Taxing Tuesday: Boo Hoo, High-States Under More Pressure, Head Taxes, and More

by meep

Let’s hit it!

MEGAN MCARDLE ON HIGH TAX STATES

Megan McArdle at WaPo: Democrats are about to have to pay up

Before the ink was dry on our new tax bill, outraged blue states were screaming about the cap on the deductibility of state and local taxes. Their governments were also frantically seeking ways around it, and small wonder. For decades, high-tax states with a lot of wealthy residents enjoyed a hefty subsidy from the rest of America. Legislators were understandably panicked over what voters might do when handed the rest of the bill.

That panic generated some desperate ideas. The most popular, currently, is allowing people to convert tax payments above the $10,000 cap into a “charitable donation.” New York, New Jersey and Connecticut have already passed laws to allow this.

While charmingly innovative, this approach is likely to fall afoul of tax courts, as will the other proposed tactics. Blue-state taxpayers may finally have to confront the full cost of the government they want. And Democrats will finally have to confront the tension between what those voters want government to do and what they’re willing to pay for.

Yeah, that’s the trouble, isn’t it?

And here’s the kicker:

Eventually, however, Democrats are going to have to either give up their big dreams or hand those voters the bill, because they’re the ones with most of the money. This creates a certain cognitive dissonance for progressives. “There’s a bitterness that all the tax cuts went to the rich,” says Marc Goldwein of the Committee for a Responsible Federal Budget, “and not enough of them went to the rich in New York and California and Connecticut.” Until that dissonance is resolved, Sen. Bernie Sanders (I-Vt.) will keep promising big new programs with laughably inadequate financing mechanisms — and blue-state legislators will denounce inequality while cooking up tax-evasion schemes to perpetuate it.

As I’ve found in my various stress tests, the SALT cap generally doesn’t bite until really high incomes.

What happens is that people like me – high income, living in a high-tax state and working in a different high-tax state – have a wash on the taxes. I don’t get a cut… but at least my federal taxes aren’t higher, either.

Mind you, my family isn’t “rich” compared to others in my town. For example, Bill Gates just bought a horse farm in my town for his daughter (as a graduation present) – not that I’ll ever see her around (I’m not part of the horsey set). I’m in the “poor” section of town, where incomes are in the mere 6 figures.

I’m not envious of the horsey set, though. They’re not in my way, and their local taxes (to the extent that their horse farm tax break means they pay any at all) help fund lots of services in my town. But those “poor” of us are pretty heavily taxed, too. We pay out the wazoo for services, and you better believe we get them.

McArdle Took it to twitter:

As the battle over "who subsidizes whom" winds into its fourth hour, let me remind you that mortgage interest and SALT deductions benefit ONLY taxpayers who are rich enough to 1) pay high marginal federal rates and 2) itemize their deductions (plus their wealthy jurisdictions)

— Megan McArdle (@asymmetricinfo) May 16, 2018

A lot of people will get swept into the much higher standard deduction, and not itemize anymore. And for those who do itemize, and find they can deduct less — well, it will be a lower rate applied to higher numbers — and it may be a wash (as I’ve found out for a lot of combinations).

STATE TAX REFORM: THERE ARE RIGHT WAYS AND WRONG WAYS

Something a little more dry.

Here are some tax reform stories at the state level:

Key Findings

State tax reform is a difficult process, but states like Utah, Indiana, and North Carolina, and the District of Columbia, illustrate that reform can be successful when it happens in a diligent and thoughtful way. Other states can learn much from these experiences.

All four of these jurisdictions lowered tax rates, broadened tax bases, and simplified their tax structures, improving their competitiveness.

Tax reform does not need to be a one-year effort. Indiana, for instance, instituted its reforms over a five-year time frame.

The use of tax triggers helped North Carolina and the District of Columbia ensure that they had sufficient revenues to pay for government services.

Kansas, however, illustrates an unsuccessful example of tax reform. Dramatically cutting a state’s revenue source, without offsetting spending or tax changes, puts the state’s fiscal health in jeopardy. These problems were exacerbated by Kansas’s special pass-through exemption, which narrowed the state’s tax base.

The high tax states do need to broaden their bases, or they end up way too dependent on very high income people, who tend to have very volatile incomes (because of how they make their money.)

