Wisconsin Wednesday: Is Contribution Growth Moderate?

by meep

So let’s consider the other side: is contribution growth moderate?

Yes.

LOOKING DEEPER: WISCONSIN DOLLAR CONTRIBUTION

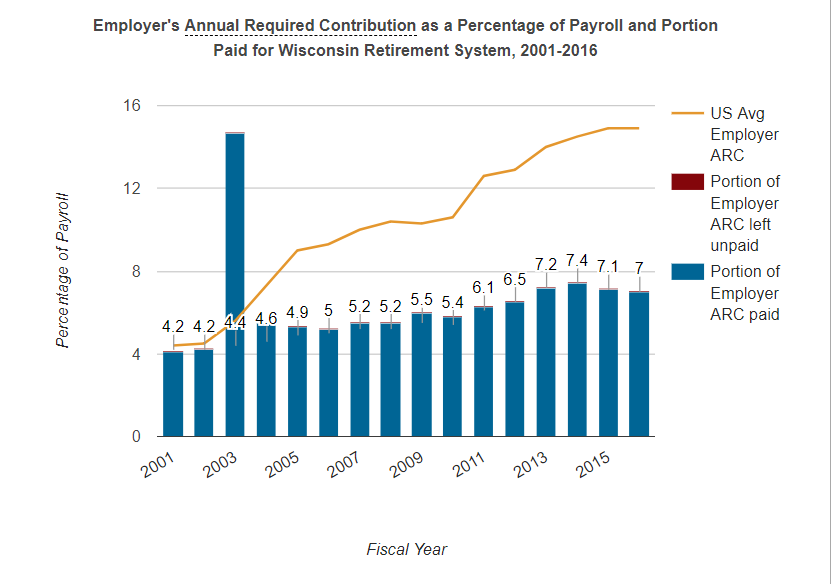

Okay, okay, that’s just a percent of payroll, and the employer contribution specifically.

And 2003… looks like a pension obligation bond…..

I am going to ignore the POB for right now, because it may actually be one of the rare times that it wasn’t actually a tool of Satan.

So let’s look at what was actually contributed to the pensions, by the employers and employees.

Now the fun part of doing these graphs is that certain things just pop out at you. Like, I bet that the 2005 data is wrong – I bet the employer and employee contributions got mixed up between the two.

Graphs really make that stand out.

Also, I don’t see the obvious POB from 2003, but that’s okay. Maybe it’s somewhere else in the database, and I didn’t find it yet.

Anyway, the Employer contribution amount grew at a 5.7% per year increase, and the Employee (but not per-employee) contribution amount grew at 4.1% per year increase, from 2001 to 2016.

Is that moderate?

COMPARED AGAINST OTHER SYSTEMS

As with the benefit amounts, let’s actually compare this against other states with similar contribution amounts in 2001.

We’re not going to worry about the employee contribution rate (though that can be concerning — if it grows too rapidly for your workforce to absorb, there will be trouble.)

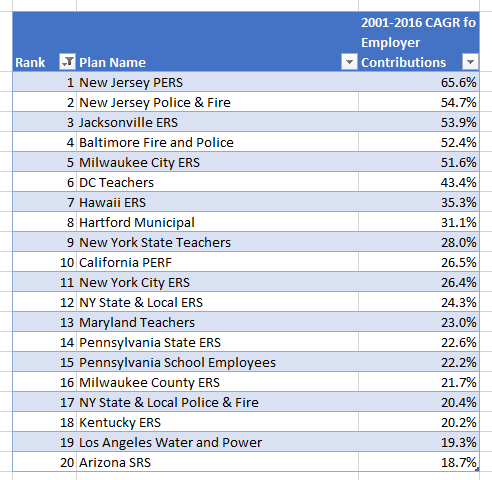

Let’s just compare Wisconsin against all the other plans I can get 2001-2016 contribution growth rates for.

I was able to get 138 plans for which I had information on employer contributions.

Here is where Wisconsin lands:

That’s fairly low down in the ranking.

Heck, let’s check what’s at the very bottom of the ranking:

Uh… many of those plans are in horrible condition. You may not believe Wisconsin’s “perpetual 100% funded ratio”, but when a public plan says it’s less than 40% funded, you should probably believe them.

Let’s check at the top of the ranking list:

Whoa.

WHY THOSE ARE NOT FAIR COMPARISONS

So let me go down the list of why these contribution growth rates, especially over 2001-2016, may be misleading:

1. Many public plans aren’t making “full” contributions… even under some very optimistic valuation assumption sets.

2. Many public plans specifically did some dodgy stuff in the early 2000s, taking contribution holidays after the huge run-up of the late 90s dot-com boom. So the starting contributions are artificially low.

3. I had to delete a few fairly important plans… like some major Illinois plans… because I didn’t have complete data for them.

It may be interesting to compare the funded ratios against the contribution growth rates….

Yeah, there’s no connection.

Anyway, yes, Wisconsin employer contribution rates are quite moderate.

Good for them.

That’ll do, pension plan, that’ll do.

Related Posts

Wisconsin Wednesday: Is Benefit Growth Moderate?

Introducing this Week's State Pensions Example: Nevada

Public Pension Watch: California and Illinois Executive Resignations, Spiking v. California Rule, and more!