Around the Pension-o-Sphere: Mostly Kentucky, Some California, and Pew Rains on the Parade

by meep

Today is mostly about Kentucky, as Bevin signed the pension bill that has teachers riled up (they’re going to be protesting today), has spurred a promised lawsuit, and there are a few leftover bills that were vetoed… and I’m not sure if the legislature has time (or willingness) to overturn those vetoes.

I do have a little about California – one proposal to try to get a semi-bailout of local pensions via better-funded ones, as well as a diversity drive that Calpers and Calstrs are not happy about. Finally, Pew has its annual report out about the state of public pensions (I don’t need to spoil this; you already know the answer.)

KENTUCKY TEACHERS PENSIONS

Bevin signed the bill: Amid teacher protests, Kentucky governor signs pension bill

FRANKFORT, Ky. (AP) – Kentucky’s Republican governor has signed a bill into law that makes changes to the state’s troubled public pension systems over the loud objections of the state’s teachers.

Matt Bevin told WHAS-AM he signed the bill on Tuesday. It preserves most benefits for current and retired workers but will move new hires into a hybrid plan that puts less risk on the state.

Bevin said the bill is not what it could have been but said there is nothing in it that is bad for Kentucky.

Teachers have opposed the bill. They were angry that lawmakers rushed to pass it near the end of the legislative session without revealing the bill publicly.

The Kentucky Education Association has been leading the protests. Bevin called their leadership “absolute frauds.”

That’s really building bridges there.

Beshear filed a lawsuit: Kentucky Attorney General Beshear sues to block pension reform law

FRANKFORT, KY. -Attorney General Andy Beshear is suing Gov. Matt Bevin in an attempt to overturn the controversial pension reform bill the governor just signed into law.

“Today I have fulfilled my promise and filed suit against the pension bill, Senate Bill 151,” Beshear announced online Wednesday morning as he filed the 34-page suit in Franklin Circuit Court.

….

Beshear’s lawsuit claims the bill violates an “inviolable contract” within state law that protects the retirement benefits granted a public employee at the time the employee was hired. He also charges that the legislature violated parts of the Kentucky Constitution and state laws in the rushed process that saw the bill go from its unveiling to final passage in less than nine hours on March 29.

Yeah, I’ll get back to that process item in a bit.

My guesstimate: the “inviolable contract” aspect will be enough to knock down all the changes that reduce pension cost. I am also guessing that the process will not be what gets the bill whacked.

I am not a lawyer, but I’m just going by what has happened with all of Illinois’s attempts to chip away their unfunded pension liability.

(psssst, you have to amend the state constitution… FIRST)

Teachers have been and will continue to protest: Kentucky teachers vow to flex their political muscle – Houston Chronicle

FRANKFORT, Ky. (AP) — Bruised by their fight over pensions, Kentucky teachers are mobilizing like never before to support legislative candidates who pass a key political test: support for public education.

Teachers and their supporters flocked by the thousands to Kentucky’s Capitol on Monday to demand generous state funding for schools and decry pension changes they say will discourage people from entering the profession. And they had a blunt message for legislators opposing their agenda.

“We will remember in November,” they chanted.

“We are realizing what a powerhouse we are,” said Angela Coleman, an eighth grade teacher from Floyd County. “We can be a very, very big voting bloc.”

It doesn’t require a public employee union to be a gigantic voting bloc.

It just requires a large group of people with shared interests.

This does not require guessing: the election season in Kentucky this year will be nasty.

All the other news/commentary pieces I hoovered up on the above items:

- Kentucky Gov. Signs Controversial Pension Bill, Immediate Lawsuit Follows | Chief Investment Officer

- As Teachers Plan More Protests, Kentucky Governor Signs Pension Bill

- Credit rating agency sees pension reforms as positive for state, more work to be done

- Kentucky police will limit number of teachers protesting in Capitol Friday | Lexington Herald Leader

- Kentucky teachers encouraged to walk out Friday if they have the leave

- Kentucky teacher protests: As movement grows, ‘sickout’ splits appear

- Kentucky attorney general sues Gov. Matt Bevin over new pension law

- Lawsuit challenging Kentucky pension bill filed by Beshear, KEA and FOP | Lexington Herald Leader

- Kentucky attorney general, union sues to block pension bill | News | heraldcourier.com

- Kentucky pension reform: Bill becomes law at midnight Tuesday

- Lexington ‘Prepared’ For Pension Pressure, Mayor Says | WUKY

- Pension bill: ‘I did not like how we handled this process, and I apologize’ | LebanonEnterprise.com

About that last link. That’s from state senator Jimmy Higdon, from Lebanon, Kentucky (middle of the state) who is President Pro Tempore of the state senate.

