Illinois Quick Take: Gas Taxes

by meep

As Mark Glennon notes, now that the Illinois budget has been passed over the veto of Gov. Rauner, we’re finding all sorts of poisonous goodies inside.

The latest discovery in the IL budget nobody read: New gas tax. https://t.co/8cSnYx5Vgl

— Wirepoints IL News (@WirePoints) July 12, 2017

This thing is just full of all sorts of surprises. IMAGINE THAT

— Mary Pat Campbell (@meepbobeep) July 12, 2017

GAS TAX INCREASES

Look, nobody expects tax decreases in the bill. But people weren’t expecting quite so many taxes to be increased, I bet.

So here it is: The Secret Tax In the Illinois Budget No One is Talking About

Like it or not, Illinois workers will have to endure an 32% increase in their income tax when they get their next paycheck this month, but there’s another tax increase no one is talking about. This one amounts to a whopping $95 million dollars.

Pfft. $95 million is not even 0.3% of the budget.

But let’s go back:

When state lawmakers approved the Illinois budget last week that included a provision to raise the state income tax rate to one of the highest rates in the history of Illinois, state lawmakers, under the direction of Illinois House Speaker Michael Madigan (D), snuck in another tax increase, that will hit you every time you fill up your car or truck.

Yes, a gas tax increase of 5 cents a gallon. Rockford Senator Dave Syverson, took to social media on Monday night to remind his constituents that “back door gas tax increase” was approved. So how does this work, according to Syverson, the back door gas tax is:

a tax at the wholesale level, which raises the retail price. This move will add approximately 5 cents a gallon. ($95 million total)

Yet another reason why this budget plan was wrong.

Oh jeez, wholesale taxes. I have a whole thing with regards to the Chicago soda tax, but that’s another time.

WHAT ARE GAS TAXES LIKE NOW?

The Tax Foundation is my go-to place for tax stats. Y’all are great!

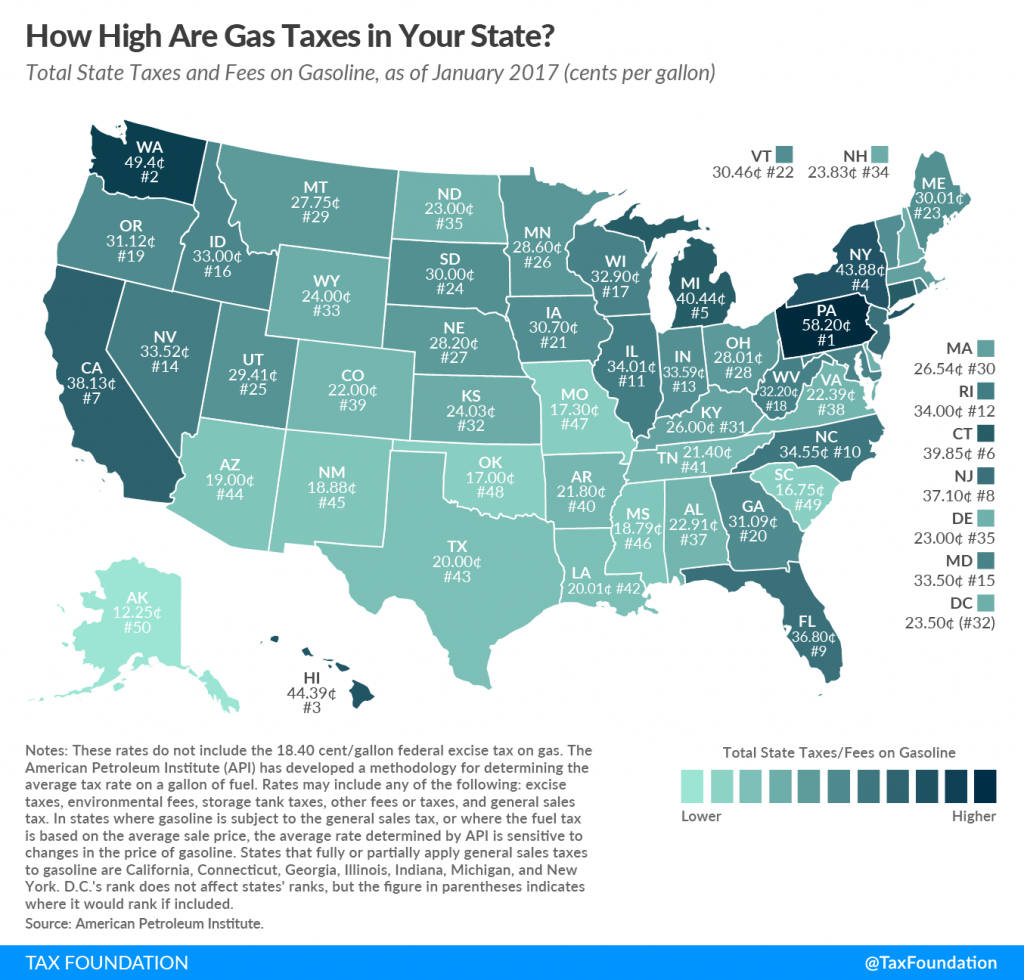

Here is their state-by-state gas tax map:

So that’s before this rise – Illinois had been #11 for gas taxes at 34.01 cents per gallon. State Sen. Dave Syverson said it will increase approximately 5 cents, so I’ll just add 5: 39.01 cents per gallon.

At that level, it would push above

- - NC at 34.55

- - FL at 36.80

- - NJ at 37.10

- - CA at 38.13

And Illinois would be at #7, having pushed those four out of the way. It would still be surpassed by

- - CT at 39.85

- - MI at 40.44

- - NY at 43.88

- - HI at 44.39

- - WA at 49.4

- - PA at 58.2

Note: none of those states border Illinois.

GAS UP IN INDIANA

Here is a close up around Illinois, with the current tax rates:

Currently, Illinois gas taxes are higher than all its neighboring states, but let’s close in on Indiana particularly: 33.59 cents per gallon.

There are loads of convenient crossing-over points for Indiana to Illinois, but at Illinois gas taxes currently being only 1.3% higher than Indiana gases, not even being a half penny different per gallon, it’s not really worthwhile to go over to Indiana to gas up. For now.

But with 5 cents per gallon tacked on, all of a sudden there’s a 5.42 cents per gallon difference, with Illinois gas taxes being 16% higher than Indiana’s.

Just some food for thought.

Related Posts

States Under Fiscal Pressure: Connecticut

Taxing Tuesday: Our Clever Ideas are Totally Going to Work! Please Billionaires, Don't Leave!

State Bankruptcy and Bailout Reactions: Chicago Pleads, Bailouts Rationalized, and Bailouts Rejected