States Under Fiscal Pressure: New York and New York City

by meep

I should probably do these as two separate entities, but the finances of NYC do drive the state [whether it should is a question, but not for now], so I will combine stories on both.

The rioters and looters in NYC did cut down on attention to the fiscal hit due to COVID. Now, it’s a fiscal hit due to COVID and a bunch of busted-out windows on Fifth Avenue. But it’s not the city’s windows, right?

Oh, right, they want taxes from those stores. Oops.

Well, let’s see how the state and city are doing, money-wise.

New York asks for money

Every night, Cuomo sends an email to those of us who want COVID-related updates.

On May 27, this was in the email:

3. I am calling on the U.S. Senate to pass a COVID relief bill that helps all Americans and provides fiscal support to states. State and local governments have seen revenues go down and costs go up due to COVID — we need federal relief so that we can support hospitals, firefighters, teachers, police officers and other working Americans. In Washington D.C. today, I also met with President Trump and urged him to support a public infrastructure program to help supercharge the economy. We have shovel-ready projects in New York — all we need is federal approval.

Here is a press release on various items from the presentation that day:

Amid the ongoing COVID-19 pandemic, Governor Andrew M. Cuomo earlier today called on the U.S. Senate to pass a coronavirus relief bill that helps all Americans and provides unrestricted fiscal support for states. The next bill should focus on funding state and local governments, working families, state testing and tracing efforts and a real economic stimulus with no handouts to corporations who do not protect their workers and only enrich executives or shareholders. The House of Representatives has already passed a bill that includes $500 billion for states and $375 billion for locals; Medicaid funding for the most vulnerable; increased SNAP food assistance; 100 percent FEMA federal assistance; funding for testing; and repeals SALT cap to help states most affected by COVID-19.

Governor Cuomo also reiterated his call for the U.S. Senate to repeal the SALT limitations. The states most impacted by COVID-19 represent more than one-third of the national GDP. They also send tens of billions of tax dollars more to the federal government than they get back, and the dollars they send are then redistributed to other states and big corporations. These very same states that have been most impacted by COVID-19, are also the states that were hit hardest by the cap on state and local taxes, the politically motivated first double tax in U.S. history that was implemented by the federal tax law in 2017.

Ah, yes, the SALT cap.

As noted in the press release, the House HEROES bill had a SALT cap repeal.

For what it’s worth, the biggest money moving around isn’t to “states” and “big corporations”. It’s transfer payments to individuals in the form of Social Security and Medicare. That is attached to specific individuals, and there are some components related to where you live (for Medicare), but not much.

