A Week of Bad Pension Ideas: Pile on the Hedge Funds, We'll Make it Up in Expectations!

by meep

First up, the article that came to my attention last week:

Christopher B. Tobe, a pension consultant and former trustee for the Kentucky Retirement Systems, said most public pension funds seemed to be sticking with hedge funds, known as alternative investments, in spite of mediocre returns. “I’m seeing huge increases in alternatives among public pension funds,” he said in an interview. “Nobody seems to care about performance.”

For the first nine months of this year, that performance has underwhelmed; hedge funds, which hold $324 billion in public pension money, eked out a net 0.18 percent gain, according to Preqin, a data analysis firm. That’s certainly better than the 2.6 percent loss recorded during the period by the Standard & Poor’s 500-stock index, but meager hedge fund returns like these are nobody’s idea of great.

Besides contending that hedge funds provide outsize returns, their supporters say the funds have another big selling point: Their returns are not correlated to the stock market. That means they move independently of the market when it goes up and down.

But research shows that hedge funds are becoming more and more correlated to the overall stock market. They are less likely, it turns out, to perform as a hedge against a balanced portfolio’s other holdings.

….

Some data is emerging, though, that raises serious doubts about the benefit of hedge funds for big investors with a long-term perspective. Utah, for example, increased its holdings in hedge funds and private equity in recent years. By 2013, those allocations at the Utah Retirement Systems had reached 40 percent of assets under management, up from 16 percent in 2005.Have its hedge funds helped the Utah pension’s investment performance? A May 2015 report to the Utah Legislature suggests not. Prepared by the Office of the Legislative Auditor General, the report concluded that if the state’s retirement system had maintained its 2004 allocation with fewer alternative assets and no hedge funds, the pension fund would have gained $1.35 billion in additional assets by 2013.

A new report, “All That Glitters Is Not Gold,” draws a similar conclusion. Conducted by researchers for the American Federation of Teachers, the report examined the hedge fund performance of 11 large public pensions and found that these investments exacted a high cost, had laggard returns and generally moved in tandem with the overall stock market.

…..

Over a total of 88 fiscal years studied, the report concluded that the pensions’ hedge fund stakes generally trailed those of each overall fund. For every pension fund reviewed, the total fund portfolio outperformed the hedge fund piece over the period in which hedge funds were in the mix.

In slightly more than one-quarter of the years analyzed, the hedge funds outperformed a same-size total fund’s returns, but that failed to make up for lower returns in other years. This lackluster performance translated to $8 billion in lost investment revenue at these funds, the report said.

……

Fee secrecy is a major problem with hedge funds and private equity investments, according to Edward Siedle, a forensic pension investigator at Benchmark Financial Services in Ocean Ridge, Fla., and a former Securities and Exchange Commission enforcement lawyer.“When I started with the S.E.C. 30 years ago, there were two things that the regulators and the regulated agreed on: Money management fees would come down over time and transparency would increase,” Mr. Siedle said in an interview. “But just the opposite has happened. Fees are at a historic high and transparency at a historic low.”

Finally, the teachers’ union report turned up compelling data on how closely hedge funds’ performance mimics that of the overall market. Ten of the 11 pension funds reviewed in the report demonstrated “significant correlation” between the performance of the hedge funds they invested in and the performance of the overall fund. The similar returns occurred even during the 2008 crisis, the study found.

Fixed-income portfolios among the nine pensions providing information about these accounts showed less correlation, the report said, at a much lower cost.

Yes, interesting that.

A lot of familiar names in the above piece.

Christopher Tobe wrote Kentucky Fried Pensions and has often commented on the Kentucky pension situation. He spurred me into looking a little at the Kentucky plans as well. Tl;dr version: worse than Illinois. Worse than Chicago, even!

Ted Seidle has been doing a series of forensic audits of various pension plans, with a special focus on hedge funds/private equity/etc. and the fees they charge. His most recent report is on the Jacksonville, FL police and fire pension fund. That’s an ongoing situation I’m keeping an eye on.

The report All That Glitters is Not Gold is at this link.

WHY PAY SO MUCH FOR BROAD MARKET RETURNS?

The question does become why public pensions are taking on these asset classes if they’re not getting much extra for the fees they pay.

I’ve written about the use of hedge funds and other ‘alternative’ asset classes before, doing an entire series of posts (links at the end of this one).

To quote myself from last year:

One item is that the value of the liabilities, in current actuarial practice, are based on discount rates that the clients themselves pick. The higher the discount rate chosen, the smaller the liabilities look. Thing is, this discount rate is supposedly tied to the expected return on assets and there are limits to plausibility if one invested to back pension promises the way insurers have to invest to back annuity promises.

If the pension plans invested in U.S. Treasuries, they would be able to do no better than the rates on Treasuries over the period for the particular bonds… you may have heard that the interest rates are fairly low right now.

If the pension plans invested in liquid equities, one might be able to claim about 7% long-term returns or so… so to boost it even above that, one needs harder-to-measure, higher-risk, and potentially higher-return assets.

And thus the push for “alternative assets” in public pension funds.

Barry Ritholtz at Bloomberg View notes the same thing:

A new report poses an interesting question: “Would public pension funds have fared better if they had never invested in hedge funds at all?”

This is a subject we have investigated numerous times. The conclusion of the report confirms our earlier commentary: a small number of elite funds generate alpha (market-beating returns) after fees for their clients while the vast majority underperform yet still manage to overcharge for their services.

…..