Let’s see his excuses:

On April 5, we passed Senate Bill 151, which contained parts of SB 1, the pension bill. As your senator, I want to say that I did not like how we handled this process, and I apologize. This issue has dragged on for far too long, and I admit it could have been handled better. However, there are no perfect solutions, and inaction on reforming Kentucky’s public pension systems was no longer an option. Billions of additional dollars will be budgeted to reduce the unfunded liability. The pension reforms enacted by the General Assembly ensure that the core retirement benefits of every current public employee are protected, and new public employees will have a sustainable retirement income in the future. In SB 151, we require future General Assemblies to fully fund all plans.

You cannot “require” future legislatures to do anything. They can change the law and say “Nope, we don’t have to do that.”

So let’s see what he has to say about the bill that was passed:

The final version of the pension bill is much different than the one first proposed, and I worked to change many of the proposals after hearing from concerned constituents. I voiced the concerns of many teachers, retirees, and KERS/CERS members who contacted me, and with their help we improved the plan that I voted on in these specific ways:

1. No reduction in COLA

2. Only change to active teachers is capping sick days at the end of this year

3. New employees go into a hybrid cash balance plan. This stops the digging so we can concentrate all funding toward our unfunded liability.

4. Requires future governors and General Assemblies to fully fund all pension plans.

5. Moves TRS to level-dollar funding, and away from percentage-of-payroll funding, which required an additional $400 million a year.

6. Makes changes to CERS and KERS pension plans. Allows for service credit to be used for retirement eligibility until July 1, 2023.

I like number 5. Level dollar for paying down an unfunded liability is more stable, because a huge part of why even the “good” plan – CERS – is doing poorly is because they took a -of-payroll approach, and assumed that payroll grew at 4 per year.

To give you an idea – they assumed that in 10 years they’d be paying about 50% more than they’d pay in the current year to amortize the unfunded liability. And assuming the unfunded liability didn’t grow due to further bad experience.

The reason I’m not highlighting any of the others in his list is because it either doesn’t cut the unfunded liability, is meaningless (“require” them to fully fund the pensions), or will almost certainly be struck down by a court due to the “inviolable contract” aspect.

KENTUCKY BUDGET AND TAX BILL

That wasn’t the only thing going on in Kentucky. It’s a big thing, but there were also a few other big things.

Bevin promises to veto entire Kentucky state budget and tax overhaul | Lexington Herald Leader

Kentucky Governor Matt Bevin said Monday he will veto the legislature’s proposed two-year state budget and a tax bill that generates hundreds of millions of dollars to help fund it.

“The whole thing is not as thoughtful or as comprehensive as it needs to be,” Bevin said of the tax plan during an almost 30 minute harangue about fiscal responsibility. “If we’re going to do tax reform — and we need to do tax reform — it needs to be comprehensive.”

The bill, which was introduced and passed on April 2 before it was available to the public, applies Kentucky’s 6 percent sales tax to 17 services, increases the cigarette tax by 50 cents per pack, and cuts the individual and corporate income tax to a flat 5 percent tax. It also cuts some typical tax deductions, including those for medical expenses, medical insurance, paid taxes and investment income.

…..

“There are many legislators who literally just don’t understand this. They don’t,” Bevin said. “They’re smart people, they’re intelligent people, they’re educated people on many fronts. They don’t understand finance, they don’t understand pensions. And yet they’re the ones who are going to have to make decisions.”

Well, it’s not like he understands public pensions, either. He knows benefits need to be cut, and he doesn’t realize that can’t happen only via legislation, but will require a constitutional amendment (man, that sounds familiar)

“I want to make something very clear, this pension bill that was passed does not solve the problem, doesn’t even come close to solving the problem,” he said. “As pointed out by some who opposed it, why should we pass something that would raise $300 million over the next 20 years if we have a $60 billion problem?”

Bevin expressed his main concerns with HB 362, which would have local governments increase pension contributions over a longer period, rather than an immediate 50% hike. Although Bevin did not have any qualms with that part of the bill, the section he rejected would put the financial support of semi-governmental agencies such as the colleges and mental health agencies that want to split from the badly underfunded pension system in the hands of the state, which includes non-pension system members.