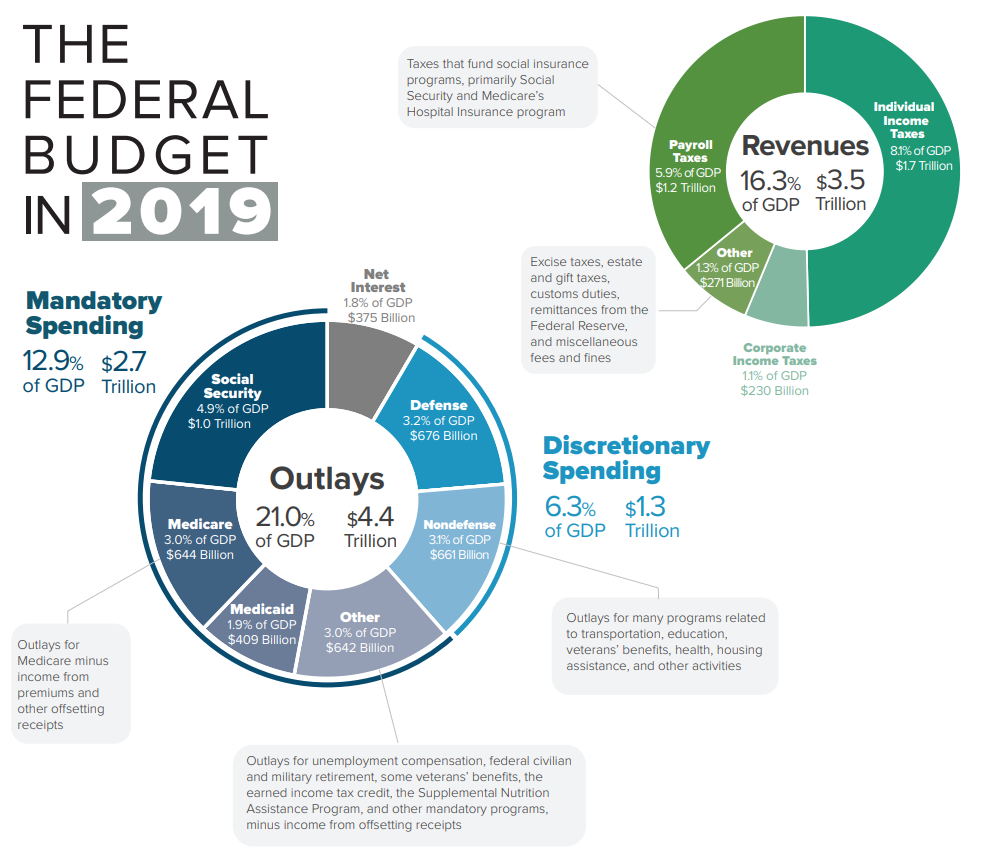

Here’s a nice image, courtesy Wikipedia:

“Mandatory spending” is a misleading term, but let me leave that for now.

Social Security benefits, by themselves, are 23% of the federal expenditures. Medicare another 14%. Over a third of federal expenditures are those two programs, and it doesn’t matter that the cash is going to Florida and other hot retirement spots, and not so much to New York.

Medicaid may be a bit more to the point, as states are directly involved in that. New York is tops in this sort of spending:

2. New York

2015 state health spending: $2,911 per capita ($57.6 billion)

State government spending, all programs: $9,376 per capita (7th highest)

Population 65 and over: 15.3% (22nd lowest)

Population with a disability: 11.5% (11th lowest)

Population with health insurance: 93.9% (17th highest)

And, of course, the federal government chips in on Medicaid.

Similarly: Top 10 States for Medicaid Spending [in FY2016], where New York is number 2, just below California. NY spent $63 billion, and California spent $82 billion.

In any case, no, the HEROES Act is not going to get through the Senate, and, as far as I know, has been completely ignored in the Senate. They have other things to do.

Also, New York has other things to do, such as keep an eye on their pensions.

Are New York pensions strong?

I got an email from the state comptroller a few weeks ago, with a link to the following video:

Now, this is an unlisted video, meaning you can only get to it via a direct link [nobody will just “discover” it].

I thought that a little strange. Why not make it public and discoverable? Heck, it’s linked from the actual comptroller website, so I’m not sure why this video is being hidden.

Anyway, part of this is in reaction to a statement made by a Republican congressman:

“States like New York, Illinois and California have been vocal in their demands for funding to bail out their pension systems, which were failing long before the COVID-19 outbreak, and other programs that aren’t related to this crisis.”

So what did Politifact write about this?

An analysis of the pension systems in all 50 states in 2017 by the nonpartisan Pew Charitable Trusts, released in June, found that New York was one of only eight states that had at least 90% of its pension obligations funded. New York had assets to cover 94.5% of its pension obligations.

E.J. McMahon, who analyzes state finances at the conservative Empire Center for Public Policy, said no bailout is needed for New York’s pension system, “which by public-sector standards is among the best-funded in the nation.”

New York State Comptroller Thomas DiNapoli, who oversees the pension fund, has called the fund “well-funded and strong,” despite the economic disruptions related to the pandemic.

DiNapoli said in a statement that a bailout is not needed and has not been requested.

