Taxing Tuesday: Don't Blame the SALT Cap for the Pain of High Taxes, Also: The Quest for Trump's Tax Returns in Tweets

by meep

This SALT cap thing is probably going to be litigated for the next 4 years.

Okay, maybe not. I hope it gets to SCOTUS, and the high tax states definitively lose.

But let’s go to the recent tax-related stories.

ILLINOIS POLS WOULD LIKE TO BLAME OTHERS FOR THEIR HIGH TAX PAIN

In high-tax Illinois, stark differences on state, local tax deduction caps

Cut the highest state and local taxes in the country or remove the federal SALT deduction cap, that’s the debate between Illinois’ Democratic congressional delegation and their Republican colleagues siding with Gov. Bruce Rauner.

The SALT deductions were capped at $10,000 in the tax reform bill congress passed in late 2017. The Republican-controlled U.S. House passed a measure last month to the Senate that would make that cap, along with the individual federal income tax cuts, permanent.

U.S. Rep. Rodney Davis, R-Taylorville, sponsored the House bill. He said only about a third of his district actually took the SALT deduction when it was offered.

The nonpartisan Tax Foundation reports the average Illinois family keeps $2,300 because of the federal tax cuts. But Illinois also has among the highest state and local tax burden in the country.

…..

Republican U.S. Reps John Shimkus and Adam Kinzinger said the real answer is to lower the state’s taxes.“That’s the answer,” said Shimkus, R-Collinsville. “The onus should be on the state of Illinois not on the federal government.”

“Look, this state has been mismanaged for a very long time and the current governor has done his best to pull us out but it’s a deep hole,” said Kinzinger, R-Channahon, “and when you have among the highest property tax rates in the free world, in the United States of America, obviously something is wrong with how Springfield is being managed and that’s something that needs to be handled.”

The problem is, of course, Illinois really can’t withdraw from their high-tax ways. They have old promises to keep, and the money has to come from something.

If they get around to cutting costs somehow… but, let’s take a look at the “promises” of the likely next Illinois governor.

NO MATTER WHO WILL BE ILLINOIS GOVERNOR: I PREDICT A LOT OF TAX PAIN

Do you really want to vote for an even bigger Illinois tax burden?

