Trying to Deflect the Blame: Calpers and the Catholic Church (and Trump!)

by meep

This one is going to be a bit different. It’s about someone caught out, and trying to make the whistleblower look bad.

In one case, it’s not a whistleblower so much as an investigator. Yes, there’s a public pension angle.

CALPERS HIRING WOES

CalPERS Board President Priya Mathur and Vice President Rob Feckner's claim that

yvessmith</a>'s reporting on Ms. Frost’s misrepresentations is “a spiteful attempt to attack retirees” is obviously asinine and idiotic. <a href="https://t.co/g6XoK7CrJM">https://t.co/g6XoK7CrJM</a></p>— TransparentCal (Transparent_CA) September 10, 2018

Oh, pointing out that Marcie Frost may have lied on her resume, and may be unqualified to be CEO at Calpers, is attacking retirees?

Seems to me that the CEO of the org can do a lot of damage to the retirees herself. Especially if she isn’t qualified to do the job. Back in May, we had the story of a falsified resume for CFO of Calpers. That guy was booted. [Oh, sorry – he resigned … before he could get booted]

Well, this time the unqualified person with a potentially puffed-up resume is Frost herself.

As before, Yves Smith at Naked Capitalism did the requisite investigations.

In reverse chrono order:

Sept 10: Former Official Criticizes CalPERS Board Member Richard Costigan’s Defense of CEO Marcie Frost’s Lies

Sept 7: Financial Times’ FundFire Unambiguously Confirms Our Reporting of Misrepresentations by CalPERS CEO Marcie Frost

Aug 30: Financial Times Publication Confirms Accuracy of Our Reporting on CalPERS CEO Marcie Frost’s Resume Misrepresentations; Board Refuses to Investigate and Instead Attacks Us

Aug 28: Why Marcie Frost’s Shoddy Resume Alone Was Reason Not to Hire Her at CalPERS

Aug 27: Cover-Up of CalPERS’ CEO Frost’s Misrepresentations of Her History: Document Destruction/Loss at CalPERS, Pressure on The Evergreen State College

Aug 27: CalPERS CEO Marcie Frost’s Misrepresentations Regarding Her Education and Work History During and After Her Hiring

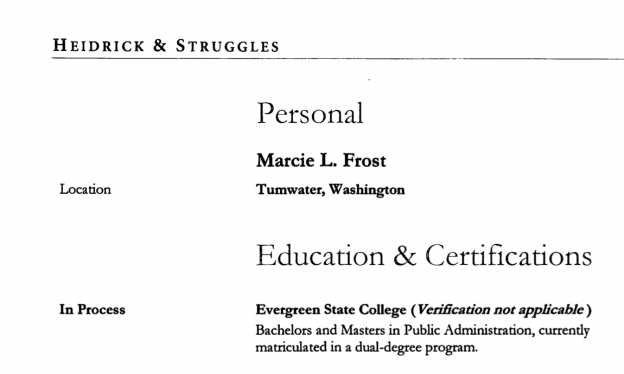

Basically, Marcie Frost does not have a college degree.

She graduated high school 36 years ago, and that was it for her completed schooling. Now, I don’t necessarily think that precludes her from the role, if she has requisite experience that shows she can handle the U.S.‘s largest pension fund. One can learn a lot in 36 years of experience, and get quite far, without formal certification.

Oh, I notice that back in one of my May posts on Calpers governance, I saw it claimed in Frost’s official bio that she was pursuing degrees – that was from the 2016 press release — a clear misrepresentation.

What I said at the time:

Eh? Pursuing?

Look, I’m fine with people not having college degree (my husband Stu doesn’t have any college degree), and definitely fine with people not having a masters degree. Sure, she has experience… in Washington.

How big is the Washington pension funds? Going by the Washington state page at Public Plans database, I see four different funds overseen by DRS, and it totals $65.5 billion, covering 394 thousand participants.

