch above junk. Fitch Ratings has rated Illinois at two notches above junk .

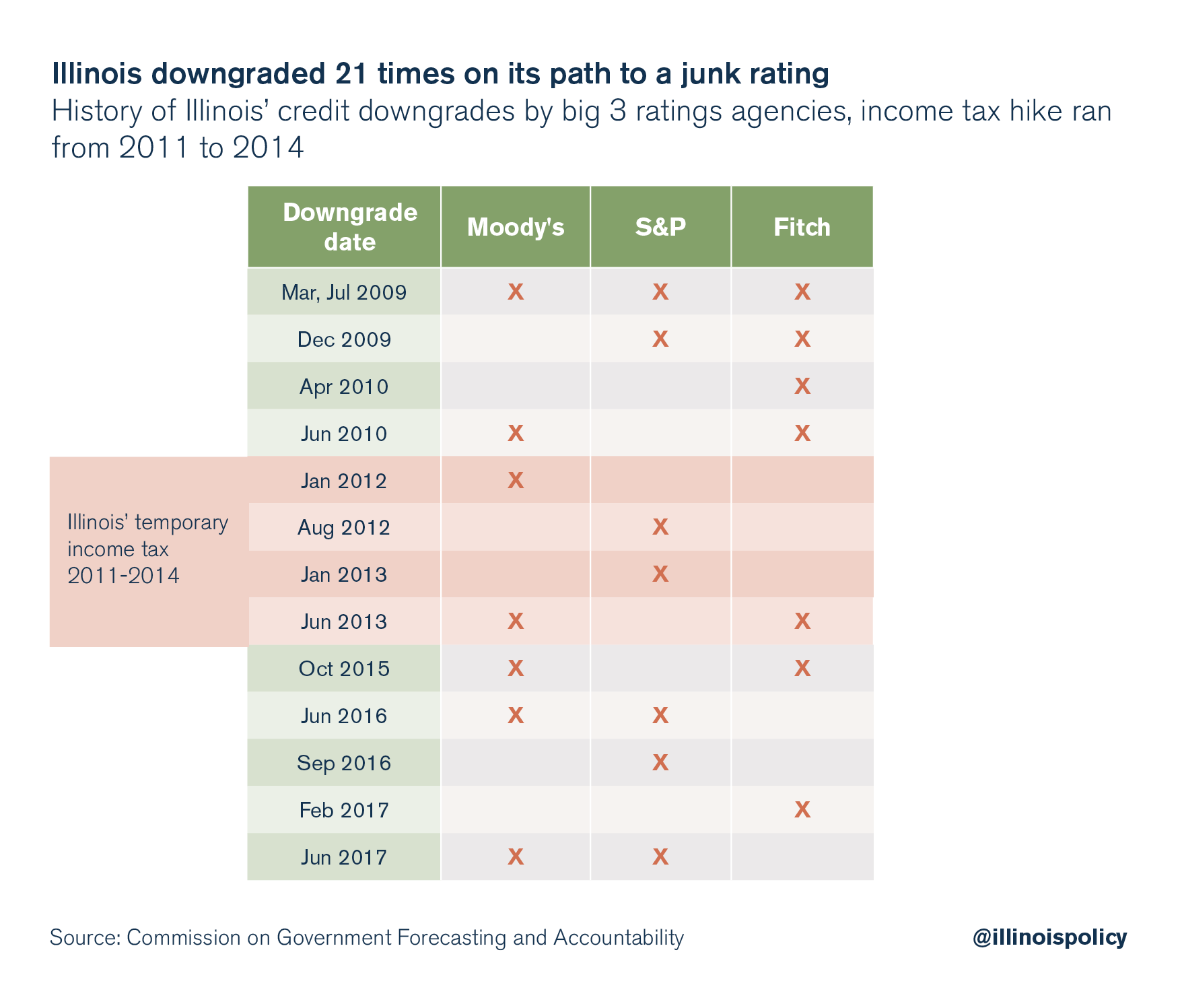

As per the Illinois Policy Institute, this makes the 21st downgrade from 3 credit rating agencies total, since 2009:

This is what Moody’s said on its rating action:

Rating Action: Moody’s Downgrades Illinois GOs to Baa3 from Baa2, Affecting $31.5B of GO and Related Debt; Outlook Negative

Global Credit Research – 01 Jun 2017….

