Taxing Tuesday: What if Trump Doesn't Spend All the Money? And State Income Taxes

by meep

I’m not happy with the omnibus spending bill, but nothing unique there.

That said, the following is funny to me.

Fears grow that Trump could ignore Congress on spending

:

Lawmakers and activists are preparing for the possibility that President Donald Trump’s administration, in its zeal to slash the federal budget, will take the rare step of deliberately not spending all the money Congress gives it — a move sure to trigger legal and political battles.

The concern is mainly focused on the State Department, where Secretary of State Rex Tillerson has drawn criticism for failing to spend $80 million allocated by Congress to fight Russian and terrorist propaganda and for trying to freeze congressionally authorized fellowships for women and minorities. Activists and congressional officials fear such practices could take hold at other U.S. departments and agencies under Trump.

“We’ve seen just too many instances these past few months … where there is clear congressional intent and funds provided, yet an unwillingness or inability to act,” Sen. Ben Cardin of Maryland, the ranking Democrat on the Senate Foreign Relations Committee, said in a statement to POLITICO.

And another on the same theme:

How Trump Could Circumvent Congress On Spending By Impounding Funds:

There are two ways for the Trump administration to subvert Congress’s intent in appropriating. Trump could announce that he will leave congressionally appropriated funds unspent, a move that we have ti go back more than forty years to the Nixon administration to make sense of. Trump will be tempted to go this “express” route for the propaganda value of contrasting himself with the big bad allegedly “spendthrift” Congress. Moreover, from his perspective, by doing this loudly and expressly, he will direct attention to his asserted overall goal of making savings, rather than just toward his personal ideological goals of starving particular programs for funds.

However, President Nixon totally lost the battle of impoundments, creating a binding precedent. After Nixon announced the impoundments, Congress fought back by insisting on the appropriations. Nixon lost a pivotal Supreme Court case, Train v. United States. And, Congress enacted the Congressional Budget and Impoundment Control Act. This Act required him to submit any proposals for impoundments, defined as “rescissions” and “deferrals,” for Congressional votes. This is a statutory framework that has worked well for forty years. If Trump uses it, he will win few of those necessary votes. If Trump does not use it, he is operating outside the very well-established law.

Look, I’m not happy with Trump deciding to implement tariffs by fiat (wtf, how is that possible without legislation?), etc., but it is funny to me that somebody is trying to exert something re: Congress’s sphere of power.

Thing is, how would you know something is a “recission” or “deferral”? If it is merely a transfer payment to a particular group, I can see it. There’s a certain amount of money that’s supposed to go to Planned Parenthood; if that amount doesn’t come, they’ll raise hell until they get it.

But if it’s a matter of sending money to the executive branch to do something…. I can see Trump saying “Well, we’d love to spend this money, but you haven’t actually approved of the appointment of the person to spend that money… we can’t just “spend” money if there’s nobody to spend it on something…..”

More from that second:

The second way is for Trump not to announce his cuts expressly, but to sneak them in by diverse ways. For keeping money unspent, the key agency is the Office of Management and Budget (OMB), and the management officials under OMB in each agency. The OMB Director, Mick Mulvaney, is a very savvy veteran of budget issues, and he will have management officials in important agencies who implement his directions. For this approach, the key is sophisticated work in the shadows. It includes taking heed of nuances between whether the appropriation provides that the funds “shall” be spent or just “may” be spent and asserting the power not to spend funds saying “may” because they are discretionary.

Another method is to “transfer” funds from one appropriation item to another one, which can be a big change that puts a whole program out of business. It may include “reprogramming” funds within an appropriation item, more fine-tuned than transfer, moving funding from one activity (allocation) to another. While this is a smaller change it can still starve some program that is out of favor.

In sum, a whole new chapter may be beginning in the friction between the Trump administration, Congress, and the public.

I’m very curious to see if that happens.

But ultimately, none of that crap matters.

This is why.

