Taxing Tuesday: A Campaign Video, Ready-Made, for Republicans, Illinois Tax Doom, and More

by meep

Sometimes, they make it so easy:

Nancy Pelosi asked if Dems win majority would she raise taxes. "That's accurate." pic.twitter.com/3LMfxfr36T

— Comfortably Smug (@ComfortablySmug) May 8, 2018

GOP: Pelosi Will Raise Taxes! Pelosi: “Accurate!”

Is this the tweet that launched a thousand campaign ads, and burnt the topless towers of Democratic midterm ambitions? If the Republican Party and/or the National Republican Congressional Committee doesn’t cut a version of Nancy Pelosi’s remarks at today’s Politico Playbook interview for every contested House race, they should get sued for incompetence. Jake Sherman asks Pelosi about GOP claims that a Democratic House majority would pass a single-payer health care system and raise taxes. “The second part is accurate,” Pelosi replied

Nancy Pelosi keeps giving the GOP talking points:

First it was her repeated admonitions that the GOP’s tax cuts amounted to “crumbs” for the middle class — a talking point that has clearly given her Democratic colleagues agita because of its elitist overtones. “Language is important, and we have to be very careful that we don’t insult people by saying that the amount of money they get is crumbs,” one of them, Rep. Emanuel Cleaver II (D-Mo.), told Politico. “We cannot be seen as patricians.”

….

And finally came Tuesday morning. Appearing at a Politico event, Pelosi was asked to respond to GOP talking points that a Speaker Pelosi would institute single-payer health care and “raise taxes” by moving to “roll back the tax cuts that they passed this year.” Pelosi’s response: “The second part there is accurate.” So there is Pelosi — on video — appearing to confirm she would try to raise taxes if Democrats win back the majority.The moment isn’t quite as easily transferrable to GOP campaign ads as some might want it to be, given that the question was somewhat complex. And Pelosi may argue that her “that’s accurate” comment was about rolling back certain tax cuts rather than “raise taxes.” She added, “I do think we should revisit the tax legislation in … a bipartisan, transparent way.”

So here’s the deal: she is actually being truthful when she says she wants to undo the TCJA.

HOWEVER, that wouldn’t necessarily raise taxes on everybody.

They’re so desperate to actually reduce taxes for their constituencies in places like San Francisco, New York, and Chicago… where the only thing keeping people from outright fleeing is that at least they used to be able to deduct all those expensive local and state taxes.

This is how they try to spin it:

Her spokesman, Drew Hammill, pointed to Pelosi’s previous comments looking to roll back specific aspects of the tax cuts while strengthening middle-class tax cuts: “Once again, Republicans are desperate to misrepresent any effort to roll back their debt-exploding tax giveaways for big corporations and the wealthiest 1 percent as ‘raising taxes’ on middle class families.” He noted the that GOP tax plan would eventually raise taxes on individuals when those tax cuts expire in a decade. (Congress may renew those cuts before then.)

So they want to try to raise taxes on corporations (which provide very little of federal receipts), remove the SALT cap (which really only hits high income folks in high tax places… but many times people (like me) will really only see a wash – no cut for me. Boo hoo.)

Anyway, I look forward to hearing more details about Pelosi’s tax proposals. I know of the two items I mentioned above, one of which is eh, and the other which helps target very specific constituencies who not only will hurt under the TCJA, but they are likely going to hurt more.

PROPOSED DOOM FOR ILLINOIS: YEAH, LET’S RAISE TAXES 40%

Jack up property taxes for pensions, say three Chicago Fed economists

Illinois homeowners, who already pay some of the nation’s highest property taxes, should pay about 40 percent more for the next three decades to wipe out the state’s crippling pension debt, according to a trio of economists at the Federal Reserve Bank of Chicago.

The economists argue that paying off the state’s $129.1 billion in unfunded pension obligations cannot be done with revenue from new taxes such as a tax on marijuana sales or on financial transactions.

