Stupid Pension Trick: Extra Contributions from a Special Fund

by meep

Today’s trick is courtesy California, where Governor Jerry Brown had the bright idea of throwing extra money into the California pension hole.

THE PLAN

Political Road Map: Here’s how (and why) the state is making a $12-billion pension payment next year

If you’re a homeowner, you’ve likely had someone suggest that the easiest way to lower your long-term debt is to make an extra mortgage payment. Thanks to the miracle of compound interest, your total costs in the long run go down.

Last week, Gov. Jerry Brown essentially decided that it was worth applying the same principle to the state government’s debt for the pensions of its employees.

To do so, the governor’s newly revised state budget includes an almost $12- billion payment in the coming fiscal year to the California Public Employees’ Retirement System (CalPERS). Part of that amount is mandatory: a $5.8- billion payment required by law to cover retirement promises that were made to workers, in some cases, decades ago.

The mandatory portion is about 75% more than what the state was paying just five years ago. And for all of the complexity involved with pensions, there’s a simplicity to the math. There are only three pots of money from which to pay pension commitments: employee contributions; employer contributions (which is the state government and, thus, means taxpayer money); and investment returns on CalPERS’ $320-billion portfolio.

Those pension investments have failed to live up to expectations. Last fall, CalPERS directors officially lowered the fund’s profit predictions, which triggered a bigger invoice being sent to Brown and lawmakers. Smaller, but still serious challenges exist for the California State Teachers Retirement System (CalSTRS).

Brown’s budget team said last week that a $12-billion infusion of cash now will result in a savings to taxpayers of $11 billion over the next 20 years. A similar prepayment idea to improve the bottom line for county retirement systems has been introduced in the Legislature by state Sen. John Moorlach (R-Costa Mesa).

Though it may be fiscally prudent to do so, making an extra payment amounts to a lot of money — in this case, equal to almost 10% of total general fund revenues in the coming year, and close to double the state’s combined contribution to the University of California and Cal State University systems.

So where does the extra money come from? It’s a loan from an obscure surplus cash account, and not from current government services and programs. In all, $6 billion will be borrowed from the Surplus Money Investment Fund for a supersized pension payment.

I love the term “extra money”, especially when government is involved.

So there’s $6 billion coming from some “surplus cash”. I wonder how big the pension hole is:

Jerry Brown: California Pension Liability Skyrockets by 22%

Governor Brown’s May Revised Budget reveals that the State of California’s and the University of California’s unfunded pension liabilities have skyrocketed by 22 percent in the last year.

The State of California is notorious for predicting spectacularly high pension investment returns, and then admitting lousy performance. But Governor Brown’s 2017-18 May Revised Budget admitted for the first time that the state’s and UC’s long‑term pension and healthcare liabilities jumped by $51 billion in the last year to $279 billion, “due to poor investment returns and the adoption of more realistic assumptions about future earnings.”

I am not going to touch on valuation issues in this post (that’s not the stupid part, anyway).

But $6 billion towards filling a $279 billion hole? That’s 2 PERCENT of the pension debt getting paid down – the debt that’s for PAST service.

Next year, the pension liability will go up (the total liability, not the unfunded part) because more people will have accrued more pensionable service (yes, some will die and reduce the liability, but not enough to keep the total liability from going up). California has got to pay for the new service, as well as pay down that old debt.

I’m sorry, but $6 billion ain’t diddly. And it’s not even a real contribution — the system has also accrued a $6 billion liability by borrowing from the fund.

Another news story: California Proposes $6 Billion Boost to CalPERS

California Gov. Jerry Brown’s revised state budget proposes a $6 billion supplemental payment to The California Public Employees’ Retirement System (CalPERS), which he says will save the state $11 billion over the next two decades.

The supplemental payment effectively doubles the state’s annual payment. It is intended to ease the effect of increasing pension contributions due to the state’s unfunded liabilities and the CalPERS Board’s recent decision to lower its assumed investment rate of return to 7% from 7.5%.

…..

As of June 30, 2016, CalPERS was only 65% funded, and reported unfunded liabilities of $59.5 billion. According to the revised budget, without the supplemental pension payment, the state’s contributions to CalPERS are on pace to nearly double by fiscal year 2023‑24. However, the additional $6 billion will reduce the unfunded liability, and help lower and stabilize the state’s annual contributions through 2037‑2038, assuming there are no changes to CalPERS’ actuarial assumptions.According to the budget, contribution rates as a percent of payroll will be approximately 2.1 percentage points lower on average than the currently scheduled rates. For example, peak rates would drop from 38.4% to 35.7% for state miscellaneous (non‑safety) workers, and peak rates would drop from 69 percent to 63.9 percent for CHP officers.

