Asset Grab Bag: Whistleblower Award for Blogger, Private Equity Fees and Returns, and more

by meep

To close out asset week, here are my leftovers from last week’s posts. There’s not a single theme here, other than perhaps governance of pension funds.

CONGRATS TO TED SIEDLE

Siedle, Raimondo Critic, to be Awarded $48M in SEC Record Whistleblower Case

GoLocal has learned that Ted Siedle, the Forbes columnist, critic of Gina Raimondo’s investment strategy in hedge funds, and sometimes GoLocal contributor, is in line to be awarded $48 million of more than $70 million in a record award by the U.S. Securities and Exchange Commission case.

The final numbers will not be finalized for approximately 60 days.

Siedle, reached by phone in Florida, refused to comment on the potential award and has not made any public comment on the record award.

The Case

The case involves a total of six JP Morgan whistleblowers — one identified as former JP Morgan rep Johnny Burris and the other GoLocal has learned is Siedle. There are four other identified whistleblowers, but none of them are to receive awards as presently structured.

According to documents leaked on Thursday to the national financial press, “The Claims Review Staff preliminarily determined to recommend to the Commission that Claimant #1 and Claimant #2 voluntarily provided original information to the Commission that led to the successful enforcement…”

“Many times the government gets a bad rap,” said Burris, one of the six whistleblowers, who provided a redacted copy of the SEC letter. “With this award, the SEC and the [Commodity Futures Trading Commission] have done the peoples’ work and they should be commended for that,“ Burris told On Wall Street.

As a part of the government action, JPMorgan agreed to pay over $300 million in regulatory fines in 2016.

……

Raimondo Criticizes SiedleOver the past three plus years, Siedle has repeatedly raised concerns about Raimondo’s management of the RI employees pension fund and has repeatedly said that any money saved by pension reform has been squandered in fees to hedge funds.

Raimondo dismissed Siedle’s criticism from the onset – he is a columnist for Forbes and a former SEC investigator – she said he is an agenda driven “blogger.”

The rivalry by Siedle and Raimondo goes back to when Raimondo was Treasurer and Siedle criticized her investment strategy which focused a higher proportion than most states in investment in alternative investment aka, hedge funds.

After GoLocal unveiled the issues raised by Siedle, the Providence Journal reported a few month later — in October of 2013 that Raimondo said, “There is nothing new here (of a Siedle report). This is just a rehash of criticism we have seen from this person in the past … He is making tens of thousands of dollars, paid by opponents of pension reform, to poke holes in me…and our pension reform efforts.″

On Thursday on GoLocal LIVE, then Governor Chafee criticized Raimondo for not only her investment strategies as Treasurer, but also her claims about her role in pension reform. “And my final issue [on pension reform] is performance,” said Chafee. “Retirees were promised their COLA would come back when the fund reached a certain solvency — and now the hedge funds [investments] pushed that out further. The investments were terrible with the rapaciously high fees. The retirees have to be livid,” Chafee said.

Earlier this year, now-Treasurer Seth Magaziner rejected Raimondo’s investment strategy and dramatically lowered the RI retirement’s system investment in hedge funds.

Man, I feel vindicated sometimes by my own blog posts, but not $48 million in vindication.

I would be happy with 80%.

I have been reading Siedle’s pieces on Forbes for years, and he obviously focuses on asset management issues, for pension funds in general, with a special eye on the use of hedge funds and private equity.

A recent piece by Siedle:

How To Steal A Lot of Money From CalPERS, The Nation’s Largest Public Pension

How hard would it be to steal millions from CalPERS, the nation’s largest public pension with $320 billion in assets? Easy-peasy.

Yesterday the Wall Street Journal reported a disturbing fact—a fact well known to pension insiders for years. That is, officials at CalPERS do not know the full extent of the fees the pension’s private equity managers take out of the pension.

At a 2015 meeting, the chief operating investment officer openly acknowledged that no one knew the performance fees paid.

Let’s clarify what’s going on here. Presumably the mega-pension knows, or can readily establish, all the fees—asset-based and performance—it pays its money managers pursuant to fee invoices. (A breakdown of other operational fees—which can be significant—can either be gleaned from investment fund financial statements or specifically requested from managers.)

What CalPERS doesn’t know is the performance and other fees its managers take directly from the funds they manage for CalPERS without asking, disclosing or invoicing.

At the same 2015 meeting, the chief operating investment officer admitted, “We can’t track it today.”