“99.5% of the problem is going to be paid for and solved by people who are not in the system. One-half of 1% will be contributed by people who get 100% of the benefit,” he said, lamenting that it would take a whopping $1,3500 per Kentuckian in taxes and contributions to make the pension solvent.

Hmmmm, makes me think of Skin in the Game… I’ll be talking about that this weekend a little.

A VIEW FROM THE LEFT

Here is something really interesting.

The current leaders of the Jefferson County Teachers Association (JCTA), the Kentucky Education Association (KEA), and the TRS – some in office since 2003 – have presided over the greatest slide in assets in a teacher pension in American history. The funded level of the teacher pension has fallen from an 86% funded level in 2003 to 32% today, with liabilities of around 30 billion dollars. Many financial experts now consider the TRS to be in a death spiral. What happened to our watchdogs? Weren’t the JCTA, KEA, and TRS supposed to watch over this key benefit and to protect it from harm?

Teachers are busy people; they rely on their watchdogs to keep watch. Few people know that teachers are not recipients of Social Security, as the teacher pension was originally intended to provide for teacher retirement. Now, it is anyone’s guess where the funds will come from to repair the financial damage that has been done to this retirement system.

Moreover, in recent years, the teacher pension system has been pouring funds into highly-secret, high-risk, high-fee alternative and private equity investments – an attempt to “big-bet” TRS back to solvency. We all know what happens to gamblers who play with scared money. When teachers demanded to know how their contributions were being invested, and filed a transparency lawsuit seeking this information in 2014, they were opposed by TRS management. In a surprising February 2016 action newsletter from JCTA, transparency was blocked by the teachers’ own union.

Hmmmmmm. Again, makes me think of Skin in the Game. The people directly affected if things go poorly are not being informed of the decisions being made in their names — the people making the decisions do not suffer when things go wrong.

Hmm.

More Kentucky items that I’m not commenting on:

- The House actually voted to tax 100 percent of all Kentucky pensions

- Pension Relief Uncertain After Kentucky Governor’s Veto

- Kentucky governor vetoes pension bill allowing agencies to withdraw from state plan – Pensions & Investments

I may or may not pay attention to the lawsuit as it works its way through the courts. I think the result is extremely foreseeable, so I’m not really all that interested in keeping close tabs.

CALIFORNIA PROPOSALS

Moving onto California, there’s various proposals out there.

Supporters of a ballot measure to a split roll property announced last week they’re aiming to put the proposal on the high-turnout November 2020 ballot.

The proposal, backed by the so-called Schools and Communities First coalition, seeks raise between $6 billion and $10 billion a year by extracting more money from certain commercial properties. Under the plan, 40 percent of revenues would go to schools and 60 percent to local governments.

Make no mistake, behind all the talk about schools and communities is the simple fact that any additional taxes extracted from Californians will go towards offsetting the pernicious effects of rising public sector pension costs.

It’s not about classrooms and students. It’s about CalSTRS pension costs to districts, teachers and the state set to balloon from $5.9 billion in 2013-14 to $15.1 billion in 2020-21.

…..

Among the biggest supporters of the split roll is the United Teachers Los Angeles, the teachers union in Los Angeles Unified. The district is projecting that by 2031-32, the district will spend 28.4 percent of its budget on healthcare and 22.4 percent of the budget on pensions. By comparison, in 2011-12, the district spent just 13.8 percent of the budget on healthcare and 10 percent of the budget on pensions.

Referenda to “tax that OTHER guy, over there” probably pass fairly easily in California.

Of course, if “that OTHER guy” moves away, no longer to be taxed…

A different proposal:

A bill that some California cities argue is unconstitutional is currently making its way through the state legislature.

Many cities, including Lodi, are concerned that AB 1912, introduced by Assemblyman Freddie Rodriguez, D-Pomona, will threaten the ability to use Joint Powers Agreements and also put hundreds of cities in JPAs over their constitutional debt limit.

A JPA is a partnership between local or state agencies that allows them to address public needs and provide services by pooling resources and reducing costs.

Under the bill, if a JPA agency participates in a public retirement system, all parties, both current and former to the agreement, would be jointly and severally liable for all obligations to the retirement system.

Let’s look up the phrase for us non-lawyers:

Where two or more persons are liable in respect of the same liability, in most common law legal systems they may either be:

jointly liable, or

severally liable, or

jointly and severally liable.….

If parties have joint liability, then they are each liable up to the full amount of the relevant obligation.

…..

