Can the Government Tell If You're Dead or Alive?

by meep

The following story popped up in my twitter feed:

Ex-Chicago police commander spared prison for collecting dead mom’s Social Security checks for years

Before I start quoting the story, let me fix that headline:

Ex-Chicago police commander spared prison for collecting dead mom’s Social Security checks for over 23 years

That’s better. I could put in the dollar amount as well, but whatever.

Here is the heart of the story:

A former Chicago police commander once considered a rising star in the department was spared federal prison Tuesday for pocketing more than $360,000 in his dead mother’s Social Security payments over the course of more than 23 years.

U.S. District Judge Manish Shah sentenced Kenneth Johnson to two years of probation and ordered him to serve the first six months in community confinement, likely at a Salvation Army facility in Chicago.

…..

In addition to the period of probation, Johnson will have to pay back all of the money he stole, Shah said.

…..

Johnson, 55, pleaded guilty in May to theft of government funds, admitting he failed to notify the Social Security Administration when his mother died in May 1994 and instead continued to cash her monthly checks. In all, Johnson stole a total of $363,064 from the time of his mother’s death to November 2017 when the scheme was uncovered.In seeking up to two years in prison, federal prosecutors revealed in a recent court filing that Johnson withdrew some of the stolen funds from an ATM while at work at the Englewood District police station.

In 2016, Johnson used stolen funds to pay for a hotel room in Phoenix, according to the filing. Two months later, he used other Social Security payments for round-trip airfare to Los Angeles to attend a “crime-fighters conference,” prosecutors said.

…..

The scheme was eventually unraveled by a watchdog arm of the Social Security Administration that red-flagged Johnson’s mother’s account in 2017 because she had not used Medicare, even though at that point she would have been 96, according to the prosecution filing.After sending a letter to the woman’s last-known address and receiving no response, the payments were stopped and the matter referred to the agency’s inspector general, who determined Johnson’s mother had, in fact, died at age 72.

So many things to address in this story.

GETTING THE DETAILS CORRECT ABOUT PEOPLE

First, let us consider the perp, Kenneth Johnson.

In the Tribune article, it says he is 55 years old (in 2019). He started receiving his benefits in 2012 — when he was 48 years old. He was a 32-year veteran? He started when he was 16 years old? What?

I think the Tribune got his age wrong. I bet he’s 65 years old now, not 55. Then he retired at age 58, and started when age 26. All that makes sense from what I know about standard cop careers. Flubs do happen, but it might be a good idea to check that age on Johnson.

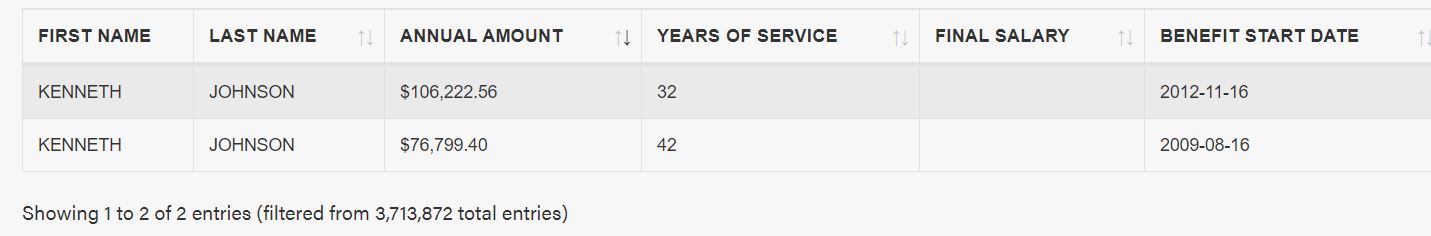

We can actually look up Kenneth Johnson’s pension amount: $106,222.56 in 2017 [there is another guy with his name, but I think the one who retired in 2012 is who we want].