As for the case on which Siedle was a whistleblower to the SEC — well, I see two large and separate fines on J.P. Morgan in the last couple years. The one that seems likely to have Siedle involvement (the other would require insider info, this one wouldn’t) — J.P. Morgan to Pay $267 Million for Disclosure Failures

Washington D.C., Dec. 18, 2015—

The Securities and Exchange Commission today announced that two J.P. Morgan wealth management subsidiaries have agreed to pay $267 million and admit wrongdoing to settle charges that they failed to disclose conflicts of interest to clients.

An SEC investigation found that the firm’s investment advisory business J.P. Morgan Securities LLC (JPMS) and nationally chartered bank JPMorgan Chase Bank N.A. (JPMCB) preferred to invest clients in the firm’s own proprietary investment products without properly disclosing this preference. This preference impacted two fundamental aspects of money management – asset allocation and the selection of fund managers – and deprived JPMorgan’s clients of information they needed to make fully informed investment decisions.

In a parallel action, JPMorgan Chase Bank agreed to pay an additional $40 million penalty to the U.S. Commodity Futures Trading Commission (CFTC).

“Firms have an obligation to communicate all conflicts so a client can fairly judge the investment advice they are receiving,” said Andrew J. Ceresney, Director of the SEC Enforcement Division. “These J.P. Morgan subsidiaries failed to disclose that they preferred to invest client money in firm-managed mutual funds and hedge funds, and clients were denied all the facts to determine why investment decisions were being made by their investment advisers.”

Julie M. Riewe, Co-Chief of the SEC Enforcement Division’s Asset Management Unit, added, “In addition to proprietary product conflicts, JPMS breached its fiduciary duty to certain clients when it did not inform them that they were being invested in a more expensive share class of proprietary mutual funds, and JPMCB did not disclose that it preferred third-party-managed hedge funds that made payments to a J.P. Morgan affiliate. Clients are entitled to know whether their adviser has competing interests that might cause it to render self-interested investment advice.”

This definitely sounds like the kind of thing in Siedle’s wheelhouse — he keeps an eagle eye on fees, breach of fiduciary duty, and conflicts of interest.

Speaking of fiduciary duty and the SEC, I see this piece from March: Rhode Island State Pension Fiduciaries’ History Of Not Cooperating With SEC.

During his campaign for Rhode Island General Treasurer, investment newbie Seth Magaziner (31 year old son of Bill Clinton policy advisor Ira Magaziner) promised greater transparency regarding the state pension’s high-risk, costly opaque alternative investments gamble than his predecessor, Governor Gina Raimondo.

Promises, promises. When was the last time a politician followed through on a promise of greater transparency?

In his first few months in office, Magaziner quickly opted to continue Raimondo’s flawed secrecy policy, refusing to release to local media GoLocalProv uncensored reports on more than a dozen hedge funds in which the state pension fund had invested—despite his campaign pledges. Apparently Wall Street needed protection more than Rhode Island state pension stakeholders.

Now, Magaziner has withdrawn a great deal of Rhode Island assets out of hedge funds:

Rhode Island has withdrawn $340 million worth of hedge fund investments as part of the state’s effort to save fees and improve returns for its pension system.

“We are moving away from the high-cost hedge funds that have failed to meet expectations while charging unacceptably high fees,” said Treasurer Seth Magaziner. “Our new ‘Back to Basics’ strategy will improve performance and reduce risk, providing a more secure future for Rhode Island public employees and all taxpayers.”

In September, Magaziner announced a “Back to Basics” investment strategy for the Rhode Island pension fund, which included redeeming an estimated $585 million from hedge funds over the next two years.

In October, Rhode Island’s State Investment Commission unanimously voted to terminate its investment in seven hedge funds. These included hedge funds with Ascend Capital, Brevan Howard, Brigade Capital Management, Emerging Sovereign Group (formerly Carlyle Group), Partner Fund Management, Samlyn Capital, and Och-Ziff Capital Management.

Would you like to see what the fund allocation looked like before that move?

Yeah, that allocation to alternatives is a little high. Not as nasty as Dallas before its particular asset crash, but still fairly high.

COUNTERPOINT: PRIVATE EQUITY FEES TO INCREASE?

So the argument has been it’s difficult to tease out the fees being charged in private equity and hedge funds (and then there’s the issue of measuring value before final cash out… but that’s next section).

Private Equity Fund Managers Raise Fees in 2017 Amid Booming Demand

Bolstered by record fundraising amid soaring investor demand, private equity fund managers raised fees in 2017, according to research by Preqin.

Private equity buyout, funds of funds, real estate, infrastructure and distressed debt funds all saw rising mean management fees in more recent vintage years.