The funding for the supplemental payment will be paid through a loan from the Surplus Money Investment Fund. Although the loan will incur interest costs of approximately $1 billion over the life of the loan, actuarial calculations indicate that the additional pension payment will lead to net savings of $11 billion over the next 20 years.

THE DEBT TERMS ARE SURE, THE RETURNS ON PENSION ASSETS ARE NOT DAMMIT.

This is essentially a POB… but there’s no bondholders to stick with the tab in a bankruptcy event… unless you mean the taxpayers as bondholders.

THE COMMENTS

David Crane says Boosting Pension Contributions Is Fine; But borrowing from a special fund to do so is not

Borrowing to boost pension fund earnings is not a new idea. That’s what “pension obligation bonds” do. The motivation behind such loans is low short term interest rates relative to what the borrower thinks it can earn by betting on stock and bond markets. Borrowing to bet on rising asset prices can sometimes work and even spectacularly (see eg margin-financed speculation in stocks before 1929 and mortgage-financed speculation on US housing before 2008) but sometimes those bets sour, and when they do, POB’s are extra expensive because they impose two interest costs (the pension obligations and the borrowing).

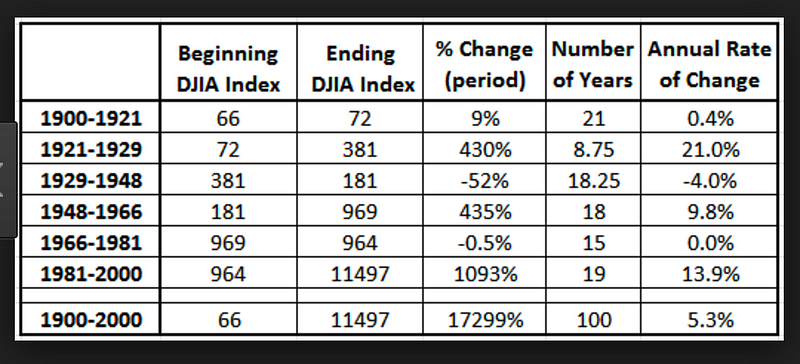

Brown claims his proposal will generate $11 billion in pension cost savings over 20 years because the borrowed funds will be deployed by CalPERS into assets that will earn seven percent per annum. Seven percent per annum for 20 years translates into nearly a quadrupling of assets. How likely is that to happen? Below are two charts showing historical interest rates and stock market returns.….

…..

The more unique aspect of Brown’s proposal is his choice of lender. SMIF (“Surplus Money Investment Fund”) is where the state holds revenues until needed for public services. Eg, gas tax revenues are housed in SMIF until they are needed for, say, road repair. SMIF invests in short-term (as opposed to long-term) instruments because that money is expected to be used in the short term. By expressing a willingness to move $6 billion from short term to long term investments, Brown must believe SMIF has more money than it can use in the short term. If so, then in any event SMIF should move some money to longer-duration and higher-yielding investments.

…..

But that doesn’t mean SMIF should be a source for the POB, which (based on available information) appears flawed for several reasons:1. Citizens have all the risk. Citizens supply SMIF’s funds and are on the hook for state employee pensions regardless of how the bets turn out, and the borrowing is a way to shield employees from sharing in the boosted contributions. In fact, using special fund cash to finance pension contributions would reward CalPERS’s board for keeping normal-cost contributions — the only pension costs shared by employees — unreasonably low.

2. Brown has selected the state’s Rainy Day Fund as the source of repayment for the loan but that can’t be more than a fig leaf given that the small size of the RDF is woefully insufficient for the state’s budget volatility, as explained here. Using any of that fund for this purpose leaves citizens with even less protection.

3. SMIF might need the money before the loan is due. SMIF may not need the $6 billion now but circumstances change and the state’s principal responsibility is to provide services. Also, one has to worry that, in order to validate the rationale for using SMIF’s money, the state might down-manage services in such a way as to reduce the need for that $6 billion but at a cost to citizens in the form of fewer road repairs, etc. After all, how would citizens know?

4. A loan from a special fund — funded entirely by citizens and not at all by employees — for the purpose of financing pension contributions sets a dangerous precedent. In addition to rewarding CalPERS for setting unreasonably low normal-cost contributions, what’s to stop the state from making all special funds available for such purposes and politicians from claiming that taxes filling special funds are going to public services when the money is actually being used to boost pension contributions?

Steven Greenhut at the California Policy Center:

Forget fiscal responsibility: Jerry Brown embraces pension shell game

The Jerry Brown administration last week released its revised May budget and, lo and behold, it has finally decided to (kind of, sort of) tackle the state’s massive and growing level of unfunded liabilities – i.e., the hundreds of billions of dollars in taxpayer-backed debt to fund retirement promises made to the state’s government employees.

It’s best to curb our enthusiasm, however. The governor didn’t have much of a choice. This was the first state budget that is compliant with new accounting standards established by the Governmental Accounting Standards Board that requires states to more properly account for retiree medical and benefits beyond pensions.