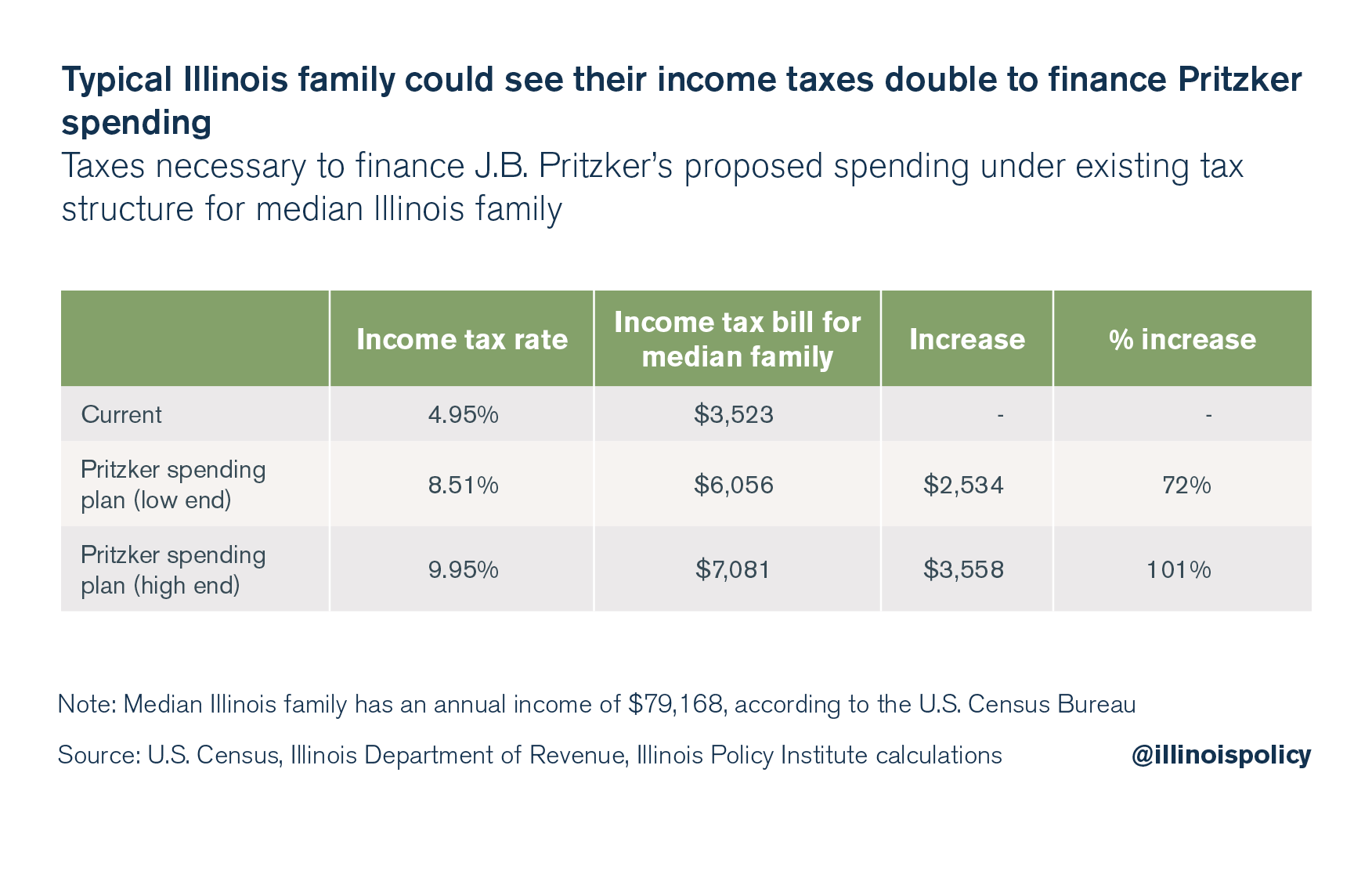

Illinois Democratic gubernatorial candidate J.B. Pritzker has been unwilling to share his proposed progressive income tax rates or details about how much his policy agenda will cost taxpayers. But people who study policy, such as those at the Illinois Policy Institute, can calculate how much the kinds of programs Pritzker is selling will cost, and it’s a hefty tab: As much as $18 billion in new spending, according to the institute.

A bill this large would require nearly doubling Illinois’ personal income tax to almost 10 percent. A typical family could see its state income tax bill rise to more than $7,000 from $3,500, the institute predicts.

…..

Pritzker has made it clear what he believes will put Illinois back on the path to prosperity: higher taxes, higher spending and higher debt. He wants to roll back the scholarship tax credit program for poor students in struggling school districts and he has ruled out reforms to the public employee pension scheme that is bankrupting Illinois. His proposals would also include up to $1 billion for universal taxpayer-funded preschool, $5 billion in bonds to cover unpaid bills and billions more in new infrastructure spending.Other proposals, such as government-provided health insurance, are not easily calculated because of a lack of sufficient detail, but would certainly add additional costs for the state.

Add it all up and you get a tab of up to $18 billion in additional state spending.

Well, for a while at least. At some point, the bond market may not swallow all the bonds Illinois tries to sell.

With Democrat control of both houses, coupled with the likelihood of higher taxes and spending, Illinois would be on the fast track to economic ruin.

As opposed to its current slow-ish track?

Rauner looks unlikely to win re-election. But even if he were to win, taxes almost definitely are going to rise on Illinois residents, no matter what the legislature does… because the need to cover ever-increasing pension contribution costs will keep ramping up, especially if the legislature does nothing about it.