Legislative gridlock has sidetracked efforts not only to address pension needs but also to achieve fiscal balance, allowing a backlog of bills to approach $15 billion, or about 40% of the state’s operating budget. During the past year of fruitless negotiations and partisan wrangling, fundamental credit challenges have intensified enough to warrant a downgrade, regardless of whether a fiscal compromise is reached in an extended session. As the regular legislative session elapsed, political barriers to progress appeared to harden, indicating both the severity of the state’s challenges and the political difficulty of advocating their solutions. Extending the impasse, and the state’s embedded operating deficit of at least $5 billion (or 15% of general fund revenue) would signal further pressure on the state’s credit position. But the state’s credit could stabilize at the current level in the event of a political consensus that more closely aligns revenues and spending, without relying on unsustainable fiscal measures.The downgrade to Baa3 for Illinois’ GO bonds is consistent with the state’s intensifying pressure from pension liabilities; by our calculation, the state’s unfunded pension liability (Moody’s adjusted net pension liability, or ANPL) for its five major plans in aggregate grew 25% in the year ended June 30, 2016, to $251 billion.

I want you to think about $251 billion dollars.

THE UNFUNDED PENSION LIABILITY: LARGEST OUTSTANDING DEBT

If I were a politician, I would say “Oh, but that’s if everybody retired right now”, because I would be a slimy bastard who doesn’t know what the hell I’m talking about.

The $251 billion represents the value of pension benefits RIGHT NOW, though to be paid in the future, that are ALREADY EARNED BY EMPLOYEES.

The “official” number, if I understand it, is about $130 billion. That’s because the state is using a higher discount rate to develop that number. So i

And the “right now” cost, also known as “present value” to finance folks, inherently grows at the discount rate each year. Right now, the Illinois plans have discount rates of 7.25% – 7.5%. So the unfunded liability, in its rollforward, will naturally grow that amount. So you have to pay down even more each year.

That number will keep growing if the state doesn’t fully pay for newly-earned benefits each year in addition to paying down the unfunded portion.

Even when the funded ratio improves for Illinois, the unfunded portion can keep growing, because it’s a slightly smaller percentage of a total liability that has kept growing.

Moody’s uses a lower discount rate, which gives it a higher unfunded liability. But that liability would naturally grow more slowly.

In any case, whether the unfunded liability of the state pensions is $251 billion or $130 billion, it dwarfs the outstanding general obligation bonds being downgraded — a measley $26 billion.

Oh, and the state comptroller’s page as of right now shows $14.5 billion in unpaid bills by the state.

ALSO I FORGOT: Those unfunded pension liabilities? That doesn’t include the retiree health benefits that the Illinois Supreme Court said could never be cut, even though it’s still not clear to me what they mean by “cut”.

DEADLINES? WE LAUGH AT DEADLINES!

So, it was just a week ago that I noted not much progress had been made in the Illinois legislature.

Indeed, nothing much happened at all.

Gov. Rauner responds to state lawmakers failing to pass state budget

SPRINGFIELD, Ill. (WLS) — Illinois residents woke up to a new reality Thursday. The failure to pass a budget for the third year in a row made the state one-of-a-kind. People are fed up with Springfield, but still, no action.

ABC 7 had a one-on-one with Governor Bruce Rauner and he responded to the budget crisis.

“Dereliction of duty” is the phrase the governor kept using Thursday as well as Wednesday. Like Wednesday, he continued to blame the budget impasse on the Democrats. All of this comes as the credit agencies have once again for the seventh time downgraded the state of Illinois.

“Let me remind you that in all of his time the state of Illinois has existed we have never once gone without a budget until Governor Rauner took office,” Susana Mendoza, Illinois Comptroller, said.

Mendoza said her office has to deal with over $14 billion of unpaid bills and $800 million in late interest and penalties.

Knowing the Governor Rauner would veto a budget that included tax increases, House Democrats left town without voting on a Senate-passed budget. The governor said all along he would only sign a budget with tax increases if it included reforms like workman’s comp or a property tax freeze, two things Democrats have passed but the governor said the bills don’t go far enough.

They didn’t even try.

So what exactly happened Wednesday night? Not wanting to take the political risk of sending a budget to Republican Governor Bruce Rauner that he would then veto, Illinois House Democrats chose not to vote at all on a Senate budget plan that included tax hikes, missing the midnight deadline.

What exactly is the problem? They’ve overridden Rauner’s vetoes before.

Oh, but they need to get some Republicans to vote with them to do that.

There’s a glimmer of hope for a budget. The fiscal year doesn’t begin until July 1, so there could be a last-minute supermajority vote before then.