Calpers is much larger: almost $300 billion, covering 1.9 million participants.

Then I went on to knock Evergreen State, but I think I should leave them out of it, as it doesn’t seem she did much of anything there in the first place.

To give the opposite side its take: CalPERS affirms confidence in CEO amid questions on educational background

A news release dated July 14, 2016 — when Ms. Frost was hired — states she is “pursuing dual bachelor’s and master’s degree in public administration from Evergreen State College.”

Wayne Davis, spokesman for the $358.9 billion California Public Employees’ Retirement System, Sacramento, said that was an incorrect statement.

Ms. Frost was enrolled but did not complete a program at Evergreen State College that awards units toward a bachelor’s degree based on experience. He said the program is known as “Prior Learning from Experience,” which allows students to earn 45 of the 180 units needed for a bachelor’s of science or bachelor’s of arts degree. According to the college’s website, a bachelor’s degree is required to pursue a master’s degree in public administration.

So it sounds like she may not have taken any classes at all, or at most one or two. I have heard of these PLE credits, and I think they are legit as well.

“The board knew her education background when they hired her in 2016. They knew she did not have a college degree. That was no secret and Marcie never hid it,” Mr. Davis said in an email. “Marcie’s talents, expertise in pension administration, hard work and an unquestioned ability to work with people earned her the top job.” She was director of the Washington State Department of Retirement Systems, Olympia, before she joined CalPERS.

Then why was it part of the 2016 press release?

Anyway, whatever. Yves Smith has very specific accusations, including documentary evidence.

(from Yves Smith’s post Financial Times’ FundFire Unambiguously Confirms Our Reporting of Misrepresentations by CalPERS CEO Marcie Frost

(from Yves Smith’s post Financial Times’ FundFire Unambiguously Confirms Our Reporting of Misrepresentations by CalPERS CEO Marcie Frost

Here is something from Bloomberg: Calpers CEO’s Education to Get Scrutiny From Some Board Members

Board member Margaret Brown said she’ll seek a full investigation of Frost’s representations during the hiring process and since, while two other members contacted by Bloomberg News said they plan to ask the CEO about her education during her annual performance review in late September. Three members of the 13-person board said Frost’s education is irrelevant because she never claimed to have a college degree, and was hired based on interviews and her record heading the Washington State Retirement System.

“The board’s confidence in Marcie Frost and her leadership is unwavering,” President Priya Mathur and Vice President Rob Feckner said in a joint statement. “These continued efforts to tear down Calpers and discredit Marcie and the broader leadership team at the system are nothing more than a spiteful attempt to attack retirees, beneficiaries and the promised benefits of public employees.”

See, I may have bought the “we knew she only had a high school diploma” talk if it weren’t this crap of blaming the investigator. The moment somebody does an obvious deflection like this — I wonder what else they’re trying to hide.

Because Margaret Brown? She’s an outsider Calpers board member… and she’s a plan participant. It should be interesting to see what happens in late September.

Here is a post from Tony Butka, Can Anyone Control Out-of-Control CalPERS?

Let me be succinct. CalPERS is now being run by a CEO who documentary evidence proves lied not only to CalPERS, but also her prior employer, Washington State, regarding her resume, particularly about her educational background and work history. Almost worse, the President of the CalPERS Board and some executives are trying to cover it all up.

….

Material misrepresentations on an employment application should be and are cause for discharge of any public employee, and if CalPERS beneficiaries like you and me ever lied on our employment application, the department or agency that hired us would fire us in a New York Minute. For cause.

This is even more serious for a top executive. Should be an automatic boot. There’s one thing of putting a positive spin on one’s work accomplishments; there’s another of putting in things that you never did.

At this point, they’re saying that it wasn’t on the resume or application at all. Again — why did it get into the press release?

The Takeaway

Back in the 90s, I served as the Executive Officer for the Los Angeles County Civil Service Commission for about a decade. Based on those experiences I can tell you for a fact that Marcie Frost’s misrepresentations on her resume would have resulted in a quick letter of resignation or termination.