Here is the study on Pritzker’s promises

Here’s a “nice” table:

A thought: maybe Illinois should be thinking about how they can fulfill their old promises. The recent debate between Rauner and Pritzker doesn’t make me feel like that’s in the cards at all.

PRO BONO TAX LAWSUIT

I knew that Westchester County was on the forefront of suing against the SALT cap.

I didn’t know my own town was at that forefront as well.

Post from North Salem Town Supervisor Warren Lucas:

On September 17th Assemblywoman Amy Paulin met with me and other Town Supervisors of Westchester at monthly we hold to discuss topics of interest. She was looking for help in putting together a coalition of municipalities and school district’s who would work to deliver comments to the IRS proposed regulations which they issued on August 27.2018.

The legal firm of Baker and McKenzie which specializes in IRS tax law and regulations agreed to do the work free of charge. The initial comments, an 85 page PDF, is attached.

….

Our group called the “Coalition for the Charitable Contribution Deduction” (3CD), consists of local governments including counties, cities, towns, villages. and school districts, in the states of New York and New Jersey, along with state and countywide professional and advocacy organizations.Baker & McKenzie LLP, on behalf of the 3CD coalition submitted our 85 page response to the IRS’s yesterday.

Regardless of your opinion about the tax reductions and our Federal government, not allowing the deduction of (Income tax+real estate taxes) together totaling over $10,000 will have an adverse affect on housing values and sales in our Town and in Westchester County and will impact some of our residents.

While the Federal tax cuts will save a larger percentage of homeowners money on their 2019 income taxes not everyone will see a reduction based on their individual circumstances. For that reason the Town Board felt it necessary to support Assemblywoman Paulin and Assemblyman Buchwald in getting this coalition setup and as such our residents.

North Salem was the first Town in Westchester to join 3CD with a anonymous vote of the Town Board in our September 24th meeting.

Anonymous vote of the town board? WTF?

Okay, whatever, it looks like the law firm is doing this pro bono, and likely because the partners are directly affected by the SALT cap themselves. Fair enough.

I’m not going to read the whole 85 page document, and not even the introductory remarks, because it is full of tax law stuff that I am not expert enough to comment on.

I will comment on one thing I see in the paper — they mention the various charitable funds for private schools, and how this is used to get around the AMT (alternative minimum tax), etc. Alas, that wasn’t written into the previous tax law either, but was just how the IRS had been treating things.

I imagine those funds are similarly going to get hit with the new ruling from the IRS. Indeed, I believe the IRS commented on that very fact. Too bad.

Interestingly, there is a bit about businesses (not individuals) making contributions. Hmmmm. Maybe there still will be a workaround.

TAX TWEETS AND LINKS

Let us let these tax tweets fly!

I took this test and released the results for anyone who cares to see because I’ve got nothing to hide. What are YOU hiding,

realDonaldTrump</a>? Release your tax returns – or the Democratic-led House will do it for you soon enough. Tick-tock, Mr President.</p>— Elizabeth Warren (elizabethforma) October 15, 2018

=snort= Yeah, he’ll get right on that.

This is impossible to check because Trump refuses to release any of his tax returns https://t.co/9UcKmQ7ZuQ

— Chris Cillizza (@CillizzaCNN) October 16, 2018

last fall: Treasury Secretary Mnuchin says “Not only will this tax plan pay for itself but it will pay down debt,” boosting revenue/cutting deficits through growth, reduced corporate tax avoidance

— John Harwood (@JohnJHarwood) October 15, 2018

this fall: Treasury reports 2018 deficit up 17%, corporate tax payments down 31%

4 Republican policies led to a $779 billion deficit in 2018:

— Bernie Sanders (@SenSanders) October 15, 2018

- Bush Tax Cuts: $488 B

- Trump Tax Cuts: $164 B

- Wars in Iraq and Afghanistan: $127 B

- Defense increases since 9/11: $156 B

Without tax cuts for the wealthy and endless wars we would've had a $156 billion SURPLUS.

