Obamacare Tax Watch: What to Watch For

by meep

In the prior post, I made a prediction about a bunch of angry stories in mainstream media re: the Obamacare tax/penalty (governmentese: shared responsibility payment)…but I forgot there was also going to be a different set of angry stories, also coming up in February: the subsidy clawback.

And the subsidy cliff, which people forget about.

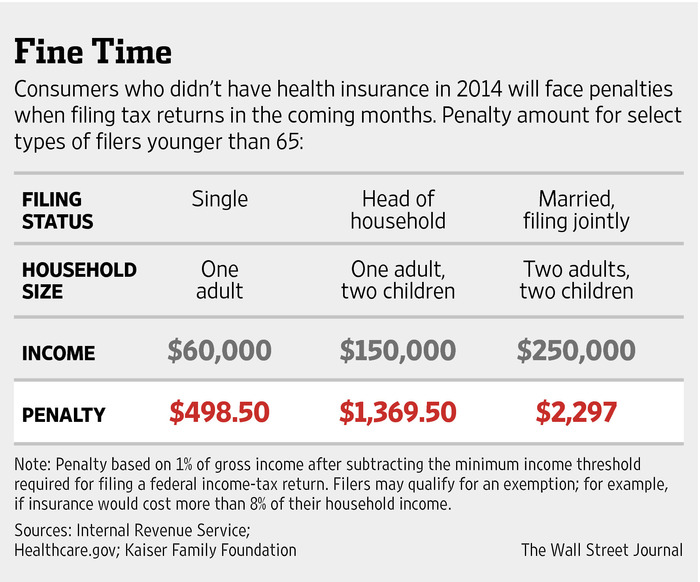

This WSJ piece reminded me about the subsidy disaster (and they didn’t mention the cliff):

The first year of the Affordable Care Act is in the books, and now comes a tricky tax-filing season for millions of Americans.

The law’s requirement that most Americans carry health insurance means all filers must indicate on federal tax forms whether they had coverage last year and got tax credits to help pay for it. Those who didn’t have coverage could face a fine, although reduced staffing at the Internal Revenue Service and certain changes to the law mean the so-called individual mandate is expected to be lightly enforced this year, tax preparers say.

Translation: there is going to be a shitload of tax fraud perpetrated this year. Primarily by people claiming to have had coverage, when they didn’t.

When said simple lie will save you hundreds to thousands in tax pain, you better believe people will check the box “YES”.

But then there’s the subsidies: that’s going to be more difficult, fraud-wise.

About seven out of every eight Obamacare insurance customers who enrolled between November 15 and mid-December are poor enough to qualify for taxpayer-funded subsidies designed to lower their monthly premiums.

The Department of Health and Human Services reported that number Tuesday, saying it’s up from 80 per cent a year ago.

Americans who participate in government-brokered medical insurance can get subsidies from the federal treasury if their households earn less than four times the government’s official ‘poverty’ level.

That situation describes 64 per cent of all U.S. residents, according to the Kaiser Family Foundation. But far more are qualifying, suggesting that the Obamacare subscriber base is dramatically tilted toward low-income earners.

There are several problems with this.

First, the subsidy is also based on how much the premiums are and your income. If the premiums are low enough, you don’t get a subsidy. Who has the lowest premiums? In most states, it’s the young adults. Most states aren’t as insane as New York, where age-rated is disallowed. So it’s generally older folks who would be getting higher subsidies at the same income level.

But wait, there’s more!

You know who may be getting the most of all? Those who are just under Medicare age (age 60 – 65) who are retired. If they don’t have defined benefit pensions, then they’ve got incentive to carefully throttle their earnings.

By the way, step one penny over that subsidy cliff, and you get NO SUBSIDIES. Considering that annual premiums for older adults are pretty hefty, you could be seeing a clawback even higher than the individual mandate penalty/tax.