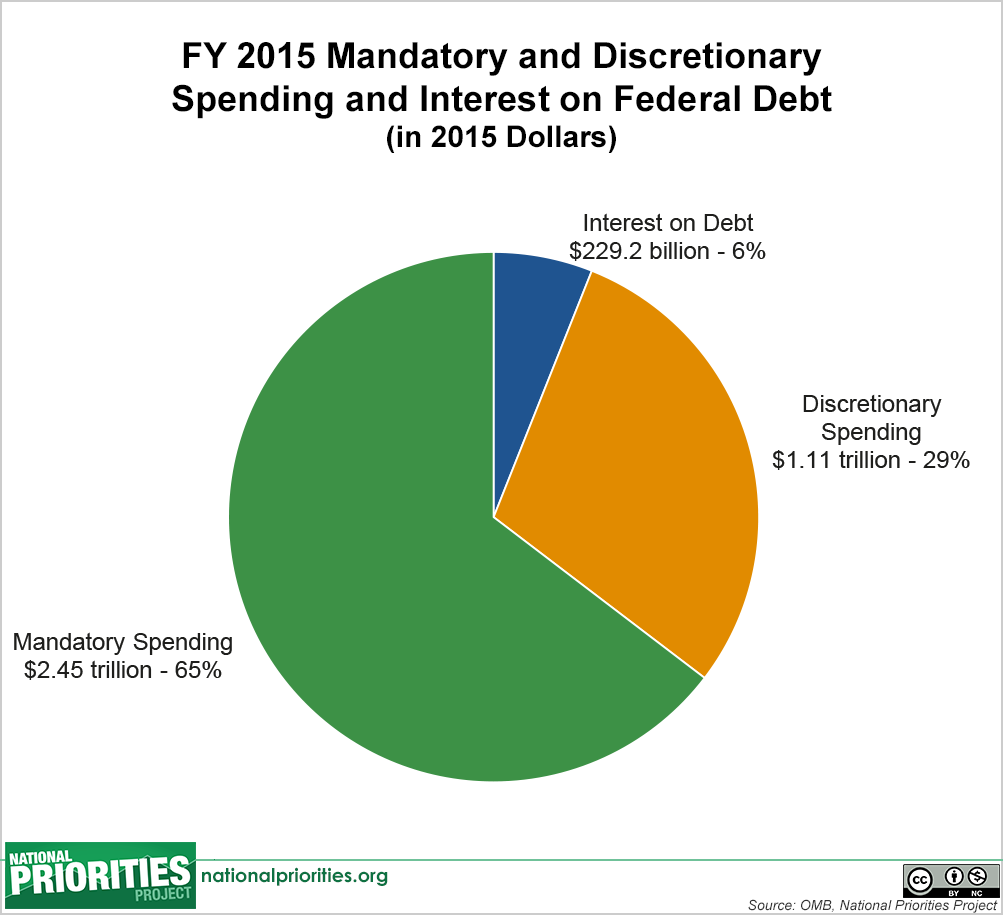

NONDISCRETIONARY SPENDING

It’s called “nondiscretionary spending”, but all of it could be withdrawn via act of Congress, if they wanted to (yes, there would be huge implications (politicial and financial) if they didn’t spend this money, but they absolutely have the power of the purse).

Let’s think through:

- Paying for interest/maturity of Treasury bonds

- Social Security benefits

- Medicare benefits

- Medicaid transfers to the states

- Retirement benefits for federal workers

All that junk is thrown into “mandatory spending”.

Source: Fighting for a U.S. federal budget that prioritizes peace, economic security and shared prosperity – from 2015.

According to that, over 70% of the spending is “mandatory”.

The bit they’re fighting over is the less than 30% of the actual federal budget… and that’s just as % of the budget, not as % of actual federal government revenue. I’m not going to figure this out now, but I may try later – think of that deficit. We could allocate it to the “mandatory” spending pro rata… anyway, again, that’s for another time.

Here’s my point.

The big federal $$ problem is in that mandatory spending, not in that less-than-30% that they’re so worried Trump won’t fully spend.

I understand those expenditures are important to the specific groups expecting to get them as income. But with respect to the fiscal position of the U.S., they’re small beer.

But I would be happy to see some squeezing on that portion to get some to play ball on the “mandatory” parts.

Separately: Roger Simon at PJMedia: Trump Is Justified in Using the Military Budget for the Wall

SINGLE FILER, NO DEPENDENT, LEVEL PERCENT STATE INCOME TAX

Continuing with my series of trying out how the Tax Cuts and Job Act (TCJA) works compared with prior federal income tax, I’m using the Tax Foundation’s calculator to make comparisons.

I started out just looking at the effect of the standard deduction, and then tried out level $ amounts for property tax.

This time, I’m trying out state income tax. Now, there’s essentially no difference between what I’m doing this week and what I did last week — the SALT (state and local tax) deduction cap is $10,000 for the combined amount… doesn’t really matter which bucket I put it into.

HOWEVER, the point is to look at the before/after change, and while last week I treated property tax as a level $ without respect to income level (state/local property tax isn’t based on your income, after all), this week I’m doing a state income tax as a level % of income. Yes, I know this isn’t wholly realistic, because even “flat tax” states tend to allow some deduction… but I don’t care. This is more an exercise in math in seeing how it all works out.