During that time, I learned a few things about acceptable conduct, and particularly about public employees. First, dishonesty seems to be a matter of character, be it stealing or fibbing. Whether it is an Eligibility Worker during the Northridge earthquake illegally putting in a claim for a hundred bucks or less, or a mid-level manager siphoning off public funds for personal use, you are either inherently dishonest or not. It’s part of who you are.

The second thing I learned is that the abuse of power by a public official is a corrosive betrayal of what constitutes a “public servant.” Whether displayed by a clerk, a public official, or a Board member, it straight up stinks. The tendency is again a matter of character, not training. It’s pure “I have the power, you don’t, too bad for you.”

Further, the higher the levels of dishonesty or abuse of power, the more people are impacted. Believe me, lower level employees know about the foibles of their bosses. If the higher ups are unethical power junkies, the morale of the troops is directly impacted for the worse. A key sign becomes the number of staff members who leave or transfer.

Unfortunately, the current Board President, Priya Mahur, believes in truly Trumpian levels of secrecy and hiding what should be publicly available documents from us, the beneficiaries. She also tried to cover up Charles Asubonten’s mess, presided over the $3.4 million settlement with Dow Jones over blatant copyright infringement, and put her finger on the scale of the recent CalPERS Board elections. What a Prez.

Please write or call any of the following officials to demand an investigation into this mess, since CalPERS itself seems incapable of doing so:

I agree with Butka — if you’re a Calpers participant, I recommend you use the contact info at the bottom of Butka’s piece to highlight this issue. I am not a Calpers member, so all I will say is that when you have that level of dishonesty, do not think the consequences will stop at the level of the top person. You can see the email that Butka sent here.

I decided to do a little recent-news-digging myself, and came across this from June: CalPERS Boosts Pay for Next CIO, CFO

Retirement system hasn’t been attracting enough top talent with current pay package.

In a move aimed at drawing top candidates and competing with other public pension funds, the $352.79 billion California Public Employees’ Retirement System (CalPERS) has voted to increase the compensation package for its next CIO and CFO.

“Right now, this is probably pretty bad timing in terms of looking for a CIO in the marketplace, because three of the top five public fund jobs are open right now,” Andrew Junkin, president of Wilshire Consulting, said at the June 19 meeting of CalPERS’s Performance, Compensation and Talent Management Committee. “New York City is open, New York State is open, CalPERS is open … competition is going to be fierce.”

The CalPERS board voted to revise the CIO salary range to $424,500 to $707,500, with incentives of as much as 150% of that salary.

Just imagine what the CEO is getting.

Current CIO Ted Eliopoulos announced in May that he will be stepping down at the end of the year, and former CFO Charles Asubonten left that same month after questions arose about the accuracy of his resume. According to California state salary records, Eliopoulos earned a base salary of $552,842.90 in 2017, with total compensation of $867,177.90. Meanwhile, Asubonten earned $45,833.34 in salary for the few months he worked in 2017, with total pay and benefits of $120,833.34. The Los Angeles Times reports his annual base salary was $250,000.

“Our compensation is just too low,” Richard Costigan, a member of CalPERS’ board of administration, said in May, according to The Sacramento Bee. “We’re not attracting quality candidates. The quality candidates who want to come here are negatively impacted by the salary levels.”

Yeah, if you could only get unqualified people for your CEO and CFO positions, in the U.S.‘s (second) largest public pension fund, maybe you are setting compensation too low.

I know you wouldn’t be pleased to have to search for a CEO, CIO, and CFO at the same time, but suck it up, buttercup. It’s a self-inflicted wound.

Oh wait, they have a new CFO, effective Oct 1. So that’s one down. Quote:

Mr. [Michael] Cohen will be the third finance chief to oversee Calpers’s finances this year.

