Around the Pension-o-Sphere: Kentucky, New Jersey, Montana, and Higher Wages Make for Cheaper Pensions?

by meep

Not necessarily in that order.

HIGHER WAGES AND LOWER PENSION COSTS?

I’ll let Rob Fellner of the Nevada Policy Research Institute explain:

In trying to come up with ways to tackle Nevada’s soaring pension debt, a key Nevada legislator put forth an idea that is the functional equivalent of trying to put out a fire by dousing it with gasoline.

At last week’s Interim Retirement and Benefits Committee legislative hearing, Assemblywoman and Committee Chair Maggie Carlton made it a point to declare that increasing wages for government workers was a viable way to reduce Nevada’s pension debt.

…..

Because higher wages translate to higher future pension benefits, Nevada governments and taxpayers would get billed twice: as the cost of higher wages is compounded by higher annual pension costs.So what, if any, reduction in PERS unfunded liability would occur in exchange for increasing both the annual wage and retirement costs of Nevada governments?

Literally, zero dollars — and that’s in the best-case scenario. But more on that later.

…..

PERS has already adopted a schedule of expected dollar payments that must be paid in order to eliminate its existing unfunded liability.Thus, changes to the payroll base do not affect the actual dollar amounts that must be paid. For example, if $11 must be paid next year, it is immaterial whether it is 10 percent of the $110 payroll assumed, or 11 percent of $100. While a higher payroll means a lower percentage cost, the actual cost remains unchanged.

I love these percentage games.

NEW JERSEY INCREASES DISCOUNT RATE

Yes, I said increases. Because, just by doing that, the pensions magically become cheaper! And look better-funded!

New Jersey treasurer resets public pension rate of return

NEW YORK (Reuters) – New Jersey’s treasurer said on Thursday she will increase the expected rate of return for the state’s struggling public pension system from 7 percent to 7.5 percent, then lower it again over time.

The switch to a higher assumed rate means that the state, and participating local governments in New Jersey, will for now escape the higher costs that arise when investment return assumptions are lowered.

The savings come at a fortuitous time for new New Jersey Governor Phil Murphy, who took office in January and is facing a shortfall ahead of his first budget proposal in mid-March.

The higher rate will save about $238 million for the state and more than $400 million for local governments in the near term, according to the office of Acting State Treasurer Elizabeth Maher Muoio.

IT WON’T SAVE A DAMN THING.

I don’t care that the qualifying phrase “in the near term” is tacked onto the “saving”. This is like underpaying your credit cards, so that the balance increases, but saying that by underpaying you’re “saving” money.

I am thoroughly disgusted.

More New Jersey pension stories:

- John Bury:Trusting Murphy Is S.O.S.

- John Bury: S5 To Get “Reasonable” Changes

- John Bury: S5 and COLAs

- POTENTIAL PUERTO RICAN FORECLOSURES REMAIN CONCERN FOR PENSION SYSTEM

- Another gift to the unions, another pummeling for taxpayers | Editorial

MONTANA

Here is a little point-counterpoint.

Point: Candid talk needed to address state’s pension woes

Rep. Tom Burnett, R-Belgrade

Montana’s pensions for our government employees are in trouble. We need to have a candid discussion of the costs the state faces to make pensions solvent.

Montana has nine public-pension systems, one each for judges, highway-patrol officers, sheriffs, game wardens, city-police officers, firefighters, volunteer firefighters, teachers, and public employees. The teachers’ plan, TRS, and the public-employees’ plan, (for employees not covered by other plans), PERS, are by far the biggest. Combined, they cover about 90% of employees owed state pensions.

…..

Public pensions are a splendid deal for Montana state retirees, who receive on average $34,308 per year[iii]. If combined with an average Social Security benefit of $14,800 per year[iv] their benefits would total about $49,000 yearly. Is that generous or stingy? Well, one obvious comparison is with the median annual wage in Montana: $29,580.But Montana’s public pensions aren’t sustainable, as too little money is being put aside to fund, over the long haul, the pensions contractually due to the employees. I believe many public employees understandably worry that the pension benefits they’ve been promised will be hard to collect; some have privately told me so.

…..