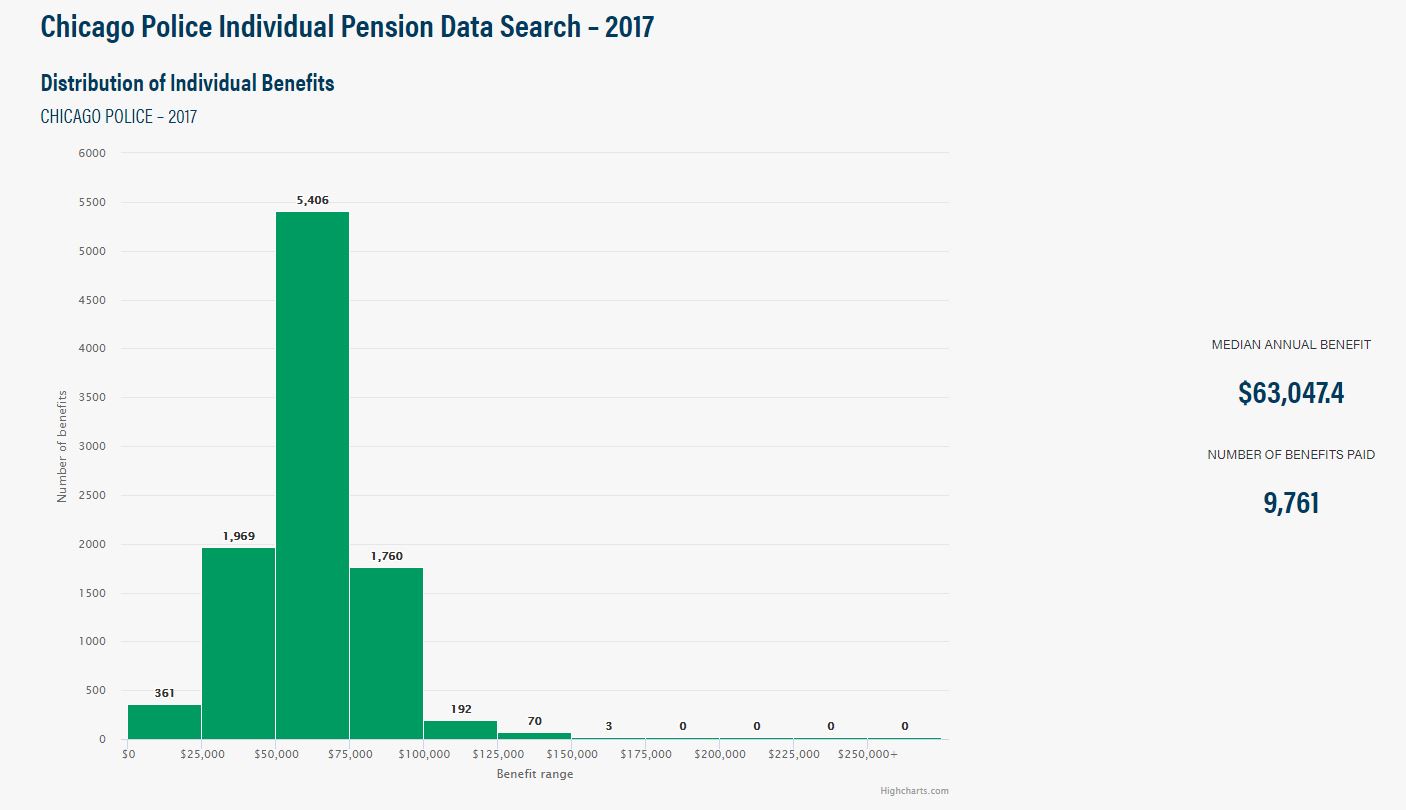

According to the Better Government Association, about 300 people for Chicago Police had pensions over $100K:

But again, that makes sense given he was a commander. I expect the higher-ranking guys to have higher pensions.

Finally, let’s consider that he stole $320K over 23+ years, and that averages to about $15K per year, which actually sounds about right for Social Security benefits.

He would be able to pay these back in a few years, if his pension were entirely garnished (it won’t be completely garnished.)

Also, yes, he gets to keep his pension, because it gets yanked only if your misdeed relates to your job. He stole from the federal government, not from Chicago. So he’s safe there.

That pretty much disposes of my issues with Mr. Johnson. He is not the first person to do something like this, but being able to do it for over 20 years is pretty special.

TWO LARGER ISSUES

But now I want to address bigger issues:

1. The increasing possibility of this type of fraud

2. What kind of systems on checking on the elderly or other people receiving regular benefits do we need to have?

INCREASING POSSIBILITY OF FRAUD: SOCIAL SECURITY IS DIRECT DEPOSIT ONLY NOW

Back in ye olden times, my grandma had to get a PO Box, because people would steal her Social Security check when it came, monthly. They knew when the checks came. And yes, it was a bit tough to cash a check not made out to you, but I guess they figured a way.

But it’s even easier when the cash goes directly into a bank account, and somebody just needs a card/online access to get the cash.

Since 2013, Social Security has been direct deposit only:

If you apply for Social Security or Supplemental Security Income benefits, a new law went into effect March 1, 2013, requiring that you receive your payments electronically.