I see they also have a new controller now, and with an accounting degree and MBA, she sounds like she’d be qualified. So maybe the salary boost and a little more attention to the hiring process, they really are getting better candidates.

Back in May, I said:

If Calpers wondered why Calpers participants (especially retirees) keep electing representatives like Margaret Brown, just doing this stuff will get you more Margaret Browns. You may outnumber the Margaret Browns, but there is going to be a reckoning.

Cut out the rinky-dink crap, guys.

Do due diligence, allow board members to provide oversight, and stop opening up other people’s mail.

You think getting a little heat for two high-profile unqualified hires is bad?

Wait until you get called-in-front-of-the-legislature levels of bad. Or, shall I remind you, the federal charges in the pay-for-play scandal, which was only 5 years ago!

It’s not clear to me that Calpers has its governance in order, after supposed clean up. I don’t particularly trust that it’s really been cleaned up, given this deflection.

Cut out the Mickey Mouse level shenanigans, y’all. You have to take your lumps, so just take them now, and don’t raise them to worse levels.

Because it will only get worse if you keep trying to deflect things, rather than face problems head-on.

And the more you deflect, the more suspicious outsiders get of your behavior.

CATHOLIC CHURCH DEFLECTION

That brings me to my next governance issue: the Catholic Church.

I’m Catholic, and I’m underwhelmed by the bishops, which includes the bishop of Rome (aka the Pope). I can talk from a religious point-of-view, but I’m just going to be flat and talk about this on an institutional level. Because that’s where I have relevant experience.

I’ll start this one with a few tweets.

I'm trying to put a charitable interpretation together, and I can't. He seems to believe that sins of bishops should be hidden for the greater good and that's terrifying. https://t.co/zZbxRwKwSl

— Jane the Actuary (@JanetheActuary) September 11, 2018

This is akin to the most depraved and sick psychological abuse. Pope Francis is saying that if you are a victim of sexual assault at the hands of a Bishop, you are doing the devils work by speaking out. This is diabolical. https://t.co/W3Ae86BARF

— Catholic Sat (@CatholicSat) September 11, 2018

While there already had been exposures of child sexual abuse, as well as predation on post-pubescent children (aka teenagers), the recent news is about the cover-up — how bishops deliberately shuttled people around, deliberately hid info, etc.

And then there is the “turning the seminaries into harems” part, which is new information to outsiders.

Some of these items have been swirling around as rumor for a very long time, and it came to a head with the Pennsylvania grand jury report on these shenanigans and then former ambassador Archbishop Carlo Vigano dropped some extremely specific accusations against various people in the Catholic hierarchy.

So we got various piffle from various Cardinals and bishops, some others put out more forceful statements, and then the Pope thought he’d play coy and then try to redistribute the blame to everybody else.

No, just as it is Marcie Frost herself that would be a threat to Calpers retirees if she were incompetent, not a well-known Calpers gadfly who accuses her of such, it’s not the accuser who necessarily has done any damage. Because Vigano was extremely specific with his charges, which should make them easier to refute if untrue.

It’s one thing not to respond to a vague accusation. I agree, that can be pointless, and it is just somebody stirring up crap.

It’s another to try to play cute with extremely specific accusations that can be checked in documents.

The result is not going to be the laity saying: “Oh yes, the problem is that I worshiped the priests themselves too much! I see how I’m also to blame!”. Most of us haven’t had that attitude towards priests in the post-Vatican II years, and definitely not since the first round of abuse revelations, which were decades ago. I have been friends with some priests, but if they had assaulted me, I would have gone straight to the police. But then, I wasn’t a young man in seminary, whose future career may depend on a senior priest’s help.

To be sure, “successful” predators learn which people are easier to target, but that’s why the real disappointment now isn’t the predators themselves but the men — the “leaders” — who covered all this up.

Or just stayed silent.

As Pope Francis floated as his first response.

