Illinois Finance: The Ongoing Non-Crisis and the Oncoming Real Crisis

by meep

The budget standoff continues, so obviously these people aren’t getting paid.

Did they stop selling tickets? Don’t be silly.

Win more than $25,000 in the Illinois Lottery and the best you’ll get is the same thing you’ll get from your out-of-work brother-in-law sleeping on your couch, drinking all your beer — an IOU.

That is not good enough for two lottery winners. They’ve filed a federal lawsuit against the Illinois Lottery, which is continuing to sell tickets, even though it doesn’t have the authority to pay off anyone who wins more than $25,000.

…..

The lawsuit filed by attorney Thomas Zimmerman, Jr. on behalf of Rasche and co-plaintiff Danny Chasten — who is due $250,000 from a winning ticket in July — alleges Illinois Lottery officials are committing fraud by continuing to advertise and sell games even though they know they can’t pay off winners of more than $25,000.The suit seeks to force the payment of people who win more than $25,000 with 5 percent interest. It also asks that nobody who works for the Illinois Lottery, or the private company that manages it, get a dime in pay until the winners get what’s owed them.

Beyond the allegation of fraud — advertising what the Illinois Lottery can deliver — the problem is both legislative and bureaucratic.

The state of Illinois is three months into its fiscal year, but Gov. Bruce Rauner ® and the Democrat-controlled Legislature have been unable to agree on a new budget. They are stuck on how to fill a $2.6 billion deficit that opened up when some temporary tax increases expired.

Under Illinois law, the state comptroller has to sign checks of more than $25,000. Without a budget, the comptroller has no authority to sign those checks, so the Illinois Lottery doesn’t have the ability to pay off winners.

…..

“You know what’s funny? If we owed the state money, they’d come take it and they don’t care whether we have a roof over our head,” Danny Chasten’s girlfriend, Susan Rick, told reporters at a press conference to announce the lawsuit. “Our budget wouldn’t be a factor. You can’t say (to the state), ‘Can you wait until I get my budget under control?’”Chasten, Rasche, and the other Illinois Lottery winners — we don’t know how many; Lottery officials won’t comment on that — waiting for their checks are in the unlucky 10 percent of those waiting for the state to pay its bills.

Ninety percent of all state government expenses are being paid, thanks to individual pieces of legislation and court orders — including the salaries of those working inside the Illinois Lottery and the private company that manages it.

Illinois Rep. Jack Franks (D) doesn’t think that’s fair. He wants to force the issue.

He understands the Illinois Lottery actually has the money to pay off winners, but without a budget, doesn’t have the authority to write the checks.

Well, no they’re not, if you include payments that should be made to the pensions.