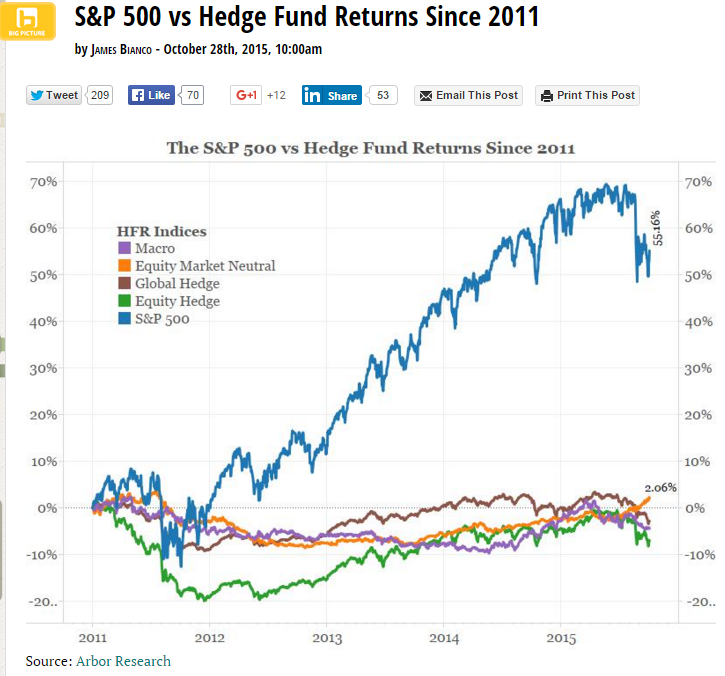

People do care about performance, as well as fees. It is just that in the hierarchy of public-pension fund needs, both take a back seat to expected returns. This is because the higher the expected return, the lower the capital contributions required of some obligated public entity.Here is the punchline: Those expected returns are a myth. They don’t exist, except for the most elite funds, which are a tiny percentage of the industry. A few can generate alpha; most of the rest are mere wealth-transfer machines. As the chart below shows, none of the major classes of hedge funds beats the market.

Here’s the chart he’s talking about:

Back to Ritholtz:

In other words, hedge funds aren’t used to generate higher returns; they simply make it possible for some public entity to reduce contributions to the underlying pension. This is the primary driving force in the rise of hedge funds for public pensions.

This fiction has been perpetuated by consultants and others with a vested interest. The myth has been swallowed whole by politicians, who can make the finances of the local and state governments they oversee appear better than they really are.

I have yet to find the source of the idea that hedge funds outperform the market. It was created out of whole cloth as a sales pitch. There is no basis in accepted academic theory or actual practice to expect the hedge-fund industry to deliver returns above beta (market-matching returns). But the huge gap between pension-fund obligations and their actual assets has encouraged fund managers to invest more in hedge funds because of these inflated return expectations.

It’s called marketing.

The search for alpha (extra returns uncorrelated with the broad market, which is beta) is a perennial topic in the investment biz. I won’t say I’m an alpha atheist, but I invest in market index ETFs. Alpha may exist, but I doubt I’ll be able to find it.

Many pension funds are desperate for returns. The pension promises they’ve made are really expensive, and they’re hoping that investment returns will cover that huge expense.

But they’ve not been.

The main thing to worry about now is whether these alternative assets not only don’t give extra returns, but give very large losses.

REVIEWING THE PAST

Previous posts on alternative assets and public pensions:

- Don’t go chasing waterfalls or alternative asset classes

- Public pensions and alternative assets: Dallas shows how it can end

- NJ use of alternative assets and followup to that post

- SC use of alternative assets

- San Diego use of alternative assets

- Rhode Island use of alternative assets

- NC use of alternative assets

- Calpers pulling out of hedge funds

- Reaction to Calpers decision and more reactions

- Some alternative asset boosterism

About that last post:

bq.. I do want to make something clear: “alternative” assets are not, in and of themselves, scams or even necessarily inappropriate for pensions.

However, there are aspects that make them questionable for use in public pensions, especially in states with a long history of official corruption and also in states where the funded position is poor. It is also very questionable when such high percentages are allocated to these asset classes.

The whole point of the assets being “alternative” is that there is no broad, liquid market in these assets, and in the case of many of the hedge funds and private equity funds, investors are restricted from removing their investments for a certain period of time.

This makes a certain amount of sense, but if one must have cash flow paid to pensioners, you can see how this can become a problem if the pension plan can’t even liquidate a large percentage of its supposed assets.

The point is that investing in alternatives requires more sophistication and a lot more investment discipline than using market-traded stocks and bonds.

When it goes well, it can be a boon to the funds, but when it goes poorly, it can be disastrous.

ACCOUNT FOR RISK TO CHANGE BEHAVIOR

I am somewhat skeptical in the measurement of returns on alternative asset classes. You don’t actually know what your total return was until the money has all come out, because there’s no market price for alternative assets — it’s not until the assets have been turned back into cash that you know what the value was. That’s what makes them “alternative”: they’re fairly illiquid assets.

Illiquid investments are not necessarily a problem, but it’s a large problem if it forms a large portion of the portfolio and you have to liquidate holdings to pay pensions.

Since writing some of the posts above, some of the plans have decided to withdraw from particular alternative asset classes. In the case of Calpers, they may be pulling out of hedge funds, but they are still using other alternative asset classes.

In the insurance world, by regulations insurers are required to hold relatively large amounts of capital against the possibility that volatile or hard-to-value assets will go sour. The risk charge is 30% for these assets (compared to less than 1% for top-rated bonds). As a result, insurer portfolios tend to be light on alternative assets, though they do judiciously invest in order to get some extra return on surplus.

If pension plans had to account for their asset risk, even with getting to pick high discount rates, I think they would invest differently.

Related Posts

Governing Magazine: In Memoriam

RIP, James Spiotto, Municipal Bankruptcy Expert and Advocate for Long-Term Solutions

Taxing Tuesday: Illinois Tax Persiflage