I don’t see them going for spending cuts. But making sure that they don’t have to keep eagle eyes on billionaires should be helpful.

WHERE HAVE ALL THE MILLIONAIRES GONE? LONG TIME PASSING…

Speaking of taxing people with volatile income, here’s the Pioneer Institute with comments on Millionaires’ Taxes:

Study: Methodology of Noted “Millionaire’s Tax” Researcher Excludes Vast Majority of Millionaires

The work of a Stanford University Professor whose research has formed the foundation of efforts, such as one scheduled to appear on the Massachusetts ballot in November, to impose surtaxes on high earners is flawed because it excludes the vast majority of millionaires, according to a new study published by Pioneer Institute.

Professor Cristobal Young’s research has found that no more than 2.4 percent of U.S.-based millionaires changed their state of residency in any given year. But his methodology, which he describes as “people who earned $1 million or more in year t and changed their state of residency between year t and t+1,” captures just a small fraction of U.S. millionaires.

The ballot measure, known as Proposition 80, would amend the state constitution to add a 4 percent surtax on all annual income over $1 million.

The Federal Reserve Board estimates that there were 14.7 million U.S. households with net worth of $1 million or more in 2016, but only 6.8 percent of them had incomes of $1 million or more that year. During the same year, 92.3 percent of the 4.43 million households with net worth between $2.5 million and $10 million had incomes of less than $1 million, and would therefore be excluded from Professor Young’s research.

So, there are two bits here: the distinction between wealth (a.k.a. assets owned) and income (a.k.a. a cash flow in a given time period). Many very high income people can have negative wealth. You can always tell when the bust comes.

And here’s the unreliability about these sources:

When high net worth individuals do earn $1 million or more in a year, they tend to do it on an irregular basis. According to IRS data, the majority of U.S. taxpayers who reported gross annual incomes of $1 million or more over a nine-year period did so just once during that time. Less than 6 percent earned $1 million or more in each of the nine years.

A lot of the one-time payouts are from selling businesses and that sort of windfall, not any kind of steady income source. Think President Obama’s book advances – he doesn’t get those every year.

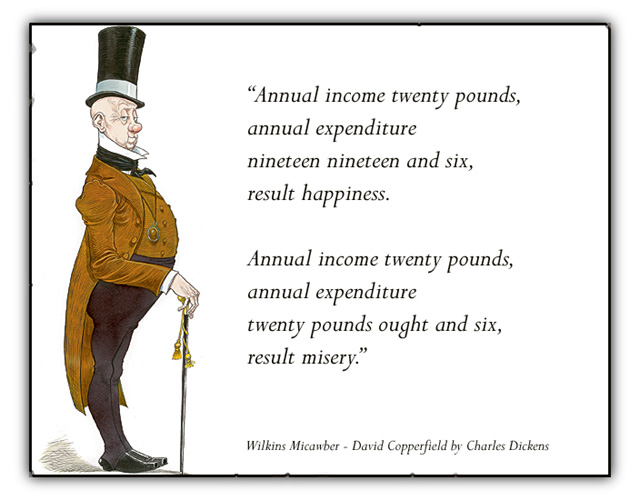

One would hope that one would accumulate wealth over time… but one can just ask Mr. Micawber about that.

Perhaps the states can learn from that.

Florida, which has no income, capital gains or estate taxes, accounts for almost half the out-migration of adjusted gross income from Massachusetts, far more even than New Hampshire, which also has no income tax. Professor Young argues that the evidence for migration of millionaires is largely driven by the Sunshine State and has written that “When Florida is excluded, there is virtually no tax migration.”

Okay, that’s pretty damn funny.

“If we exclude the state most people leave to escape taxes, then people don’t leave to escape taxes!”

MMmmm, that’s quite the argument you have there.

“Saying there’s virtually no tax migration when you exclude Florida is like saying that if you exclude Muhammad Ali, Louisville hasn’t produced many great boxers,” said Sullivan.

Heh.

CALIFORNIA KEEPS IT IN THE FAMILY

30 percent of California tax agency managers have a relative on staff

A California tax department where almost a third of managers are related to another employee is unwinding nepotistic chains of supervision six months after a state audit revealed a problematic concentration of personal relationships among staff.