Unlisted infrastructure funds saw mean management fees rise from 1.38% for 2014 vintage funds to 1.48% for 2017 vintage funds and vehicles in market. Private equity buyout funds saw mean fees rise from 1.85% for 2015 vintage funds to 1.94% for 2017 vintage and funds currently being raised. Across the same period, closed-end private real estate funds have seen average fees go from 1.41% to 1.57%, and 2017 vintage real estate funds are charging the highest average fees tracked by Preqin in a decade.

“The private capital industry is enjoying a period of almost unprecedented fundraising, as record distributions and often ambitious allocation plans spur investors to commit ever-increasing amounts of capital to private capital funds,” Selina Sy, editor of the Preqin report said in a statement. “This is particularly true of larger fund managers with proven track records: some of these firms are able to raise record-breaking funds in the space of a few months, and many managers are reporting that their latest vehicles are extremely oversubscribed.”

The booming demand is allowing managers to charge higher fees. “In this context, some of the largest and most successful private capital fund managers have seen the balance of power in negotiating favourable fund terms change in their favour over recent quarters, and some seem to have raised the management fees on their recent or forthcoming funds as a result,” Sy said.

…..

Other asset classes trying to regain investor interest, such as hedge funds, have seen fees decline during the year.

By the way, while some public pension funds are pulling out of private equity, many are simply pulling out of hedge funds… and then putting that money into private equity.

BUYER BEWARE: HOW ARE PRIVATE EQUITY RETURNS MEASURED?

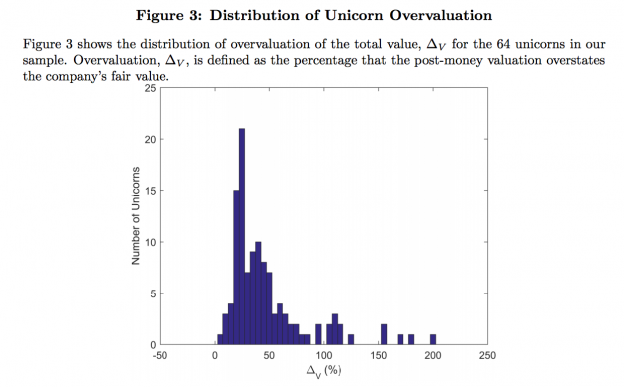

From Yvew Smith at Naked Capitalism: Fake Unicorns: Study Finds Average 49% Valuation Overstatement; Over Half Lose “Unicorn” Status When Corrected

We’ve written regularly about how private equity firms are widely acknowledged to lie about their portfolio company valuations, inflating them when they are raising new funds, in crappy equity markets, and late in the life of funds, when the most of the remaining holdings are valued at their purchase price but typically sold at a loss.

But their go-go cousins in venture capital tell much bigger whoppers, and with much more visible companies.

A recent paper by Will Gornall of the Sauder School of Business and Ilya A. Strebulaev of Stanford Business School, with the understated title Squaring Venture Capital Valuations with Reality, deflates the myth of the widely-touted tech “unicorn”. I’d always thought VCs were subconsciously telling investors these companies weren’t on the up and up via their campaign to brand high-fliers with valuations over $1 billion as “unicorns” when unicorns don’t exist in reality. But that was no deterrent to carnival barkers would often try to pass off horses and goats with carefully appended forehead ornaments as these storybook beasts. The Silicon Valley money men have indeed emulated them with valuation chicanery.

Gornall and Strebulaev obtained the needed valuation and financial structure information on 116 unicorns out of a universe of 200. So this is a sample big enough to make reasonable inferences, particularly given how dramatic the findings are.1 From the abstract:

Using data from legal filings, we show that the average highly-valued venture capital-backed company reports a valuation 49% above its fair value, with common shares overvalued by 59%. In our sample of unicorns – companies with reported valuation above $1 billion – almost one half (53 out of 116) lose their unicorn status when their valuation is recalculated and 13 companies are overvalued by more than 100%.

Another deadly finding is peculiarly relegated to the detailed exposition: “All unicorns are overvalued”:

The average (median) post-money value of the unicorns in the sample is $3.5 billion ($1.6 billion), while the corresponding average (median) fair value implied by the model is only $2.7 billion ($1.1 billion). This results in a 48% (36%) overvaluation for the average (median) unicorn. Common shares even more overvalued, with the average (median) overvaluation of 55% (37%).

