Public Pension Watch: Chicago, Not Waving But Drowning

by meep

A favorite poem from childhood ends this way:

Oh, no no no, it was too cold always

(Still the dead one lay moaning)

I was much too far out all my life

And not waving but drowning.

Another thing I have linked at frequently is this post on what drowning actually looks like

Drowning Doesn’t Look Like Drowning

…..

This doesn’t mean that a person that is yelling for help and thrashing isn’t in real trouble – they are experiencing aquatic distress. Not always present before the instinctive drowning response, aquatic distress doesn’t last long – but unlike true drowning, these victims can still assist in their own rescue. They can grab lifelines, throw rings, etc.

Look for these other signs of drowning when persons are in the water:

-Head low in the water, mouth at water level

-Head tilted back with mouth open

-Eyes glassy and empty, unable to focus

-Eyes closed

-Hair over forehead or eyes

-Not using legs – Vertical

-Hyperventilating or gasping

-Trying to swim in a particular direction but not making headway

-Trying to roll over on the back

-Appear to be climbing an invisible ladder.

Even if you don’t want to read about public pensions, you might want to read that piece on drowning. That may come in very handy in the short term.

I have thought about these things as some very large public pensions are currently drowning metaphorically, and it’s not clear to me that they realize this. There are all sorts of signs that have been popping up, and today’s clear example is Chicago.

It’s clear to me that Rahm didn’t take the Daley warning seriously when he left his sinecure. Daley realized that the party was over, and the death of fun was on its way. The only reason he would leave was that the money train was no longer choo-choo-ing along. Rahm may have thought that the disaster wasn’t immanent, but, again, Daley wouldn’t have left if the disaster was a safe twenty years away.

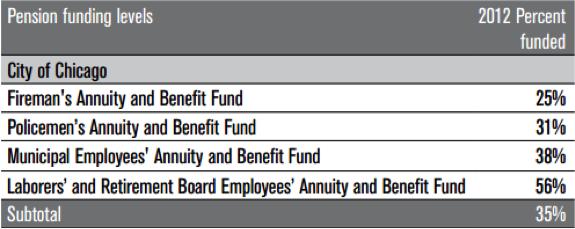

So let us look at the extent of the problem:

Well, uh, that’s not necessarily a bad, thing, right? It’s not like they’re all retiring now! The unfunded liability just means what you’d have to pay if they all retired right now, right?

NO IT DOES NOT.

The unfunded liability is an estimate of the pension promise thus far earned that has not been provisioned for (roughly). It has assumptions built in as to when people are actually eligible to retire, and when they are likely to retire. So the unfunded liability, roughly, would be the money you would need if the pension plan were frozen and nobody accrued any more pension benefits, but still couldn’t retire before retirement age.

What happens when one has a large unfunded liability, and the “required” contributions aren’t made, is that the unfunded liability generally gets much worse.

Which is what has been happening.

How bad is it? This bad:

One of the problems is that the population of Chicago has dropped over the past decade as the liabilities have grown. And the latest “fix” doesn’t fix the problem at all:

Mayor Rahm Emanuel did what he had to do to convince Gov. Pat Quinn to sign on the dotted line.

But chances the mayor and City Council can solve Chicago’s $20 billion pension crisis without raising property taxes range between slim and none.

A 56 percent increase in Chicago’s telephone tax buys time to appease Quinn and get past the Nov. 4 gubernatorial election and the Feb. 24 city election for mayor and aldermen.

But it’s a Band-Aid that produces nowhere close to the $750 million in property tax collections the mayor had hoped to generate over five years to save the Municipal Employees and Laborers Pension funds, let alone make a looming, $600 million payment to shore up police and fire pension funds in even sorrier shape than the other two. There’s also the teachers pension fund that must be saved.

And here’s another story on Chicago’s plight.

The problem is, of course, that Rahm can’t really increase the taxes. He and the City Council do like being re-elected (as long as they’ve got a piece of the action), and people have realized that the flights and roads lead out of the city as well as in.

Rahm et. al. have been fishing for some kind of state bailout, as Detroit has gotten Michigan to “contribute” a bit to them as part of the bankruptcy workout. But the state of Illinois is in no condition to be bailing anybody out. The suburbs, which have funded ratios about as bad as Chicago’s (if not worse in some cases), are not going to pony up for Chicago.

As per the above, the signs of the pension plans drowning are not new, but it doesn’t seem anybody is doing anything about the body bobbing in the waves.

And I don’t think CPR is going to revive the corpse.

Related Posts

Cook County Soda Tax: Look Who's Come to Save the Day!

Connecticut Pensions: Pushing Off Payments Til Later Ain't Reform

GameStop Follies: Hedge Funds, wallstreetbets, and Public Pensions