Taxing Tuesday: California Chicanery, Geeking Out, And What About Payroll Taxes?

by meep

This is a “Geeking Out” special.

But first, idiocy from California:

CALIFORNIA: YEAH, GIVE US ALL THE MONEY, COMPANIES….WHADDYA MEAN, YOU’RE LEAVING?

Some people think California’s finances aren’t wrecked enough.

California’s Corporate Income Tax Rate Could Rival the Federal Rate

A constitutional amendment (ACA-22) pending before the California Assembly would more than double the state’s corporate income tax rate, yielding the nation’s highest rate–an astonishing 18.84 percent, up from the current rate of 8.84 percent. Assemblyman Kevin McCarty (D), one of the lead sponsors of the amendment, characterized it as “middle class tax justice” and argued that given federal rate reductions, corporations could afford to pay more in California taxes.

They could also afford to move somewhere else entirely. Only a few companies have to exist in California – specifically, the wineries. Tourism-related stuff.

Tech companies? Nope. They can easily move.

Entertainment? Lots of movie production has already moved to Canada.

California’s current 8.84 percent rate hasn’t drained the state of businesses; California boasts 54 Fortune 500 companies, one of three states with 50 or more (joining New York and Texas). There are plenty of reasons why businesses might want to be located in California even though costs (taxes and otherwise) are high. Even now, however, we’re seeing an exodus toward lower-tax jurisdictions. What began as a trickle is now a steady stream. At 18.84 percent? It could be a torrent.

…..

Companies make their location and investment decisions based on a variety of factors: workforce, education, quality of life, cost of living, taxes, and more. Taxes are a factor, but far from the only one. But if California’s corporate rate rivals most national rates, while other states continue to offer far more attractive tax systems, the rate rises greatly in importance. Companies willing to put up with an 8.84 percent rate because of what California has to offer might well reconsider if that rate is jacked up to 18.84 percent.On our State Business Tax Climate Index, which measures tax structure, California would slip from 48th to a projected 49th overall were this amendment ratified, with its corporate income tax component rank plummeting from 32nd to 46th. The corporate income tax rate is only one variable of 114 in an analysis focused on a wide range of structural issues, but an 18.84 percent rate would set California so far apart that the component result is dramatic.

Go for it, California. And get to working on seceding from the U.S., too. (And splitting yourself as well.)

Oh, and that’s also with the highest marginal personal income tax rates, too. Way to go, idiots.

GEEK TIME!

IT’S GONNA BE NUMBERS, FOLKS — YOU’VE BEEN WARNED!

Or you could scroll to the end, where I post tax tweets.

STARTING OUT SIMPLE: STANDARD DEDUCTION

As I mentioned a few weeks ago, the Tax Foundation put out a nifty calculator:

So, I just methodically went through a bunch of combos while I was sitting watching MST3K, Futurama, and Adventure Time episodes (the things I do for this blog!).

I used a variety of combos of income levels, marital statuses, and how the deductions broke out.

I’m not going to hit you all at once with this. First, the Tax Foundation has already done some analysis, such as this piece on the marriage penalty/bonus.