Let’s check out that paper: Squaring Venture Capital Valuations with Reality

Will Gornall

University of British Columbia (UBC) – Sauder School of BusinessIlya A. Strebulaev

Stanford University – Graduate School of Business; National Bureau of Economic ResearchDate Written: July 11, 2017

Abstract

We develop a financial model to estimate the fair value of venture capital-backed companies and of each type of security these companies issue. Our model uses the most recent financing round price and the terms of that financing to infer the value of each of their shares. Using data from legal filings, we show that the average highly-valued venture capital-backed company reports a valuation 49% above its fair value, with common shares overvalued by 59%. In our sample of unicorns – companies with reported valuation above $1 billion – almost one half (53 out of 116) lose their unicorn status when their valuation is recalculated and 11 companies are overvalued by more than 100%. Overvaluation arises because the reported valuations assume all of a company’s shares have the same price as the most recently issued shares. In practice, these most recently issued shares almost always have better cash flow rights than the previously issued shares, so equating their prices significantly inflates valuations. Specifically, we find 53% of unicorns have given their most recent investors either a return guarantees in IPO (14%), the ability to block IPOs that do not return most of their investment (20%), seniority over all other investors (31%), or other important terms.

So, this is about venture capital specifically (not all private equity is like this), but valuations for private equity as a whole is problematic.

Because you don’t know how much it’s actually worth until it throws off cash.

For publicly-traded stock, you have market prices, and you can figure out what current values for your current holdings are. Even if the shares don’t throw off dividends, you know you can take your stock to the market and sell it (especially if you have only a small portion of the market capitalization for a particular company.)

Yes, it can be very volatile. Private equity valuations, by their nature, are not going to be as volatile… because they’re measured less frequently.

Even for thinly-traded public stocks, you can check their close price for the day. For private equity… it’s tougher. The valuation is made based on various assumptions, and you don’t really know the value until you cash out.

These types of illiquid investments can be useful in institutional investing, especially when there’s good oversight and governance. But it’s not clear that public pensions necessarily have good oversight of their private equity arrangements, for those that have them.

SINGLE FIDUCIARY FOR A PENSION FUND?

This is one governance issue for New York state pensions that burns my buns: a single fiduciary for the state plans.

North Carolina is another state in a similar situation:

Folwell has too much power over N.C.’s $93.9 billion pension plan:

One person, the State Treasurer, makes the investments for North Carolina’s $93.9 billion public pension. We are one of four states where a sole fiduciary has this responsibility. It is time to make a change and vest investment authority in a board of trustees.

Our new Treasurer, Dale Folwell, has come into office with a number of sensible ideas for improving performance and efficiency and cutting costs. However, in his first important set of decisions, Mr. Folwell has cost the pension far more than he has saved and provided compelling evidence that North Carolina needs to move investment authority from the State Treasurer to a board. In recent days, the state’s chief investment officer, Kevin SigRist, tendered his resignation. His departure reinforces the need to change the governance of the state pension plan in order to promote continuity.

Over the first six months of his tenure, Mr. Folwell has terminated 13 equity managers representing $7.3 billion in pension assets. Instead of reinvesting the proceeds in equities, the treasurer moved the money into fixed income and money market securities. This maneuver reduced the pension’s equity exposure well below its long-term target and represents one of the most elementary mistakes in investing: market timing. Clearly the treasurer is hoping the stock market will fall at some point and that he will be able to reinvest the proceeds at lower prices. Warren Buffet has called market timing a big mistake and commented on the maneuvers in his most recent annual letter:

“Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle. Many companies, of course, will fall behind, and some will fail. Winnowing of that sort is a product of market dynamism. Moreover, the years ahead will occasionally deliver major market declines – even panics – that will affect virtually all stocks. No one can tell you when these traumas will occur – not me, not Charlie [Munger, Berkshire Hathaway’s president], not economists, not the media.”

And I’d add, not the state treasurer. The pension plan must earn 7.2 percent in order to avoid additional contributions from taxpayers or state employees. When the treasurer materially reduces equity exposure, which according to the Treasury Department’s own assumption should earn about 8 percent over long periods of time, Mr. Folwell is sacrificing hundreds of millions in future performance.

He’s also potentially giving up volatility… depending what he replaces the equities with.

Timing the market is a hideous strategy for a long-term fund as with pensions.

There’s a reason the assets backing fixed annuities (i.e., where you’re promised payments for life at a specific level) are primarily fixed income assets. Using equities to fund pensions can be a risky business.