The pension systems in other states Biggs mentioned, Illinois and California, have different situations. Illinois has one of the three worst-funded systems, at 38.4% funded, and officials there have asked for a bailout of the pension fund.

Are New York pensions strong? Well, yes and no.

The state funds are doing pretty well, as mentioned in the Politifact piece.

The city funds — by which I mean New York City — are not.

New York City Pensions

Back in 2016, I took a quick peek at New York City pensions and said:

STATE VS CITY

In any case, interesting dichotomy between the state results and NYC’s results, but I can’t say I’m surprised.

The localities don’t control what contributions get made and what benefits are awarded: the state tells them what to do.

But New York City… ah, they set their own benefits, contributions, assumptions, etc.

In both cases, they’re seeing escalating costs just to keep their funded ratios level. But the state’s level is much closer to fully-funded than the city’s.

At least under the assumptions they’re using.

The state may not actually be all that great, hmmm.

In any case, FDNY pensions have a disability pension issue, both FDNY and NYPD have relatively low retirement ages, so let’s look at the NYC Teachers plan as more indicative of the city’s pension problem. Also, there are 216,687 participants in the NYC Teachers plan, compared to the numbers of the other two: 27,656 participants for the NYC Fire fund and 85,686 for the NYC Police fund. The fund for general city employees has 341,890 participants, so they do (as a group) outnumber the teachers.

Here are what the required contributions are doing:

From 11% of payroll in 2001, up to about 40% in FY2017. That’s quite the ramp up in required contributions, don’t you think?

I will also note they underpaid a few times, but they have been doing official full-funding since 2006.

How had the funded ratio acted?

That’s also not good. They reached a low of 56.4% funded in 2015. They were escalating contributions each year, and fully paying what the actuaries told them to… and they kept losing ground.

Yes, there was some recovery in 2016 and 2017. Pity there’s such a lag on the NYC financials, but that may give us a hint as to a bunch of tricks being played, perhaps.

Or perhaps there’s something really deficient about a “full funding” method that seems to have losses every year for over a decade.

New York City pensions did have slight improvements in FY2017, and I don’t have info past that right now. But they are not in a strong position. Obviously, they’re not as bad as the New Jersey Teachers fund but that’s damning with faint praise.

Renters leave, Landlords shafted, No tax revenue for the city

Legal Insurrection did a round-up of this problem in May: Shutdowns Have Brought New York City to the Brink of Economic Catastrophe

“The knock-on effect is an ‘alarming’ drastic reduction in the number of landlords who will be able to pay their tax bills on July 1 which will result in devastating losses in tax revenue for the city”

Professor Jacobson recently wrote about Ghost Towns USA, with pictures showing quiet and empty streets in New York City, due to the Coronavirus lockdown. If this goes on much longer, the economic effect on the city will be disastrous.

The cracks are already starting to show.

…..

Small business owners in New York are trying to sound the alarm. Cuomo and de Blasio should be listening to them.

…..

Everything is connected through the economy. If people can’t work, they can’t pay rent. Then the property owners can’t pay their bills. Eventually, everything crashes.This is not sustainable. New York needs to reopen.

This piece ran before riots and looting.

New York City has just started opening up this week, but… not much. We’re all assuming the big protest marches, with thousands of people crowded together, are going to lead to more COVID outbreaks. Maybe we’ll all get lucky, and it won’t happen.

Do people want to work in a city during a pandemic?

Duh, no, they don’t.

Nicole Gelinas in the NY Post: NYC’s urban model faces existential crisis in post-pandemic world

Manhattan needs its people back. But do the people need Manhattan? COVID-19 may not be a pause, as Gov. Cuomo puts it, but a rupture — one that has vast implications for New York.

For half a century, New York’s growth policy, stripped of some subtleties, has been as follows. Step one: Build up a dense corporate office hub centered around 150 blocks of Midtown Manhattan. Step two: Improve transit, so that you can move these millions of commuters onto the island of Manhattan every day in crowded metal tubes, and then, at the end of the day, move them back out.

