Illinois Pensions: General Assembly Retirement System (GARS) number-crunching

by meep

Last time I looked at the State Employees Retirement System in Illinois, I mentioned that as bad as that one was, the pension fund for the legislators, GARS, was even worse, at about 20% fundedness.

Let’s have a look at that one, shall we?

Unfortunately, GARS is not in the Public Plans Database, and when you see the numbers below, you’ll probably understand why.

So I’m going to start with GARS’s own financial reports, which can be found here.

This time, I’m going to show the complete table on page 2 of the 2014 CAFR:

Fiscal Year 2014 Highlights

232 Total Membership 158 Active Contributing Members

$56,789,460 Net Position–Restricted for Pensions, fair value

Contributions $1,502,605 Participants $13,956,669 Employer

$8,363,428 Net Investment Income

17.9% Investment Return

Benefit Recipients

303 Retirement Annuities 117 Survivors’ Annuities 1 Reversionary Annuities

$20,800,502 Benefits Paid

$397,502,761 Total Pension Liability $56,789,460 Fiduciary Net Position $340,713,301 Net Pension Liability

14.3% Funded Ratio

Oh sorry, the 20% funded ratio was from a prior year, not 2014. I don’t need to tell you that 14% funded is pretty bad. But the Illinois politicians aren’t worried about this plan, and the reason why should be evident from a few reasons.

But we’ll get to that in a bit.

Let’s do a little math. First, let us consider the number of active participants. I just googled how many current members of the Illinois General Assembly there are and it seems the total is 59 in the Senate and 118 in the House, for a total of 177.

Only 158 of them are participating. Hmmm.

(This may also give you some understanding why the Public Plans Database doesn’t include this plan — it’s dinky)

Here is a list from last year of those opting out of the program:

GARS – Legislators Not Participating:

State Rep. John Anthony (R-Plainfield)State Rep. Kelly Burke (D-Evergreen Park)

State Sen. Melinda Bush (D-Grayslake)

State Rep. John Cabello (R-Machesney Park)

State Rep. Katherine Cloonen (D-Kankakee)

State Sen. Thomas Cullerton (D-Villa Park)

State Rep. C.D. Davidsmeyer (R-Jacksonville)

State Rep. Scott Drury (D-Highwood)

State Rep. Brad Halbrook (R-Charleston)

State Rep. Josh Harms (R-Watseka)

State Rep. Jeanne Ives (R-Wheaton)

State Rep. Dwight Kay (R-Glen Carbon)

State Rep. Stephanie Kifowit (D-Oswego)

State Sen. David Luechtefeld (R-Okawville)

State Sen. Andy Manar (D-Bunker Hill)

State Sen. Karen McConnaughay (R-Aurora)

State Rep. David McSweeney (R-Cary)

State Rep. Anna Moeller (D-Elgin)

State Sen. Julie Morrison (D-Deerfield)

State Rep. Tom Morrison (R-Palatine)

State Rep. Marty Moylan (D-Des Plaines)

State Sen. Jim Oberweis (R-North Aurora)

State Rep. Ron Sandack (R-Downers Grove)

State Rep. Sue Scherer (D-Decatur)

State Rep. Silvana Tabares (D-Chicago)

State Rep. Kathleen Willis (D-Addison)

26 legislators… hmmm, 177 minus 26 is 151. Well, maybe there was some overlap or something. Or perhaps some of those 26 really didn’t opt out.

But back to the simple math – in 2014 there were contributions of $15.5 million, and $20.8 million in benefits made. To be sure, the $8 million in investment income does cover the needed cash, but…. the return for 2014 was 17.9%… a wee bit higher than normal, doncha think?

The assumed return on assets was 7.0%, but if you look at the blended discount rate (which results from having to discount the shortfall at a much lower rate), it’s down to the much more reasonable valuation rate of 5%.