….“In our view, Illinois’ best option is to impose a statewide residential property tax,” they wrote, in part because it would be fair: “Illinois residents who have benefited most from the past services of governmental employees are more likely to be homeowners, so it seems reasonable that they should pay a larger share of the costs.”

They are proposing a statewide tax of 1 percent of a home’s value. Under their plan, the tax bill on a $500,000 house would go from about $11,600 to $16,600, an increase of $5,000, paid each year for 30 years.

…..

Illinois homeowners pay an average of 2.32 percent of their home value in property tax every year, which according to WalletHub is second only to New Jersey’s 2.40 percent.

….

The proposed increase would amount to a 43 percent increase on the average that Illinois homeowners pay.

So this is a properly-reported public finance article: they show all the relevant numbers (also, they talk about the range of rates, but I didn’t copy that bit over).

Here is the Chicago Fed economists’ blog post on the idea:

How Should the State of Illinois Pay for its Unfunded Pension Liability? The Case for a Statewide Residential Property Tax

The State of Illinois has a very large unfunded pension liability and will likely have to pay much of it off by raising taxes. The Illinois Commission on Government Forecasting and Accountability estimated the state’s unfunded liability at $129.1 billion in mid-2017,1 which was about 19% of state personal income.2 Benefits to public employees are protected under the Illinois Constitution, and a recent attempt to reduce the unfunded liability by reducing retirees’ benefits was struck down by the Illinois Supreme Court.3 So, assuming that the state can’t reduce its current pension obligations and that it wants to maintain its current level of services, Illinois residents are going to have to pay higher taxes. What’s the best way to do it?

Because the debt is so large, it’s unrealistic to think that new taxes (such as a tax on legalized marijuana or financial transactions) or increases that affect only a narrow segment of the population will be enough.

…..

In our view, Illinois’s best option is to impose a statewide residential property tax that expires when its unfunded pension liability is paid off. In our baseline scenario, we estimate that the tax rate required to pay off the pension debt over 30 years would be about 1%. This means that homeowners with homes worth $250,000 would pay an additional $2,500 per year in property taxes, those with homes worth $500,000 would pay an additional $5,000, and those with homes worth $1 million would pay an additional $10,000.

You know what? I think they’ve got quite the idea here.

Because this is the first group I’ve seen that has put out a realistic quantification of what it would take to actually pay for the pensions.

But there’s that big assumption that the state can’t (or, rather, won’t) reduce current pension obligations. But this is not the blog post for questioning that assumption.

This is a slap of reality to all the various political actors who believe that somehow, magically, the pension problem will get taken care of without a huge amount of fiscal pain. That they can manage through it somehow.

Here’s Mark Glennon’s reaction in Crain’s: Chicago Fed team proposes perhaps the dumbest ‘solution’ yet to the state’s pension crisis

It’s inhumane, desperate and foolish: an annual statewide property tax of 1 percent for 30 years or as long as it takes, dedicated solely to state pensions. A Federal Reserve Bank of Chicago economist proposed it at last month’s conference on what lies ahead in pension reform, co-sponsored with the Civic Federation. Now three Fed economists have formally released the proposal: Homeowners with houses worth $500,000 would pay an additional $5,000.

Play with the numbers and you’ll find that for a family making $80,000 and living in a $250,000 house, this new tax would be worse than raising their Illinois income tax rate to 8 percent.

How blind can they be to the disaster already inflicted by Illinois property taxes? Suicidal property tax rates have robbed hundreds of thousands, maybe millions, of Illinois families of their home equity—probably the lion’s share of whatever wealth they had.

South Cook County is a humanitarian tragedy in itself and should be a national story. There, average effective residential rates exceed 5.2 percent and commercial rates average over 12.7 percent, helping fuel a death spiral.

…..