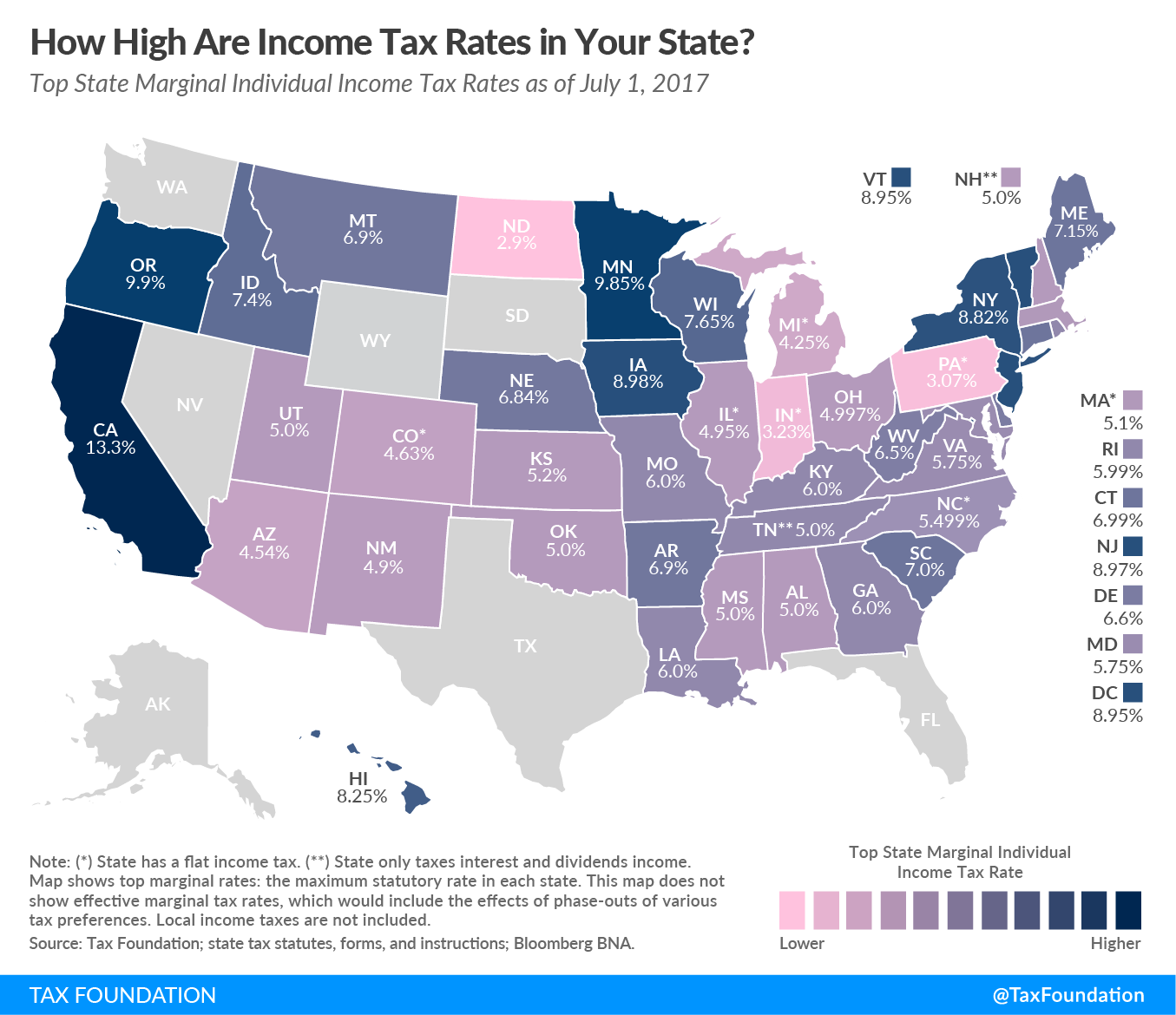

These were the 2017 state tax brackets, and this map shows the highest marginal rate:

That high of 13.3% in California is their infamous millionaire’s tax, so let me make it simpler: I’m just going to try out three levels of state income tax rates: 0, 5%, and 10%. Again, because of the SALT cap, in all cases the post-TCJA result will just be the standard deduction. The point is to compare it against the pre-TCJA amounts.

First, I’m going to post the non-deceptive graphs.

Here are the dollar amounts paid under the different scenarios:

The black dashed line is the post-TCJA amount. It’s hard to see where the curves cross over, so let’s look at the same graph, but done as rates:

It’s clearest for the 10% state income tax curve (the yellow curve) — it seems that the results below $300K income are good (as in, TCJA lowered their taxes), but that over that, you’re running into trouble.

Let’s check it out at the two income tax levels.

First, the 5% flat rate:

The results are a little odd, but remember that my constrained axes are exaggerating effects (at least with respect to dollars). So taxes are higher for the $300K-$400K folks here, but not by much — about 0.5%. The biggest relative benefit is about $60 – $140K, with almost 3% benefit (again, the standard deduction effect).

While above $400K, there’s some benefit, it’s relatively small — less than a 1% reduction.

Finally, the 10% flat tax:

Uh…..

So here’s the deal: go back to the original, non-deceptive graphs. Higher income folks get higher federal income taxes under these various scenarios, without comparing it to the pre-TCJA situation.

The thing is, the pre-TCJA situation reduced higher income people’s federal income tax by quite a bit due to the high state taxes they pay. With SALT deductions capped at 10K (LESS than the standard deduction), obviously, the high-income-tax-paying people will get hosed.

Note that it took a really high state income tax rate to get there, though. Only California has a marginal rate that high, and that’s on millionaires (in income, not wealth).

Now, these have been fairly pristine examples – just looking at the isolated effects of a level property tax amount (in dollars), and a level state income tax amount (in percentages).

Next week, I’m going to start adding complications, like dependents. See you then!