California Department of Tax and Fee Administration Director Nicolas Maduros reported on Thursday that 141 of his department’s 484 managers has a familial or other close personal relationship to another employee.

A handful of those relationships appear to violate the department’s new anti-nepotism policy. Maduros said the department has corrective action plans for 17 of the managers whose relationships present conflicts for the organization.

That… is very high. I tried coming up with a legit explanation (group marriages!) but no, there obviously is a really big family problem there.

If only that sort of thing applied to political dynasties as well. I think we’re all sick of the Kennedys, Bushes, Clintons, Madigans (for the Illinois folks), etc.

More:

The State Personnel Board released an audit in November that found more than 800 of the 4,200 employees at the tax department has a familial relationship to someone else at the Board of Equalization.

The report drew attention to several instances in which job applicants appeared to receive a hiring advantage because they were related to someone at the department, and it questioned the hiring of a group of employees in December 2012 just before a law took effect that would have limited their potential retirement income.

Of course there’s a pension angle.

Nepotism is the destroyer of public trust and has no place in any governmental body including the California tax department. With nearly 1/3 of the dept. managers having a close relationship with other employees, I'm glad something is being done.https://t.co/Q8Txx4xoUo

— Steve Westly (@SteveWestly) May 21, 2018

ABOUT THOSE HEAD TAXES

So I’ve bashed Seattle a couple times for going with a head tax idea.

Yeah, I’m not done with that yet.

Seattle’s New Business Head Tax Law is Deeply Unpopular

The best that can be said for the Seattle City Council’s embrace of a $275 per-employee business head tax is that at least it isn’t $500 a head, as originally planned. Still, the city’s decision to tax employment is being panned all around, and rightly so.

Former Governor Christine Gregoire, a Democrat, blasted the tax, saying, “I firmly believe it is a tax on jobs. I firmly believe it undermines our international and national reputation.”

…..

Amazon, one of the city’s largest employers, didn’t mince words, saying in a statement that the new tax leaves the company “very apprehensive about the future created by the council’s hostile approach and rhetoric toward larger businesses, which forces us to question our growth here.” Starbucks was similarly outspoken; the company excoriated the Council’s decision, charging that the city “continues to spend without reforming and fail without accountability.”Supermarkets, which often operate on paper-thin margins, are particularly alarmed. Two Albertsons grocery stores are slated to close due to the high cost of doing business in Seattle. That’s not due to the head tax, but with this new burden, more closures could follow, reducing food access and affordability in low-income communities.

…..

Seattle is one of the few large cities in the country to impose a major business tax, the local Business & Occupation (B&O) gross receipts tax. In most other states, localities have no option to impose either a corporate income or gross receipts tax on businesses. The combination of a major business tax and an employee head tax seems to be completely unique to Seattle—and not in a good way.That’s why there’s been such broad bipartisan opposition to the head tax. It’s why Mayor Jenny Durkan (D) worked to bring the rate down from $500. And it’s why the story may not be over.

But wait, others are looking into this craptastic idea!

Great news for Texas!

— Rob Bernosky (@votebernosky) May 21, 2018

Cupertino mulls ‘head tax’ on Apple, other local businesses: report https://t.co/I1qLkaFtJQ #FoxBusiness

Cupertino mulls ‘head tax’ on Apple, other local businesses: report

Cupertino, California, the city that houses tech giant Apple’s global headquarters, is mulling whether to implement a “head tax” on its largest employers, according to a report Monday.

Under the proposal, Apple and other large employers would pay an annual charge for every employee that works in the city. Cupertino City Manager David Brandt told the San Francisco Chronicle that local officials have started polling the city’s residents on whether they would support the tax and where the tax revenue would be spent.

Fab idea, dudes. I think those tech companies have been sitting too long on the West Coast, and should spread more broadly geographically, like maybe siting in Iowa or something.

HEAD TAX TWEETS

Let’s just dump a bunch of tweets re: the head tax.