We shouldn’t have to beg elected officials to disclose their financial interests – that's why I've released my tax returns from the past 10 years. My plan to #EndCorruptionNow would force

realDonaldTrump</a> & all federal candidates to release theirs too.<a href="https://t.co/BGVfmiuMq9">https://t.co/BGVfmiuMq9</a></p>— Elizabeth Warren (SenWarren) October 16, 2018

If Trump wanted to prove his lack of conflicts with Saudi Arabia and Russia, he could release his tax returns.

— Kyle Griffin (@kylegriffin1) October 16, 2018

So I guess I see what the talking points are right now. Interesting that the supposed tax fraud story didn’t have “sex appeal”… oh wait, I meant, completely as expected, nobody is much interested in this tax stuff (except what taxes they themselves have to pay.)

I was told the tax cuts would pay for themselves. https://t.co/pYQbnguQOy

— Matt Fuller (@MEPFuller) October 16, 2018

REMINDER: Yesterday was the deadline for Trump to file his 2017 taxes.

— Chris Cillizza (@CillizzaCNN) October 16, 2018

(He asked for an extension in the spring.)

I’m pretty sure Trump has accountants for that. Heck, I assume his tax accountants were the ones who filed for the extension to begin with. That’s what they’re paid for.

Currently, just three big taxes – income tax, National Insurance contributions and VAT – account for 60% of revenues. Increases in the rates of these taxes could raise substantial sums ¾ pic.twitter.com/FDdU6HCHyi

— IFS (@TheIFS) October 16, 2018

Raising tax revenue by 1% of national income would put the tax burden in the UK at around the highest level seen in the post-war era. It would still leave the UK’s tax burden ranked near the middle of OECD countries (2/4) pic.twitter.com/miYYd2JV3E

— IFS (@TheIFS) October 16, 2018

And finally:

Social Security and Medicare are NOT entitlements. Social Security is an annuity paid for with a separate payroll tax. The more you put in, the higher the payment. Medicare is also paid by a separate payroll tax. https://t.co/jklOB0bada

— Dan Spencer (@VeganAndHeathen) October 16, 2018

There is so much wrong with this….. I will just leave it at: no. Social Security is not an annuity.

Annuities actually have reserves and guarantees.

Tax stories:

- Tax evasion: blacklist of 21 countries with ‘golden passport’ schemes published

- Republican Super PAC Says Little About Tax Reform in Campaign Ads

- Ending austerity could push UK tax to highest since 1940s – IFS

- What’s a Service Business? That’s Now a Multibillion-Dollar Tax Question

- MARC BENIOFF WANTS TO TAX BILLIONAIRES, INCLUDING HIMSELF

- 6 Whopping Tax Mistakes That Can Ruin Your Retirement

- Tesla’s Nevada tax ‘clerical error’ rankles subsidy critics

- Why Limits on State Tax Deductions Might Not Be Such a Big Deal After All

- How to game the new standard deduction — and 3 other ways to cut your 2018 tax bill

- Republicans take gas tax repeal message to the pump in California

- Democrats will be able to make Trump’s tax returns public if they take back Congress. Here’s how.

Back to the Trump tax returns issue.

I really don’t see “Vote for us! We’ll publish Trump’s tax returns!” as a great motivator for voters to go to the polls (from either side), or to convince middle-of-the-roaders.

I don’t think many people actually care, including the various people who bray about Trump’s tax returns every day.

Mrs. Trump, what do you think?

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/60140131/My_Post__21_.1529608579.jpg)

Yeah, that’s what I thought.

Related Posts

Taxing Tuesday: Republican Tax Ideas for an Election Year

Friday Trumpery: DOL pick, take two

Friday Trumpery: No Exemptions for State-Run "Private" Pensions [UPDATED]