Will there be a state and municipal public finance bailout?

by meep

I suppose op-ed folks gotta write about something, but the following piece is all over the place. As well, I’m just not seeing the plausibility of this within the next year, which is the period in which action would need to be taken.

So let me take it bit by bit.

The set-up: the potential collapse of pension funds and federal bailout

WSJ op-ed by Allysia Finley, April 2: The Coming Biden Bailout of Blue States and Cities

The balance-sheet risks for mismanaged states and municipalities have been hiding in plain sight just as they were at Silicon Valley Bank. Continued financial-market turmoil and a prolonged economic downturn could cause some pension funds to collapse and cities to declare bankruptcy. Taxpayers will invariably wind up on the hook for politicians’ bad financial bets.

And bondholders.

Remember the bondholders who can get defaulted on? Yeah, those bondholders remember that, too.

By the way, my understanding is (NOTE: I am not a lawyer of any sort, much less a municipal bankruptcy lawyer) that merely running out of money in a pension fund is insufficient to declare municipal bankruptcy.

It depends on the particular state.

Rather than getting into the details, go here: Understanding Municipal Bankruptcy and Who Can Use Chapter 9? by Jim Spiotto (RIP)

Even better, from 2017: Illinois Financial Disaster: Clean Up Your Own Damn Mess [by me], where you can see my opinion about Illinois’s long-standing balance sheet problems where I also grab info on what it takes to file for municipal bankruptcy.

Side trip into ESG issues

I don’t feel like pulling this entire op-ed apart. In many ways, I am very sympathetic to the views expressed therein.

But it’s all over the place.

Like, why the side trip into talking about “green bonds”?

Now that credit is more expensive, states and localities have come up with a creative new way to finance their political investments more cheaply: Market their bonds as “ESG.” New York City last autumn floated $400 million in “social impact” bonds to fund construction of affordable housing. Enormous demand from investors reduced yields the city had to pay.

If the investors want them, why not?

I think there were two possible threads in this op-ed, but they weren’t well-traced.

Because it could be it wasn’t investors, but “investors” — that is, these “green bonds” were bought by agents on the supposed behalf of principals… whose interests weren’t actually being represented. Such as… private pension funds, perhaps?

(No, public pension funds are unlikely to be invested in these… unless there is bad risk management….

….oh wait, maybe they are invested in these bonds….)

Anyway, that the bond issuers are giving the buy-side what they want is no big deal unless they’re lying about aspects of the bonds. This has nothing to do with the public pension fund problem.

Back to the public pension failure issue

Let’s take a look at the core argument:

But stock prices haven’t increased much, and the values of other pension-fund investments are falling. Fixed-income assets such as government bonds used to make up about half of pension-fund portfolios but now are only about 20%. To meet their targeted investment return rates—typically between 7% and 8%—pension funds loaded up on higher-yielding stocks and “alternative investments” such as real estate, hedge funds and private equity, which rely heavily on leverage.

I am in agreement here. From my last post on alternative asset allocations in public pension funds: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition

The median allocation was at almost 30% in 2020.

Back to the WSJ op-ed:

These alternative investments now make up about 30% of pension-fund investments and are getting slammed by rising interest rates. Defaults on office buildings are increasing while property values fall, which will ding pension funds and make it harder for local budgets to fund retirement obligations. About 80% of property-tax dollars in Chicago go to pensions.

Okay, again, a bunch of different things is being crammed into one paragraph.

Look at my graph. Yes, the median is about 30% of investments, but there is a huge range. Some plans have no alternatives at all. Some have a lot more. I didn’t label the dots — I just wanted to show the general tendency of the increasing allocations.

As well, I have no indication what the various natures of those alternative investments are. Some are investments in real estate, but those “alternatives” are a lot of different kinds of things. They’re not all investments in real estate.

I do agree that if the contributions are primarily from commercial real estate in Chicago, then no, you shouldn’t be investing the commercial real estate in the pension fund. That’s too much risk concentration.

Who will fail? And when?

Back to the piece:

Yet Chicago’s four pension systems have only enough assets to cover about 25% of what they owe workers and retirees, which is less than Detroit’s pension funds had when the Motor City declared Chapter 9 bankruptcy a decade ago. Pension funds in states like Illinois, New Jersey and Connecticut aren’t in much better shape.

That is correct.

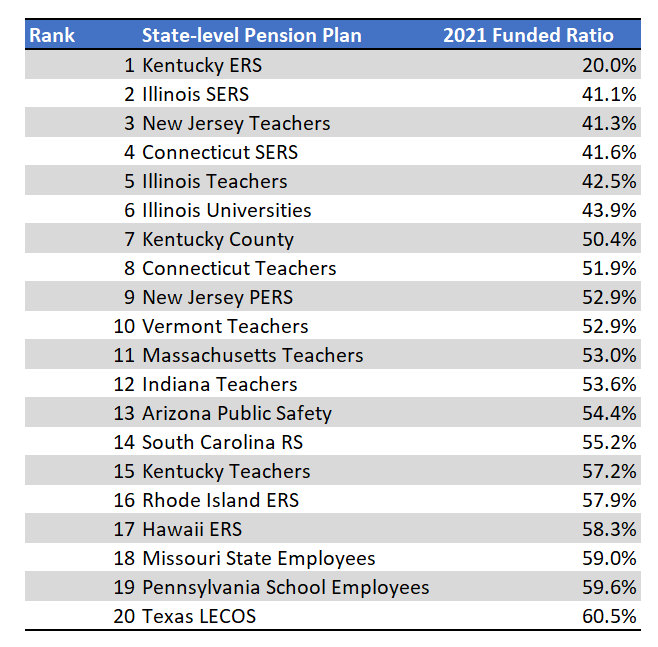

And some “red” states also have some extremely poorly-funded state-level pension plans, too. I grabbed the 2021 funded ratios from the Public Plans Database.