Now, you may wonder about the “unbanked”. Don’t worry — they can send cash to debit card.

What are direct deposit and Direct Express?

By choosing to get your Social Security or Supplemental Security Income benefits by direct deposit, we will electronically deposit your funds directly into a bank’s depository account (e.g. checking account, savings account, and prepaid card account).

By choosing Direct Express, we will electronically deposit your funds directly into a prepaid debit card account. Direct Express has no enrollment fee or minimum balance requirement to open or use the account.

I seriously do not know what anti-fraud protections are on these debit card accounts. How easy is it for a family member to take these cards and use them?

Now, it’s mainly a matter of how deaths get reported to various financial institutions, etc. I’ve been keeping track of stories like this since 2010, but it’s not comprehensive. I don’t have a search looking for these stories — indeed, I didn’t particularly notice this one until the sentencing. He got the conviction itself in May.

Very few of these stories have to do with hiding a dead body (though it is involved in a few) — it is tough to do that, so I don’t expect fraud to come from that.

I see the potential for increased fraud is that as people get older, they are more likely to have other people to handle their finances (informally or formally), and that I could see it as relatively easy for people to simply not close accounts or report the death to all the institutions they should. Heck, one could be having the money go to a joint account, so bank accounts would not necessarily automatically close, even with a good death reporting system.

But the problem becomes that once you’ve started down this fraud path, what is your exit strategy? At some point, the systems will realize the person the money is going to is way too old. Like with Johnson, who had to have had years of anxiety over getting caught — early on, he may not have thought about it, but as time went on, it became more and more likely. This English woman had a similar length of time of collecting her mother’s pension: 22 years.

In Johnson’s case, the way the account was flagged was that his mother was supposedly 96 years old. And she hadn’t used Medicare at all. That’s kind of a giveaway.

So they sent a letter to her last known address, and then stopped payments once they received no answer.

She had been dead for over two decades at that point.

Could that have been caught earlier?

Should it have been caught earlier?

SHOULD WE HAVE REGULAR CHECKS THAT A PERSON IS STILL ALIVE?

Here is an amusing tale: when the oldest person in the world died in July 2010 (man, they keep doing that), the next-supposedly-oldest person was on a list and they went to go talk to him… and the person had been dead for decades.

Sogen Kato (22 July 1899 – c. November 1978) was a Japanese man thought to have been Tokyo’s oldest man until July 2010, when his mummified corpse was found in his bedroom. It was concluded he had likely died in November 1978, aged 79, and his family had never announced his death in an attempt to preserve his longevity record. Relatives had rebuffed attempts by ward officials to see Kato in preparations for Respect for the Aged Day later that year, citing many reasons from him being a “human vegetable” to becoming a Sokushinbutsu. The cause of death was not determined due to the state of Kato’s body.[citation needed]

The discovery of Kato’s remains sparked a search for other missing centenarians lost due to poor record keeping by officials. A study following the discovery of Kato’s remains found that police did not know if 234,354 people over the age of one hundred were still alive. Poor record keeping was to blame for many of the cases, officials admitted.

Indeed, somebody did a research project finding that almost the “WOW, They’re long-lived!” places were where there was poor record-keeping. Also, it helped to have an incentive (like, say, a guaranteed pension) to fake one’s age. When Stu mentioned an area of Japan where people supposedly lived to very advanced age, I mentioned that I bet it was a poor area. [And indeed, the particular area Stu was talking about is in the paper.]

Here’s a Vox piece on the phenomenon:

[I]t looks like the majority of the supercentenarians (people who’ve reached the age of 110) in the United States are engaged in — intentional or unintentional — exaggeration.

The paper, by Saul Justin Newman of the Biological Data Science Institute at Australian National University, looked at something we often don’t give a second thought to: the state of official record-keeping.

Across the United States, the state recording of vital information — that is, reliable, accurate state record-keeping surrounding new births — was introduced in different states at different times. A century ago, many states didn’t have very good record-keeping in place. But that changed gradually over time in different places.

Newman looks at the introduction of birth certificates in various states and finds that “the state-specific introduction of birth certificates is associated with a 69-82% fall in the number of supercentenarian records.”

…..

The paper puts forward a controversial proposal. It seems unlikely that living in high-crime, low-life-expectancy areas is the thing that makes it likeliest to reach age 110. It seems likelier, the paper concludes, that many — perhaps even most — of the people claiming to reach age 110 are engaged in fraud or at least exaggeration. The paper gives a couple of examples of how this might come about; some of it might be reporting error, and some of the supercentenarians might be produced by pension fraud (someone might be claiming a dead person is still alive for pension benefits, or claiming the identity of a parent or older sibling).

