Chicago Mayoral Race: Screwed No Matter Who You Choose, Thanks to Unfunded Pensions

by meep

So, I wander onto twitter about once a day, and sometimes I engage, and many times I don’t.

I noticed something from one of the mayoral candidates, Lori Lightfoot. Remember how I said she wasn’t as bad as Preckwinkle? I still think that’s true, from a practical standpoint of how Preckwinkle has operated and how Lightfoot has operated. Lightfoot has indications of not being as enmeshed in Chicago corruption, and that’s a good thing.

But she’s not necessarily going to be better when it comes to Chicago’s finances.

Here is a tweet:

Just a reminder—pensions are a promise. No exceptions. https://t.co/uzH3nmz6TK

— Lori Lightfoot (@LightfootForChi) March 1, 2019

I will come back to it after a tangent.

MEEP EXPOUNDS ON STRESS-TESTING CHICAGO PENSIONS

I had a back-and-forth where somebody had the gall to say that public pensions don’t have to be fully funded.

So I happened to mention about MEABF being in an asset death spiral and my old projections from 2017. Then somebody made the mistake of telling me about a stress test done on MEABF in 2017, and that having 0% returns didn’t have the money running out.

I decided to check it out for myself. And… guess what… the stress test pretty much accords with my own projections.

I want to go to this unrolled twitter thread where I looked at a MEABF stress-test. The stress test runs from 2017 to 2022, and… well, you’ll see what I say:

Chicago MEABF is one of the city pension funds. A 2017 stress test was done

https://www.meabf.org/assets/media/5d-chicago-muni-stress-5yr.pdfHere are the results I see in that report: they tested multiple historical scenarios (2008 financial crisis, Black Monday, etc.) as well as some simple scenarios (flat market)… and projected to 2022. So it’s just a five-year stress test. Why five years?

Because that’s what the client asked for.

Not because it makes much sense for a pension fund whose promises extend decades.

But let’s see the result from some of those scenarios

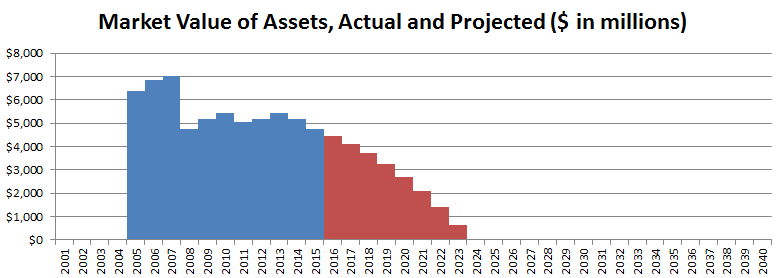

Here are projected fund levels under selected scenarios

the three worst in this graph: 2008 financial crisis, flat market, and Black Monday. All three showing asset death spiral behavior

What’s an asset death spiral? Here you go:

http://stump.marypat.org/article/151/public-pension-watch-how-screwed-is-chicago

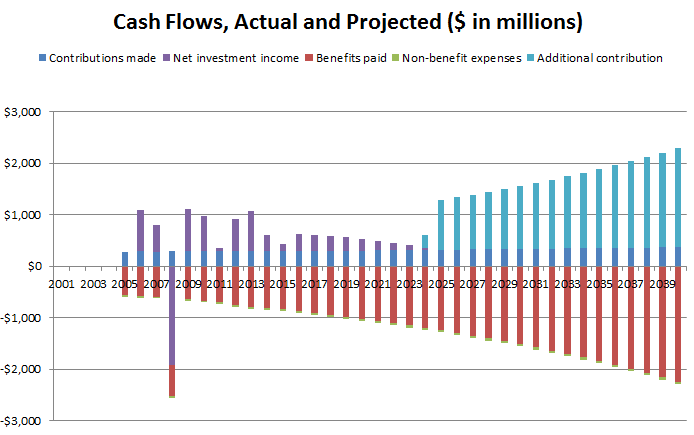

An asset death spiral is when balance sheet weakness manifests itself in something really serious: a lack of cash flow to cover promised benefits.

So you have to sell off assets to cover liabilities cash flows… and cannot earn out of a hole

Having to sell off assets to cover liability cash flows is not necessarily a bad sign — if your liability is shrinking.

If the liability growing, or even level, it’s a horrible sign.

Here is an official bullet points from the report:

“- Given the negative cash flow profile of the Fund, there is a risk of severe impairment. Most significantly, a repeat of the 2008 financial crisis could reduce the assets to less than $1 billion over a five-year period. “

The projection started out at $4.1 billion in 2017 — ending up at less than $1 billion in 2022 in this projection is extremely bad. It would be going to pay-as-you-go not long after 2022 in such a projection.