That region is not alone. About 100 towns and cities just in the Chicago area have residential rates exceeding 3 percent. The area’s property taxes are higher than rates in 93 percent of the country, with Lake and DuPage counties upward of out-taxing 98 percent.Calling those rates “confiscatory” isn’t exaggeration. They destroy home equity, which the Chicago Fed authors actually count as justification for the proposal. “Current homeowners would not be able to avoid the new tax by selling their homes and moving because home prices should reflect the new tax burden quickly.” Property can’t leave so seize it, in other words.

Property value can definitely leave, by the way.

Ask Detroit about that. Ask the various places that found a bunch of properties with negative equity value at the end of 2008… hard to tax bankrupt owners, and the banks may just abandon the homes.

So. What’s it going to be?

THE COST OF PROMISES

I don’t really take the property tax proposal at face value, because the way I read it is this:

“You don’t want to do anything that will cut pensions or services? Fine, this is how much it will cost.”

Illinois can’t actually afford its level of services and its already promised pensions.

The amount of taxation it will take will destroy whatever property values exist in the state.

It’s going to take a lot to build up political consensus to allow for a state constitutional amendment that would actually allow even the most modest of pension changes: more cost-sharing on retiree health benefits; reduction in COLAs; more cost-sharing for pension benefits in general.

I think it actually takes quantification like this to show the taxpayers of Illinois: you need to call for action to amend your constitution. Get to it.

And, as James Spiotto and Mark Glennon mention – there is something not requiring constitutional change (yet), but mere legislative change: the state of Illinois needs to allow for municipal bankruptcies. But, again, for another time.

COMMENTS ON SOME ILLINOIS TAXATION

Because even before imposing a new tax, the residents of Illinois are already feeling bad effects of taxes.

Comments about the taxation levels in Oak Park, Illinois give a flavor:

Submitted by Ray Muccianti on Tue, 2018-05-01 20:45

Takes away our ability to enjoy our retirement at every increase. Our income does not keep up with village expensesOutrageous

Submitted by Doug on Tue, 2018-05-01 21:05

Property tax has tripled since I purchased my home. I now pay 50% more on property tax monthly than my mortgage.Unsustainable. And it’s the taxing bodies greedy silo driven fault.

Taxes

Submitted by Neal Buer on Tue, 2018-05-01 21:08

When I bought my house, my taxes were 4% of my income. Now my taxes are over 50% of my gross income. When you retire, your income drops but taxes keep going up. At some point, you have to leave. It’s like being foreclosed on.….

Submitted by Anonymous on Tue, 2018-05-01 21:36

The property tax rates have seriously impacted my budget. I am hoping to move once my current 7th grader graduates from 8th grade, before my current 4th grader enters middle school. I live in a townhouse without a yard and I pay more than 1,000 in taxes each month. Additionally, I have become more cynical regarding the services Oak Park provides. For the rate of taxes, I feel there should be better road conditions, nicer landscaping, a greater sense of safety and public spaces. For example, we join the forest park aquatic center rather than the OP pools due to how crowded they always are, we grocery shop in riverside or melrose park as I don’t like the bag tax, we go to stores in RF and surrounding areas because the parking is easier. I find myself asking “why do I live here?” More often than I’d like.How have property taxes affected me

Submitted by Alan Peres on Tue, 2018-05-01 21:46

Property taxes have risen far faster than my family income. They take a larger percent of after tax income so push out other spending.Unaffordable

Submitted by C Connor on Tue, 2018-05-01 22:03

Our taxes have doubled since moving here in 2008 which has outpaced our income. Will need to get another job or move out of Oak Park.…..

We are moving out of Oak Park and will be selling our 2 flat along with our primary home. I have studied the tax situation for the last year and do not believe the rate of tax increase will slow, we are throwing in the towel.In 2005, when we moved into Oak Park, we expected to die here. We are choosing to get out while we can.

….