One way our pensions have masked their weakness is by assuming a highly optimistic annual rate of return, 7.75 percent on their invested assets. The governing board for one of Montana’s pension programs recently reduced that number by a microscopic amount, to 7.69%. Most economists who study pension programs recommend using drastically lower rates of return, between 4.5% to 5%. Some even recommend a “risk-free” rate of return assumption of 2.344%[v]. At that rate, Montana pensions are only 34% funded.One of our legislative fiscal analysts ran a computer model of the teacher’s retirement system assuming a 4.65% rate of return, which still may be overly optimistic. His result? An additional $350 million per year would have to be paid into the fund to make it solvent. Since PERS is roughly the same size as TRS, a similar infusion may be needed for it. The two total $700 million per year, a staggering figure.

How should we think about that $700 million per year? One way is to compare it to other items in the state’s budget. For example, the university system gets $189 million per year from the budget. The Army National Guard gets $18 million, K-12 schools get $731 million in aid, and the highway patrol gets $37 million[vi].

Counterpoint: No, pensions are not in trouble

Representative Tom Burnett’s latest guest column would have you believe that Montana’s pensions are in big trouble. They are not. He insinuates that pension problems experienced in Illinois are happening in Montana. They are not. He states that pension fund return estimates are too optimistic. They are not. In recent years investment revenues consistently exceeded their goals. He beat up on state employees collecting their pension by adding a Social Security benefit to their monthly amount. That’s wrong to do. State employees in pension plans don’t participate in Social Security. Worst of all, Tom suggests that pension funds should be converted to 401K plans. This is a terrible idea.

As an MSU employee, I am painfully aware of what an expensive mistake closing pensions can be. Back in the 90’s the university withdrew from the pension plan and went with a 401k (or DC) system. It was an expensive blunder that we employees have been subsidizing for decades. The reason is that we have a contractual obligation to employees and retirees who paid into that pension systems. The universities and employees have been bearing that cost. Can we please learn from that mistake?

…..

Montana has done a good job of managing pension funds. Perhaps my proudest accomplishment as a state legislator was carrying and passing HB 377. This bill, drafted by Governor Bullocks team, fixed the teachers pension system.

…..

Montana’s pension funds needed attention for other reasons. They were doing well until the Great Recession of 2008. To go back to our tub analogy, the financial crash scooped a very large quantity of water out of the pension tub and dumped it down a drain on Wall Street. That tub has since been refilling due to continued contributions and investment success, but with the level of retirements that will occur in the future, we had to make some adjustments in order to keep the fund from running dry. We did that in 2013.Under the new rules, new and existing employees saw their contribution go from 7.15 percent to 8.15 percent. New employees will have to contribute longer in order to qualify for a full pension. Teachers will have to have to work 30 (instead of 25) years to receive a full pension. These reasonable adjustments placed our pension funds on sound financial footing. Despite Rep. Burnett’s “what if” assertions and incorrect assumptions, the numbers say that the sky is not falling.

Rep. Tom Woods, D-Bozeman, is the chairman of House Democrats.

Well, we’ll see, won’t we?

The Public Plans Database has two of the state pensions, one of which was 77% funded and the other was 69% funded as of the latest available measurement date.

That counterpoint was a bit light details, wasn’t it? You can go to the link to see if I missed anything important, but I don’t think so.

I don’t see how it really proves that the pensions are not in trouble.

I guess I should be happy they didn’t refer to the pensions being close to 80% funded… well, one is….

KENTUCKY

Ugh. Not this again.

Okay, I may as well provide you with the info. I am really unhappy with the developments in Kentucky.

- Failing the public: Legislature kicks can on pension reforms — again

- Pension Bill – Plusses and Minuses

- Why cities and counties still don’t know if they must cut jobs to pay for pensions

- Chris Tobe: Level-dollar funding will destroy Kentucky pensions

- AG warns proposed pension overhaul wouldn’t hold up in court

- Substitute Kentucky Pension Bill to Be Introduced

- Attorney General letter citing 21 legal violations with bill

- Kentucky Teachers Crowd Public Hearing Of New GOP Pension Bil[l]

- GOP pension plan mere political cover

- Kentucky looks to ease local governments’ pension pain

- Letter from actuarial firm GRS on effect of proposed bill

- Kentucky’s new pension reform bill is illegal, says Attorney General Andy Beshear

- Review But No Committee Vote On Pension Overhaul

- Retired teachers voice opposition to pension overhaul

- Kentucky pension reform: Plan would give local governments, schools more time to pay tabs

- Kentucky pension reform bill hearing approaches

I have no substantive comment right now other than Gov. Bevin has been really shoddy/lazy with respect to this plac. Even I, a non-lawyer, could see that several of the items that would actually save money would be considered unconstitutional — and Bevin is too lazy to ask for the work to amend the state constitution.