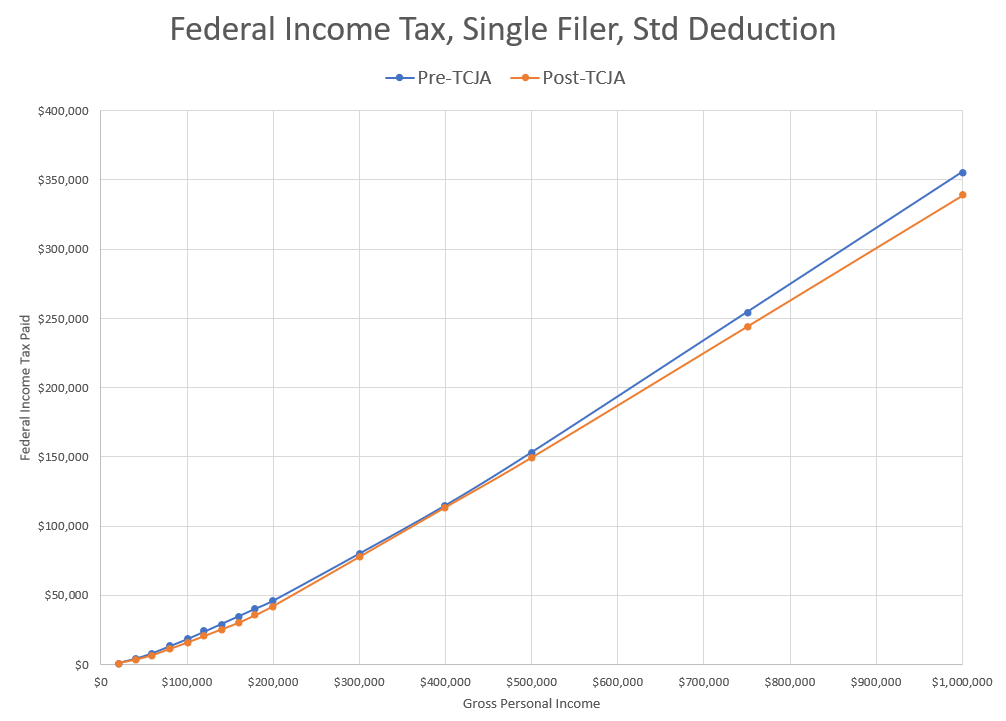

So for this first round, I’m keeping it to a single filer, no dependents, and just the standard deduction. We’re starting out easy — the standard deduction changed and the tax rates changed. Let’s look at the result, shall we?

I will start with what I consider a misleading graph, and then break it down into real terms.

I am graphing out the before/after differences for different income levels, with the dollar difference in blue and rate difference in orange.

Again, remember I am trying to be deceptive here. So let’s do the blue line first:

OMG! THE RICH PEOPLE GET THE BIGGEST BENEFIT!

Yes, they do in absolute dollar terms… but if we look at that orange line, we see who benefits in terms of effective tax rate. There, it seems that those at $160K – $180K income get the biggest benefit.

TAX CUTS FOR THE RICH! BURN IT DOWN!

Okay, now I’m going to graph what I consider non-deceptive graphs. You ready?

Here are the taxes paid pre- and post-tax bill. The blue line is the old federal income tax levels; the orange line is post-TCJA.

So… the more you have in income, the more taxes you pay. Hmm. Yes, the curve is pushed down more for those at higher income levels; but the entire curve is that the higher your income, the more taxes paid. Thank goodness, wouldn’t want to have perverse things like tax subsidy cliffs (=cough= Obamacare)

But surely, there’s something non-progressive going on with the tax rates!

Hmmm. So, the higher your income, the higher the tax rate you pay. (It’s kind of in the math to begin with). And yes, those at about $160K-$180K push down the rate far more than anywhere else. But if you’re only paying 5 – 10% in a federal income tax rate, there’s only so much you can push that down.

With the standard deduction, everybody’s taxes are cut. In coming weeks, I’ll start adding complications, to see if we can find the winners/losers. There are definitely losers, and it obviously comes in once one starts itemizing.

Spreadsheet with the data underlying the graphs

GIVING PROPER DUE TO DAN HEMEL

So, I just came across this due to the Wall Street Journal. The NY Times tried to determine who the losers in the tax bill would be…. and they screwed up.

I gave kudos to Hemel on Friday for his take on the SCOTUS Janus case, and I absolutely give him props here. He knows his stuff:

I say this as someone who is generally happy to point out the ways in which the new tax law produces unattractive results. But this couple appears to be among the winners — largely on account of the fact that Samuel is self-employed. 2/

— Daniel Hemel (@DanielJHemel) February 26, 2018

Factoring in their $864 of qualified dividends, their tax before credits is:

— Daniel Hemel (@DanielJHemel) February 26, 2018

10%*19050+12%*(77400-19050)+22%*(98206-864-77400)+15%*864

which, unless there's something wonky with my version of Excel, equals $13,424. That's actually $40 less than they paid in 2017.

4/

To be sure, their family may be worse off in the long run, b/c the ~$1.4 trillion deficit increase from the new tax law will lead to a reduction in gov't services &/or higher taxes down the road (to be paid, if not by Samuel & Felicity, then by their children). 6/6

— Daniel Hemel (@DanielJHemel) February 26, 2018

The full 20% deduction is available to consultants (& doctors and lawyers & everyone else) w/taxable income below $315k for a married couple (half that for singles/heads of household). Samuel & Felicity are well below that threshold. https://t.co/mWGA7gI3G6

— Daniel Hemel (@DanielJHemel) February 26, 2018

As a result of this, the NY Times had to run a correction — but Hemel points out they still had it wrong.

Still don't see why Samuel & Felicity aren't claiming nonrefundable dependent credits of $500 for their children Luke & Heidi and their parent Sydney, for additional tax savings of $1500 under the new law. https://t.co/OWmIX6cLkb pic.twitter.com/DRH3bO6QWZ

— Daniel Hemel (@DanielJHemel) March 5, 2018

Anyway, good for Hemel. I understand complaining about the tax cuts adding to national debt — I think that’s very possible, but we’ll see.

The thing is, people keep just pointing to taxable income increasing… but not factoring in lower tax rates, or other credits. The “taxable income” part doesn’t really matter if the percentage being applied to it is a lot smaller, and if the credits subtracted off at the end are larger.

