Watching the Money Run Out: A Simulation with a Chicago Pension

by meep

Megan McArdle lays out the issue of underfunding public pensions deliberately:

Don’t Mess Around With Government Pensions

No one likes making pension fund payments. You have to take money that you could be enjoying right now, and hand it over to some stranger, in the hopes that decades hence, when you’re ready to retire, said stranger will hand it back to you and enable to live out your golden years in reasonable comfort. The connection between sacrifice and reward is, let us say, a little too distant for proper enjoyment.

…..

One recent installment in this perennial debate comes out of Berkeley’s Haas Institute for a Fair and Inclusive Society. The author, Tom Sgouros, has a background in public finance, and his arguments are careful and mathematically literate. Nonetheless, I find them unconvincing.I favor a conservative approach, and I mean “conservative” in the accounting, rather than the political sense. To err on the side of caution. And why should we be cautious? So we can make darned sure that workers get what they’re owed.

Sgouros agrees, in fact, that such conservative standards are the correct approach for valuing private-sector pension contributions, in case the business goes bust and the pension needs to stand on its own. But he says that governments are different, because they can’t go out of business. In other words, government pensions are less risky, so they don’t need such strict standards.

HA HA HA HA.

Let the Detroit retirees know about that.

My prior post on the Haas paper

But back to her piece:

This is … sort of true. A government pension plan can, in theory, operate underfunded forever — as long as the tax base and the workforce are growing faster than their current pension liability.

Funny thing about assumptions… sometimes they don’t come true.

Also, sometimes they don’t come true because the assumptions you make fuel behavior that makes those assumptions more likely to not pan out.

Back to McArdle:

Most state and local pension plans are not at a point where they’d have to cut benefits tomorrow, and few of them will be in that situation in the near future. But the whole point of a pension is to allow people to know that they’ll be secure decades from now, when things may be very different.

Which means that the people in charge of the pension should be planning for that, not saying “Well, the taxpayer of tomorrow will figure out some way to make the numbers work.” Current contributions should be invested to cover the future benefits for current workers; future contributions should be devoted to the workers who make them. And no one should be relying on future taxpayers to bail them out of a jam, not least because there’s no way to know if they’ll be able to.

Or want to.

But hey, let’s forget about all those other examples we’ve seen where current retirees get cut due to funds running out (Prichard Alabama, Rhode Island, Detroit, Greece), let’s find the most immediate disaster: Chicago’s MEABF.

A NEW TOY: PROJECTING PENSION CASH FLOWS

One issue I’ve had talking public pensions with non-finance people (and even some finance people) is that balance sheets are very abstract. Especially given the nature of the assets (some of which are hard to value) and pension liabilities (so many assumptions to go into valuing them).

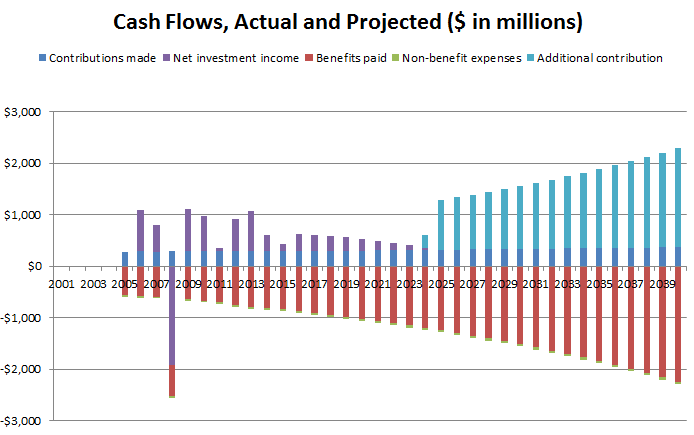

What’s not abstract are the cash flows:

- Contributions into the fund

- Investment income on assets increases the fund

- Benefits paid out

- Expenses deplete the fund

I’m using the cash flows that are in the Public Plans Database, which go through fiscal year 2015 currently (so it’s a bit of a lag).