Sure it will happen.

STUPID REVENUE IDEAS

So the controlling Democratic part of the Illinois legislature pretty much has one idea:

Let’s get a gander at this doozy: Taxing financial managers:

Senate passes first-in-nation financial tax, despite government report saying it will cause mass evasion

Less than an hour after Democrats in the Illinois Senate endorsed a budget that would raise income taxes, they voted to become the only state in the nation to impose a new 20 percent tax on financial managers.

State Sen. Daniel Biss, D-Evanston, told the Senate floor Wednesday that his bill that would impose a tax on money managers that use federal loopholes to declare their income as capital gains. This means their income is taxed at a rate of 23 percent, as opposed to the the top personal federal income rate of 43 percent.

“What Senate Bill 1719 does is to plug that hole,” Biss said, adding that it would raise the state hundreds of millions of dollars in new money.

If passed into law, Illinois would be the only state that imposes a tax attempting to close the gap between capital gains and federal income tax rates.

Daniel Biss is proof that just because one is smart in pure mathematics doesn’t mean one has a lick of sense when it comes to the mathematics of reality.

But hey, maybe there will be something in academia for you, Biss.

Republican politicians pointed out the obvious problem:

State Sen. Chris Nybo, R-Lombard, argued that investment managers aren’t typically tied to a location and would simply leave the state, negating any new tax revenue.

“The people that you’re hoping to tap into, they’re going to leave,” Nybo told Biss. “There’s no question that they’re going to do anything that they can to avoid being subject to this first-in-the-nation tax.”

An identical bill was considered in the state House in April, where state Rep. David McSweeney, R-Barrington Hills, requested a fiscal note from the state Department of Revenue to determine the legislation’s financial impact.

Nybo read that fiscal note aloud on the Senate floor.

“… In the long run, this bill would raise no new revenue for the State. Due to the magnitude of the tax, this bill would elicit a strong behavioral response from would-be taxpayers. Taxpayers would be strongly incentivized to either reclassify fees so as not to be considered ‘investment strategy’ or to relocate the taxable activity so that it is beyond the reach of the State,” the note for the now-stalled House Bill 3393 read.

Now, I work in the investment biz, in Hartford, a city on the brink of bankruptcy in a state that is similarly financially stressed. Finance is a huge portion of the state’s biz, but it’s really expensive to live (and work and buy) here.

By all means, send us your rich, huddled masses of CFAs, Chicago. We will take them.

Here is the Wall Street Journal’s comment on this ‘privilege tax’:

Illinois’s ‘Privilege Tax’ Proposal Forgets Citizens’ Right to Leave

The state can’t even pass a budget, but it wants to put a new 20% levy on fees to financial professionals.Proponents here call it the “privilege tax.” In their continuing quest to punish the productive areas of the economy, liberal groups are pushing legislation in blue states that will force finance professionals to pay up — or move out.

….

The new tax is pitched as a way to squeeze more revenue — as much as $1.7 billion a year — from hedge funds and private-equity firms, which purportedly get off easy on their federal taxes because of the “carried interest loophole.” But under the current version of the bill, Illinois would keep collecting the privilege tax even if Congress were to cease taxing carried interest at the lower capital-gains rate.Liberal groups are also hoping — probably in vain — that a multistate agreement will prevent financial firms from simply decamping to friendlier climes. An earlier version of the Illinois proposal included a provision so that the 20% tax would take effect only if and when New York, New Jersey and Connecticut enacted similar measures. But the bill as written now would impose the tax regardless, and lawmakers will simply have to hope other states follow suit.

Back to the comment:

Yet who says financiers can’t do their jobs just as well in Palm Beach, Fla. — or London, Zurich or Hong Kong? The progressives peddling this idea don’t understand that Chicago competes for these businesses not only with New York and Greenwich, Conn., but with anywhere that can offer cellphone service and an internet connection. Finance is international and highly mobile.

Precisely. Thank goodness for the Law of Unintended Consequences.

Chicago became a financial center in a day before video conferencing, email, and free long distance phone calls. It made sense to create financial hubs in key cities.

Today, it’s not as vital.

It’s not just the financial advisors who may look across state lines. People who use these services are going to be impacted as as the advisors pass along expenses to their customers like every other business on Earth. Due to the inexpensive nature of technology, everyone can use video conferencing, email, and cell service to coordinate with advisors outside of the state.

Let’s see Illinois try to prohibit speaking with an out-of-state advisor. That’ll go well.

There would probably be some federal law issues there.