Because of those new standards and low investment returns, the state’s unfunded liabilities (including the University of California retirement system) soared by an astounding 22 percent since last year. But even this new estimate of $279 billion in liabilities is on the optimistic side. Some credible estimates pin California state and local governments’ pension liabilities at nearly $1 trillion, based on more realistic rate-of-return predictions.

I will get back to the valuation issue another time. Back to Greenhut:

The other reason to be skeptical of the Brown administration’s commitment to solving the problem can be found in the May revise itself. The budget “includes a one‑time $6 billion supplemental payment” to CalPERS, according to the Finance Department. “This action effectively doubles the state’s annual payment and will mitigate the impact of increasing pension contributions due to the state’s large unfunded liabilities.”

Where is the extra $6 billion coming from in a budget that supposedly is so pinched that the governor recently signed a law raising annual transportation taxes by $5.2 billion?

Simple. The state is borrowing the money to pre-pay some of its debt.

Where have I heard that one before?

In other words, the state will be borrowing the money at fairly low interest rates and then investing the money and earning, it hopes, higher rates. The difference will help pay down some of those retirement debts. Even the well-known pension reformer, Sen. John Moorlach, R-Costa Mesa, lauded the administration for embracing that idea.

But it’s something of a shell game. It should work out well, provided the markets do as well as the state expects. In doing this, however, the state is taking out new debt that will need to be repaid. There’s no free money here. A number of localities have embraced a similar strategy with pension-obligation bonds, which are a form of arbitrage, in which the government is borrowing money and betting on future market returns.

So let’s see what John Moorlach at Fox and Hounds has to say:

Governor Brown wants to prepay the California Public Employees Retirement System (CalPERS) with $6 billion beyond what most had expected.

The source of the funds is the Surplus Money Investment Fund. Don’t ask me why a state with a $169 billion unrestricted net deficit has some $50 billion in a low interest bearing account with such an odd title. Perhaps the University of California Chancellor can explain how her system and the state can better pull these things off?

Also, don’t ask me why the timing is so odd. The Legislature just approved an annual $5.2 billion gas and auto tax increase, and now the Governor has $6 billion for non-road repair expenditures?

Despite these concerns and anxieties, I like the proposal. It’s about time that the Governor got serious about the state’s spiraling unfunded defined benefit liabilities, but, I would postulate that this proposal needs a little more sizzle to make it an even more interesting opportunity.

Oh dear lord, no. No sizzle, please.

Whenever a public pension fund gets any sizzling idea, at the very least taxpayers get burned. Sometimes the bondholders and employees do, too.Back to Moorlach’s comments:

….

To make the proposal more interesting, Governor Brown should ask the Board of CalPERS what type of incentive they will give the state for the prepayment. CalPERS will benefit from the large influx and should provide at least a 3.75 percent reduction on the actuarially calculated required contribution. This would provide a $225 million savings to the state, using the $6 billion figure, thus providing some sizzle.

Seriously?

A 3.75% haircut is the sizzle? Oh, you want them to see this as a “surplus” to be played with for high yielding investments?

How about no. Calpers played around with their politically-correct, pension-money-losing “green” investments enough. They can go for boring and deal.

MY (OTHER) COMMENTS

Yes, I made some comments above, but this whole thing stinks as a pension trick (mind you, it’s not the dumbest one I heard recently… I’ll get to that in my next post).

1. It barely affects the pension debt

2. It involves borrowing from a short-term fund to do the ole POB arbitrage magic – so the state has an additional debt to match the amount the pension debt goes down

3. It cannot be repeated next year – this works only because the SMIF has $6 billion in assets that it doesn’t need to be liquid.

4. These are the current yields being credited on the SMIF – remember, the “extra” money municipalities put in to get a little better than 0% on their revenues. Notice the dates – I’m not sure their method of crediting, but it looks like all money that came in after 2001 is getting less than 7%.

So you’re screwing over municipalities? I mean, why shouldn’t they be getting the 7%? I mean, if Calpers et al can have their “guaranteed” 7%, why not the SMIF participants?

Separately, I can’t find the financials on the SMIF. I have tried finding balance sheets, cash flow statements, anything, at the State Controller’s Office. All I’m getting are those yields, and some extremely out-of-date documents. similarly at the state treasurer’s site. Went to the state CAFR, nothing.

If you know where the financials for the SMIF can be found, please let me know: marypat.campbell@gmail.com or tweet @meepbobeep

Anyway, this is “one neat trick” that does nothing much for the pensions, or the state. Par for the course.

Related Posts

Pennsylvania Pensions: Liability Trends

Public Pensions Watch: Sometimes Politicians Do the Right Thing

Testing to Death: Which Public Pensions are Cash Flow Vulnerable?