You care about the ultimate bottom line – what are the total taxes you pay – not just one component that goes into determining that number.

SALT IN THE WOUNDS: FIGURING OUT PAYROLL TAXES

So some kind of consultants have been going around giving presentations to high-tax states about how they can fix the feds sucking off the sweet tax money from their favored parasitic hosts: high income folks.

SALT SUBSTITUTE: STATES RESPOND TO NEW TAX LAW

Now that President Trump has signed the sweeping tax overhaul into law, state policy makers have to decide on a response. In particular, lawmakers in high-tax states will try to shield their residents, who face the brunt of changes to the state and local tax deduction.

Peter Evangelakis, Ph.D., a REMI economist, invites you to join him for a webinar on Tuesday, February 6th or Thursday, February 8th from 2 to 3 p.m. EST when he will explore options for states in light of the Tax Cuts and Jobs Act and the potential consequences of the resulting changes to state tax policy.

For this webinar, he will review the ways the new SALT provisions affect certain states, and the possible adjustments those states will make. For example, states may consider shifting from a state income tax to an employer-side payroll tax that would still be deductible under the new law. He will demonstrate how states can estimate economic effects as they revise their tax code in response to the federal law.

It seems that REMI sells their consulting services and models to governments, I suppose to help policy makers intimidate opponents via producing lots and lots of numbers.

I have watched the one-hour presentation, and I want to point out one thing. This is from the slides:

And this is my own, informal transcript (removing all the “um“s and “you know“s, and other contentless noise) – this is starting around timestamp53:07

[During Q&A period of presentation]” Some skepticism that the states could pull off the change to the payroll taxes

[answering:] and I agree, and I think that this is one possibility, but I think that the federal government could certainly respond and say “there are certain things you can’t do.”

For example, people were rushing to prepay their property taxes at the end of last year, before the IRS said “This is not going to fly for most of you.” It only applies to only a very small set of people

….

So, I think, in terms of how this actually plays out — I share some skepticism that this could be done by states with no response from the IRS. I think it is an interesting exercise to think about what would happen.

So here’s the deal – they are basically playing with their standard model (it seems) and doing some what-if analysis…. but they don’t have all the changes implemented. They just did the “SALT tax cap in isolation of everything else” aspect, and then implemented the payroll tax to see what would happen.

What I really want to see is the full table from this slide:

That would be useful in seeing why people are really worked up (and where).

But more to the point – my big reaction to the whole presentation:

- I don’t trust your model. I have no reason to trust your model. You have given me no reason to trust your model. I don’t care if governments have hired you – I doubt the people making that decision are all that knowledgeable re: econometric models.

- THE WHOLE EXERCISE IS ABSURD. There is no way in hell the IRS/Trump Admin is just going to sit and let billions in federal tax walk away on state-level shenanigans. They have already shown their willingness to shut down:

- prepaying 2018 property taxes

- carried interest loopholes

Let me know how this payroll tax is supposed to work under that reality.

ON TOP OF THAT: are your high-state-income-tax-paying people on a payroll? Perhaps these people are independent consultants. How would payroll taxes help them? They’d be their own employee? Is that your idea?

ON TOP OF THAT: it does absolutely nothing for the property tax issue

They are trying to fix a “problem” that occurs only to very high income people with high holdings in real estate. A payroll tax is not going to fix the problem of these high-income/high-real-estate-wealth people.

BACK TO BEATING UP ON HEMEL

Here is Hemel talking about the payroll tax idea:

Why States Should Seek to Offset the Effects of the SALT Rollback

A response to a thoughtful but critical Tax Policy Center analysis

I usually find myself in agreement with Tax Policy Center experts Leonard Burman and Frank Sammartino, and I almost always learn a lot from reading their analysis. But I disagree in almost every respect with their recent post on proposals in several states to use payroll taxes and charitable credits to offset the impact of the new federal tax law’s SALT limitations.

…..

I have argued here and elsewhere that states should respond to the new federal tax law by shifting away from personal income taxes on wage income and toward employer-side payroll taxes. (I provide further details on how this shift might work in a short piece published by Bloomberg Tax last month.) The core of the case for a payroll tax shift is that all workers — and not just those who itemize deductions on their federal income tax returns — should be able to pay with federally deductible dollars for public schools, public hospitals, public infrastructure, and other public services provided by state and local governments.

Why? Why that “should”? I think that none of the state/local taxes should be deductible, so it doesn’t matter if you itemize or not.

….