The converse is several or proportionate liability, where the parties are liable for only their respective obligations.

…..

Under joint and several liability or all sums, a claimant may pursue an obligation against any one party as if they were jointly liable and it becomes the responsibility of the defendants to sort out their respective proportions of liability and payment.

Yeah, that could get very ugly very quickly. I agree with the person who said:

“The whole purpose of a joint powers authority is for local governments to join together so they can save costs to achieve a mutual goal through efficiencies of scale,” City Manager Steve Schwabauer said. “If we have joint and several liability for all associated with the operation of that enterprise that could really undo the value of JPAs in California.”

Yeah, what that guy said.

DIVERSITY FOR THEE, NOT FOR ME

So let’s check on the diversity drive in California.

CalPERS Likely to Reject Diversity Engagement Targets

The Investment staff of the $349 billion California Public Employees’ Retirement System is recommending that the CalPERS Investment Committee reject diversity targets for corporate boards as requested by state Treasurer John Chiang, show board documents for the committee’s April 16 meeting.

Chiang, also a CalPERS Investment Committee member, had requested in November 2017 that CalPERS define a diverse board as consisting of at least 30% women. He also wanted a standard that the composition of boards be 30% diverse regarding both women and ethnic and cultural representation.

I’ll have you know I’m 100% woman!

Okay, dorky joke over.

What about Calstrs? CalSTRS Vexed over Plan Aimed to Promote Diversity Among Fund Managers | Chief Investment Officer

CIO aims to fix program that hired young, female, and minority managers, whose returns are sub-par.

The California State Teachers’ Retirement System (CalSTRS) is having trouble with its plan to let new outside investment managers run a chunk of its global equity investments. Returns are not great, and the fees are too high, according to Chief Investment Officer Chris Ailman.

So Ailman is seeking to revamp the retirement system’s global equity developing manager program, as it’s known. Outside managers who are young, female, or minority were signed up to run these funds. Global equity funds can make stock investments in any country.

…..

One problem is that its lower returns have dragged down the performance of the system’s other funds. As a result, Ailman recommended to the CalSTRS board at a retreat meeting in Riverside, California, last week that the $ 1.8 billion developing managers program be moved out of the global equities asset class. That way, the developing managers segment won’t dampen bonuses for investment staffers in the asset group.

Uh….. love that commitment to diversity.

He said he wanted to keep morale of investment staffers involved in the management of the emerging managers program up in terms of their bonus compensation. “It’s all about how do you properly motivate people,” he said.

Okay, you know what? This is sounding bad to me. You can read the whole thing, but the reason this sounds bad to me is I know something else Ailman yammered on about recently.

Ailman drops Facebook account; CalSTRS to ask about ‘terrible’ governance – Pensions & Investments

Christopher J. Ailman, CIO of the California State Teachers’ Retirement System, is deleting his personal Facebook account, and the $224.4 billion pension fund is also preparing a letter to the company on its governance practices, he said in an email.

CalSTRS will be writing to Facebook because the company’s “governance is terrible,” Mr. Ailman said in the email.

“We are currently establishing contact with Facebook to learn more about what controls are in place today to protect users’ data into the future,” said Aeisha Mastagni, portfolio manager in the CalSTRS’ corporate governance unit, in a written statement Thursday. “Additionally, we would like to understand what additional steps Facebook is taking to protect this data in order to regain the trust of their users, the public, and their shareholders.”

…..

As of Dec. 31, CalSTRS’ holdings in Facebook were valued at more than $931.2 million. CalSTRS had $181.3 billion invested in equities as of Jan. 31.

Now, I can believe facebook’s governance lacks, but this sort of grandstanding is a bit much.

I think there are some good concerns over facebook info, etc., but to give you an idea of why I’m unconcerned (note: I’ve been online before the web, and I’ve got info about me all over the place), I looked at what info facebook has on me, and what it thinks it knows about me.

The politics are way off — last year, it thought I was liberal, and now it thinks I’m moderate. =snort= Pretty much everything that’s accurate about me in the system is something I deliberately put in my public profile. So way to go facebook.

In the time I’ve been on facebook (9 years now, I think), I can think of two ads served to me that has actually led to a sale: one for MM LaFleur (I’m a big fan) and one for Turing Tumble (not yet made, but I am so looking forward to this.) Too often, it’s just serving me pictures of the Amazon books I JUST BOUGHT.

Anyway, yay for Calpers for keeping their eyes on what’s important, and I gotta pay more attention to Calstrs, because this is not looking good to me.