That stress test does not really show the fund would not run out in a reasonable time frame — just not in 5 years

Sorry for that tortured construction in the final sentence. The three scenarios mentioned – even if you have the assets growing at the assumed 8% (or whatever) per year return after 2022 – will almost definitely run out, it’s just that the assets run dry past the 5-year horizon.

There’s a reason they asked for 5-year projections and not 10- or 20-year projections.

I had tested MEABF back in 2017 myself. You can see those results here. For my baseline scenario, which included a steady 7% per year return, I had the fund running out in 2024.

Chicago MEABF, back when I looked at it in 2017, was actually one of the worst pensions I tested.

MAGIC MONEY TREE

So let’s go back to the tweet that set me off:

The promises are already unfulfilled. The disaster doesn't occur when the funds run out of money and you can no longer sustain pay-as-you-go.

— Mary Pat Campbell (@meepbobeep) March 1, 2019

Shorting the promises starts when the city deliberately underfunds its pension promises for years.

You don’t need to pre-Fund contributions even GASB doesn’t advocate that. We aren’t private industry.

— Jeff Johnson (@JeffJohnson_5th) March 2, 2019

That last one is where I started getting angry.

Good luck when the money runs out. Pension promises are operating expenses—operating expenses at the time the benefit is earned, not decades in the future. If you don't fund when the promises are made, you are putting benefits at actual risk.

— Mary Pat Campbell (@meepbobeep) March 2, 2019

And actuaries have run stress testing on the pension plan and show that even with a 0% market for 5 straight years (which the country would have much larger problems than a muni plan) we don’t go pay-go.

— Jeff Johnson (@JeffJohnson_5th) March 2, 2019

That was foolish. I actually looked up the stress test and found what it really showed.

In the meantime: https://t.co/J8hADOp3gN "Because they thought that pensions could not fail in reality, that gave them incentives to do all sorts of things that actually made the pensions more likely to fail. "

— Mary Pat Campbell (@meepbobeep) March 2, 2019

But here’s the thing: what’s the “plan” when the money runs out?

If you were unaware: a magic money tree does not actually exist.

Here is the main thing to keep in mind: the amount it will take to do pay-as-they-go is higher than the current contributions.

I will revisit this later this week to check on my calculations, but I do not see that Chicago can afford pay-as-you-go pensions any more than they could afford pre-funded pensions assuming 8% returns.

MESSAGE TO CHICAGO: THE PROBLEM WILL NOT MAGICALLY DISAPPEAR

So.

Chicago voters.

Here is your bottomline: neither of the mayoral candidates in the run-off know how to deal with the ginormous financial hole Chicago faces.

Frankly, I think Rahm Emanuel is getting out now because he knows the shit will actually hit the fan, money-wise, in the next mayoral term. Sure, there were other issues for him in getting re-elected, but I think if the money could hold out, he would have run for mayor again.

I don’t think the money is going to hold out very well over the next 5 years for Chicago.

I could be as wrong as Meredith Whitney – after all, I thought Rahm was a fool to rush in where a Daley ran away – but I do not see Chicago getting repaired in its finances in the next mayoral term. Even if Pritzker is governor, the state of Illinois is unable to bail out Chicago. It has some pretty bad money issues of its own.

And I highly doubt the feds will bail out Chicago (they didn’t do a damn thing for Detroit while Obama was President… so why would Trump do a damn thing… or even the next president, should a Democrat win?).

Anyway, I do need to run the numbers again, but I highly doubt the reality for Chicago will be much changed.

I forecast pain.

While, of the two, Lightfoot seems the less involved in the long-standing Chicago corruption….that will not fix the inherent financial weakness of Chicago’s government.

Look, I’m not wishing ill on Chicago. I just think ill is coming to Chicago. I didn’t have any hand in the decades of deliberate pension underfunding.

I didn’t cause any of the pain that will be coming to Chicago, and I don’t glory in it.

But I am extremely angry at the people who have tried to minimize the repercussions that are the extremely foreseeable results of deliberate policy.

I will pray for your souls, those of you who are responsible. You really need it.

Related Posts

Pennsylvania Pensions: Nibbling at the Edges

Around the Pension-o-Sphere: the "Strong Men" of Venezuela and Russia Can Do Only So Much

Public Pension Assets: It's Not Your Money to Play With, Pension Trustees