Burman and Sammartino are correct that the SALT deduction is claimed primarily by high-income households. But because a shift toward a state-level payroll tax would benefit non-itemizers as well as itemizers, the immediate effects of a payroll tax shift are more progressive than the old SALT deduction. Moreover, and perhaps more importantly, legal incidence does not equal economic incidence. The benefits of SALT likely flow not only to the taxpayers who claim the deduction but also to the individuals who rely on state and local governments for education, health care, housing, cash assistance, and so on — and who will thus will be harmed if state and local spending drops.

Okay, but then you’ve got the people who don’t pay payroll taxes at all. Would you have a self-employment payroll tax to cover those folks? I guess so.

Finally, Burman and Sammartino are correct that Congress could — in theory — respond by changing federal law. I’m skeptical, though, that such legislation could win a majority even in the Republican-controlled House, as Republican representatives from blue states would be unlikely to give their assent. (There are 28 Republican representatives from California, New Jersey, and New York alone.) Burman and Sammartino further warn that “[i]f Congress disallows charitable deductions that are offset by tax credits, several existing state programs also could be invalidated.” Many of those existing programs are, in effect, acts of First Amendment arbitrage, designed to immunize private and religious school voucher programs from Establishment Clause scrutiny. At least in my view, if the federal government allows states to use charitable credits to finance private and religious schools, then it should allow states to use charitable credits to finance public schools and other public goods and services too. If Congress decides to end the unequal treatment by disallowing credits for private and religious schools, then that doesn’t strike me as such a terrible outcome.

But is it something from Congress…. or rules-making from the IRS? Because the IRS could just change that, right?

By the way, here are the links to his other writings on the matter:

- State Payroll Tax Shift Stands on Solid Legal Ground

- Why states may get away with creative income tax maneuvers (I know I’ve pointed and laughed at this one before)

- States and Localities Can Offset Federal Tax Law’s Impact on Their Residents

Whatever. It would be amusing if I never have to pay NY income taxes again because they idiotically moved to a payroll tax. I work in Connecticut. I currently pay both NY & CT income taxes. Yes, it sucks.

TAX TWEETS

The first batch comes courtesy of Twitchy, which noticed something:

The #TrumpTax has been a giveaway to corporations and the 1%. Democrats want to take that money and fund our roads, schools, and bridges. https://t.co/DOWwsAEOEU

— The Democrats (@TheDemocrats) March 11, 2018

As many noted, they sure do want to take that money.

At least they are fully admitting they want to take your money. Should be a solid strategy in 2018. https://t.co/s0oMFVTLo6

— Nancy Swider (@nancy_swider31) March 12, 2018

Over 80% of the country approves of the GOP tax cuts.

— Blue State Snooze (@BlueSnoozeBlue) March 12, 2018

So the Dems want to raise taxes.

New Dem motto – We're Still Not Listening

Roger L. Simon writes on Why the Democrats Made Such an Idiotic Tax Proposal. I like the mammal concept, but here’s a big point: a huge portion of America’s population had to leave their prior countries because they were assholes (that’s my interpretation, at least.)

A few more tax tweets:

Democrats' plan = More taxes and more spending. Vote for a Democrat and raise your taxes! https://t.co/UlWznjdtnT

— Jason Chaffetz (@jasoninthehouse) March 12, 2018

I'm sorry. I just have to laugh.

— Bill Mitchell (@mitchellvii) March 12, 2018

Media spin today is: "How can Republicans survive the Cat 5 turbulence of the Trump presidency? Can tax cuts save them?"

Actually Liberals, Trump is kicking your ass so bad I'd have gone "Cat 6" if I were you.

"Poll: Most small business owners say they will not hire, give raises because of new tax law" https://t.co/uEQNN1NupQ pic.twitter.com/AllrmJ6ynI

— The Hill (@thehill) March 12, 2018

In the PA-18 election, Republicans seem to have given up on using tax cuts as a selling point. As Greg Sargent says, that belies their previous insistence that the cuts would be a big winner 1/ https://t.co/tDIFmc6bVk

— Paul Krugman (@paulkrugman) March 12, 2018

More Than Half Of 2018 Earnings Growth Is From Trump's Tax Cuts And Stock Buybacks https://t.co/5Hk1gifzpT

— zerohedge (@zerohedge) March 12, 2018

Trump jokes with

RepKevinBrady</a> (but also indicates he's not really joking) that a second round of tax cuts is in the works <a href="https://t.co/T8FIR0urB1">pic.twitter.com/T8FIR0urB1</a></p>— Aaron Rupar (atrupar) March 12, 2018

Hmmmm, interesting.

Related Posts

MoneyPalooza Monstrosity! Looking at the SALT Cap Provisions

Taxing Tuesday: Income Tax for Chicago?

Taxing Tuesday: Novel Concept to Politicians - Nunya