No, you cannot be silent in the face of evil. I understand there is repentance, but ffs, when alcoholic priests were treated and repented… nobody was so foolish to tell nobody of that weakness, and definitely not to allow the priest full run of the sacramental wine. Similarly for priests who embezzled — they no longer were allowed to handle any parish finances… or ANY finances… under church authority.

So now, people are trying to read the papal secret (or not-so-secret) messages in homilies, Pope Francis at Mass: Bishops must pray to overcome ‘Great Accuser’

At Mass in the Casa Santa Marta on Tuesday, Pope Francis invites bishops to overcome the “Great Accuser”, who seeks to create scandal, through prayer, humility, and nearness to God’s people.

In his homily at Mass on Tuesday morning, Pope Francis said it seems the “Great Accuser” is attacking the bishops of the Catholic Church to create scandal.

…..

‘Great Accuser’ seeks to scandalizeFinally, Pope Francis said bishops need these three attitudes to face the scandal whipped up by the “Great Accuser”.

“In these times, it seems like the ‘Great Accuser’ has been unchained and is attacking bishops. True, we are all sinners, we bishops. He tries to uncover the sins, so they are visible in order to scandalize the people. The ‘Great Accuser’, as he himself says to God in the first chapter of the Book of Job, ‘roams the earth looking for someone to accuse’. A bishop’s strength against the ‘Great Accuser’ is prayer, that of Jesus and his own, and the humility of being chosen and remaining close to the people of God, without seeking an aristocratic life that removes this unction. Let us pray, today, for our bishops: for me, for those who are here, and for all the bishops throughout the world.”

If the accusations are true, then no, it’s not the person who is speaking the truth who is causing scandal. This is so basic, that it makes me wonder how far Jesuits have fallen into casuistry that the Pope can get mush-brained on this score. Even if he’s sincere, it doesn’t address the issue, and it smacks of a suspicious deflection.

It’s just like replying with “you’re attacking retirees!” when you’re calling into question the truthfulness and qualifications of the CEO of the (second) largest public pension fund in the U.S.

If the accusations are false, then yes, you need to show that they are false. This is not a court of U.S. law, with innocence until proven guilty. This is actual people knowing about actual harm, with additional accusations of cover-ups of that harm. This is about trust in an institution – not necessarily the religious aspect, but all the other aspects. For example, I had donated pretty well to the Cardinal’s Appeal every year, money that goes to all sorts of non-religious social services and the like… and I’m rethinking it this year, and sending a letter instead.

Oh, and the Trump connection here – this piece at Patheos by Jane the Actuary: What the Pope and Trump (may) have in common:

But here we are. The Pope is prattling on about the virtue of silence and preventing investigation of Vigano’s claims. The USCCB has announced its intent to have an investigation at some point in the future and seems to think that’s good enough. Individual bishops are calling for more — but, let’s face it, those seem to be individual bishops of small dioceses, and hence, men without the power to actually have an impact, in the unfortunate system of assigning to archbishops of archdioceses with the largest populations, the greatest power. Cardinal Wuerl has pretty much given the middle finger to the Catholics in his diocese, with an open acknowledgment that “the archdiocese would be well served by new leadership,” but hoping that he’ll be able to distract everyone with a “Season of Healing.”

No. We are not little kids. These men love their positions more than they love the truth. If only there were a Solomon again, we’d get some clarity.

I have no expectation the complicit will admit they were so, just as with Calpers.

Oh, and there’s a little bit of Trump content in Jane the Actuary’s post, but none really in mine. I’m just having a bit of fun.

Additional from Jane the Actuary: Some Cover-up Crisis links

THE WAY WE LIVE NOW

All this reminds me – both the Calpers and the Catholic governance problem – of an audiobook I’m currently listening to: Trollope’s The Way We Live Now.

I’m only half-way through, but there’s one thing I noticed early on: the amount of humbuggery among all the characters, except for a few.