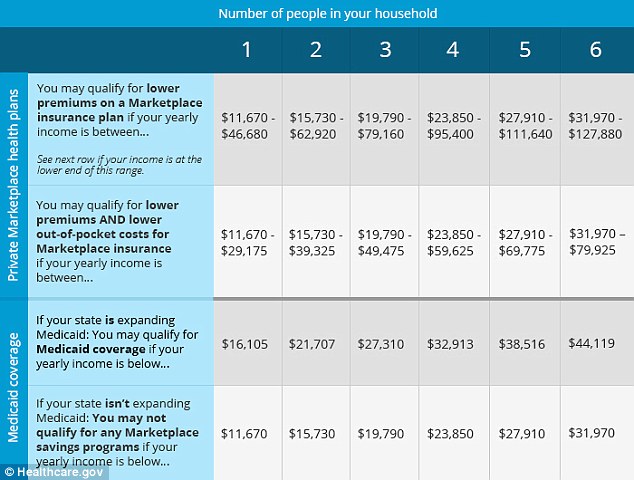

What are the income limits? Let’s check a table from that Daily Mail UK article.

I want to draw your attention to two numbers: where the subsidies cut off for a one-person household and where they cut off for a two-person household.

One person: $46,680

Two people: $62,920

Think of how lucrative it can be for a two-retired-person household to get divorced and start filing taxes separately. That’s a marriage tax penalty beyond the one you’ve heard about, because of this cliff. The other tax marriage penalty affects taxes in a marginal, continuous way. This one is that you get married, you owe a non-proportional amount of taxes.

Of course, it’s harder to fake income amounts when your banks and employers are reporting directly to the IRS, but there are plenty of small business owners (and consultants, and cash businesses…) that may see even more incentive to under-report income for 2014 (and as long as Obamacare is in effect). You may start understanding the idiotic 1099 tax reporting reg was tried — the sane politicians knew there were huge incentives to income-reporting fraud in Obamacare.

I’m not even considering the Supreme Court case right now.

The Washington Post’s Greg Sargent looks at how many people could be affected by a Supreme Court ruling in King v. Burwell, an upcoming challenge to the implementation of Obamacare. The challengers in the case argue that the plain text of the law does not allow for the provision of health insurance subsidies in the law’s federally run health insurance exchanges; the administration argues that the overall purpose of the law allows for its decision to disburse subsidies in federal exchanges. If the Court sides with the challengers, then federal exchange enrollees who receive subsidies would lose them, increasing the cost of their insurance.

Sargent points to recent enrollment data suggesting that the number of affected individuals could be higher than a previous estimate of about four million.

“The reason this matters,” Sargent writes, is that “highlighting the potential for such a SCOTUS decision to result in widespread disruptions and dire consequences — both for millions who might lose coverage and for the insurance and health care industry in these states — may figure heavily in the government’s strategy for winning the case.”

Basically, the government may attempt to convince the court that its interpretation of the law should be allowed because the disruption involved in ruling for the challengers might be too large.

Thing is, the disruption is starting as soon as people start prepping their taxes. I may try a few experiments in TurboTax to see what it does. TurboTax is not going to be trying to enable tax fraud, but boy does it allow you to easily see the impact of changing the answers to specific questions.

You better bet people will be switching a “NO” to a “YES” when it comes to the individual mandate tax/penalty.

I am not changing my prediction of yelling articles of the individual tax/penalty, because professional tax preparers are going to have to be really careful — enabling tax fraud explicitly is very, very dangerous for them. Besides, the IRS has tried giving people lots of outs for the first year, and there is the item of not being able to grab more that would have been in any refund…. but we shall see.

I will revisit my prediction by February 1.

(Thanks to the Ellen DeGeneres Show Scrapbook for the animated GIFs)

Related Posts

Meep Picks Apart: Teresa Ghilarducci on Working Longer

Obamacare Watch: 30 March 2014 -- Voter Registration, Incompetency, and Not Thinking Things Through

Teachers at it again: New Jersey Teachers Union Antagonizing Parents....Why?