….

Midtown’s prime-office vacancy rate last November was 10.4 percent, compared to 8.9 percent two years earlier — with “supply outpacing demand,” city economists noted, thanks to massive new construction at Hudson Yards and in Midtown East.Now, both sides of this equation are irretrievably broken. No one has any idea how New York’s and New Jersey’s transit systems can resume moving nearly 3 million people on and off a dense island by this fall. The answer won’t be more driving. A 30 percent drop in pre-COVID transit would mean a doubling of vehicles on Midtown’s streets — a total standstill.

So: What happens to all those offices sitting eerily empty? It isn’t only a short-term problem. Even if we get a vaccine tomorrow, many commuters have found that they like staying home. JPMorgan Chase and Facebook — both, prior to this, planning new Manhattan office towers — are now saying people can work closer to home or at home.

Now, some of this is under dispute. There are reasons people like going into the city, and I know I liked living there, back in the days of Rudy and Bloomberg.

But the value proposition of Manhattan specifically has been called into question, along with mass transit and skyscrapers. Many of the people who had been working in Manhattan don’t really need to be there to get their jobs done.

The inability of de Blasio to do anything useful does not make businesses feel secure in their physical locations, as he lets looters smash shop windows to grab the goodies inside. Talking of defunding the NYPD is not going to inspire anybody to want to stick around.

WSJ: New York Faces Coronavirus Tax-Revenue Hit

The state and city risk losses as wealthy residents spend months in second homes out of state and others work from home

Tax revenues for New York City and the state are on the line as some of the region’s wealthiest residents flee to the suburbs or beyond while employers keep out-of-state commuters in their homes.

Both the state and city rely disproportionately on the wealthiest taxpayers to fund services such as schools, hospitals and police officers. Before the coronavirus pandemic hit, people who typically commuted into New York City but live in New Jersey or Connecticut paid New York taxes for income earned in the state.

That allocation could change depending on how the states interpret rules on telecommuting, tax professionals say.

Meanwhile, other taxpayers who own both a New York City residence and a second home outside the city might try to shift their legal domicile to the latter, in hopes of escaping the city’s higher combined tax rates.

I have my own tax perplexity, living in New York and working for a Connecticut company. But I am unlikely to physically be in Hartford before September.

Back to the piece:

A more immediate issue for the state involves telecommuting. Roughly 1.3 million taxpayers with domiciles in other states generated $7.9 billion in tax liability in New York in 2017, a spokesman for the New York State Department of Taxation and Finance said.

Work for a New York-based company performed remotely is still taxable in New York if the telecommuting took place for the convenience of the employee. Mr. Endres said he believed taxpayers could make a strong case that working remotely because an office was ordered closed as a result of the coronavirus meant they were teleworking out of necessity, and not subject to New York taxes.

Boy howdy, the tax lawyers are going to be having a good time next year.

Budget cuts and non-cuts

CUNY: CUNY teachers face ax as $115M in coronavirus budget cuts loom

City University colleges are rolling out plans to slash their adjunct teaching staffs as the system faces a nearly $150 million cut in aid thanks to the coronavirus budget crises at City Hall and in Albany.

The famed John Jay College of Criminal Justice is prepared to cut 430 adjunct professors, amounting to roughly 40 percent of its teaching staff, according to their union, the Professional Staff Congress.

Officials at the College of Staten Island are planning to cut course offerings by 35 percent, while Brooklyn College could slash as much as 25 percent of its courses and steep cuts are anticipated at Harlem’s City College, too.

……

Lawmakers in Albany gave Gov. Andrew Cuomo the power to adjust spending levels in the state budget based on actual revenues during times of emergency, cuts that could cost the system up to $95 million, a CUNY budget analysis provided by the PSC shows.Additionally, the de Blasio administration has already slashed $20 million in city support for the public higher education system in the current budget and plan to cut nearly another $32 million during the next budget, according to CUNY and union officials.