That’s all you’re getting from me, Bevin.

Okay, here’s something:

Enjoy your raspberry, Bevin.

SURPRISE! SODA TAX!

Here is one non-pension item.

I came across this post at Legal Insurrection, and knew I had to throw it in.

Philadelphia Soda Tax Fizzles, Brings in $13 Million Less Than Expected

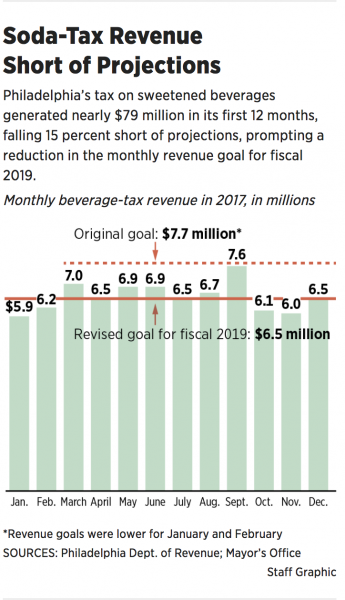

Philadelphia set the bar last year when officials added a 1.5 cents-an-ounce to sweetened beverages. It only brought in $78.8 million…$13 million less than they city hoped.

You mean to tell me that when you charge a lot more for pop that people won’t buy it? I’m SHOCKED! Not really. I mean, as a loyal Diet Coke consumer, the tax wouldn’t have pushed me away. But come on. You shouldn’t really rely on a tax on something that people can avoid.

Philly soda tax revenue falling short, city adjusts plans for pre-K and other programs

Philadelphia’s tax on sweetened drinks has lacked the revenue fizz that officials anticipated, and the city is downsizing plans for the programs it’s intended to fund.

In Mayor Kenney’s budget proposal, which he will unveil Thursday, the tax’s projected revenues are lowered by about 15 percent. The controversial tax, the first of its kind in the nation and closely watched by other cities, will likely bring in $78.8 million in the current fiscal year, officials said — about $13 million less than the city had planned in its current budget.

As a result, the city has decreased the number of pre-K seats and community schools it planned to open in the next five years. Instead of expanding the free pre-K program to serve 6,500 children by fiscal year 2023, the city is estimating a maximum of 5,500 seats. The number of projected community schools has also been cut, from 25 to 20. And spending for the Rebuild Initiative to improve parks, libraries, and recreation centers will be scaled back, according to Finance Department officials.

…..

Separately, because the Pennsylvania Supreme Court will consider a challenge to the tax, the city has not yet fully expanded the programs it funds. Under a new five-year plan released Thursday, more pre-K seats and community schools will be added in fiscal year 2020, when officials expect the litigation will be over.

Pa. Supreme Court to hear soda tax case

The Pennsylvania Supreme Court said Tuesday that it will consider the legality of Philadelphia’s tax on soda and other sweetened beverages, giving fresh hope to opponents of the controversial levy.

The court said it would hear the American Beverage Association and other local businesses’ appeal of a Commonwealth Court decision last year to uphold the controversial tax. The rest of the country will be watching the outcome. Philadelphia became the first major U.S. city to pass a tax on soda in 2016, and a number of other cities have since considered or implemented similar taxes.

Justices will weigh whether the 1.5-cent-per-ounce levy amounts to a double tax. Pennsylvania law prohibits the city from imposing a levy on something already taxed by the state. The tax is imposed on distributors, but lawyers representing the beverage industry and local retailers argued that the levy is being passed on to consumers, who already pay sales tax.

Ha ha.

That’s it for now … I hope the electricity stays on over here in New York this weekend.

Stay warm!