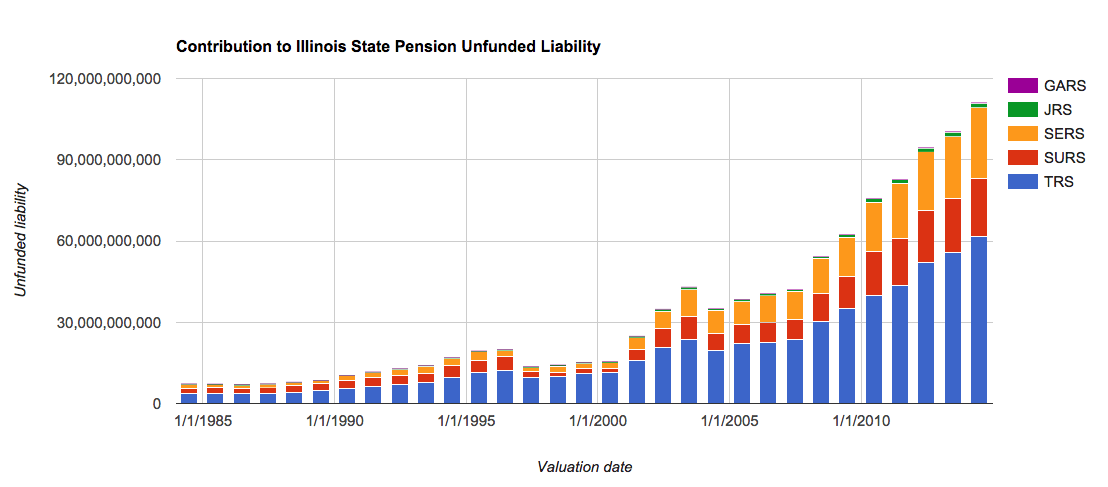

And now the the time where we look at the unfunded liability development:

Oh, naughty naughty legislators. The biggest cause of the unfundedness of this plan is easy to see: undercontributions, at 45%. Much worse than what we saw with SERS.

No wonder it’s so unfunded.

But the legislators are not worried about GARS. It’s not really a problem.

For one, the legislators are pretty sure those who come after would have an interest in making sure those pensions get paid. For another, some of those politicians, when booted out of office (or “retiring” from office) land in a nice local public job, transfer their pension credit over, and they’re in an entirely different plan.

But here’s the real reason:

That’s the contribution each of the state plans gives to the whole.

Can you see the very small purple sliver representing GARS?

No?

I’m not surprised: in 2014, it made up only 0.2% of the whole state UL out of those 5 plans. Even the judges’ system manages to contribute 1.3% of the whole UL.

The teachers plan: 55% of the unfunded liability.

This is why I’ve been saying that TRS is likely the first to go…. it’s so huge. I generally look at teachers’ plans because they tend to be very very large — from the sheer number of participants. There are more teachers than policemen and firefighters, for example.

I know people like to yammer about more prison guards or police than teachers, but it’s not true.

But I will get to TRS in time.

For now, I do advocate whacking politicians’ pensions more than the other pensions get hit — these plans tend to be woefully underfunded, partly because the politicians think they can get away with it. They get to vote on their own salaries, their own pensions… and they’d rather spend some of their budget now on current expenses (like nice offices) rather than funding a pension they “know” will get paid.

Well, maybe it shouldn’t be. After all, these are the people who are a huge part of the problem in boosting benefits and not requiring that “required” payments be made.

I will look at other plans where the full payments are required to be made, but that will have to wait for another post.

The problem is, if you whack the Illinois politicians’ pensions, it will have no effect on the solvency of the rest of the pensions. And they will have no direct skin in the game….

…but it doesn’t seem like having a little skin in the game right now is affecting their behavior much, so may as well whack the pensions, pour encourager les autres.

Related Posts

Cook County Soda Tax: Persuasion and Comparisons - Why Not Tax Juice?

Data Visualization: People and Books in 1946

Use Data Visualization Responsibly