Top-earning public officials should cut their pay amid NY’s fiscal crisis

New York’s top officials have talked a lot about “shared sacrifice” in recent weeks. How about leading by example?

Common Cause New York suggests state legislators forgo half their pay since they haven’t been legislating: After OK’ing the state budget back on April 3, they took off and haven’t returned to the Capitol since, when they normally spend these weeks passing nonbudget laws. Oh, and that budget essentially handed the dirty work of slashing state spending by $10 billion or so to the governor.

It’s not a bad idea: Some 2 million workers across New York have lost their jobs; countless businesses are dying and even top executives have been taking pay cuts.

….

Let’s take this further: The top earners in city and state government could all voluntarily adopt a pay cap — say, at $200,000 annual salary — for the duration of this crisis.Gov. Cuomo pulls in $225,000 (set to hit $250,000 next year); Mayor de Blasio, $258,750 per annum. So that cap wouldn’t ding them too badly.

But, ooh — Chancellor Richard Carranza draws $363,000. If he honored the $200,000 cap, the remainder could go for four school-lunch aides. And CUNY Chancellor Felix Matos Rodriguez’s salary is $623,500; joining the cap could pay for a dozen adjunct profs.

Greg Russ, the NYCHA chairman-CEO, earns $402,000. His shared sacrifice would fund at least a couple of building supers.

MTA Chief Transformation Officer Anthony McCord, hired at $325,000 for work that includes slashing 2,700 jobs, has been assigned other duties during the crisis — but surely the professional slasher should share the pain now.

Makes sense.

Carranza warns of massive NYC public school cuts in face of ‘horrific’ budget

The New York City Office of Management and Budget has projected a $7.4 billion loss in tax revenue due to the pandemic across previous expectations for fiscal year 2020-21. The DOE’s [Department of Education’s] fiscal 2020-21 budget of $34.2 billion includes $27.5 billion in operating funds and another $6.7 billion in education related pensions and debt service funds.

The DOE executive budget includes $111 million in reductions in savings from the current fiscal year’s operations, and another $471 million in reductions and savings for fiscal year 2020-21.

Remember how het up people were getting about $6 billion for the NYPD?

The DOE had $34.2 billion.

Seems to me that NYC is spending at least five times on education than on the cops. Just thought I’d point that out.

Before I leave this little whip-around the stress on New York – state and city – let’s take a look at a proposal to grab some more revenue for the state.

Tax on data? Have they thought this through?

A Tax on Data Could Fix New York’s Budget

Because working New Yorkers face enough taxes, the task is to find new revenue sources. The first place to look is the data economy, which cities and states have failed to harness properly for decades. Every day, tech companies — from big players like Amazon, Apple, Facebook and Google to smaller startups and online merchants — capitalize on personal consumer data for advertising, marketing and product development.

We are working on a legislative plan to create a data sales tax that would, for the first time, capture the value of user data that companies buy and sell for profit in New York.

This is idiotic. Just FYI, these are the authors:

Messrs. Adams and Gounardes, both Democrats, are respectively, Brooklyn’s borough president and a New York state senator.

I linked to their official “about” pages, in case you were curious.

Back to the op-ed:

Our proposal’s framework has four parts. First, we need to quantify the amount of data generated by New Yorkers and commercialized for profit. Second, we must create a regulatory process requiring entities that sell or transfer New Yorkers’ personal data for commercial purposes to register and disclose their transactions. Third, we need to calculate the appropriate tax — a transaction fee or percentage of net revenue. Fourth, revenue has to be apportioned between state and local governments to support desperately needed public investments.

They think they’re doing a Facebook/google tax, but I think they don’t realize how unworkable any of this is. Way to encourage offshore, untouchable internet entities to form. Going to be tough to tax that Russian server, for instance.

And one nugget with a number in it:

Data brokers, third parties whose business is to sell consumer information, are estimated to garner $200 billion a year in revenue.