Kentucky. Indiana. South Carolina. Texas.

But yeah, you’ll see plenty of “Blue” states in this list… partly because Illinois has 5 state-level pension plans, and they’re all very poorly funded.

Data from Public Plans Database

But learn the lesson of Meredith Whitney. (And the danger of the 80% funded myth.)

What it takes for the money to run dry

Governments don’t fail the same way private entities do, financially.

Many governments ran with unfunded pensions until they hit the Great Depression.

Simply running out of assets in the pension funds does not mean they can’t keep running on. Social Security has been doing pay-as-it-goes since it was first set up. Do you understand what might be the issue?

Going back to Meredith Whitney:[something I wrote in January 2022]

Meredith Whitney ran into trouble because she had prognosticated that muni bonds would run into trouble shortly because she had seen the balance sheet troubles of governments, which aren’t the same as cash flow troubles. Even there, Puerto Rico has shown even absent financials anybody can rely on, a government entity can roll on for quite a while before being forced to cut anything at all. What would cause trouble for a private company is not the same thing that causes trouble for a government.

What does cause trouble for a government?

Why, for example, did Detroit run into trouble?

Here’s a hint — Detroit population:

1990: 1.028 million

2000: 945,500

2010: 711,200

2020: 638,200

The population decreased by 25% between 2000 and 2010. That’s pretty devastating to a city’s revenue stream, I would imagine.

The bankruptcy was declared in 2013.

When is this supposed to happen?

Let me go back to the op-ed, and look at the conclusion:

Insolvent cities could declare bankruptcy, but states as a matter of federal law can’t. That means their taxpayers will inevitably have to pay more to cover the pension shortfalls. In Illinois 25% of general tax revenues pay for pensions. Many states—including Illinois—can’t afford to bail out their underwater cities, but they also may not want the stain of allowing them to go bankrupt.

The most likely outcome: A cascade of bailouts by some combination of U.S. taxpayers, the Fed and municipal bond investors. Democratic-run states and big cities are simply too politically important for the Biden administration to let fail.

I assume (please, dear Lord, let me assume there is institutional knowledge within the WSJ editorial board) that the editorial board knows that it will take a long time for any major pension funds to fail.

Even among the Chicago pension funds, the one closest to failure, MEABF, has a few years to go before completely running out of assets. The state funds are even farther away.

I am not really seeing how this is supposed to play out. When is this supposed to play out?

Some recent history

Illinois tried a play to get a “bailout” for its pension funds back in 2020 when the pandemic initially hit…and that was only for $10 billion. And that’s when their unfunded liability was over $100 billion.

A state-local government bailout didn’t occur in 2020, but they did get a bunch of money shoved at them in 2021.

While fiscal year 2021 results had been good for public pensions, fiscal year 2022 results were very bad.

But even with those facts on the ground — you have to realize how much it took for Detroit and Puerto Rico to get to where they were.

Detroit got shoved into bankruptcy after losing 25% of its population, plus some outright criminality from top city officials, plus the state taking over the finances of the city to force it into Chapter 9 proceedings.

Puerto Rico has been a financial basket case for a long time for a variety of reasons, including being shot through with corruption (though this is probably a result of the mess of its governance, similar to New Jersey. (and don’t ask about New York… or Chicago))

Even with all the stuff going on in both of these places, it took a very long time before bonds actually got defaulted on, at which point action had to be taken.

It wasn’t pensions that did it.

Things take a long time

I have been waiting for New Jersey and Illinois pensions to “fail” since I was in my 30s. I’m going to be turning 49 in a few weeks.

They’ve got plenty of assets to limp along for quite a while.

So, I’m trying to figure out how a supposed public pension bailout would occur. At least with the multiemployer pension bailout, they were plans covered by ERISA, which public plans are not.

I could see Chicago’s municipal plan (MEABF) being a potentially important plan failing within the period needed where Biden would be relevant, and then… well? Chicago goes to Illinois first (which doesn’t have the money, either).

Then the House of Reps tells Chicago and Illinois to go screw.

And then Biden does what?

Signs an executive order? Because that worked so well with student loan forgiveness.

Anyway, I guess everybody comes up against deadlines and needs to write something. I understand.

Look, I get it. I want pensions to be fully funded. The problem is people (and especially politicians) prefer to spend cash on flashy stuff that people can see right now. And they know pensions don’t fall apart all at once… so hey, let’s just cut back on the contributions… just a little bit….for a year… then 5 years… then….

Yeah.

So, no. I’m not seeing any explicit bailouts going on. Not within 2 years.

Now, if you want to talk about politicians 10 years from now…..

Related Posts

Taxing Tuesday: Mmmmmm, Donuts... I Mean, Hmmmm, Biden and Sanders Tax Plans

Arguing against the Public Pensions "Truths" and "Myths"

Taxing Thursday: It's Up to You, New York, New York