I have been notified that Folwell is giving a talk in September:

“THE PRICE OF PROMISES”- SEPTEMBER 13, 2017

presented by:NORTH CAROLINA STATE TREASURER DALE R. FOLWELL, CPASeptember 13, 2017 at 12:0 PMThe Charlotte City Club

As former Speaker Pro Tempore and NC Assistant Secretary of Commerce, Dale Folwell has experience in solving problems for the citizens of North Carolina. He served four-terms in the N.C. House of Representatives. While in the House, Mr. Folwell authored 29 major pieces of legislation that saved money, minds, and lives for North Carolinians.Three years ago as assistant secretary of commerce, he inherited the most “broke and broken” unemployment system in the United States. Under Mr. Folwell’s leadership and with help from the General Assembly, North Carolina employers and hard-working employees, the state was able to pay-off $2.7 billion in unemployment debt and build a $1 billion surplus in 30 months.

In November of last year, Mr. Folwell was elected North Carolina’s 28th State Treasurer. The North Carolina State Treasurer is responsible for the state’s pension and healthcare plans valued at more than $100 billion. Treasurer Folwell has promised the people of North Carolina that he is going show them where their money is, who is managing it and how good they are at their jobs.

If one of y’all go, maybe you should ask him about the sole fiduciary issue.

According to NASRA, these are the four states with a sole fiduciary (usually State Treasurer or equivalent) for their state pension funds:

Several states have

abandoned this model in recent years (e.g., South Carolina), and there are currently only four

remaining states with major pension funds using the sole fiduciary governance model:

Connecticut, Michigan, New York, and North Carolina.

Oh, great, Connecticut, too. You’d think both Connecticut and New York would be a little more savvy re: investment governance, but obviously not.

OTHER PENSION ASSET RELATED STORIES

Some of these hit on posts I made last week, some I just noticed. Enjoy!

- AI-CIO: eVestment: Public Pension Plans Gravitating to Real Assets, Private Equity… if you say so.

- Governing Magazine: Pension Plans Had a Great Year, But Retirees Likely Won’t Benefit From It — well, they benefit to the extent their plans become better-funded (spoiler-alert: they won’t, really)

- 5% Is the New 8% for Pension Funds — Most targets are still too high, and that’s a problem for employees and taxpayers.

- Huffington Post: Kentucky’s Hedge Funder Governor Keeps State Money In Secretive Hedge Funds – there’s a whole “thing” going on in Kentucky right now… I will need to revisit Kentucky issues again soon.

- Michael Riley makes a hedge fund pitch for Rhode Island (psst, they don’t need more hedge fund strategies)

- Public Pension Returns Barely Broke Even in Fiscal Year 2016 — these “great returns” are primarily FY 2017, fwiw.

- Divestment will benefit [NY] state’s pension fund – well, we’ll see, won’t we?

- Private equity coffers boom as pension funds look for somewhere else to put money beyond stocks

- University of California endowment revamps asset allocation in turn to more private assets — not a pension, but a public institutional fund nonetheless.

- Opinion: Here’s proof the average U.S. household isn’t the ‘dumb money’ – a bit of fund, comparing hedge fund performance against household investments

- Bill Bergman at Truth in Accounting — not asset issue, but related: Accounting for money with malleable words

Let me excerpt Bill’s blog post:

Next week I will be attending a conference at the American Institute for Economic Research in Great Barrington, Massachusetts. I worked there for a year about 10 years ago. It’s a great place, with a great library as well as a fascinating history, including the work of the founder before, during and after the Crash of 1929 and subsequent monetary and banking developments.

The conference is titled “Sound Money, Free Banking, and Private Governance.” My contribution is titled “Accounting For Money with Malleable Words.” The introduction to my paper includes “What happens when imprecise words lead us into places we think we know, but places we don’t really know because the words are unreliable and/or deliberately misleading? The use and abuse of word choice was a central concern of E.C. Harwood, and Dewey and Bentley. In that spirit, I offer seven combustible naming issues for reflection and discussion:

- Accounting for “cash” on the balance sheet

- Accounting for “money” – a specific case (M3)

- Accounting for federal government “assets,” as opposed to “resources”

- Accounting for federal government “liabilities,” referencing Social Security

- The federal “debt limit” and the meaning of “oblige”

- The Social Security “Trust Fund”

- “Balanced budget” requirements in state and local governments”

Ugh, the Trust Fund. I hate that accounting fiction. It’s worse than goodwill on a balance sheet.

Related Posts

Around the Pension-o-Sphere: Illinois, California, Shareholder Activism, and Puerto Rico

Public Pension Concept: Plan Long-Term for Long-Term Promises, and Don't Give Contribution Holidays

Pennsylvania Pensions: Nibbling at the Edges