Sorry, $200 billion in revenue doesn’t sound like a hell of a lot to me. For one, that’s not their profit. Second, that sounds like that’s a worldwide number. This is really not sounding like a lot to me.

As I noted in an earlier post, the NYC budget is about $90 billion and the NY state budget is $177 billion.

The responses to this idea in letters to the editor:

I find it amusing and somewhat ironic that two New York politicians are now proposing to tax tech companies for access to personal consumer data for marketing purposes. Was it just a year ago that New York City decided to pass on an Amazon HQ facility that would have employed 25,000, generating billions of dollars annually, most of it subject to taxation to the benefit of New York City and state’s coffers?

Joe Sabbatino

Hilton Head, S.C.

Messrs. Adams and Gounardes show a complete lack of understanding of the problem. They state: “Because working New Yorkers face enough taxes, the task is to find new revenue sources.” They then devote the rest of the piece describing a “new” revenue source that is a tax on the personal data bought and sold by tech companies, large and small. Who exactly do they think ultimately will pay these new taxes?

New York’s budget problems stem not from a lack of revenue but from outsize, unsustainable spending.

Doug Locker

Decatur, Ga.

Cutting in here for a moment. I see these two letter-writers are from South Carolina & Georgia, which is where I first lived…. SC for a very short period of my life, and Georgia for many years. Interesting that people from those states are responding so sharply.

As a CPA, I’ve seen my fair share of annual pensions in excess of $100,000 that went untaxed by states. Why? Because New York government and local workers are a Brahmin class, a la Puerto Rico, who are protected and served by politicians like Messrs. Adams and Gounardes.

The next time you hear these two pilgrims or their ilk belch out the “fair share” diatribe, take it with a pound of (untaxed) salt.

Greg Debski

Howell, N.J.

People do have to pay federal income taxes on those pensions. To be sure, taxing the state pensions with state and city income taxes may push said retirees to live in Florida, where there is no income tax… but many of them do anyway. You can’t even call them “working New Yorkers” — they were New Yorkers who had worked… in the past.

That said, some states also exempt public pensions from income tax… and some states exempt private pension benefits as well. Heck, trying to find more info on who exempts and who doesn’t, I couldn’t find what I needed, but I did find this piece explaining which states taxed Social Security benefits. It really is all over the place.

Borrowing money to pay the bills

WSJ: New York City Seeks Power to Borrow Up to $7 Billion for Coronavirus Expenses

The New York state Legislature on Thursday declined to vote on a measure that would have authorized New York City to borrow billions of dollars as the city struggles to contain the costs from the pandemic.

The Legislature can revisit the legislation in June, lawmakers said. The mayor’s office will continue discussing the bill with legislators, a mayoral spokeswoman said.

The bill would allow the city to borrow as much as $7 billion, payable over the next 30 years.

Yikes. Paying operating costs and financing it over 30 years? Are they nuts?

New York City needs the ability to borrow money to cover operating costs as a backup option in case federal lawmakers don’t provide the city with additional aid, Mayor Bill de Blasio said Thursday.

The city faces a combined funding shortfall of $9 billion for the current fiscal year and for the next one beginning on July 1, he said.

….

New York Gov. Andrew Cuomo, who was in Washington, D.C., on Wednesday lobbying for more federal aid, said the state needs to wait to see if federal lawmakers will pass legislation to give the state more money. He said New York City has to be cautious.“Borrowing for operating expenses is a risky proposition and needs to be done with caution, if at all, because now you are really rolling the dice on future revenues,” Mr. Cuomo said Thursday [May 28].

As much as I dislike Cuomo, he has a far better grasp of finance than de Blasio does. Of course, my kids have a better grasp of finance than de Blasio.

Here’s how the NYT covered this: Virus Forces N.Y.C. to Consider Tactic That Nearly Led to Ruin in ’75

The grim outlook has forced top officials to contemplate a maneuver that has been disparaged ever since it brought New York to disrepair and the brink of bankruptcy in the 1970s: allowing the city to borrow billions of dollars to pay for its basic operating expenses.