Submitted by Lisa Mulligan on Wed, 2018-05-02 07:22

My taxes have gone from $9,600 to over $32,000. It doesn’t even matter what time frame this represents, it’s out of control. I am a fiscally responsible resident, have always lived within my means which sometimes means making tough choices. I have improved my property and improved my community. Now, you are essentially telling me that I need to leave my home and community. Who can sustain these taxes? How can residents who want to remain in Oak Park during their senior years ( generally on a fixed income) do this? I am sickened that I will have to make a choice to sell my home because I can NO LONGER afford my current taxes let alone what you will do to my taxes going forward. And I have appealed my taxes annually. How can you live with this – knowingly pushing a whole segment of our community out because of taxes alone. Look at the number of homes on the market right now. If you contacted these residents I bet you would find out that a large number of sellers are leaving because of taxes. In my neighborhood, this is the single most talked about topic, with generally everyone in disbelief and disgust. To make it worse, for residents selling their homes current property tax levels directly impact their sales price. Taxing at the level that Oak Park is taxing at lowers property values. When does ithis out of control taxing situation get addressed? Probably not before many valued residents are forced out of the community. Then you can look around and ask the question “where is our diversity”? I guarantee you, it won’t exist.

Well, well, well.

I will just say that many revolutions/massive changes have been spurred by taxes. Just think American Revolution — but that was not unique.

Here’s a nice little list of such things.

Even before the SALT cap, these places were getting desperate for tax revenues, and the SALT cap only makes the situation uglier.

All out tax revolt in Illinois?

It’s a possibility.

AN ALTERNATIVE VIEW: THOSE DIRTY FOREIGNERS GET ALL THE BOOST

CBO estimates imply that TCJA will boost incomes for foreign investors but not for Americans

Proponents of the Tax Cut and Jobs Act (TCJA) claimed it would boost the U.S. economy and generate higher incomes for the American people. At first glance, recent estimates from the Congressional Budget Office (CBO) appear to support that argument. But the CBO analysis includes a subtle, yet extremely important difference: Foreign investors will end up receiving much of the gains and the net income available to Americans will rise barely, if at all.

The CBO analysis implies that TCJA effectively will have no impact U.S. incomes after 10 years. The difference, in econ-speak, is between the estimated effect on Gross Domestic Product (GDP, or the output created within in the U.S.), the effect on Gross National Product (GNP, output created by American workers and American-owned capital), and ultimately on Net National Product (NNP, which is GNP minus depreciation of capital goods, and comes closest of the three measures to American incomes). Hang on while we explain the difference.

I have an alternate interpretation: CBO analysis ten years out is crap.

Unless you’d like to explain to me why I should trust it. Have they gone back and checked how well their models did compared to what actually happened? Maybe I missed such analysis, but I really don’t trust this macro modeling stuff.

Separately, the CBO analysis is based on the tax cuts of individuals going away as per the bill (as opposed to Congress making the cuts permanent at a later date), because obviously, they can’t base their modeling on something that has yet to happen. (Oh wait, they totally could, but they’re not doing so. Given all sorts of things that could happen in the future, I think that’s wise.)

CBO estimates that TCJA will increase U.S. GDP by 0.5 percent in 2028. CBO projects that the tax cuts will boost output in 2028 largely because lower tax rates on capital income—such as the 21 percent rate on corporate profits—increases the after-tax rate of return which in turn will boost the stock of productive capital such as computers or factories.

But here’s the kicker: CBO figures that most of that additional capital will be financed by foreigners—for example, from overseas corporations building factories in the U.S., or foreign investors buying U.S. stocks and bonds.

Or, I dunno, pension funds that own stocks and bonds.

In any case, I really don’t trust GDP projections, especially 10 years out. I would love to see info on CBO model accuracy.

Doing a quick search I find:

From 2015 – The CBO’s Crystal Ball: How Well Did It Forecast the Effects of the Affordable Care Act?