There is a fairly obvious financial scam going on surrounding a U.S.-Mexican railroad, in which a young British man, Paul Montague, who had inherited money has found that the company his money is tied up in has gotten some sort of government contract to build a railroad from the middle-of-nowhere in the U.S. Southwest to the middle-of-nowhere in Mexico. One of his business partners from California shows up in England, and sets up a stock company around this railroad, and sets as its chairman the out-of-nowhere rich man Augustus Melmotte, lately of Paris, who has been buying his way through London society.

One expects it a matter of time that it will all collapse.

The railroad boom/busts or just financial flummery in general should sound familiar — there are the natural booms & busts, and then there are the loose practices and outright frauds. Think of Theranos, Enron, Madoff. They’re all confidence games – they depend on the confidence of those gulled that there is something substantive going on.

In this case, Madoff is the best parallel. Many people think Melmotte’s a scoundrel, has gotten his wealth by underhanded means… but if they can get a piece, why not? Similarly, many of Madoff’s investors thought he was illegally front-running, but that they would get the upside and none of the downside.

For Melmotte to keep his scam going, the London board of directors for the Mexican railroad project is packed not only with Paul Montague, but a few useless nobility (who know nothing of finance, much less of railroads), one lickspittle who doesn’t know the business but knows how to deflect unwelcome visitors from Melmotte’s door, and one moneylender (who must have a good idea of the cash flow).

Chairman Melmotte tends to manage it well, with 15-minute weekly meetings of the board, and buying time from the young man (who had a hell of a lot more of his own money in the company than anybody else, and had been owed back interest from the company) by pretending to sell some of his shares for cashing out.

But at some point, Paul Montague realizes he has no clue what’s going on, and notices all the deflections by Melmotte, who is unwilling to provide any financial statements to the board. Melmotte manages to knock him off balance once — Paul is fairly weak, and Melmotte tries to cow him by pointing out his complicity. But Paul keeps insisting of being informed as to the real state of things.

That sort of board member can be really troublesome for somebody running a scam.

Melmotte tries one last ploy — get Paul over to Mexico to “investigate” how the railroad is doing, with expenses paid by the company. Thing is, Paul realizes he doesn’t know at all how to go about such a thing, and would likely end up with no information at all. Paul knows that Melmotte is trying to get him out of the way, because an honest man, even if ignorant, can do a lot of damage for this sort of plan.

An honest person can be scammed, but it is very difficult to keep an honest person quiet once they discover they’ve been scammed.

The way many scams remain “safe” is by targeting those who are weak or compromised in some way. That way, they will rally around the chief deceiver. A few of the other board members, in talking to Paul, admit that they have no clue what’s going at the board and that they really have no business being there. But they owe money to or have had favors from Melmotte….and they can’t be so rude as to question the man’s probity or knowledge. They’re bound up in these endeavors as well, and have all sorts of financial weaknesses themselves. They want to believe this will make them rich, or at least secure. Melmotte is using their social positions for his own ends.

And I went a few further chapters, and it looks like it may unravel because an entirely different person — Dolly (Adolphus) Longstaff — got scammed and was not compromised by Melmotte. Dolly’s father was the compromised one… and he’s too weak to head off either his son or Melmotte. Dolly sicced his lawyer on the matter, independent of his father’s lawyers, and spread a rumor in the City about the forgery… and all the hangers-on start to drop off.

Should be fun to watch what happens next.

But perhaps less fun to see what happens next for Calpers and the Catholic Church.

It was mentioned that Marcie Frost has a performance review coming up at the end of September, so I’ll keep my eyes out for that, and there is talk of various bishops/cardinals resigning in the U.S.

But don’t expect it to stop there, for either.

Related Posts

Never Forget: 100 Years Since the Russian Communist Revolution

Taxing Tuesday: Republican Tax Ideas for an Election Year

Banning All Things Gun: It's a Poor Weapon That Points Only One Way