I’ve made a toy model using these four cash flows, with 4 assumptions you can set:

- Contribution growth rate

- Benefit growth rate

- Expense (non-benefit) growth rate

- Net investment return

All of these are on an annual basis, I assume the cash flows are end of year (hey, it’s a toy), and I assume the rates compound deterministically, on an annual basis.

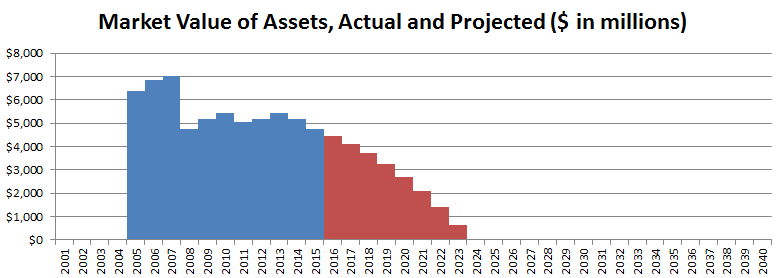

I look for when the assets run out (if they do), and if they do run out, I look to see the step-up in contributions to cover the benefits and expenses.

The spreadsheet is here for you to play with, if you so desire. Just download & go to town.

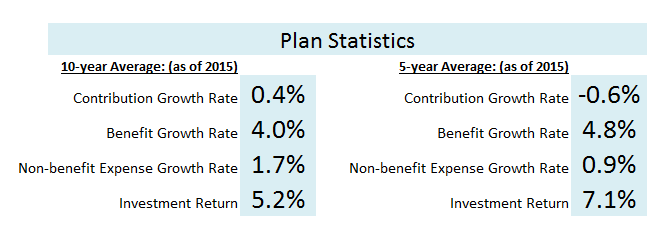

I display the 10-year and 5-year averages for the assumption items to give you an idea of the range of behaviors. There’s a drop-down menu for selecting the pension plan you want projected.

FIRST EXAMPLE: MEABF

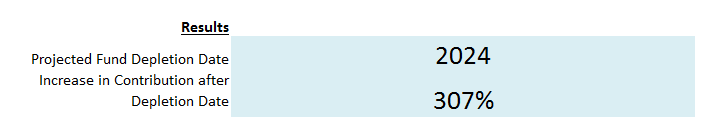

I decided I wanted to check the projection of Chicago’s MEABF done by Zero Hedge. They made assumptions a little differently from how I did it, but that’s okay.

They projected a depletion date of 2024.

Let’s see what I get.

Here are the historical stats:

Here are the inputs I used: (nice round assumptions, related to the historical averages)

Here are my results:

So yes, my projections agree with the Zero Hedge projections. Ta da.

REBUTTAL TO THE PAY-AS-YOU-GO FOLKS

One thing to note for those who think pay-as-you-go is A-okay. (That is: “It doesn’t matter if the pension fund runs out, we can just pay for benefits with current contributions.”)

The reason the pension assets run out is because the starting assets are insufficient, and the contributions are really insufficient.

This is why I looked at what the increase in contributions would have to be to cover the outgoing cashflows. In this case, the increase is over 300%. So if you think the current contributions are too high, how are 4x the contributions going to be affordable?

If you think pre-funding the pensions is expensive, wait until you have to do pay-as-you-go. It’s really expensive.

CAVEATS OUT THE WAZOO

Obviously, none of these items grow in a constant manner, though it looks like benefit cash flows grow more steadily. We saw that didn’t necessarily happen with Rhode Island pensions, but that’s because they cut COLAs.

So this is just a toy model, making very simplistic assumptions.

But it can indicate where plans are vulnerable (and which ones are vulnerable). I will be exploring that space more next week.

If there are aspects you’d like me to add or to test, just let me know (marypat.campbell@gmail.com) – I’m still trying out different options for display of results and different assumption sets to test (again, watch this space next week).

Related Posts

Chicago is a Big Ball of Bad Ideas

Calpers Governance Watch: Fallout from ex-CFO Meng Resignation

Public Pension Watch: California and Illinois Executive Resignations, Spiking v. California Rule, and more!