Abstract

The Congressional Budget Office (CBO), a nonpartisan agency of Congress, made official projections of the Affordable Care Act’s impact on insurance coverage rates and the costs of providing subsidies to consumers purchasing health plans in the insurance marketplaces. This analysis finds that the CBO overestimated marketplace enrollment by 30 percent and marketplace costs by 28 percent, while it underestimated Medicaid enrollment by about 14 percent. Nonetheless, the CBO’s projections were closer to realized experience than were those of many other prominent forecasters. Moreover, had the CBO correctly anticipated income levels and health care prices in 2014, its estimate of marketplace enrollment would have been within 18 percent of actual experience. Given the likelihood of additional reforms to national health policy in future years, it is reassuring that, despite the many unforeseen factors surrounding the law’s rollout and participation in its reforms, the CBO’s forecast was reasonably accurate.

Basically, they did better than other forecasters… but 30%, 28%, and 14% are not small deviances.

Another one (this one from 2012): CBO Forecast Accuracy

Economic variables are key drivers of the numbers in CBO’s budget projections. I noted last week that CBO’s new outlook assumes substantially lower interest rates, which appears to produce more than a trillion dollars of savings over the next decade.

Policymakers should be aware, however, that macroeconomic forecasts are not very accurate, despite the sophisticated models available today. Consider how CBO completely missed the recent recession until after it had already started (in December 2007).

…..

Upshot: With respect to budget policies, policymakers should forget what the macro models are saying. What we know for sure is that the government is spending $1 trillion a year more than it takes in. That’s just crazy. We need to cut spending, and we need to start now.

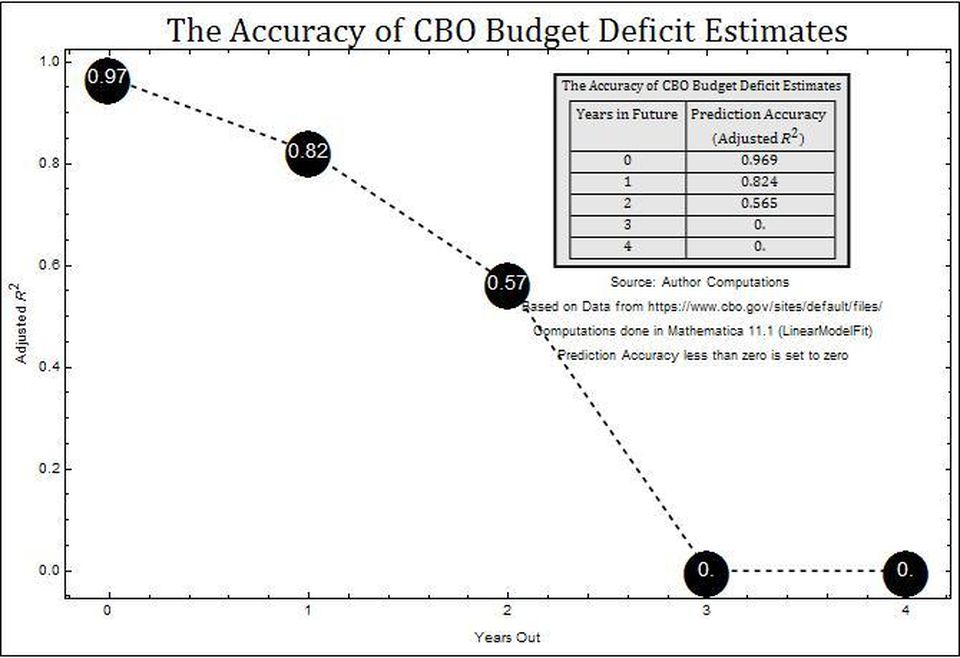

A more recent one – from 2017: CBO Budget Projections: After Two Years No Better Than Throwing Darts

Look at the chart below. It shows the deterioration of CBO predictive accuracy when it comes to the federal budget deficit. The circular markers show how accurate these predictions have been since 2009 in forecasting how large the federal budget deficit would be. As one can see, although CBO estimates are very good for the same year in which they are made, accuracy deteriorates rapidly. By year 3, CBO projections have actually been no better than luck.