Seattle backs ‘head tax’ on large companies to help homelessness.

benshapiro</a> reacts: “Guess when homelessness will really increase – when Amazon picks up & leaves because there are plenty of states that would be happy to have them without leveraging a $75M per year tax.” <a href="https://t.co/7Dxta1G9tl">pic.twitter.com/7Dxta1G9tl</a></p>— FOX & friends (foxandfriends) May 15, 2018

Wowza. A pretty blunt statement from

Starbucks</a> senior vice president John Kelly on <a href="https://twitter.com/hashtag/HeadTax?src=hash&ref_src=twsrc%5Etfw">#HeadTax</a> passage in Seattle: <a href="https://t.co/JbrF4EnDJe">pic.twitter.com/JbrF4EnDJe</a></p>— Brandi Kruse (BrandiKruse) May 15, 2018

Amazon will pay about $12-$13 million a year under the tax on big businesses approved today by the Seattle City Council.

— Mike Rosenberg (@ByRosenberg) May 14, 2018

For perspective, Jeff Bezos has added an average of $10.6 million to his net worth every hour so far this yearhttps://t.co/IbgAqYjUUQ

(Someone doesn’t understand the concept of unrealized capital gains… which can easily become unrealized capital losses very rapidly.)

We need housing. We need accountability. But solving the problem costs a drop in the bucket to the money being generated in Seattle. Stop defending greedy Bezos as a victim. The working class people in Seattle pay tax here for social services for everyone. So can Amazon #headtax

— Jesse Zook Mann (@zookmann) May 14, 2018

Here’s a twitter thread from Angry Seattle, but I’m going to pick a few choice items from the thread.

The process didn’t bring together the city. It divided us. It showed how shitty and self-absorbed some of the councilmembers are (cough

cmkshama</a> cough).</p>— Angry Seattle (angryseattle) May 15, 2018

So, instead of sticking to sanity, you opted to compromise, even though you know this won’t do shit, other than piss off some businesses and make them rethink growing here.

— Angry Seattle (@angryseattle) May 15, 2018

I can tell you is not the head tax. Where is all the money going? That should be the first answer we get. Spending all that money on bike lanes when we have the homes/opioid issue at hand is just dumb.

— Uncle Papi (@Coastiepi) May 15, 2018

The city just made it $270 harder to hire a homeless person and help them get their lives in order. The city should also equip the fire department with kerosene to throw on house fires.

— Chanson (@Hellachans) May 15, 2018

'No head tax here' Tacoma digs at Seattle head tax in new video https://t.co/MHFL3mzO3s pic.twitter.com/8Hh3yARjcr

— KING 5 News (@KING5Seattle) May 19, 2018

Woot! Go for it Tacoma!

AND AS YOU GO

I can’t quit my first love, the soda tax.

From the files of DUH we have: Soda Taxes Are Not a Sensible Solution to Combat Obesity

A Bloomberg editorial published this week urged the expansion of soda excise taxes to help combat obesity. The piece argues that sugar-sweetened beverage taxes around the world “are steering people away from the most dangerous of empty calories,” and that “governments everywhere should tax sugar to persuade people to cut back.”

With obesity being a major driver of preventable disease incidence and health-care expenditure in the United States, obesity prevention is certainly a laudable goal. However, the fact that excessive sugar intake can contribute to obesity does not make soda excise taxes a sensible policy solution. Excise taxes are both too narrow and too blunt an instrument to address such a complex, multifaceted public health issue.

…..

A 2012 study by Cornell University found that, when faced with a new soda tax, many households reduced their soda consumption while purchasing an increased amount of beer, substituting one “vice” for another. Another study concluded that the impact of soft drink taxes on body mass index (BMI) is minimal and not statistically significant.…..

If “taxes on sugar won’t solve the world’s obesity problem,” as acknowledged in the editorial, then where do we stop? If a special tax is imposed on foods with added sugar, should saturated fats and processed foods be let off the hook? And since unhealthy dietary habits are but one of many factors contributing to obesity, ought we to impose tax penalties on missed workouts or time spent watching TV? Perhaps we could do annual weigh-ins (they do waist measurements in Japan!), and calculate an income tax credit program for those that meet the expertly-determined ideal number.

Ha, that would be popular. Poor and minorities hardest hit!

Related Posts

State Bankruptcy and Bailout Reactions: Chicago Pleads, Bailouts Rationalized, and Bailouts Rejected

A Tribute to a Whistleblower and Watchdog: Ernie Fitzgerald

Escheatment: Looking for change in the couch cushions