And now, what with direct deposit and bill autopay, unless we have somebody going around checking that somebody alive is using the money being deposited and then disbursed, you may not know they’ve been dead for some time.

A US Navy veteran whose body was found inside his apartment in Dallas, Texas, is believed to have lain dead there for three years.

Ronald Wayne White’s family said they had reported his absence to the authorities on numerous occasions.

His body was discovered during an investigation of apartment units whose tenants had not been using water in the DeSoto area complex.

…..

His mother, Doris Stevens, who lives in Long Island in New York, said her son had regularly contacted her – but his calls ceased three years ago.She said she had reported her son missing to several different police departments, but had been told that because he was an adult and travelled extensively for work, a missing person investigation could not be opened.

…..

Pete Schulte, a detective with the DeSoto Police Department, said Mr White’s month-to-month lease on the apartment had been paid from an account into which his Navy retirement fund was regularly paid.

With more and more people living alone, this sort of thing will be happening more regularly, doncha think?

[I had this happen to a relative of mine, btw. My mom was pretty much the only person regularly calling this specific cousin, and when she hadn’t heard from him in a month, she asked other relatives to see if they could get a hold of him…. and then they asked the cops to do a welfare check. He had been dead for a month.]

In the case of White, there was no fraud. But fraud or no fraud, we may want to think about how we deal with automated systems and how to detect whether somebody is actually alive.

SOMETIMES IT REQUIRES PEOPLE TO DO THINGS

We also don’t want the horrors of somebody declared dead when they are quite alive, and are cut off from funds:

Sherry Ellis found out she was dead the day after Halloween.

The 73-year-old from Magnolia, Texas, was picking up her prescription from Walgreens when her bank card was declined. She said she knew something was fishy because the card was three months old.

So she went to the bank, and after rounds of phone calls Ellis found out she had been declared dead by the Social Security Administration.

….

The Office of the Inspector General said in 2016 the SSA sees fewer than 1,000 cases of mistaken death declarations a month. CNN has reached out to the SSA via email.The OIG also said mistaken deaths can lead to mistaken benefit terminations and “cause severe financial hardship and distress” for people like Ellis. She told CNN Saturday a social security check, her Medicare and secondary insurance were put on hold. She takes 10 different medications for blood pressure, a stomach condition and heart issues that can cost up to $1,400 without insurance.

“Medicare says they can’t do anything until SSA resurrects me,” she said.

So I’m ending this post in a place you probably weren’t expecting:

With various systems that we’ve put in place to reduce various frictions of life (not needing to go to a government office to pick up cash, to not needing to go to a bank to deposit funds, to not needing any physical presence whatsoever to take retirement money to pay regular expenses), we have difficulty having a reliable way to make sure whether somebody is alive or dead for all these systems.

But one thing is for sure:

After getting the news of her death, Ellis traveled an hour out of her way to the nearest SSA office to rectify the problem. It became a slow process.

“The Medicare office told me it might take up to 45 days to resurrect me,” she said, adding that she was in limbo for the next week. She was given a letter that basically said she was alive, but her doctor and pharmacist weren’t able to take it because she was still classified as deceased in their systems.

….

Ellis says she called local news station and CNN affiliate KTRK-TV to tell her story and since then her bank card and secondary insurance were revived. She says she won’t know until Monday if she’s still legally dead. She told CNN she was confused as to why correcting this issue is such a hassle.“I think in this day and time, if SSA finds out that they’ve made a mistake and they accidentally used someone’s social security on a death certificate, if it only took the click of a key to pronounce somebody dead, why can’t it take 30 minutes to make them alive?” she said. “Why can’t they reverse it just as quick?”

They can’t do it as quickly because they’re government.

Frankly, whether or not you’re dead is not their problem. The people who screwed up are not going to get fired, their pay is not going to get docked, and their benefits are not going to be cut off.

Maybe they’re hoping that with having trouble getting her medication, she can die before they have to actually do a damn thing. [yes, that’s me being mean. But given the government systems have no other potential punishment other than mockery….]

Let’s just say: whether a person is dead or alive is a question too important to let the government handle.

But who should do it?

[Somebody who can be sued]

Anyway, something to think about.

Related Posts

Mortality Nuggets: Car Crashes, COVID Deaths, and the WONDER of the CDC

Mortality with Meep: Cause of Death Trend -- Heart Disease -- 1999-2020

Chicago Homicides Quick-Take: 2020 is as Bad as 2016, Just More Concentrated