Numerous fiscal experts and public officials, including Gov. Andrew M. Cuomo, are leery of giving the city permission to solve its budget problems by taking on significant debt, sensitive to the reckless borrowing that began more than 50 years ago under Mayor Robert F. Wagner and accelerated under the city’s next two mayors, John V. Lindsay and Abraham D. Beame.

The shortsighted economic strategy — Mr. Wagner blithely called it a “borrow now, repay later” philosophy — was one reason New York City reached the brink of bankruptcy in 1975, leading to the creation of the New York State Financial Control Board, which was given broad oversight of the city’s financial management.

Mayor Bill de Blasio, who has asked legislative leaders to grant him permission to issue bonds to cover the city’s operating costs, has said he would only do so as a “last resort.”

Doing so, however, has increasingly become a real possibility: Legislative leaders, returning this week from a nearly two-month hiatus to vote on a raft of coronavirus-related bills, are discussing the issue with the governor’s office and city officials.

“What do you do if you don’t have the option of some amount of borrowing? You have to do massive cuts, massive cuts to all city agencies,” Mr. de Blasio said on Thursday. “That will undermine any possibility of the right kind of restart and recovery. So, borrowing the right way, it makes sense.”

Luckily, some people see the NYPD as worthy of cutting. Too bad cutting it entirely wouldn’t even be enough to fill the budget gap.

And in New York State’s recently passed budget, lawmakers included a provision that gave Mr. Cuomo the ability to borrow up to $11 billion, giving budget officials increased flexibility amid uncertain revenue forecasts. State Senator Liz Krueger, chairwoman of the Senate Finance Committee, said the city is merely asking for the same leeway that the Legislature recently granted the governor.

But New York City’s problems, and its request to potentially borrow its way out of them, have added resonance because of how disastrously that scenario played out in the mid-1970s, the city’s last and most famous brush with the fiscal abyss.

The Financial Control Board forced the city to absorb drastic spending cuts: Workers were let go and hospitals were closed. Crimes and disorder rose; tens of thousands of residents fled the city, as New York turned into a national symbol of urban decay.

Mr. Cuomo, who prides himself on being fiscally conservative and would need to sign the legislation, referenced the 1970s nadir as he cautioned against granting New York City borrowing capacity. He said on Thursday that although government has long issued bonds to pay for long-term capital projects, doing so for operating expenses was fiscally questionable.

It’s one thing to do some short-term borrowing for short-term problems. But financing one year’s worth of gap over 30 years? Yowza.

Anyway, the article is quite long, but I want to pull out one more sentence.

Both the mayor and the governor have said that without substantial federal recovery funds, essential city and state services, like policing, health care and education, would be endangered.

Mmmmm.

Fiscal hostage-taking not looking like a good tactic now

Yeah, how are you guys going to hold up policing as a fiscal hostage right now?

There have been some really bad swings with respect to political rhetoric coming from the same people — no group anything/it’s important to come together in large groups; we’ll have to cut budget for cops and we don’t want to/we’re going to cut budget for cops and give it to other portions of the budget. Sometimes the swings happen within one hour of each other, but the less foolish give it at least a couple days.

As it stands, I don’t see the Senate touching the HEROES Act, and Congress has moved onto shinier objects for now. This person argues there will be no stimulus bill before the end of July, and I certainly don’t see them picking up anything before then. Maybe they’ll be thinking about state/local bailouts in September. Maybe we’ll finally get an extraterrestrial invasion the movies have always promised us.

Either way, I have a feeling I can blog about state bankruptcies, bailouts, and fiscal stresses in general for this entire summer.

Related Posts

Around the Pension-o-Sphere: Actuaries Testifying, New Standards, Actuary Bloggers, Pew Report, and Connecticut

Taxing Thursday: It's Up to You, New York, New York

Public Finance: Full Accrual Accounting and Governmental Accounting Standards Board Testimony