REAL NONPAYMENT: PENSIONS

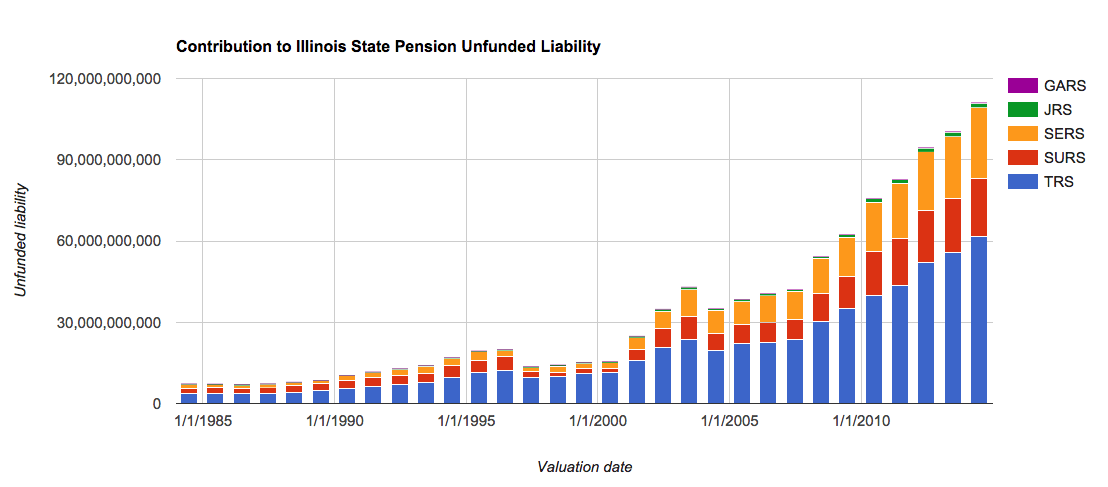

Just looking at the largest of the Illinois pensions, the Teachers Retirement System, just by eyeballing you can see they’re not making even 90% of the “required” payments.

Without even doing calculations, but just squinting at that graph, the only year they came close to 90% was in 2010.

NON-CRISIS VS. REAL CRISIS

The non-payment of the lottery winners is not a real crisis (I’m not pretending that anybody, even the lawyers for the stiffed lottery winners, are pretending that the non-check-writing is a crisis. Just that it’s not cricket, as Englishmen of 100 years ago would say.)

As noted in the article, the state corporation (or, rather, agency… which is really dumb of them. It should be a corporation) does have enough in reserves to pay prizes. That’s the way lotteries are supposed to be.

They have enough money to cover the expected wins, plus overhead, and probably a little cushion in case of variability of wins.

This is called “risk capital”. You know, like insurers have to hold.

Hey, what about the assets Illinois holds for its pensions?

That top number on the axis is $120 billion, by the way. Not million. Billion.

This is not the full liability — just the portion that is unfunded. Using some cushy discount rates, as explained by Jeremy Gold in my prior post.

I could use Census estimates to put the Illinois state population at about 12.8 million people, so the unfunded liability would work out to $7800/person. Not great, but hardly a crushing debt burden, right?

But that’s kind of silly. We shouldn’t include seniors or minors in trying to figure out who is expected to pay for this. I really should go by number of Illinois taxpayers.

APPROPRIATE MEASURE OF DEPTH OF DEBT

Which is what this website is trying to do. Looking at the number they put there — $158 billion in debt, it does seem they are using the official state numbers (again, using the cushy assumption set), runs to $45K per taxpayer.

Does that sound more affordable now?

Now, one could (and should) argue that it’s not like we’re expecting the taxpayers to fill the hole this year. Perhaps we could pay that down over 30 years at 7.5% interest (I’m being nice — Illinois TRS is still using 8% according to the Public Plan Database, as of 2013.)

Anyway, using this handy loan calculator, that’s a level $315 per month.

For 30 years.

That’s an additional $3800 in taxes per year.

And that’s ignoring the contributions that need to be made in the future to additional accrued liability.

These are just very rough estimates, and if anything, this is a lower bound for what is needed to fill the hole.

This is an old table of per capita state income taxes, but it looks like the per capita income taxes for Illinois in 2011 was less than $1K.

So you’re asking for a 300% increase on state income taxes to fill the hole, if I’m reading this correctly.

And, of course, this assumes everything earns 7.5% interest.

ECHOES FROM THE FUTURE

I do wonder how many lottery tickets get sold currently, given everybody knows that you’d have to wait a bit for the check if you won big.

In any case, here’s another short-term issue: the federal stopgap budget means Illinois can’t plan.

Just like all the people who are waiting on Illinois to pay their bills.

And to round this out, I will recount one of those cutesy-poo stories about one’s kids. I had a large floor puzzle of the United States… and I was asking my 5-year-old kid (at the time) to read out the states names.

She read illinois as “illness”.

How prophetic.

Related Posts

Public Pension Returns Start to Roll In for FY 2022

Pensions Catch-Up Week: Dallas Police and Fire (and Houston)

Public Pensions Watch: Sometimes Politicians Do the Right Thing