PEW PEW PEW PEW PEW PEW

Sorry, I can’t help myself.

Pew put out its report on public pensions.

Overview

Many state retirement systems are on an unsustainable course, coming up short on their investment targets and having failed to set aside enough money to fund the pension promises made to public employees. Even as contributions from taxpayers over the past decade doubled as a share of state revenue, the total still fell short of what is needed to improve the funding situation.

There is no one-size-fits-all solution to the pension funding shortfall and the budgetary challenges facing individual states, but without new policies that commit states to fully funding retirement systems, the impact on other essential services—and the potential for unpaid pension promises—will increase.

The Pew Charitable Trusts analyzed the state pension funding gap for fiscal year 2016, the most recent year for which comprehensive data were available for all 50 states. This brief outlines the primary factors that caused the widening divide in most states between assets and liabilities, and identifies tools that can help legislators strengthen policies and better manage risk for their state’s retirement plans.

In 2016, the state pension funds in this study cumulatively reported a $1.4 trillion deficit—representing a $295 billion jump from 2015 and the 15th annual increase in pension debt since 2000. Overall, state plans disclosed assets of just $2.6 trillion to cover total pension liabilities of $4 trillion.

You can go read the whole depressing thing yourself. Here’s a USA Today piece on it.

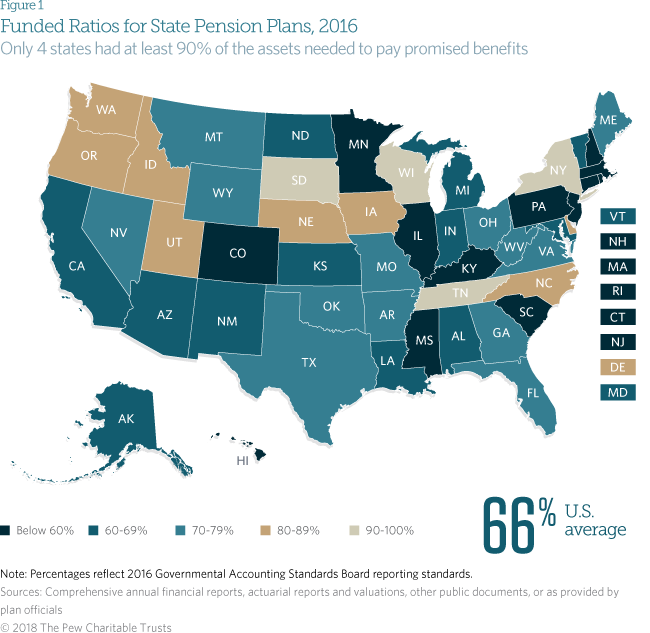

Here’s a picture:

All that blue-ish stuff? That’s below 80%… what you wanna bet I’m going to have to start running the “70% pension funding myth” as a regular item soon?

I don’t feel like addressing the items right now, so I’ll let Elizabeth Bauer (aka Jane the Actuary) do so:

3 Things That Caught My Eye In The Pew Report On Public Pensions

….

Some states are spectacularly underfunded – and they’re getting worse.The report gives an average funded ratio of 66% across all plans in the United States, and provides a visual representation in the form of a map color-coding states by their degree of funding, with 12 states getting their deepest shade of blue for funded ratios below 60%. That’s bad enough, but it masks the fact that three states are the worst of the worst: Kentucky and New Jersey at 31% and Illinois at 36%. (The fourth- and fifth-worst states are Connecticut at 41% and Colorado at 46%, and the remainder are in the 50s.)

……

Benefit payments have risen spectacularlyThis is, to me, the most startling graph in this report: benefit paid out by public pension plans came in at roughly $100 billion in 2000. In 2016, they had tripled, to about the $300 billion mark. Yes, these numbers are without considering the effect of inflation, but inflation during this time period was only about 40% in total, and the National Average Wage (as determined by the Social Security Administration) increased by 38% in that time.

Now, I’m not saying that the growth in benefits was solely due to fiscal irresponsibility on the part of the states — population growth and other factors certainly played a role as well — but it’s easy to see that an unfunded or underfunded pension system can’t cope with benefit increases of this magnitude.

I think I can address this.

But not today. :)

This week has been jam-packed, and I’m pooped.

Related Posts

Kentucky Pension Blues: Let's Get This Fire Started

Nevada Pensions: Asset Trends

Welcome to the Public Pension Watch: Hurray for New Jersey!