As Knighton goes on to say, only progressive idiots who don’t understand humans think this is a good tax policy.

Which brings me back to Biss: I found it hilarious when people assumed that at least in the math department, you wouldn’t find screeching liberals, compared to the humanities departments. Oh, you’d be so so wrong.

Indeed, while John Nash was a special case of a certifiably mentally ill person hiding out in academia for decades, his situation is not all that unusual. I’m not saying that all math profs are unhinged, just that academia is a congenial place for them.

HAIL MARY PASS: PRETEND THE BONDHOLDERS COME FIRST

Mark Glennon explains this one:

Unbelievable: Illinois House Votes With Senate To Hand Over Public Assets To Bondholders – Wirepoints Original

…..

Yesterday, the Illinois House passed SB41, which was earlier passed by the Illinois Senate. We wrote several times before about this horrid bill when it was in basically the same form as SB10. It is one of several measures that have been making their way through the legislature to give away secured, first priority claims on tax dollars to bondholders.If signed by Governor Rauner, the bill would force municipalities that want use state money as collateral to transfer complete ownership of money flowing from state government to a new, separate entity created solely to pay bondholders. By doing that, the bill would ensure a form of mortgage that would be bulletproof even in bankruptcy.

As we put it before, the only thing worse than bankruptcy is an assetless bankruptcy. Smart, self-interested creditors get ahead of bankruptcy by “collabering up” all the assets they can with liens and mortgages, ensuring they’ll get everything when things crash. That’s what’s happening here.

Worse, the bill would bind the state to refrain from doing the very things it should already be doing — working to undo mortgages that prioritize bondholders over the public. The bill further prohibits municipalities from mortgaging their state money in any way other than the bulletproof manner created by the bill.

Yes, the bill would make borrowing at a lower cost easier. You, too, could get better terms on a loan if you transferred ownership of future income to a lender, but that would be suicidal.

Thing is, Puerto Rico had a similar kind of bill.

And guess who’s getting defaulted on? The bondholders.

Rhode Island also did something similar, and were able to make pensioners suck up some of the cuts needed to keep the state going along.

The thing is, I don’t think the credit rating agencies are going to be all that enthused over this particular move. Because the state is plain tapped out. And the unfunded pension liabilities are a much larger debt than the bonds they’ve got.

There is an inherent cash problem, and as bondholders see how it’s come about in Puerto Rico, they may be a bit wary of trusting Illinois’s “fix”.

ADDITIONAL: Sponsoring Senator annoyed that someone asks him to defend his bill. And doesn’t seem to understand the objections.

END WITH A LAUGH

It’s a Friday afternoon. Let’s have a bit of fun.

Illinois bonds an opportunity for ‘bold’ investors, Citi says

Illinois’s nearly two-year budget impasse has created a buying opportunity for municipal-bond investors willing to bear the risks, according to Citigroup Inc.

With the Democrat-led legislature and Republican Governor Bruce Rauner unable to forge agreement on how to close the state’s chronic budget deficits, Illinois’s 10-year bonds yield 4.43 percent, or 2.45 percentage point more than top-rated municipal borrowers, according to data compiled by Bloomberg. That’s the biggest premium since the indexes were started in January 2013.

That may mean it’s a good time to buy, according to Citigroup. Despite the governmental gridlock, the fifth most-populous state has “strong fundamentals” and the power to tax and grow its way out of the financial hole, the bank said in a report to clients this week, citing the diverse economy and strong legal security backing its debt. While Illinois hasn’t had a full-year budget in place since June 2015, it hasn’t missed any bond payments and state law has required it to continue making monthly deposits to its debt-service funds.

“The state’s credit rating and bond prices have suffered and may present opportunity for a bold investor,” analysts Vikram Rai, Jack Muller and Loretta Bu, said. “We strongly encourage investors to take advantage of the cheapness of the front and intermediate IL GOs.”

…..Citigroup published its report before Illinois Senate Democrats approved an income-tax hike and spending plan without Republican support, making the outlook for a bipartisan, comprehensive solution even more uncertain. The Senate bills still need approval by the House. The state has until May 31 to approve a budget by a simple majority. Starting June 1, a three-fifths majority is needed, making a deal even more difficult.

And we know, there’s no deal.

Still… aren’t you bold?

Related Posts

Taxing Tuesday: A Local Discussion on the SALT Cap, and Other State Options

States Under Fiscal Pressure: California

Taxing Tuesday: DOOOOOOOM and more DOOOOOOOOM