Whatever.

SEATTLE TRYING TO KILL THE GOLDEN GOOSE

I think that’s enough commentary from me on the following:

Seattle OKs taxing companies like Amazon to aid the homeless

SEATTLE (AP) — Seattle’s largest businesses such as Amazon and Starbucks will have to pay a new tax to help fund homeless services and affordable housing under a measure approved by city leaders.

The City Council unanimously passed a compromise plan Monday that taxes businesses making at least $20 million in gross revenues about $275 per full-time worker each year — lower than the $500 per worker initially proposed. The so-called “head tax” would raise roughly $48 million a year to build new affordable housing units and provide emergency homeless services.

Okay, I will comment.

Head taxes have been the source of some of the biggest tax revolts in history, like the Peasant’s Revolt.

To be sure, Wat Tyler (the leader) got killed in the revolt, but that tax was rescinded pretty damn immediately after that.

TAX CHANGES KILLED GOTH DAY AT DISNEY?

Something a little lighter for the end.

From Vice: Disneyland’s Goth Day Is the Latest Victim of Trump’s America

After 20 years, Goth Day is facing massive cuts. The organizers say the economy and changes in tax law are responsible.

Last weekend, Disneyland’s Goth Day—officially known as Bats Day in the Fun Park—died on its 20th birthday.

Over the years, the event evolved from a minuscule macabre meet-up to an enormous emo extravaganza featuring off-site parties, attendee keepsakes, live music, a marketplace, and photos shot by official Disney photographers outside Sleeping Beauty’s Castle and the Haunted Mansion. Discounted park tickets and hotel rooms were also available. In recent years, organizers estimate as many as 8,000 goths turned up for the event.

But then, disaster struck: In March, Bats Day organizers cancelled this year’s concert. Last week, they announced the market and Disney-sanctioned group photo were dead, too, with no plan to bring any of it back.

…..

“We’ve been watching the climate, we’ve been watching what’s been going on with our economy, we’ve been watching political aspects of everything, and tax situations, and we kind of saw this coming,” Noah Korda, Bats Day’s founder, told me in a phone interview. “And it wasn’t not that we didn’t do everything we could—we ran different scenarios to see whether or not we could keep doing this, and we did a lot of research, a lot of research with tax attorneys and with our tax attorney, and, unfortunately, it just wasn’t feasible to actually continue to do the event with the way that we run the event.”The problem, he said, was that after changes to the law as a result of the Republican-penned tax bill signed into law by Donald Trump last year, the deductions organizers were able to take advantage of have disappeared. “We really can’t do 100 percent of our deductions that we’ve always been able to do,” Korda said. “Mind you, we can still do some deductions, but it’s not nearly as much as what we have been able to do.”

This is getting into a section of tax policy that I didn’t know existed.

I have tried asking my tax-knowledgeable friends, but “what’s been going on with our economy” killing Goth Day seems highly unlikely (maybe interest rates rising and they couldn’t get a good interest rate on a line of credit?) so it’s obviously something involving taxes.

WHAT WAS IT?!?

Vice is clearly not asking the important questions.

This was our best guess: it had to do with entertainment & meals being tax deductible for businesses (Goth Day was being run as a business).

Tax reform changes to meal and entertainment deductions:

Entertainment

Under the former tax law, a deduction was allowed for 50 percent of entertainment expenses incurred if directly related or associated to the business. Under the TCJA, no entertainment deduction is allowed. This means any business expenses incurred for recreation or amusement can no longer be claimed, including for example, golf outings, sporting events, concerts, hunting and fishing trips, and country club dues.

So they couldn’t deduct the Disney tickets, etc., for the planners. I don’t know how they set up their taxes, but oh well.

Related Posts

MoneyPalooza Monstrosity! Let's Check Out the State Aid in the $3 Trillion Bill

Public Finance Spotlight: Truth in Accounting

Social Security: The Annual Trustee Report - Cash Flows, Tardiness, and Other Views